The Tokio Marine #goAssure is a regular premium insurance-focused investment-linked policy that provides protection and acts as an investment vehicle to protect your financial future.

It’s a broad plan that offers protection against terminal illness, total and permanent disability, and death – letting you choose a plan that adapts to your unique needs while growing wealth over time.

What’s more! It’s flexible in that you can choose the protection age and amount that suits you best.

There’s much more to learn about the Tokio Marine #goAssure, as you shall find out in this comprehensive review.

Keep reading.

Criteria

- Plan Term: Up to 99 years

- Issue Age: 1 to 65 years

- Minimum Regular Premium: $125/month

- Minimum Investment Period: 5 years

General Features

Premium Payments

With this plan, you can choose your minimum contribution period (MCP) from a 5-year, 10-year, 15-year, 20-year, or 25-year period.

Regular Premium

The Tokio Marine #goAssure features regular premiums payable throughout your policy term.

The minimum amount of each regular premium you have to pay for each contribution period and payment mode is shown here:

| Minimum Regular Premium | |||||

| MCP

(years) |

5 | 10 | 15 | 20 | 25 |

| Premium Mode | (SGD) | (SGD) | (SGD) | (SGD) | (SGD) |

| Monthly | 500 | 300 | 200 | 150 | 125 |

| Quarterly | 1,500 | 900 | 600 | 450 | 375 |

| Half-yearly | 3,000 | 1,800 | 1,200 | 900 | 750 |

| Annual | 6,000 | 3,600 | 2,400 | 1,800 | 1,500 |

Your regular premium contribution is allocated towards buying units in the sub-funds and paying for the insurance coverage.

Regular Premium Reduction

With the Tokio Marine #goAssure, you can reduce your regular premium contributions and still maintain a minimum reduction amount and minimum regular premium requirement.

This way, you’ll have the flexibility to adjust your coverage to fit your needs while helping you stick to your budget.

Tokio Marine will determine the minimum amount at the point of request.

Premium Increase

If you have already reduced your regular premium previously, you may request to increase it.

You need to submit a written request for this to be effected.

The premium shortfall charge will be waived when the regular premium amount payable rises to match the yearly regular premium committed at the start date.

Similarly, Tokio Marine will determine the limit by which you can increase your premium.

Recurring Single Premium

At any point after the first year from the start date, you have the freedom to request to make recurring single premium payments.

The method and frequency of payment for the recurring single premiums must match that of your regular premium contribution.

So if you opted to pay monthly on your basic plan, you need to also follow monthly payments instead of choosing yearly.

The table below outlines the minimum and maximum amounts for each recurring single premium payment:

| Premium Mode | Minimum Recurring Single Premium (SGD) | Maximum Recurring Single Premium (SGD) |

| Monthly | 50 | 1,600 |

| Quarterly | 150 | 5,000 |

| Half-yearly | 300 | 10,000 |

| Annual | 600 | 20,000 |

Top-up Premium

You can apply to make premium top-ups anytime after your first policy anniversary.

The minimum amount for each top-up premium is $1,000, and the maximum amount you can pay in one policy year is $20,000.

Protection

Protection Age

Firstly, you can select the Protection Age ranging from age 65 to 99. This Protection Age will define your coverage terms for the insurance part of this policy.

You can also change the Protection Age if the following requirements are met.

The new Protection Age:

- is between age 65 and 99;

- at least 5 years from your current age.

Tokio Marine also states,

“You may change the Protection Age only when the life assured’s attained age is at least ten (10) policy year before the Policy Anniversary on which the life assured is at Protection Age”,

Which we don’t quite understand.

Lastly, you may only change the Protection Age up to 3 times in your lifetime.

If you’ve got these requirements covered, you’re good to go!

Death Benefit

If death occurs while this policy is still running, your beneficiaries will receive the Death Benefit under the following circumstances:

| At the policy anniversary when the life assured attains Protection Age; | After the policy anniversary when the life assured has attained Protection Age; |

The Death Benefit is the higher of;

|

|

Upon the payment of the Death Benefit, the policy will be terminated.

Any Top-up Units Account value will also be paid out with the Death Benefit. Additionally, a monthly protection charge will be incurred.

Terminal Illness (TI) Benefit

If you’re diagnosed with a terminal illness while this policy is still running, you will receive the death benefit up to a maximum of the TI Limit.

The policy will terminate if the death benefit is fully paid.

The maximum TI benefit payable is S$4,500,000 inclusive of all policies and riders on the same life.

