The Manulife InvestReady Wealth II has been discontinued and is now the Manulife InvestReady III.

The Manulife InvestReady Wealth II is an investment-focused investment-linked plan (ILP). This ILP has one of the lowest fees on the market and is one of Singapore’s most popular.

Dollar Bureau’s Partners’ Review of the Manulife InvestReady Wealth ll

Manulife InvestReady Wealth ll is a suitable investment option for investors looking to invest with a goal in mind. Be it for the short-term to beat inflation or to the medium-term to grow your wealth, Manulife InvestReady ll provides minimal effort and takes away the emotional pitfalls of investing, freeing up your time to focus on the things that truly matter to you.

Moreover, Manulife InvestReady ll has exclusive access to dividend-paying funds, which provides monthly payouts – unique to this ILP. You can reinvest this payout into the funds to repurchase additional units.

At the end of the day, if you’re looking for a short to medium-term investment option while ensuring that subjective, difficult, or emotional scenarios are being taken care of, investing through Manulife InvestReady ll, via a trusted financial advisor might be your best bet.

A financial advisor will be present to sit through different stages of life together with you and therefore tailor advice according to your wants, needs, and personality.

My Review on Manulife InvestReady Wealth II

Based on the information above, Manulife InvestReady Wealth II is an attractive investment option for the short to mid-term (3-20 years). It comes with attractive bonuses to boost your investments and have flexible investment periods based on your goals.

Furthermore, you do not have to make premium payments regularly (for Flexi plans) even if your policy term is 20 years. This means that you have the option to widen your investment portfolio to further spread out risk and increase returns.

Let’s not forget that you can just let your investments grow passively until you are 99 years old before cashing out – something most ILPs don’t offer.

As compared to other investment-based ILPs in the market, Manulife InvestReady boasts low fees of 2.5% for the first 10 years, and 0.7% for the subsequent years.

When compared to other similar ILPs, the fund performance is in the medium-medium aggressive range. Getting an 8 – 10% annualised return on this would be possible if you have an FA that can select the right funds for you.

Therefore, your financial advisor has to actively play a part in monitoring the fund’s performance and make amends where he deems best. Only then can you benefit from Manulife InvestReady Wealth II.

The Manulife InvestReady Wealth II also offers riders that will waive premium waivers in the scenario of early critical illness or cancer. This means that Manulife will make the investments monthly for you during these difficult times to be still able to meet your investment goals.

And because of the above benefits that the Manulife InvestReady Wealth II has, it has been awarded as one of the best ILPs in Singapore thrice.

However, as investments are a long-term commitment, it’s best to explore alternatives.

Perhaps you can start off with the Singlife Savvy Invest or the FWD Invest First Plus as potential alternatives.

Otherwise, the best way to recognise whether you’re willing to cope with such fees is to consult a financial advisor to understand if Manulife InvestReady ll is for you.

Criteria

- You need to be between 18 to 65 years old to purchase this policy

- The minimum age of the policyholder is 0 years old (You can buy this policy for your child)

- The minimum investment period of 3 years

- The minimum investment amount of S$200 or US$300

General Features

The features of Manulife InvestReady Wealth II are as follows:

Premium Payment Terms

The base premium features are as follows:

|

Min. Investment Period |

Annual | Semi-Annual | Quarterly | Monthly |

| 3 Years | S$12,000 | S$6,000 | S$3,000 |

S$1,000 |

|

3 Years Flexi |

S$20,000 or US$20,000 | |||

| 5 Years | S$12,000 | S$6,000 | S$3,000 |

S$1,000 |

|

10 Years |

S$3,600 or US$3,600 | S$1,800 | S$900 | S$300 |

| 10 Years Flexi | S$6,000 or US$6,000 | S$3,000 | S$1,500 |

S$500 |

|

20 Years Flexi |

S$2,400 | S$1,200 | S$600 |

S$200 |

At this point, you’ll be wondering what the term “Flexi” means. “Flexi” is just a term used by Manulife to describe the flexible payment options you have. You can refer to the below for the breakdown.

