Have you ever worried about the complications that arise from pregnancy?

If you have, fret not!

These worries are commonplace among prospective mums, and this is why Prudential has specially introduced PRUMum to alleviate your concerns.

PRUMum is a maternity insurance plan designed specifically for pregnant women and their newborn babies.

It offers financial protection against various health situations that may arise during and after childbirth.

Apart from protecting the mother, PRUMum also takes special care of your child by providing them with some key basic benefits to ensure they are well taken care of.

Do you feel intrigued and want to find out more?

Here is a comprehensive review of PRUMum.

My Review of Prudential’s PRUMum

PRUMum is a unique maternity plan that offers protection and support to pregnant women and their families.

Besides providing physical health coverage for mummies such as Death, Pregnancy Complications, and Hospital Care Benefits, PRUMum also takes care of your mental and emotional well-being by providing coverage for psychological consultations and postpartum depression.

If you are worried about these emotional hurdles that you might encounter as a new mother, PRUMum might be suitable for you as these benefits allow you to focus on your emotional healing.

In addition, PRUMum does not forget about your baby!

As a 2-in-1 plan protecting you and your child, PRUMum provides coverage for congenital illnesses and hospitalisation.

For parents who are planning on starting their child’s insurance journey from young, PRUMum might just be the right call for you!

Those insured under PRUMum have the privilege of signing their child up for a PRUShield Plus or PRUShield Standard plan without medical underwriting!

Given that the PRUShield plans are for life and one of the best shield plans in Singapore, you can know that your child’s insurance journey is set for life.

Did we mention that PRUMum was also on our list of the best maternity plans in Singapore too?

In summary, this plan provides you with financial security and peace of mind, ensuring that you and your baby receive the necessary support and care during and after pregnancy.

However, it’s still good to get a second opinion from an unbiased financial advisor to understand if the Prudential PRUMum is the best maternity insurance plan for you.

This is because the maternity plan protects you and your newborn baby.

Making sure your baby is fully covered from the get-go is ideal, making sure that they’re fully protected.

Also, many convert their maternity plans into whole life insurance plans for their babies, ensuring they remain protected after the policy term ends while saving money for their baby’s future.

Not only do you have to consider which is the best for your baby, but also whether it’s still the best when you convert it into a different policy.

As such, you should take extra time to compare your alternatives instead of just purchasing Prudential’s PRUMum.

If you’d like to compare your alternatives, we partner with MAS-licensed financial advisors who have helped thousands of our readers compare different insurance plans.

Click here to get a non-obligatory comparison session.

Let’s now explore the PRUMum policy in detail:

Criteria

- Eligibility: Anytime from the 13th week of pregnancy to before the child is born

- Entry Age: < 51 years old

- Fixed policy term of 4 years

General Features

Policy Terms

The PRUMum has a fixed policy term of 4 years. After the 4-year insurance period is up, the policy will be deemed terminated.

As the policy will be deemed terminated once the insured turns 51 years old, it is also suggested that you purchase the policy if you are pregnant before the age of 47 to enjoy the entire 4-year coverage period of PRUMum.

Premium Payment Terms

PRUMum is a single premium policy where the premiums are payable before the cover start date of your policy.

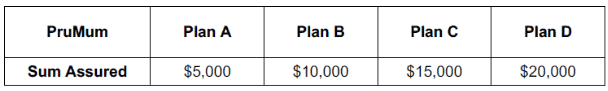

There are 4 sum assured for you to choose from depending on your needs and preferences, and the single premium payable will differ according to your choice.

Do also note that PRUMum is not approved for payment using Medisave.

Protection

Death Benefit

In the unfortunate event that the life assured passes away, PRUMum will pay the chosen sum assured.

Upon a successful payout, the Death Benefit and all other benefits for the life assured will terminate.

However, other benefits covering the child under PRUMum will still be in effect, providing ongoing financial protection for the child.

Pregnancy Complications Benefit

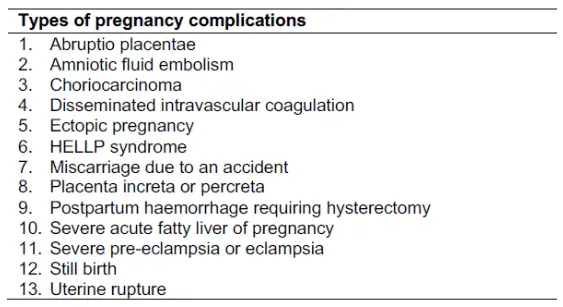

Certain risks are present for both the mother and child during pregnancy, which Prudential recognises.