Total and Permanent Disability (TPD) Benefit

If you become totally and permanently disabled while your policy is in force, you will receive the TPD benefit as shown below:

| On or before the policy anniversary when the life assured attains Protection Age; | After policy anniversary when the life assured has attained Protection Age; |

| Death Benefit x TPD Acceleration Ratio

TPD Acceleration Ratio equals to TPD Sum Assured divided by Basic Sum Assured. |

The TPD coverage ends |

The maximum TPD benefit payable, inclusive of other policies as well as the riders, is S$4,500,000.

Option Add-On Riders

You can boost your coverage with the following riders;

Critical Illness Accelerating Protector Rider

You can choose the Critical Illness Accelerator Rider to increase the death benefit of the basic plan.

With this rider, you can get up to the sum assured if any of the covered critical illnesses are diagnosed.

Early Critical Illness Accelerating Protector Rider

This rider covers you for the following critical illness stages:

- Early

- Intermediate

- Advanced

Additionally, it includes benefits for:

- ICU/HDU admissions

- Juvenile conditions,

- Special circumstances

For both the ECI and CI rider, there are no indications of how many conditions are covered each.

Enhanced Payer Benefit Rider

Premium waiver in case of critical illness, demise, or disability of the policyholder.

Waiver of Premium Rider

Premium waiver in case of critical illness of the life assured.

Spouse Rider

Premium waiver in case of death or disability of the wife or husband of the policyholder.

Enhanced Spouse Rider

Premium waiver in case of critical illness, demise, or disability of the policyholder’s spouse.

Key Features

Initial Bonus

You can receive an initial bonus in the first 4 years of paying regular premiums while the policy is still running.

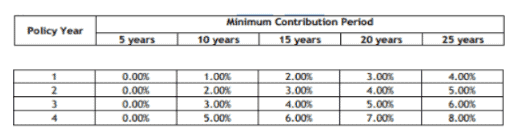

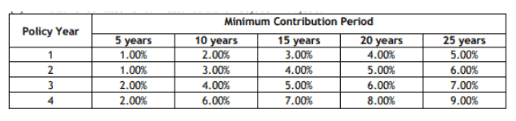

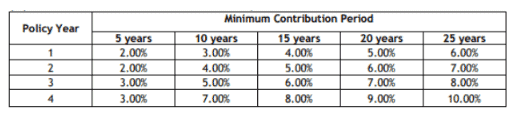

The initial bonus depends on the applicable rate, minimum contribution period, and regular premium received, as shown in the following tables:

i) Sum Assured Band ($100,000 – $199,000)

ii) Sum Assured Band ($200,000 – $299,000)

iii) Sum Assured Band ($300,000 and above)

There are no initial bonuses for any recurring single or top-ups made.

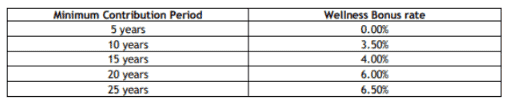

Loyalty Bonus

You can get a loyalty bonus at the end of every policy year, starting from 11 years up to the end of the contribution period.

It’s important to note that you won’t receive loyalty bonuses when the policy is on a premium holiday.

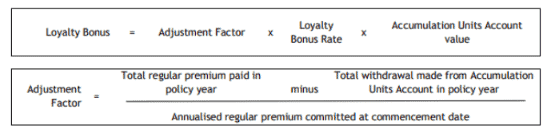

Let’s take a closer look at the formula to calculate your loyalty bonus:

The annual loyalty bonus rate is shown below:

Achievement Bonus

The policy offers you a one-time achievement bonus at the end of your minimum contribution period, subject to the following conditions:

- Prompt payments of the regular premiums throughout the MCP.

- No premium holidays taken during the MCP.

- The regular premium amount does not change during the MCP.

- No withdrawals from the Accumulation Units Account during the MCP.

It also depends on your Accumulation Unit’s Account value.

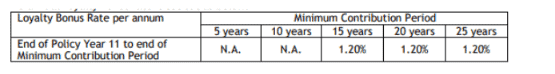

Check out the Achievement Bonus rate for the minimum contribution period below:

Wellness Bonus

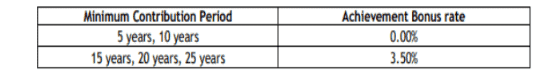

You will receive a one-time wellness bonus at the end of 5 years after your minimum contribution period, subject to the following conditions:

- There are no previous or pending claims at the end of 5 policy years after the MCP.

