The Manulife InvestReady Wealth III is an investment-focused investment-linked plan (ILP) designed to be a long-term investment solution for anyone seeking wealth.

The plan offers a range of investment options to suit different risk tolerances and investment objectives.

This post provides a comprehensive review of Manulife InvestReady (III) – the latest version of Manulife InvestReady Wealth II.

Keep reading;

My Review of the Manulife InvestReady III

My honest review is that the Manulife InvestReady (III) is an attractive option for medium to long-term investments due to its comparatively lower fees and flexible choices of investment terms – something that others can’t really compete with.

It’s also one of the few ILPs offering dividend funds for which you can withdraw or reinvest.

Unlike the previous version of other ILPs, you can actually withdraw your dividends anytime without incurring any charges.

So, if you need some extra cash, look into how much dividends you’ve made and then request for it without worrying about paying withdrawal charges.

Based on our potential returns calculation later on, you can see a 499.25% ROI after 30 years.

This is lower than the Manulife InvestReady Wealth II by 12.18%, or $5,848.19.

However, one of our partners, Jordan, compared both versions to include the bonuses you’d receive.

According to Jordan, you would get about $2,000 more with Manulife InvestReady III instead. This assumes you’re investing using the 20-Year Flexi 10 plan and with $800 monthly to hit the 60% Welcome Bonus.

We checked his calculations and it checks out, so if you’re investing and hitting the highest bonuses, the Manulife InvestReady III is great for you.

Again, you can’t get the previous version anymore, so the comparison should be made with other ILPs.

To its defence, 499.25% after 30 years is good – if you compare it to many other ILPs that don’t perform as well in similar conditions.

And you shouldn’t choose an ILP based on potential returns alone.

To select the best ILPs, you need to consider the flexibility in terms of the minimum investment period, fees, funds offered, and the flexibility it offers – which I believe the Manulife InvestReady III excels at – and is much better than its former version.

However, it’s always best to talk to an unbiased financial advisor for a second opinion.

If you need help deciding if the Manulife InvestReady III is good for you or if there are potentially better options based on your needs, we partner with MAS-licensed financial advisors to help you with this.

Click here for a free second opinion.

And if you want to know the Manulife InvestReady III features in detail, continue reading.

Criteria

- You need to be between 18 to 65 years old to purchase this policy

- The minimum age of the policyholder is 0 years old (You can buy this policy for your child)

- The minimum investment period is 5 years.

- The minimum investment amount is S$200.

General Features

The features of Manulife InvestReady Wealth III are as follows:

Premium Payment Terms

The minimum regular basic premiums are shown in the following table:

| Minimum Investment Period | Minimum Payment Period (Years) | Minimum Investment Amount | ||||

| Currency | Annual | Semi-Annually | Quarterly | Monthly | ||

| 5 Years Flexi 1 | 1 | SGD | 25,000 | – | – | – |

| 5 Years Flexi 1 | 1 | USD | 25,000 | – | – | – |

| 6 Years Flexi 2 | 2 | SGD | 10,000 | – | – | – |

| 7 Years Flexi 5 | 5 | SGD | 12,000 | 6,000 | 3,000 | 1,000 |

| 10 Years Flexi 3 | 3 | SGD | 6,000 | 3,000 | 1,500 | 500 |

| 10 Years Flexi 5 | 3 | SGD | 6,000 | 3,000 | 1,500 | 500 |

| 10 Years Flexi 8 | 8 | SGD | 6,000 | 3,000 | 1,500 | 500 |

| 13 Years Flexi 10 | 10 | SGD | 3,600 | 1,800 | 900 | 300 |

| 20 Years Flexi 10 | 10 | SGD | 2,400 | 1,200 | 600 | 200 |

Like the previous version – Manulife InvestReady Wealth II – Flexi describes the flexible payment options available.

Except for this time, it’s easier to understand via the numbers added at the end.

For example, if you see Flexi 1, it means you’ll have to invest minimally for 1 year. If you see Flexi 10, it means you have to invest for 10 years minimally.

I’ve included the years you can expect to invest under the column “Minimum Payment Period”. It’s not a payment you’re making – it’s an investment – but I used payment to avoid confusion.

The numbers at the front indicate your minimum investment period – which means how long you need to invest minimally with this policy.