As such, PRUMum covers many pregnancy complications, helping to cover the costs related to the medical treatment and care needed for the diagnosed complication.

Prudential will pay out your sum assured if the insured is diagnosed with any of the complications listed below:

This benefit ends when a successful claim is made or when the child turns 60 days old, whichever is earlier.

Do also note that the Pregnancy Complications Benefit is only claimable once, meaning that you would only be able to claim for one child if you are having twins or triplets.

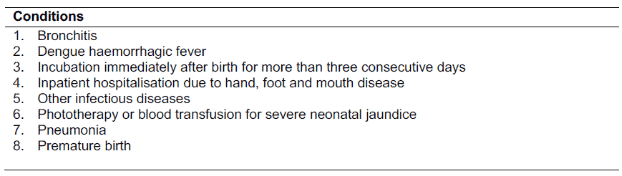

Hospital Care Benefit

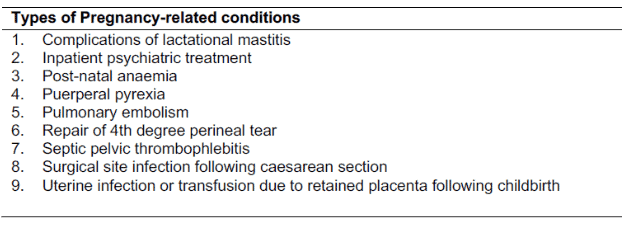

Should you require hospitalisation arising from any of the following pregnancy-related conditions, you would be eligible to claim 2% of your sum assured for each day of hospitalisation.

For your claim to be successful, the diagnosis for any of the above conditions must be confirmed by an appropriate medical specialist.

While the claim is processed on a 2% per hospitalisation day basis, the benefit is only paid up to 100% of the sum assured for each policy.

This means you could claim 50 days of hospitalisation for any of the above-listed conditions!

Once the sum assured limit is reached or the child turns 60 days old, this Hospital Care Benefit will be terminated.

However, fret not, as your other benefits under PRUMum will remain active!

Hospital Care Accelerator

While the Hospital Care Benefit covers a host of conditions, the payout is made in small denominations of 2% of the sum assured (per day of hospitalisation).

The Hospital Care Accelerator, in contrast, allows you to claim 100% of the sum assured if the hospitalisation:

- Is at least 30 consecutive days in one hospital admission, or the insured spends at least 1 day in the Intensive Care Unit (ICU); and

- Occurs between the 13th week of pregnancy and up to 60 days after the baby is born; and

- Takes place in a Singapore-registered hospital.

However, do note that the Hospital Care Benefit and the Hospital Care Accelerator are paid out from the same sum assured.

This means that if you had previously claimed the Hospital Care Benefit, your claim for the Hospital Care Accelerator will be 100% of the sum assured, less any previous payouts.

Like the earlier benefits, the Hospital Care Accelerator ends the moment the benefit sum assured is paid out or once the child turns 60 days old.

In addition, the Hospital Care Benefit will also end in conjunction with the Hospital Care Accelerator, but other benefits covered by PRUMum will continue.

Psychological Consultation Benefit

Depression and other psychological conditions are common among pregnant women, and the PRUMum ensures you are well protected.

The Psychological Consultation Benefit helps to cushion the financial impact of seeking psychological or psychiatric help, allowing you to focus on recuperating and healing your emotional and mental well-being.

Under this benefit, you are eligible to claim $100 per session of psychological or psychiatric consultation, up to a maximum of 2 sessions.

This benefit is terminated once the limit is reached, or 60 days from the child’s birth, whichever is earlier.

However, rest assured that the other benefits covered under PRUMum will continue after this benefit ends.

Postpartum Depression Benefit

Apart from pregnant women, mummies are also prone to postpartum depression, which can severely affect their mental health.

If you are a PRUMum policyholder, you can tap on this benefit to cover the costs of seeking professional help by claiming 5% of your sum.