- No premium holiday taken during the MCP.

- The regular premium amount does not change during the MCP.

- Prompt payments of the regular premiums throughout the MCP.

- No withdrawals from the Accumulation Units Account during the MCP.

The wellness bonus rate is based on the minimum contribution period, as shown in the table below:

Dividend Payouts

When receiving your dividends from the sub-funds, you can either opt to:

- Receive it in cash in which Tokio Marine will pay these dividends to you if it’s $50 and above.

- Otherwise, they will be re-invested as additional units in your chosen sub-funds.

Either way, your dividends will be paid out to you within 30 days of the end of its declaration date.

Guarantee Extra Protection (GEP)

You, as a life assured, have the privilege to exercise the Guaranteed Enhancement Privilege (GEP).

This opportunity allows you to increase the sum assured of the basic or TPD rider without the need for medical underwriting in the event of specific life occurrences.

These events that may qualify you include:

- Changes in marital status,

- Becoming a parent by having a newborn or legally adopted child,

- Graduating from tertiary education, or

- Purchasing a property.

Nonetheless, you must meet the following criteria:

- Apply before the policy anniversary or before you turn 50 years,

- Can be exercised up to 2 times during your lifetime,

- There shouldn’t be any claims within the coverage term, and

- The maximum increase in the basic sum assured is $500,000 or 50% of basic sum assured, whichever is lower.

Premium Holiday

After paying the regular premiums for the first 4 policy years, you may take a premium holiday. This lasts up to when you resume paying the regular premiums.

While on this break, your basic plan will remain in place; however, a premium shortfall charge will be applied.

Partial Withdrawal

You may request a partial withdrawal of policy value from the 5th policy year onwards provided the minimum amount is at least $500 per transaction.

During your minimum contribution period, you may withdraw from your Accumulation Units Account and/or Top-up Units Account if the remaining value of units does not fall below the minimum amount.

Also, the remaining policy value must be at least $3,000 at the time of partial withdrawal.

There are charges to make partial withdrawals, which we will cover later.

Regular Withdrawal

You can request to withdraw from the Initial Units Account, Accumulation Units Account, and Top-up Units Account on an annual, half-yearly, quarterly, or monthly basis after your minimum contribution period.

The minimum and maximum amounts are not mentioned.

Change In Sum Assured

After the minimum contribution period ends, you may apply to reduce your basic sum assured and/or TPD sum assured.

However, the amount you want to reduce must be at least $100,000 for the application to be considered.

If your current sum assured is already lower than this amount, you cannot reduce it further.

Conversely, the policy does not allow an increase in the basic sum assured and TPD sum assured unless you opt for the Guaranteed Extra Protection (GEP) option.

Fund Switching

You can switch any units of your original fund to another fund subject to meeting certain conditions, such as:

- The remaining value of the units in the original fund must be more than the minimum amount determined by Tokio Marine; otherwise, it must be completely switched out, and

- the value of units in the target fund must not be less than the minimum amount as determined by Tokio Marine.

Tokio Marine #goAssure Top 10 Performing Funds

The Tokio Marine #goAssure invests directly into the unit trust instead of their own ILP sub-fund.

| Fund | 5-Year Annualised Returns |

| Franklin Technology Fund Acc USD (TABU) | 13.72 |

| Franklin Technology Fund Acc SGD-H (TABS) | 12.29 |

| Allianz Glb Artificial Intelligence Acc SGD-H (DABS) | 11.17 |

| Infinity US 500 Stock Index Fund Acc SGD (HABS) | 9.95 |

| United Gold & General Fund Acc SGD (UACS) | 8.87 |

| Capital Group New Perspective Fund Acc USD (NAAU) | 8.67 |

| Fundsmith Equity Fund Acc GBP (1AAG) | 8.04 |

| Janus Henderson Glb Life Sciences Acc USD (BAAU) | 7.82 |

| MS Europe Opportunity Fund Acc EUR (MAAE) | 7.38 |

| Fidelity European Dynamic Gr Acc USD-H (FACU) | 7.37 |

Accurate as of 19 July 2023

Tokio Marine #goAssure Fees and Charges

Initial Charge

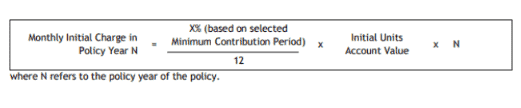

The initial charge is imposed every month and depends on your MCP and Initial Units Account Value as shown here:

The Initial Charge rate every year is shown here.

| Minimum Contribution Period (Years) | Initial Charge Rate (%) |

| 5 | 1.12 |

| 10 | 0.65 |

| 15 | 0.45 |

| 20 | 0.35 |

| 25 | 0.30 |

The initial charge applies during the premium holiday.