Taking the 20 Years Flexi 10 policy as an illustration, it means that you’ll have to invest for minimally 10 years, and your assets will remain and grow in this policy before you can make charge-free withdrawals in the 20th year.

You can also request to change the way your premium payment terms, and the new payment method will take effect on your policy’s next premium due date.

It’s important to remember that this option is not available for the MIP 5 Years Flexi 1 and MIP 6 Years Flexi 2 policies.

You also might lose some bonuses that are exclusive to the annual investment mode – which we’ll cover later.

As compared to the previous version, the Manulife InvestReady III is much more competitive in this aspect.

Premium Allocation

The Manulife InvestReady III allocates 100% of your regular basic premium to purchase units in the selected fund or funds.

Vary Investment Amount

You have the option to request an adjustment of your investment amount starting from the Flexi start date.

Any changes to the regular basic premium are effective on the next premium payment due date.

Fund Switching

As a policyholder, you can make unlimited free fund switches anytime during the policy term.

When the switch is made, the unit price will determine the number of units transferred. The minimum amount for each fund switch is $500.

If the account value of a particular fund is less than $500 at the time of the request, you must transfer all units out of that Fund.

Premium Redirection

You may redirect your future regular basic premium payments to a different fund during the policy term.

A maximum of 10 funds may be selected for redirection, with a minimum allocation of 10% per fund.

Automatic Fund Rebalancing

Starting from the second policy year, the fund holdings can automatically adjust to match your pre-specified allocations at each policy anniversary.

This process, known as automatic fund rebalancing, only occurs if the difference between your portfolio’s current allocation and the specified basic premium allocation exceeds 5%.

Partial Withdrawal

You can request to sell some of your current units in your fund to make a partial withdrawal.

The minimum amount for each withdrawal is $500, but the withdrawal amount must not cause the value of your account to fall below S$1,000 or exceed any partial withdrawal limits that may apply.

Protection

Death Benefit

If the life insured dies during the policy term, the loved ones will receive the greater of:

- 101% of the total basic premium paid plus any top-ups, minus any withdrawals made; or

- the account value minus any amount owed to the policy.

Terminal Illness (TI) Benefit

If the life insured is diagnosed with a terminal illness while the policy is still active, Manulife pays out the terminal illness benefit up to its limit.

A terminal illness is defined as an illness that is likely to lead to death within 12 months from the date of diagnosis.

If you have other policies with Manulife, then the maximum amount these policies can pay for critical illness benefits is $2,000,000, of which $1,000,000 is for terminal illness benefits.

Maturity Benefit

The Manulife InvestReady III will come to an end on your 99th birthday. You’ll receive the policy’s account value minus any debts at the time of termination.

Key Features

Welcome Bonus

The first bonus you receive is the Welcome Bonus – an additional number of units you receive based on the amount of your regular basic premium that you pay over 12 months.

The number of extra units you receive depends on how you have allocated your basic premium.

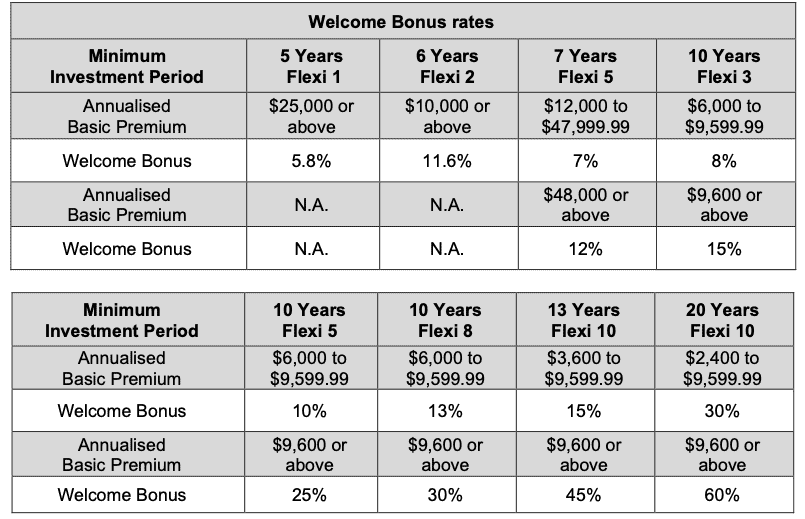

This table shows the Welcome Bonus rate depending on the minimum investment period.