- 3 Years Flexi – Single Premium

- 10 Years Flexi – Minimum of 3 Years Premium

- 20 Years Flexi – Minimum of 10 Years premium

You’ll probably wonder why the MIP is 20 years, but I only have to make 10 years of regular premium payments. Well, unlike other ILPs, the Manulife InvestReady Wealth II doesn’t want to “lock” your investments for long periods.

For example, if you opt for the 10 Years Flexi, you only make compulsory premium payments for 3 years. For the remaining 7 years, you can either opt to make more regular investments or let your investment value grow without any additions.

Of course, your returns will be lower than when you make regular contributions, but having the option to do this makes it an attractive option for those who need it!

Premium Allocation

If you choose to invest with Manulife InvestReady Wealth II, 100% of the regular basic premium will be used to buy fund units.

Renewal of Minimum Investment Period

You have the option to renew your Minimum Investment Period (MIP) for a further term of 3 years (Flexi included) and 5 years before your current plan expires. If you renew your MIP, you are entitled to receive a renewal bonus.

For MIP of 3 years and 3 years Flexi, you must exercise your renewal option on the 3rd or 6th policy anniversary. So if you fail to renew the policy on the 3rd policy anniversary, you cannot exercise your renewal option on the 6th policy year.

For MIP of 5 years, the renewal option is available on the 5th policy anniversary.

Plan Flexibility

These are a few selling points of this ILP.

Partial Withdrawals

The Manulife InvestReady Wealth II allows for partial withdrawals for when you need the cash.

However, the withdrawal charges can be pretty hefty (up to 100%) and are generally advised against. Imagine making a $300 withdrawal, you can be charged up to 100% of it. That’s $600 – which could be a few months’ worth of premiums.

We understand that sometimes you might need additional liquidity. That’s why proper financial planning is crucial, as it allows for emergency buffers that minimises the hindrance to your investments.

Changing Your Premium Amount

The Manulife InvestReady Wealth II allows you to make changes to your regular premium amount – whether you want to increase or decrease your investments. However, these changes are only applicable after your minimum investment period or the renewed MIP.

Furthermore, it is restricted to the minimum investment amount based on your MIP.

For example, you opted for the 10-year policy with a monthly investment of $500. After 10 years, if you decide to reduce your premiums, you can reduce it to $300, which is the minimum amount monthly.

Premium Top-Ups

You’ll be happy to know that there are currently no top-up charges if you’d like to make any premium top-ups outside of your regular basic premium.

The minimum premium top-up is $2,500, where 100% of your investments will be used to buy fund(s) units.

Protection

Death Benefit

If the life insured dies during his/her policy term, Manulife will pay the higher of:

- 101% of premiums paid less any withdrawal made, or

- Account value;

Less any amount owed to them

If the life insured passes before the 1st policy year from any existing illness, they would not pay any death benefit. But you’ll get a refund of the policy’s account value after deducting any welcome bonuses.

Terminal Illness (TI) benefit

If the insured contracts a terminal illness before he/she reaches the 99th Policy Anniversary, the Death Benefit will be paid in advance through a lump sum amount.

A terminal illness is a disease where the Medical Examiner determines that the patient is likely to pass away within 12 months from the date of diagnosis.

The maximum which the company pays for terminal illness and critical illness is S$2 million. The policy will remain active if the sum insured is not fully paid during the terminal illness claim.

Maturity Benefit

After the 99th birthday of the life insured, the policy will be terminated, where he/she will be paid the account value of the policy, minus any amount owed to the company.

Key Features

Welcome Bonus

With Manulife InvestReady Wealth II, you get a head-start with an initial bonus paid through additional units. This is a boosting factor if you are looking to build a decent portfolio from the start.

The Welcome Bonus is calculated as a percentage of the first 12 months of your regular basic premium, excluding premium top-ups. The bonus will be converted into additional units based on your premium allocation on any regular basic premium.