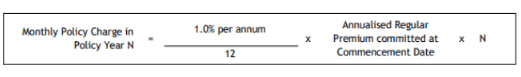

Policy Charge

The policy charge depends on regular premiums and is deducted from the accumulation units.

Here is the formula used to calculate the monthly policy charge:

The policy charge will also apply during the premium holiday.

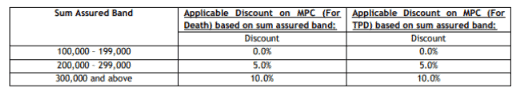

Monthly Protection Charge (MPC)

A Monthly Protection Charge (MPC) will be deducted in advance, up to the Policy Anniversary associated with your Protection Age.

This charge will remain applicable even if the policy is on a premium holiday.

MPC is calculated depending on the TPD sum at risk and the basic sum at risk based on the unit price at the policy monthiversary.

This is based on the MPC rates depending on the following factors:

- Sex

- Age

- Smoker status

- Sum assured band at policy monthiversary.

Generally, if your account value drops below your sum assured, there will be a sum at risk that you will have to pay for.

There may be discounts (non-guaranteed) applicable for the MPC, as shown in the table below:

Refer to your policy documents or talk to your financial advisor to find the MPC charges applicable.

Premium Charge for Recurring Single Premium and Top-up Premium

A 5% premium charge will be taken from each of your recurring single premium and top-up premiums before it’s allocated.

Administrative Charge

There are no administrative charges for this policy.

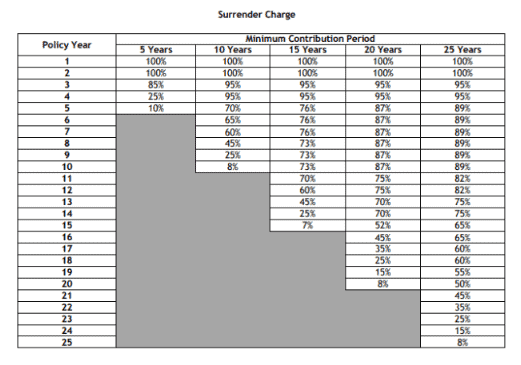

Surrender Charge

If you decide to surrender your policy on or before the end of your minimum contribution period, a surrender charge may be levied.

The following table shows the surrender charge rates based on the policy year and MCP:

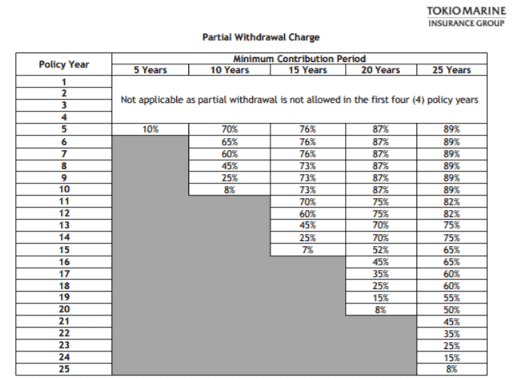

Partial Withdrawal Charge

A partial withdrawal charge may be levied upon any partial withdrawals made before the end of your minimum contribution period.

This charge is calculated by multiplying the partial withdrawal amount by an applicable percentage.

The following table shows the partial withdrawal rates based on the policy year and MCP:

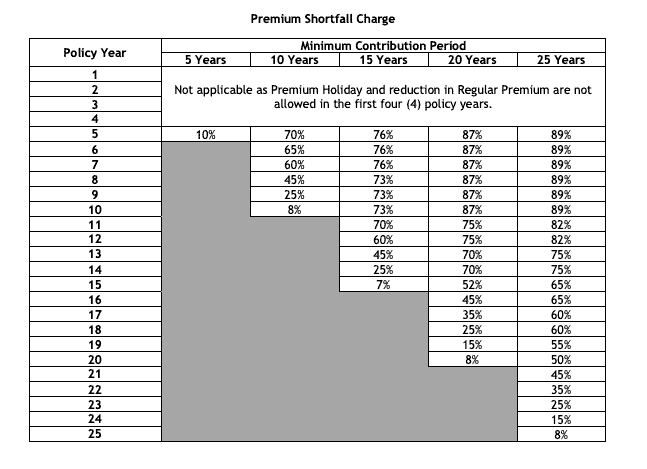

Premium Shortfall Charge

A monthly premium shortfall charge will be applied subject to certain circumstances. This includes;

- When your policy is on a premium holiday,

- When you reduce the amount of annualised regular premiums before reaching the minimum contribution period, or

- If you fail to reach the initially promised payment amount.