Annual Premium Bonus

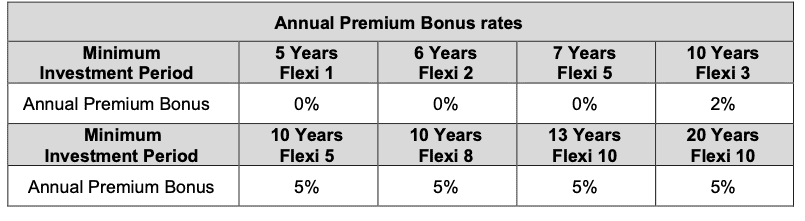

If you choose the annual premium payment mode for your first premium, you will receive a one-time Annual Premium Bonus.

This bonus is a percentage of your first annual basic premium and is added to your policy as additional units.

Here is a table to illustrate:

Loyalty Bonus

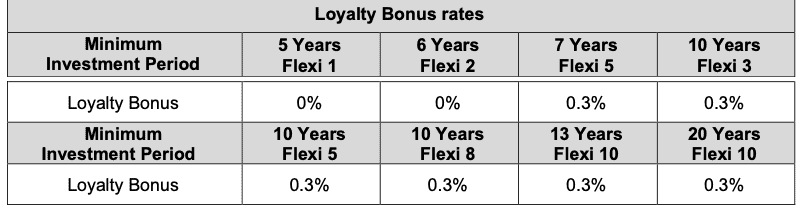

The Loyalty Bonus is given on every policy anniversary and is in the form of additional units equal to 0.3% of your account value (if applicable).

The additional units are allocated depending on your pre-specified basic premium allocation and paid out in a single payment on your policy anniversary.

To be eligible for the Loyalty Bonus, your policy must meet the following conditions;

- The policy must be in force at the time of the bonus payment.

- No partial withdrawals or reinvested dividends have been made in the 12 consecutive months.

Suppose you do not qualify for a Loyalty Bonus in a given year. In that case, you may still be eligible for future Loyalty Bonuses as long as you meet eligibility criteria in subsequent policy years.

Premium Top-Ups

It is possible to make additional ad-hoc investments, known as “top-up premiums,” during the policy term, subject to the maximum entry age allowed at the time of application.

The minimum top-up premium is $2,500, and the current top-up charge is 0%.

Distribution of Dividends

With the Manulife InvestReady III, if you choose to invest in dividend funds, you can either receive the dividends in cash or reinvest them.

This flexibility can give you access to additional funds and allow you to withdraw money in an emergency without paying extra fees.

This feature is similar to the Manulife InvestReady Wealth II and used to be unique to Manulife’s ILPs.

However, FWD’s Invest First Plus ILP is also another investment-linked policy that lets you do so, and it’s a serious contender to the Manulife InvestReady III.

Optional Waiver Benefit Riders

You can bump up your protection with optional waiver benefit riders covering terminal illness, critical illness, cancer, and total and permanent disability.

Fund Offerings

The Manulife InvestReady III currently boasts about 166 funds and sub-funds.

From these 166 funds offered, you can choose up to 10 funds at any point of time for your policy.

This ensures that you have various options to help you build your portfolio based on your investment risks, objectives, and strategies.

With this, I’ve compiled the top 10 Manulife InvestReady III funds.

Manulife InvestReady III’s Top 10 Performing Sub-Funds

The Manulife InvestReady III invests in unit trusts and directly into the funds.

| Name of Fund | 5-Year Historical Average (%) | Risk Level |

| BGF World Technology Fund | 30.77 | Aggressive |

| Franklin U.S. Opportunities Fund | 15.43 | Aggressive |

| First State Asian Equity Plus Fund | 15.29 | Aggressive |

| First State Regional China Fund | 14.50 | Aggressive |

| Schroder Asian Growth Fund | 14.20 | Aggressive |

| BlackRock China Fund | 12.46 | Aggressive |

| Allianz Europe Equity Growth | 11.83 | Aggressive |

| Schroder ISF Global Emerging Market Opportunities Fund | 11.20 | Aggressive |

| Fidelity Emerging Markets Fund | 10.54 | Moderately Aggressive |

| Fidelity European Dynamic Growth Funds | 9.84 | Moderately Aggressive |

| Fidelity GlobalFirst State Dividend Advantage Fund | 9.30 | Moderately Aggressive |

Accurate as of January 2021

Source: https://www.manulife.com.sg/en/funds/funds-ilp.html/

It is crucial to note that historical performance does not guarantee future returns. Furthermore, these are 5-year annualised returns. Always do your analysis or talk to a trusted financial advisor if you’re unsure.

