NTUC Income Maternity 360 is a maternity insurance plan specialised to provide coverage for expectant mothers and their children.

Mothers are covered against various risks, including death, pregnancy complications, and hospitalisation against childbirth complications.

If you are family planning and considering having a baby or are currently pregnant, you might want to consider this.

Continue reading our review to see if the NTUC Income Maternity 360 is for you.

Criteria

- Entry age: 17 to 44 years old for the insured mother, based on the last birthday.

- Pregnancy: 13 and 35 weeks pregnant

General Features

Premium Terms

The NTUC income Maternity 360 requires a single premium payment.

Premiums vary and depend on factors such as your age and smoker status.

Policy Term

The NTUC Income Maternity 360 provides you coverage for 3 years.

Coverage for Mother

Death Benefits

This benefit is provided should the insured mother pass away during the policy term.

NTUC Income Maternity 360 offers 100% of the sum assured as a lump sum payout.

It is important to note that when the death benefit is paid out for the insured mother, all benefits related to her under the policy will cease.

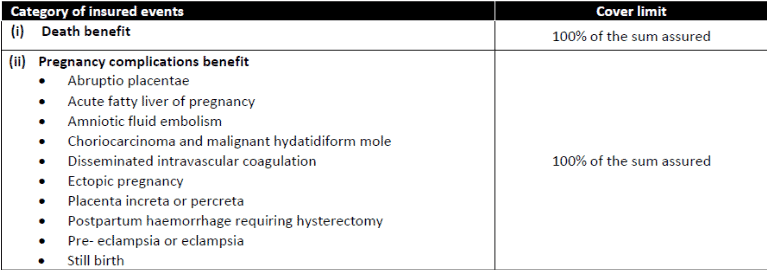

Pregnancy Complications Benefit

The NTUC Income Maternity 360 offers a Pregnancy Complications Benefit that covers you should you be diagnosed with certain pregnancy-related complications.

100% of the sum assured will be payable.

Here is the table showing what is covered under this benefit:

The diagnosis must be confirmed by an appropriate medical specialist who is a registered medical practitioner.

This benefit will end when this payment is made.

Hospital Care Benefit (Mother)

The Hospital Care Benefit covers you should you be hospitalised due to certain insured events within 42 days after childbirth.

1% of the sum assured will be payable daily if you are hospitalised for up to 30 days.

Here are the conditions covered under this benefit:

Even when hospitalisation is due to different medical conditions, the benefit payable remains the same.

The benefit provides a daily cash payout to cover hospitalisation-related expenses, and the total payout is capped at 30% of the sum assured.

Coverage for Child

Death Benefit

This benefit provides financial support to the policyholder in the event of the insured child’s unfortunate demise within 30 days after birth.

It ensures that a lump sum payout, equal to 100% of the sum assured, is provided to the policyholder in such a situation.

To be considered “live-born” for the purpose of this benefit, the pregnancy must have exceeded 28 weeks, and the insured child must meet at least 2 of these conditions after birth:

- Breathing

- The heart was beating

- Pulsation of the umbilical cord

- Voluntary muscle movement

All other benefits for the insured child will terminate once this benefit is made.

Outpatient Phototherapy Benefit

This benefit provides financial support to the policyholder should the insured child require phototherapy treatment for severe neonatal jaundice during the policy term.

In such cases, a daily benefit equivalent to 1% of the sum assured is payable per day the phototherapy machine is rented.

However, this is subject to a maximum limit of 10 days or 10% of the sum assured, depending on the duration of phototherapy treatment required.

This benefit is no longer claimable after 30 days from the date of birth.

Simplified Application Benefit

The Simplified Application Benefit in NTUC Income Maternity 360 simplifies the process of obtaining 1 or more new insurance coverages for the insured child after birth, offering a convenient way for you to secure additional coverage for your child’s financial protection.

These are the policies you can take up:

This is on condition that the insured mother takes up the new policy before 60 days lapse after her child is born.

Where more than one policy is applied, the total coverage amount for all benefits across all policies shall not exceed $150,000.

This benefit is transferable to the child’s father or legal guardian.