This charge is taken from your Accumulation Units Account ahead of time each month.

The following table shows the premium shortfall charges based on the policy year and MCP:

Waiver of Partial Withdrawal Charge and/or Premium Shortfall Charge

You can request a waiver of the partial withdrawal charge and/or premium shortfall charge within 90 days of any of the following events:

- After 4 policy years, if you are confined in a hospital for at least 5 consecutive days in an admission.

- If you are retrenched and remain unemployed for 30 consecutive days before reaching age 65.

Credit Card Charge

The Tokio Marine #goAssure imposes a 1.6% credit card charge on each premium when you pay using a credit card.

Fund Management Fee

Unlike most insurance-focused ILPs, funds under #goAssure are not their own sub-funds (in this case, TMLS).

Based on a quick glance, the funds offered by #goAssure either charge a one-time sales charge of up to 5.25%, a yearly fund management fee of up to 2%, or a combination of both.

The returns you see on the fund level are mostly net – which means you don’t have to pay any additional fees on top of the fund-level returns you see (more money for you!).

This is unique as most other insurance-focused ILPs invest in their own sub-funds that do not include fees in their fund return calculations.

Switching Fees

You’ll not be charged for fund switches.

Summary of the Tokio Marine #goAssure

| Cash and Cash Withdrawal Benefits | |

| Cash Value | Yes |

| Cash Withdrawals | Yes |

| Health and Insurance Coverage | |

| Death | Yes |

| Total Permanent Disability | Yes |

| Terminal Illness | Yes |

| Critical Illness | Yes, with rider |

| Early Critical Illness | Yes, with rider |

| Health and Insurance Coverage Multiplier | |

| Death | No |

| Total Permanent Disability | No |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |

| Optional Add-on Riders

Critical Illness Accelerating Rider Early Critical Illness Accelerating Rider Waiver of Premium Rider Enhanced Payer Benefit Rider Spouse Rider Enhanced Spouse Rider |

Yes |

My review of the Tokio Marine #goAssure

The #goAssure policy is a unique insurance-focused ILP that combines insurance and investments.

You can choose how long your minimum contribution period is – 5, 10, 15, 20, or 25 years – and premiums start at $125 per month.

It also offers coverage against Death, Terminal Illness, and Total and Permanent Disability, with options to add up to 6 riders – ECI, CI, and premium waivers.

You also have the flexibility to choose your protection age of up to 65 or 99 years.

Besides protection, #goAssure allows you to grow your wealth over time with affordable premiums. You can also get bonuses during the policy tenure and choose the best sub-fund to accelerate your wealth.

Unlike other insurance-focused ILPs and even Tokio Marine’s other ILPs (TM FlexiCover and TM FlexiAssurance), this ILP lets you invest directly into the underlying unit trust – just like a good investment-focused ILP!

This means lower fees and higher returns. It’s the combination of the #goTreasures or goClassic, but make it a whole life insurance plan!

Despite its uniqueness and potential for higher returns, I can’t recommend the Tokio Marine #goAssure.

It’s because I don’t believe in insurance-focused ILPs. These types of ILPs tie your investments and life insurance coverage too closely together.

It is common for insurance agents to tell you that when you get older, your investments will have grown a lot that can be used to pay for the cost of your insurance coverage.

Despite being an interesting concept, the insurance charges increase with age, draining your investments quickly.

In the event that the market declines, you risk not having enough money in your retirement account, and you’ll need to top it up with cash – that’s not what you want to do when you’re retired.

But what if you pass the minimum contribution period – you don’t face this issue anymore!

Yes, unlike other whole life ILPs, you don’t have to worry about paying premiums forever.

But why risk this during the minimum contribution period when you can have more control via a term insurance plan or a whole life insurance plan?

You can tie it together with an investment-focused investment plan with a short minimum investment period (like the Manulife InvestReady Wealth III) to minimise this risk you’re facing.

It is important to do your research before choosing a provider, particularly for ILPs, since each offers unique products, benefits, and payouts.

To ensure you make the best decision for your financial future, talk to a financial advisor that can provide you with reliable advice.

That way, you don’t risk making huge financial mistakes that you’ll surely regret in the future.