Fees & Charges Involved

Cost of Insurance (COI)

The cost of insurance (COI) is charged monthly by deducting units from your account to cover the insurance coverage.

The COI is based on the age, gender, and smoking status of the life insured.

It also depends on the net amount at risk (NAAR). The COI rate for death and terminal illness benefits is guaranteed throughout the policy term.

The NAAR is calculated as follows:

- 101% of [total regular basic premiums paid + any top-up premiums – any withdrawals], minus the account value.

No COI will be charged if the NAAR is less than or equal to zero.

Administrative Charge

During the policy term, an administrative charge is deducted from your account value every month.

The charge is imposed by deducting units from your account. This charge is deducted on each policy monthiversary.

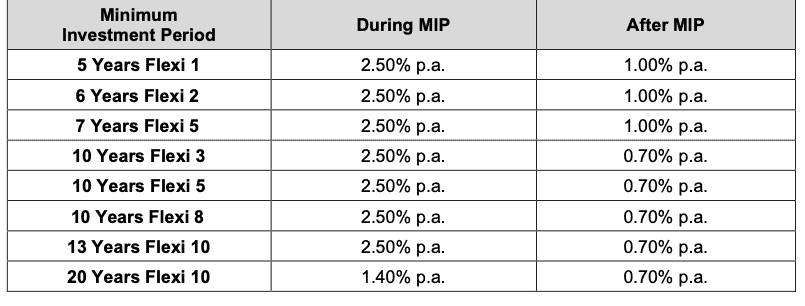

Here is a table illustrating the administrative charge percentage based on the MIP.

You will incur up to 2.5% p.a. in administrative fees during your minimum investment period – same as Manulife InvestReady Wealth II – but will now only pay 1.4% p.a. in fees if you opt for the 20 Years Flexi 10 investment period.

That’s much cheaper than the 2.5% charged in the previous version.

After your MIP, the fees drop to either 1% or 0.7%, depending on your chosen MIP. The previous version only charged you 0.7% of your account value regardless of the minimum investment period – so it’s not as competitive in this aspect.

Policy Fee

A policy fee of $5 is deducted from your account value every month during the policy term. The fee is imposed by cancelling units from your fund account and deducted on each policy monthiversary.

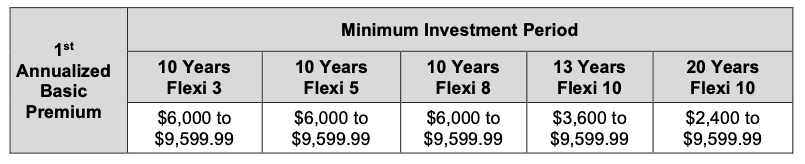

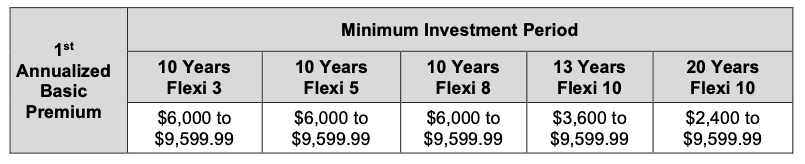

The policy fee applies to the MIPs listed in the table below and is based on your 1st year’s annualised basic premium for each MIP.

This is a new introduction, and it’s definitely not great. With the Manulife InvestReady III, you’re paying an additional $60 yearly if you fall within any of the above investment ranges.

Assuming you’re investing $6,000 a year, you’re paying an additional 0.01% in fees in the first year.

If you’re investing $2,400 yearly, that’s 0.025% more in fees in the first year, 0.125% in your second year, and 0.0083% in your third year.

I want to say that, fortunately, it’s not that much in terms of percentage points, as it’s only $5 per month.