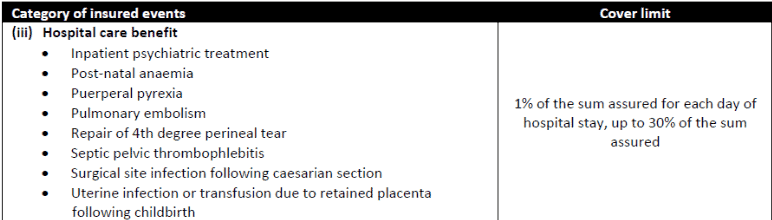

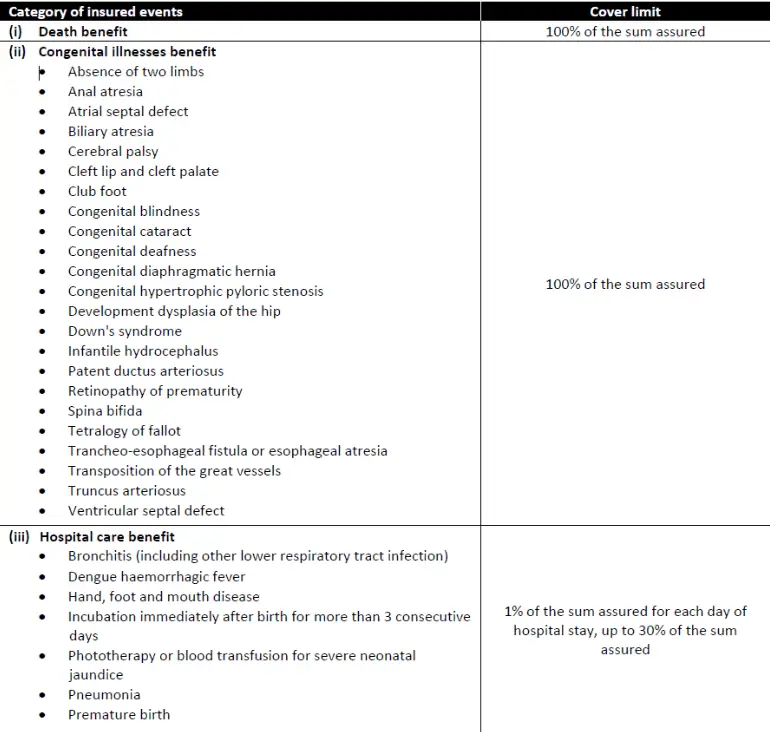

Congenital Illnesses Benefit

This benefit provides financial support to the policyholder if the insured child is diagnosed with any of the specified congenital illnesses during the policy term.

In such a case, a lump sum payout, equal to 100% of the sum assured, is provided to the policyholder.

The maximum amount you can receive for congenital illnesses won’t exceed the total coverage amount.

Once you receive this payment, the benefit will stop.

Here’s what’s covered under the Congenital Illness Benefit:

Hospital Care Benefit (Child)

This benefit provides financial support to the policyholder if the insured child is admitted to an Intensive Care Unit (ICU) or High Dependency Unit (HDU) due to specified medical conditions during the policy term.

In such cases, a daily benefit amount (1% of the sum assured) is payable for each day of hospitalisation, subject to a maximum limit of 30 days or 30% of the sum assured, depending on the reason for hospitalisation.

If your baby needs hospitalisation because of neonatal jaundice or being born prematurely and requires phototherapy or a blood transfusion, the benefit will only pay for up to 30 days from the day your baby was born.

Also, if your child has multiple health problems that require them to stay in the intensive care or High Dependency Unit of a hospital, you will only receive 1% of the total coverage amount for each day they stay in the hospital.

These are the medical conditions covered by the Hospital Care Benefit:

Summary of the NTUC Income Maternity 360

| Cash & Cash Withdrawal Benefits | |

| Cash Value | N/A |

| Cash Withdrawals | N/A |

| Health & Insurance Coverage | |

| Death | Available |

| TPD | N/A |

| Terminal Illness | N/A |

| Critical Illness | N/A |

| Early Critical Illness | N/A |

| Health & Insurance Coverage Multiplier | |

| Death | N/A |

| TPD | N/A |

| Terminal Illness | N/A |

| Critical Illness | N/A |

| Early Critical Illness | N/A |

My Review of NTUC Income Maternity 360

The NTUC Income Maternity 360 is a specialised maternity insurance plan designed to provide comprehensive coverage for expectant mothers and their newborns over a 3-year period.

It offers coverage for pregnancy complications, death of the insured mother, congenital illnesses, and death of the insured child.

It also provides coverage for the insured child in case of congenital illnesses, offering peace of mind to parents regarding their child’s health.

Both the insured mother and the insured child can benefit from hospital care coverage.

This ensures financial support in case of hospitalisation due to childbirth complications or other medical conditions.

In the event that the newborn requires phototherapy treatment for severe neonatal jaundice, this benefit covers the rental cost of the phototherapy machine, providing financial relief to parents.

After the child’s birth, the insured mother can easily apply for a new insurance policy for the newborn under this benefit.

The application process is simplified, requiring only a basic health declaration.

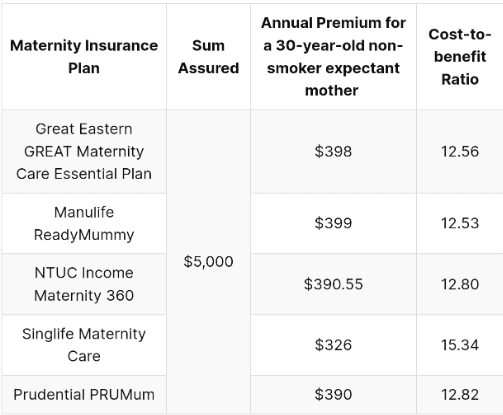

However, the NTUC Income Maternity 360 isn’t the cheapest option – which is surprising as it usually is.

Singlife’s maternity care stands out as the better option if you want a cheaper alternative.

For instance, a 30-year-old non-smoking pregnant woman looking for a $5,000 sum assured will only have to pay $326 for Singlife Maternity Care.

Despite this, overall, NTUC Income’s Maternity 360 is a good option.

However, it might not be the best for everyone.

Read our post on the best maternity plans in Singapore to find alternatives that might be better for you!

But this is just our opinion, we suggest talking to an unbiased and experienced financial advisor to find a product that best fits your needs.