For further information, refer to the table below:

| Minimum Investment Period | 3 years | 3 years Flexi | 5 years | 10 years | 10 years Flexi | 20 years Flexi |

| Annual Premium | $12,000 to less than $48,000 | $20,000 or above | $12,00 to less than $48,000 | $3,600 to less than $12,000 | $6,000 to less than $12,000 | $2,400 to less than $9,600 |

| Welcome Bonus | 0% | 4% | 5% | 10 % | 8% | 30% |

| Annual Premium | $48,000 or above | NA | $48,000 or above | $12,000 or above | $12,000 or above | $9,600 or above |

| Welcome Bonus | 0% | NA | 10% | 40 % | 15% | 60% |

To illustrate, if you invest S$1,000 a month (S$12,000 yearly) and opt for a MIP of 20 years, you’ll get 60% in welcome bonuses to kickstart your investments! This will start compounding over the next 20 years, allowing your investments to grow.

Loyalty Bonus

You get loyalty bonuses at the end of your Minimum Investment Period (MIP) and every subsequent year thereafter. These bonuses could take you a long way if you are looking forward to renewing your MIP, taking some load off your finances, and making it easier for you to reinvest.

For further details, please refer to the table below:

| Minimum Investment Period | 3 years | 3 years Flexi | 5 years | 10 years | 10 years Flexi | 20 years Flexi |

| Loyalty Bonus | 0.30% | 0.0% | 0.30% | 0.30% | 0.30% | 0.30% |

To be eligible for the Loyalty Bonus, the policy must satisfy two criteria:

- The policy is active at the point of bonus payment

- No withdrawals in the prior 12 months from the declaration date of the Loyalty Bonus

Each Loyalty Bonus given is made in one payment as additional units. The Loyalty Bonus does not apply to the Minimum Investment Period of 3 years Flexi.

Renewal Bonus

For the minimum investment period of 3 years and MIP of 5 years, you will receive a Renewal Bonus if you choose to exercise your option to renew the MIP. Refer to the table below for further details.

| Minimum Investment Period | 3 Years | 5 Years |

| Annual Renewed Premium | $12,000 to less than $48,000 | $12,000 to less than $48,000 |

| Renewal Bonus | 1% | 10% |

| Annual Renewed Premium | $48,000 or above | $48,000 or above |

| Renewal Bonus | 3% | 20% |

For MIP 3 Years Flexi, if you renew your MIP, you shall receive the Renewal Bonus. This is 2% of your account value based on the MIP renewal date.

Receive Dividend Payouts

The Manulife InvestReady Wealth II is currently the only ILP that offers dividend payouts. These payouts can be made monthly or yearly, and you have the option to cash it out or reinvest them to grow your wealth further.

Depending on the funds’ performance, you can expect around 4% in dividends.

Optional Rider Add-Ons

You can also get extra protection with an optional early critical illnesses waiver coverage, cancer waiver coverage, or Payor benefit.

These add-ons help ensure that the policy pays for itself in the event of critical illness during the MIP, allowing you to still reach your investment goals.

Fund Offerings

Manulife InvestReady Wealth II currently boasts about 140 funds and sub-funds to pick from. From these 140 funds offered, you can choose up to 10 funds at any point of time for your InvestReady policy. This ensures that you have various options to help you build your portfolio based on your investment risks, objectives, and strategies.

With this, we’ve compiled the top 10 Manulife InvestReady Wealth II funds.

Manulife InvestReady Wealth II’s Top 10 Performing Sub-Funds

The Manulife InvestReady Wealth II invests in unit trusts and directly into the funds.

| Name of Fund | 5-Year Historical Average (%) | Risk Level |

| BGF World Technology Fund | 30.77 | Aggressive |

| Franklin U.S. Opportunities Fund | 15.43 | Aggressive |

| First State Asian Equity Plus Fund | 15.29 | Aggressive |

| First State Regional China Fund | 14.50 | Aggressive |

| Schroder Asian Growth Fund | 14.20 | Aggressive |

| BlackRock China Fund | 12.46 | Aggressive |

| Allianz Europe Equity Growth | 11.83 | Aggressive |

| Schroder ISF Global Emerging Market Opportunities Fund | 11.20 | Aggressive |

| Fidelity Emerging Markets Fund | 10.54 | Moderately Aggressive |

| Fidelity European Dynamic Growth Funds | 9.84 | Moderately Aggressive |

| Fidelity GlobalFirst State Dividend Advantage Fund | 9.30 | Moderately Aggressive |

Accurate as of January 2021

Source: https://www.manulife.com.sg/en/funds/funds-ilp.html/

It is crucial to note that historical performance does not guarantee future returns. Furthermore, these are 5-year annualised returns. Always do your analysis or talk to a trusted financial advisor if you’re unsure.