Do note that postpartum depression must be diagnosed by a registered psychiatrist within 60 days of the child’s birth.

The Postpartum Depression Benefit will also come to an end once a successful claim is made or once the child reaches 60 days old, whichever is earlier.

The other benefits under PRUMum will also continue in the event that this benefit terminates.

Gestational Diabetes Mellitus Benefits

If the insured is unfortunately diagnosed with a condition related to gestational diabetes mellitus, PRUMum ensures you are covered for 10% of your sum.

These related conditions include:

- Gestational diabetes mellitus resulting in foetal macrosomia and neonatal hypoglycaemia, or

- Type 2 diabetes (contracted by the life assured) between 6 to 8 weeks after giving birth, or

- Pregnancy complications accompanied by gestational diabetes mellitus.

This benefit is deemed terminated if a successful claim is made or when the baby turns 60 days old, whichever is earlier.

However, other PRUMum benefits remain active, ensuring that you stay protected from other conditions.

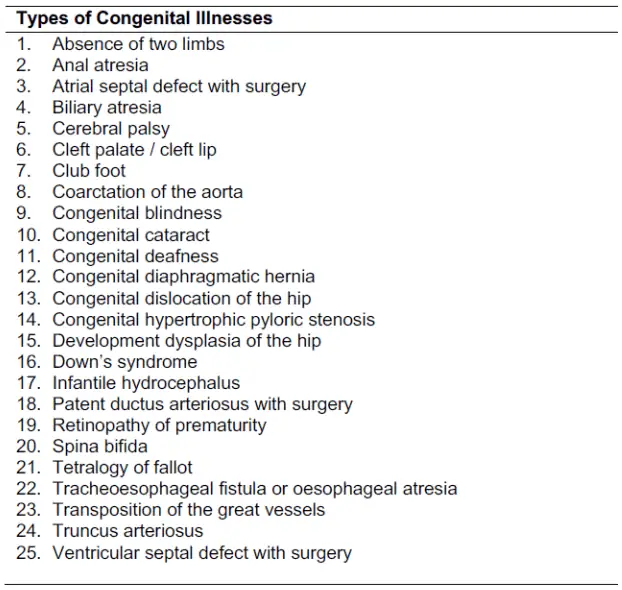

Congenital Illness Benefit

The full sum assured for your PRUMum policy will be paid out if your child is diagnosed with any of the congenital diseases listed below:

To be eligible for this benefit:

- The illness must be diagnosed by a registered medical practitioner;

- The illness must be diagnosed within 3 years from the child’s date of birth; and

- The child diagnosed with the congenital illness must be alive at the time of confirmation of diagnosis.

Note that if the life assured has multiple births within the same pregnancy (that means giving birth to twins, triplets, or more), the Congenital Illness Benefit will apply to each child separately.

This means that if all the children born within the same pregnancy are diagnosed with the congenital illness, Prudential will pay your sum assured for each child.

If the claim is only made on 1 child, the benefit remains active for the other children born within the same pregnancy.

Do note that once the claim is paid out or the child reaches 3 years old (whichever is earlier), the Congenital Illness Benefit terminates, but the other PRUMum benefits remain active.

Child Hospital Care Benefit

Considering the fact that newborn children are vulnerable and susceptible to illnesses, PRUMum also covers them if the illness requires the child to be hospitalised in Singapore.

Under the Child Hospital Care Benefit, mummies can claim 1% of your sum assured for each day of hospitalisation, up to 50% of the sum assured for your plan.

Like the Congenital Illness Benefit, the Child Hospital Care Benefit separately applies to each child born within the same pregnancy.

This means that if the claim is made only on one child, this benefit remains available for the other children born within the same pregnancy.

When the claim limit is reached, or when the child reaches 3 years old, whichever is earlier, this benefit will be deemed terminated.

However, the other benefits covered by PRUMum will remain active.

Summary of PRUMum

| Cash and Cash Withdrawal Benefits | |

| Cash Value | No |

| Cash Withdrawal Benefits | No |

| Health and Insurance Coverage | |

| Death | Yes |

| Total Permanent Disability | No |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |

| Health and Insurance Coverage Multiplier | |

| Death | No |

| Total Permanent Disability | No |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |