The HSBC Life HappyMummy is a maternity insurance policy that is bundled with the

- HSBC Life EmpoweredMum, and

- HSBC Life Flexi Protector or

- HSBC Life – Life Treasure (II)

It’s a bit complicated, but let me try to simplify this upfront before we continue with the review.

Firstly, you will need either (2) or (3) as your base policy. You will then need to purchase (1), which is bundled together with either (2) or (3).

From here, you can purchase the HSBC Life HappyMummy as it’s bundled with the HSBC Life EmpoweredMum.

Terminating (2) or (3) before its third policy year will result in the HSBC Life EmpoweredMum and the HSBC Life HappyMummy being terminated too.

And terminating (1) will also cause the HSBC Life HappyMummy to be terminated.

Simply put, this means that the HSBC Life HappyMummy requires you to have 2 policies beforehand.

Confusing? Yeah, I know.

That’s why if you’re considering the HSBC Life HappyMummy, we suggest reading this review to get a clearer understanding.

Criteria

- Entry Age of Policyholder: 18 – 45 years old

- Sum Assured: Minimum of $5,000 and Maximum of $30,000

- Eligibility: Expectant mothers who are between 13 to 36 weeks of pregnancy

- HSBC Life EmpoweredMum

- HSBC Life Flexi Cover or HSBC Life – Life Treasure (II)

HSBC Life Flexi Protector or HSBC Life – Life Treasure (II)

Firstly, let’s talk about both these policies.

The HSBC Life Flexi Protector is an insurance-focused investment-linked policy that invests your premiums to provide you with returns and insurance coverage.

On the other hand, HSBC Life – Life Treasure (II) is an investment-focused investment-linked policy that solely focuses on growing your money through investing.

I won’t be breaking down these policies in this review as we have previously done individual reviews of them.

Check them out below:

HSBC Life EmpoweredMum

Next, let’s cover the HSBC Life EmpoweredMum.

This insurance plan is specifically tailored to pregnant moms by offering financial protection for both you and your newborn during and after pregnancy.

Expectant mothers are covered in case of death, complications during pregnancy, hospital expenses, and caesarean section.

In addition, the plan provides coverage for the newborn in case of death, congenital illnesses, hospital expenses and developmental delays.

As mentioned, before getting the HSBC Life EmpoweredMum, you’ll need either the HSBC Life Flexi Protector or the HSBC Life – Life Treasure (II)

Unlike the Flexi Cover and Life Treasure (II), little information about the HSBC Life EmpoweredMum is available.

But we managed to compile whatever we found and made a HSBC Life EmpoweredMum review here.

So be sure to read that first before continuing!

Key Features (HSBC Life HappyMummy)

Now that you understand the HSBC Life EmpoweredMum better, let’s dive into what the HSBC Life HappyMummy covers you for.

Transfer of Covers to Child

Within the period of 60 days after your child is born, you have the option to transfer your HSBC Life Flexi Protector and HSBC Life – Life Treasure (II) and the additional benefit riders to your newborn child without needing a medical evaluation.

These respective riders include:

| HSBC Life Flexi Protector Riders | HSBC Life – Life Treasure (II) Riders |

| CI Choice Accelerator Benefit rider | Multiplier Benefit riders |

| CI Max Accelerator Benefit rider | Critical Illness Benefit (II) rider |

| ECI Choice Accelerator Benefit rider | Early Critical Illness Benefit (II) rider |

| ECI Max Accelerator Benefit rider | —- |

If you submit a claim on either policy before transferring it to your child, the coverage for your child’s policy will be reduced accordingly.

However, this reduction will not apply after the transfer if the policy is issued on a non-standard life basis.

Once the transfer becomes effective, all additional benefits you are entitled to will be terminated automatically.

However, you can add Payer Waiver riders to your child’s respective policy without requiring a medical evaluation of your health.

The applicable Payer Waiver riders and benefits for each policy are shown in the table below

| HSBC Life Flexi Protector Riders | HSBC Life – Life Treasure (II) Riders | Premium Waiver Event |

| Payer Premium Waiver | Smart Payer PremiumEraser rider | Death, Total Permanent Disability & Terminal Illness of the Policyholder |

| CI Payer Premium Waiver | Smart Payer PremiumEraser Plus rider | Death, Total Permanent Disability & Critical Illness of the Policyholder |

| ECI Payer Premium Waiver | Payer PremiumEraser (DTPDECIUN) rider | Death, Total Permanent Disability, Early to Advanced Stage Critical Illness & Involuntary Loss of Income of the Policyholder |

If, sadly, the unborn child passes away during the current pregnancy or if the newborn child dies before reaching 60 days old, the mother has 2 options:

- The mother can choose to continue with the insurance policies that were taken out on her life.

- The mother can choose to terminate the policies. If she decides to terminate the policy, the death benefits that would have been payable under either policy will not be paid out.

However, she will be refunded all the premiums she has paid towards the policies.

