Tokio Marine’s TM FlexiCover is an insurance-focused investment-linked plan (ILP). It safeguards against death while offering a range of investment funds for potential long-term financial returns.

As its name suggests, the TM FlexiCover encompasses flexible options such as basic sum assured, regular premium adjustments, and the life replacement option, enabling you to pivot your policy to suit your preferences.

In this article, we explore the coverage and features of the TM FlexiCover to help you determine if it meets your needs and financial goals.

Keep reading.

Criteria

- Issue Age: 1 to 60 years old

- Minimum Regular Premium: $125 monthly

General Features

Premium Payments

The TM FlexiCover only lets you make payments via cash.

This is unlike other ILPs that allow premium payments to be made via Supplementary Retirement Scheme (SRS) savings, CPF Ordinary Account (CPF-OA) and/or CPF Special Account (CPF-SA).

Premiums can be paid yearly, half-yearly, quarterly or monthly, in accordance with the below minimum regular premium amounts:

| Premium Mode | Minimum Regular Premium |

| Annual | $1,500 |

| Half-annually | $750 |

| Quarterly | $375 |

| Monthly | $125 |

Adhoc Top-ups

You may make top-ups to your policy, subject to a minimum top-up amount of $1,200.

Note that adhoc top-ups will not result in the increase of your basic sum assured.

Protection

Death Benefit

In the unfortunate event where the insured passes on while the policy is still active, the insured’s beneficiaries will receive a payout of whichever is greater:

- Basic sum assured plus top-up premium units minus outstanding debts; or

- Values of regular and top-up premium units, minus outstanding debts

Optional Add-On Riders

Term Rider

The Term Rider insures you against death, terminal illness, or total and permanent disability.

The benefits paid under this rider do not reduce the basic sum assured, acting as an additional term plan coverage on top of your current coverage.

Additional Critical Illness Rider

You will receive a lump sum payout if you are diagnosed with any critical illnesses covered by the Additional Critical Illness Rider.

Like the Term Rider, the payment of benefits from this rider does not reduce the basic sum assured, acting like an additional critical illness coverage.

Protect 1 Lite Rider

A monthly benefit is paid for 6 years upon losing the ability to perform any of the Activities of Daily Living (ADL).

Think of this as additional coverage on top of your Eldershield upgrades or CareShield Life supplements.

Additional EarlyCare Rider

This is an ECI rider that covers you for any of the covered critical illnesses across early, intermediate, and advanced-stage CI, as well as Juvenile Conditions and Special Conditions.

A benefit paid under this rider does not reduce the basic sum assured.

Waiver of Premium Rider, (Enhanced) Payer Benefit Rider, and (Enhanced) Spouse Rider

Your future premiums will be waived in the event of death, TPD, and/or upon diagnosis of any of the covered critical illnesses.

KidAssure GIO Rider

Covers death, child-related illnesses, and provides a hospitalisation benefit.

Additionally, 80% of the premiums paid will be refunded when the juvenile life assured reaches the age of 19.

Key Features

Change in Basic Sum Assured

You may increase or reduce your policy’s basic sum assured without alterations to your regular premiums payable.

Changes are subject to 2 conditions:

- You must increase or reduce your sum assured by $10,000 minimally

- The amount by which you increase or reduce your policy must be within the minimum or maximum basic sum assured limit respectively.

Increase in Regular Premiums

Regular premium increments must follow the below minimum regular premium increase amounts:

| Premium Mode | Minimum Regular Premium Increase |

| Annual | $600 |

| Half-annually | $300 |

| Quarterly | $150 |

| Monthly | $50 |

Each increment made will be taken as a new regular premium layer and will incur premium charges.

It will then be used to purchase regular premium units according to your premium allocation.

Decrease in Regular Premiums

You may reduce your regular premiums after fulfilling premium payments for the first 2 years of your policy.

Regular premium reductions are subject to 2 conditions:

- Decreased regular premium must be within the minimum and maximum regular premium

- The regular premium must be decreased by at least the following minimum regular premium reduction amounts:

| Premium Mode | Minimum Regular Premium Decrease |

| Annual | $600 |

| Half-annually | $300 |

| Quarterly | $150 |

| Monthly | $50 |

Life Replacement Option

Starting from your policy’s 2nd anniversary, you may apply to change the person insured under the policy.

These 3 conditions must be met:

- You submit proof of insurable interest on your proposed life insured upon application

- Your proposed life insured must be alive on the policy’s date of commencement

- Your proposed life insured must not be over 60 years old upon application

Should your application be approved, your policy’s benefits and riders will be altered according to the new life insured and will be subject to underwriting.

The life replacement option can only be exercised twice.

Investment Dial-up Option

The investment dial-up option enables you to decrease your active policy’s basic sum assured to zero.