Fees Involved

Cost of Insurance

The cost of insurance is charged every month by cancelling your InvestReady Funds units to provide for insurance coverage.

The cost of insurance is guaranteed and based on the attained age, gender, and smoking status of the life insured, and the Net Amount At Risk (NAAR).

Charged from the start of the policy, with NAAR being:

- 101% of [total regular basic premiums paid + Any premium top-ups – Any withdrawals], less account value.

If NAAR is lesser than or equals zero, no cost of insurance will be imposed.

Administrative Charge

The company charges an administrative charge of 0.70% per annum of the account value. This is charged through cancelling fund units. Administrative charges will apply over the policy term and will be charged monthly.

Supplementary Charge

The company also charges an administrative charge of 1.80% per annum of the account value. They charge by cancelling fund units for the initial issuance and subsequent maintenance of the policy.

Supplementary charges will only apply over the first 10 policy years and will be charged monthly.

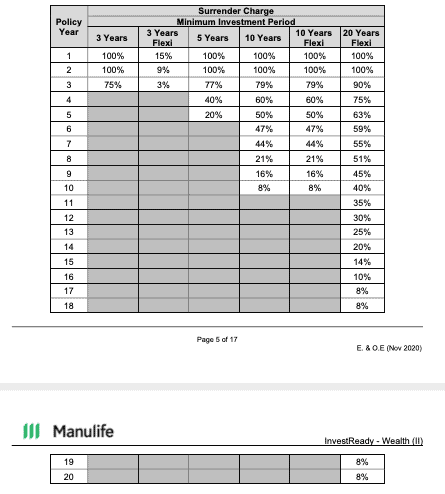

Surrender Charge

A surrender charge is valid if you request a full surrender during the Minimum Investment Period (MIP) or renewed MIP. The surrender charge will be subtracted from the sale proceeds.

The calculation formula:

Surrender charge % X Units Surrendered X Unit price of the respective InvestReady – Fund(s)

Below is the table for the Manulife InvestReady Wealth II surrender charges based on the MIP & the policy year you’re in:

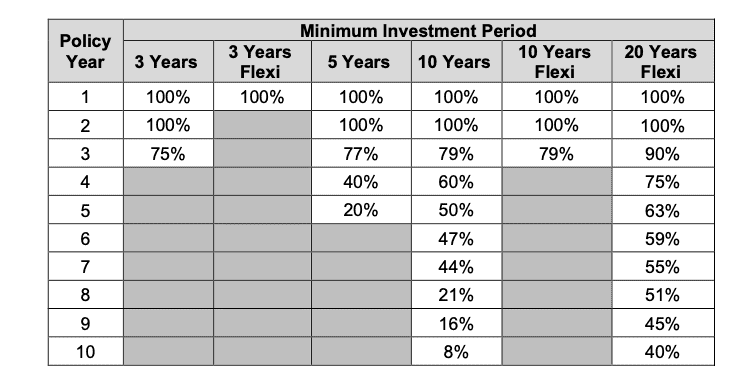

Partial Withdrawal Charge

There will be charges when you appeal for a partial withdrawal during the MIP. The percentage of the amount value that you request to withdraw will be calculated.