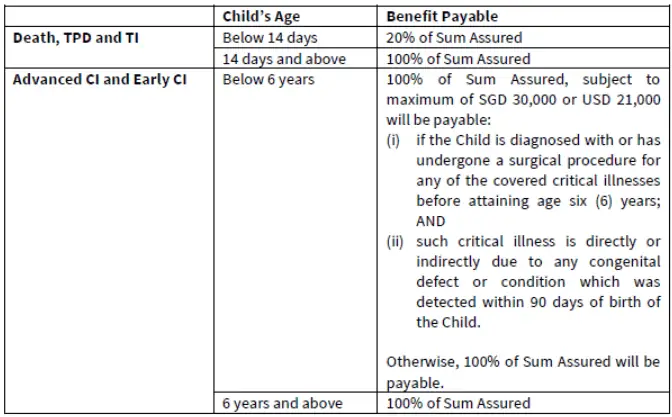

Child’s Coverage Limit for HSBC Life Flexi Protector

If the coverage amount for your child’s HSBC Life Flexi Protector is equal to or less than the maximum no-underwriting limit (S$300,000 or US$210,000), there is a maximum limit on the claims that can be made.

The specific claim limit depends on the circumstances and is as follows:

If the coverage exceeds the no-underwriting limit, your transfer request will be subject to underwriting, and the standard claim limit for HSBC Life Flexi Protector shall apply.

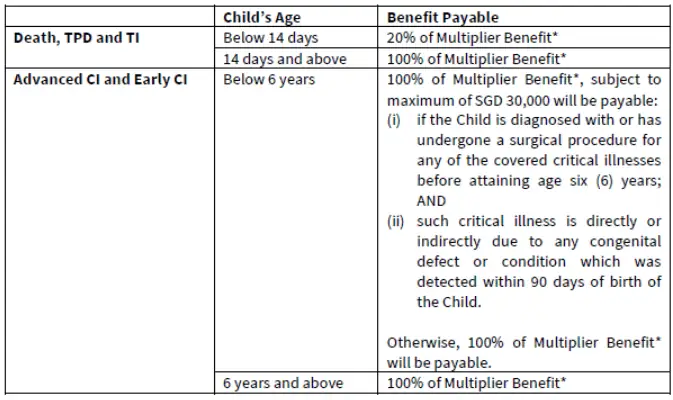

Child’s Coverage Limits for HSBC Life – Life Treasure (II)

The maximum no-underwriting limit for 1 or more children is S$300,000 for the same pregnancy.

If the coverage amount or Multiplier Benefit you choose for your child is S$300,000 or less, certain limits exist on the claims that can be made.

The specific claim limits will depend on the circumstances and will be as follows:

HSBC Life Shield Plan B for Your Child

Within 60 days after your child/ren is/are born, should you have an active policy under HSBC Life HappyMummy, you have the option to apply for an HSBC Life Shield Plan B for each child without needing to go through the underwriting process.

Furthermore, you will not have to pay premiums for the first year of the HSBC Life Shield Plan B.

However, for any additional riders attached to the policy, the riders’ premiums will still need to be paid.

All other terms and conditions mentioned in the HSBC Life Shield Plan contract and any attached riders will also apply.

The HSBC Life Shield Plan B policy for your child will terminate under the following circumstances:

- If your application to terminate the HSBC Life Shield is accepted.

- If any other event occurs that leads to the termination of the policy, as specified in the terms and conditions of the policy.

Here’s our review of the HSBC Life Shield Plan. Have a read before deciding if you’re interested in getting it for your child.

My Review Of The HSBC Life HappyMummy

The HSBC Life HappyMummy is an interesting yet confusing policy due to its structure.

HSBC Life HappyMummy is a package with 2 plans: HSBC Life EmpoweredMum and either HSBC Life Flexi Protector or HSBC Life –- Life Treasure (II).

This bundle is designed to provide focused protection for both you and your newborn child.

Since it’s bundled, we’ll include the HSBC Life EmpoweredMum together in this review.

The HSBC Life EmpoweredMum plan is the first of its kind in Singapore and offers coverage specifically for expectant mothers.

It provides coverage for early delivery by caesarean section, which means that if you give birth before 36 weeks of gestation through caesarean section, you will receive an additional 15% of the sum assured.

This comprehensive plan offers coverage for a range of pregnancy complications, congenital illnesses, and hospitalisation events.

It ensures that the mother and baby are protected throughout the pregnancy.

One of the notable benefits iof getting the HSBC Life HappyMummy on top of your HSBC Life EmpoweredBenefit is the ability to transfer policies to your child.

Within 60 days of your child’s birth, you can transfer the coverage from your plan (HSBC Life Flexi Protector or HSBC Life – Life Treasure (II)) to your newborn child without additional medical underwriting.

This means that you can extend the protection to your child seamlessly, even if there are medical complications.

In addition, the HSBC Life Shield Plan B covers your newborn child without requiring medical underwriting.

You can apply for this plan within 60 days of your child’s birth, and the first-year premium will be waived, providing an added financial benefit.

Similarly, this provides your child with coverage should there be any medical complications.

Do you need it?

Overall, HSBC Life HappyMummy provides robust protection for expectant mothers and children.

It safeguards against various pregnancy-related risks, hospitalisation, and congenital illnesses.

But I feel that the HSBC Life EmpoweredMum is sufficient for most. The HSBC Life HappyMummy is a good-to-have.

The flexibility to transfer coverage and the availability of additional coverage for your newborn child make it a comprehensive option for protecting the thing that you love and cherish the most: your child.

Not sure if this is for you?

I suggest reading our post on the best maternity plans in Singapore first.

This should provide you with some form of understand of your alternatives.

Once you understand them better, I recommend getting a second opinion on whether the HSBC Life HappyMummy is for you, and to explore other potential options that might be better.