But it’s 1 to 2 packets of chicken rice a month that I’d be losing out.

However, to look at it positively, it’s thankfully fixed at $5/month regardless of how much my account value is.

If Manulife charged this at 0.01% of your total account value, it’s much more than the $5/month I’d be paying in the long term.

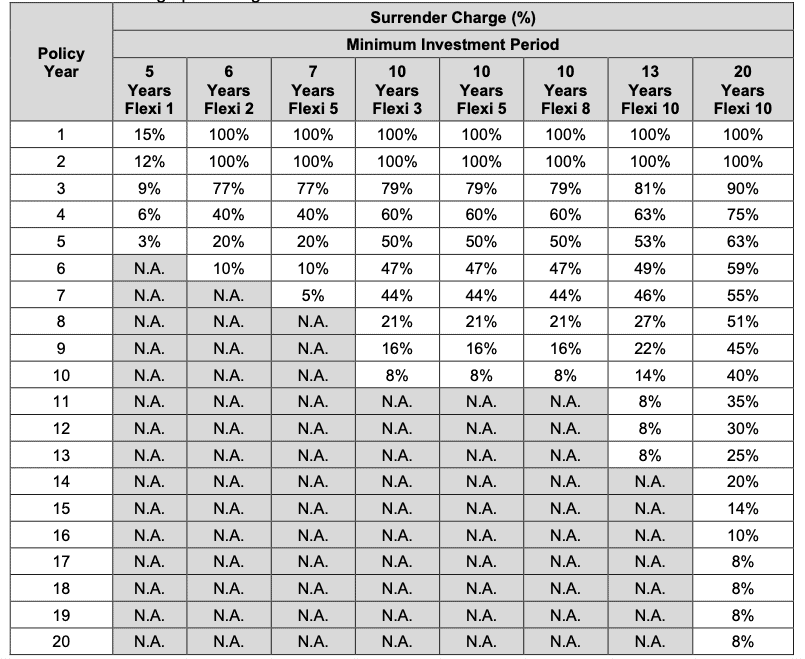

Surrender Charge

If you choose to withdraw all of your funds from your MIP before the end of its term, you will be subject to the Surrender Charge.

The Surrender Charge is calculated as a percentage of your account value and will be deducted from selling units in your account.

Any balance left after the Surrender Charge and other outstanding amounts have been deducted will be paid to you.

The following table shows the surrender charge percentage based on the policy year and minimum investment period.

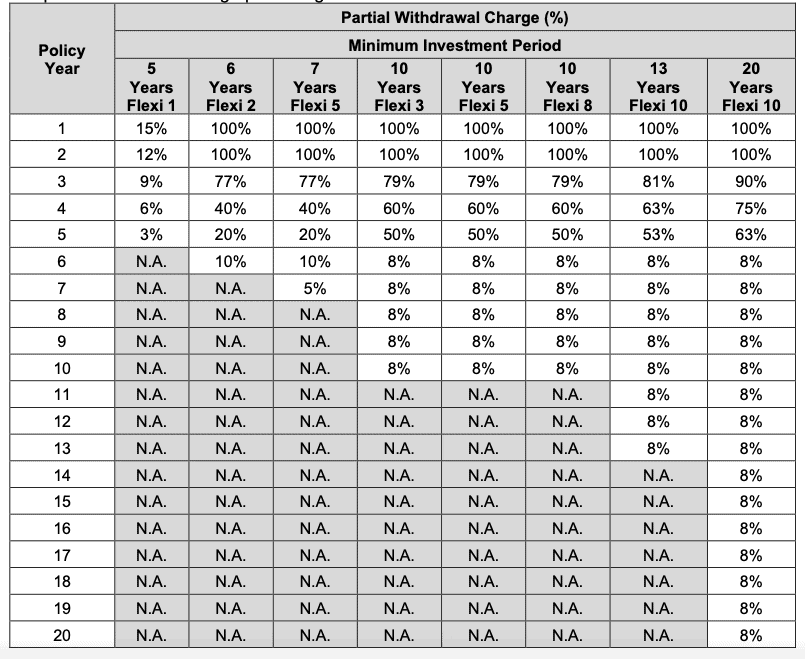

Partial Withdrawal Charge

You will be subject to a Partial Withdrawal Charge if you request to withdraw a portion of your funds before the end of your MIP.