The calculation formula:

Partial withdrawal charge % X No. of Unit(s) of specified InvestReady Fund(s) X Unit price of specified InvestReady Fund(s)

Below are the partial withdrawal charges based on your policy’s MIP.

| Policy Year | Partial Withdrawal Charge | |||||

| Minimum Investment Period | ||||||

| 3 Years | 3 Years Flexi | 5 Years | 10 Years | 10 Years Flexi | 20 Years Flexi | |

| 1 | 100% | 15% | 100% | 100% | 8% | 8% |

| 2 | 100% | 9% | 100% | 100% | 8% | 8% |

| 3 | 75% | 3% | 77% | 79% | 8% | 8% |

| 4 | 40% | 60% | 8% | 8% | ||

| 5 | 20% | 50% | 8% | 8% | ||

| 6 | 47% | 8% | 8% | |||

| 7 | 44% | 8% | 8% | |||

| 8 | 21% | 8% | 8% | |||

| 9 | 16% | 8% | 8% | |||

| 10 | 8% | 8% | 8% | |||

| 11 | 8% | |||||

| 12 | 8% | |||||

| 13 | 8% | |||||

| 14 | 8% | |||||

| 15 | 8% | |||||

| 16 | 8% | |||||

| 17 | 8% | |||||

| 18 | 8% | |||||

| 19 | 8% | |||||

| 20 | 8% | |||||

Premium Shortfall Charge

If you miss out on meeting the regular basic premium during the MIP or renewed MIP, the insurer will levy a premium shortfall charge.

This will be monthly, which will start from the first working day till the end of the grace period in which you miss the premium payments. The company imposes the charges by selling units of the InvestReady Fund(s).

The formula to calculate the charge amount:

(X% x P)/12 Months

Where X% is the premium shortfall charge rate, P is the amount of annualised premium.

Here’s the table for Manulife InvestReady’s premium shortfall charge:

Management Charge

You can refer to the respective schedules in the relevant fund prospectuses for details. Management charges are payable from the InvestReady Fund(s) assets that the policy invests in and are deducted during daily pricing.

As such, unit prices of InvestReady Funds are net of this charge at all times.

The relevant fund manager reserves the right to make changes to the charges. Your financial advisor will give you written notice of such change(s) following applicable laws and regulations.

Compulsory Fees

In terms of compulsory fees, not every fee will apply to you. If you were to commit to the policy (in SGD) from start to maturity without any changes, these are the compulsory fees you will incur:

- Administrative Charge (0.7% of account value)

- Supplementary Charge (1.8% of account value in first 10 years)

However, do note that the supplementary charge is only applicable over the first 10 policy years only. Therefore, every year you will be incurring 2.5% (supplementary + administrative) in fees for the first 10 years and 0.7% (administrative) in fees subsequently over the policy term’s duration up till age 99.

How much will I receive upon maturity of the Manulife InvestReady Wealth II?

We engaged a Manulife advisor, to do the calculation for you.

Assuming that you invest $200 monthly for 20 years and let it compound for another 10 years, the funds perform at 10% per annum, you made no withdrawals, and you did not take up any premium holidays; you can expect the below:

|

First 10 Years |

|

| Monthly premium: | $200 |

| Premium Payment Term: | 20 years (240 months) |

| Annual Fund Performance: | 10% |

| Fees in the first 10 years: | 2.5% |

| Net Fund Performance for the first 10 years: | 7.5% |

| Investment value: | $34,365.22 |

|

Next 10 Years |

|

| Fees in the next 10 years: | 0.7% |

| Net Fund Performance in the next 10 years: | 9.3% |

| Investment value: | $120,611.29 |

|

Last 10 Years |

|

| Fees in the last 10 years: | 0.7% |

| Net Fund Performance in the last 10 years: | 9.3% |

| Total Investment Value over 30 years: | $293,487.48 |

Total Premiums paid after 20 years: $48,000

Total Interest Earned: $245,487.48

ROI: 511.43%

When making comparisons against other ILPs, make sure to minimally use a consistent investment amount, investment period, and investment frequency. This ensures a fairer comparison.

Fund performances are unpredictable, but you can expect a range of potential performance for different ILPs. Furthermore, different ILPs have access to different fund/sub-funds.

Thus, one of the most significant comparison points are the potential returns and fees from different ILPs, and you will need to manage your risk based on the returns you want.