This charge is calculated as a percentage of your account value.

The following table shows the Partial Withdrawal Charge percentage based on the policy year and minimum investment period.

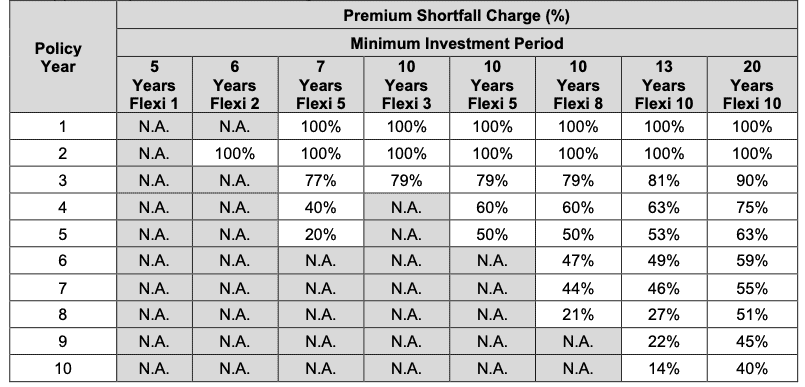

Premium Shortfall Charge

If you are still within the minimum payment period (not MIP) and you did not make your regular basic premium payment, you will be subject to a monthly premium shortfall charge.

The Premium Shortfall Charge is assessed by selling a corresponding number of units from the invested funds.

The following table shows the Premium Shortfall Charge percentage based on the policy year and minimum investment period.

Management Charge

For details, refer to the respective schedules in the relevant fund prospectuses. Management charges are payable from the InvestReady Fund(s) assets the policy invests in and deducts during daily pricing.

As such, unit prices of InvestReady Funds are net of this charge at all times.

The relevant fund manager reserves the right to make changes to the charges. Your financial advisor will give you written notice of such change(s) following applicable laws and regulations.

Compulsory Fees

In terms of compulsory fees, not every fee will apply to you. If you were to commit to the policy (in SGD) from start to maturity without any changes, these are the compulsory fees you will incur:

- Administrative Charge during MIP (1.4% to 2.5% of account value)

- Administrative Charge after MIP (0.7% to 1% of account value)

- $5/month in policy fees if you’re investing in the below ranges

How much will I receive upon maturity of the Manulife InvestReady III?

Assuming that you invest $200 monthly for 20 years and let it compound for another 10 years, the funds perform at 10% per annum, you made no withdrawals, and you did not take up any premium holidays; you can expect the below:

| First 20 Years | |

| Monthly premium: | $200 |

| Premium Payment Term: | 20 years (240 months) |

| Annual Fund Performance: | 10% |

| Fees in the first 10 years: | 1.4% + 0.01% |

| Net Fund Performance for the first 10 years: | 8.59% |

| Investment value: | $118,316.13 |

| Next 10 Years | |

| Fees in the next 10 years: | 0.7% + 0.01% |

| Net Fund Performance in the next 10 years: | 9.29% |

| Investment value: | $287,639.29 |

Total Premiums paid after 20 years: $48,000

Total Interest Earned: $239,639.29

ROI: 499.25%

Firstly, we converted the $5 monthly Policy Fees to 0.01% as it’s 0.01% of your yearly investments.

Compared to the Manulife InvestReady Wealth II, the Manulife InvestReady III is less competitive than the Manulife InvestReady Wealth II.

This shocked our team that despite having 1.4% in annual fees, the new version lost.

Why? Because in the previous version, the Administrative Charge of 2.5% is only chargeable for the first 10 years.

In Manulife InvestReady III, the Administrative Charge is based on your MIP – for which we’ve chosen the 20 Year Flexi 10 to compare against.

Even without calculations, you’ll know that if you opt for other minimum investment periods, it can’t beat the previous version.

I must mention that bonuses are generally higher (not all) for the Manulife InvestReady III, which might or might not improve your returns for other minimum investment periods.

However, this doesn’t matter as you can’t invest via the previous version anymore; thus, you’d have to compare with other ILPs in the market.

Current ILPs with the lowest fees in the market is Singlife with Aviva’s Savvy Invest and FWD’s Invest First Plus.

So compare against those instead.