You may exercise this option if you fulfil 2 conditions:

- You are at least 55 years old

- You have made regular premium payments for at least 10 years

This way, all your premiums are used to build your retirement funds.

Premium Holiday

Upon fulfilling regular premium payments for the first 2 years of your policy, you can opt for your policy to go on a premium holiday.

When your policy is under premium holiday, you do not need to pay regular premiums during its holiday period.

Your basic policy and unit-deducting riders will remain active, provided your account has enough funds to subtract fees and charges.

It’s crucial to note that the taking of premium holidays will cancel the no lapse guarantee privilege, which cannot be reinstated.

No Lapse Guarantee Privilege

During the first 6 years of your policy, should it lack units to deduct monthly charges, the no lapse guarantee feature keeps your policy active.

The no lapse guarantee privilege is subject to 3 conditions:

- You fulfil all regular premium payments for your basic policy with the 3-ay grace period

- You did not withdraw any regular premium units since the commencement of your policy

- Your policy has never taken a premium holiday

Please note that once this feature is revoked for any reason, it cannot be reinstituted.

Partial Withdrawal

You can take out some money from your active policy whenever you want, subject to the following conditions:

- Each partial withdrawal made must be minimally $1,000

- The sub-fund must have a remaining balance of at least $1,000, else the entire sub-fund must be completely withdrawn

- Your policy’s balance aggregated value of units must be minimally $1,000

The first units to be withdrawn are top-up premium units. Should the top-up premium units be insufficient, regular premium units will be withdrawn.

It’s important to note that withdrawing regular premium units will terminate the no lapse guarantee privilege.

Additionally, partial withdrawals will result in the alteration of the basic sum assured under the following circumstances:

| Description | Alteration in Basic Sum Assured |

| The value of regular premium units is lesser than the basic sum assured pre-withdrawal | Basic sum assured is decreased by the value withdrawn |

| The value of regular premium units is lesser than the basic sum assured post-withdrawal | Basic sum assured is revised to match the balance value of regular premium units, in accordance with the minimum basic sum assured |

Fund Switching

Fund switching lets you partially or fully transfer your ILP sub-funds into another sub-fund.

Each fund switch must be minimally $500.

You must switch out all its units if you have less than $500 in your original sub-fund.

After the fund switch, there must be at least a $500 balance in your original sub-fund and new sub-fund, respectively.

Quit Smoking Discount

By default, individuals with a smoker status are charged higher fees than non-smoking individuals.

However, the quit smoking discount entitles you (if you’re a smoker) to monthly protection charges at non-smoker rates in the first 2 years of the policy’s inception.

This is provided you submit a satisfactory declaration that you have quit smoking at least 2 calendar months before the policy’s 2nd anniversary.

The lowered charges will take effect upon approval in the next policy month.

Tokio Marine’s TM FlexiCover Top 10 Performing Funds

The Tokio Marine TM FlexiCover invests in unit trusts, more specifically, its own ILP sub-funds.

There are 13 funds for you to choose from; all of them are TMLS funds.

Here are the TM FlexiCover’s top 10 performing funds.

| Fund Name (Fund Code) | 5-Year Annualised Returns (%) |

| TMLS Multi-Asset 90 Fund (TS90) | 6.89 |

| TMLS Multi-Asset 70 Fund (TS70) | 4.98 |

| TMLS Multi-Asset 50 Fund (TS50) | 3.58 |

| TMLS India Equity Fund (TIEF) | 3.2 |

| TMLS Singapore Equity Fund (TSEF) | 2.77 |

| TMLS Multi-Asset 30 Fund (TS30) | 2.41 |

| TMLS Asia Pacific Income Fund (TAPF) | 1.76 |

| TMLS Global Bond Fund (TGBF) | 1.2 |

| TMLS Singapore Bond Fund (TSBF) | 0.86 |

| TMLS Global Emerging Markets Equity Fund (TGMF) | −0.09 |

Accurate as of 6 July 2023.

TM FlexiCover Fees and Charges

Policy Fee

Charged at $5 monthly, the policy fee will be subtracted from your policy at the start of every policy month.

The fee will be deducted by cancelling sub-fund units according to the unit price on every due date.

Regular premium units will be deducted first, followed by top-up premium units, should your policy funds be insufficient.

Premium Charge

Premium charges are dependent on the premium mode that you’ve selected, in accordance to the below table:

| Regular Premium / Increment Paid | Premium Charge | |||

| Monthly Premium Plan | Quarterly Premium Plan | Half-Yearly Premium Plan | Yearly Premium Plan | |

| 1st to 12th | 1st to 4th | 1st to 2nd | 1st | 75% |

| 13th to 24th | 5th to 8th | 3rd to 4th | 2nd | 55% |

| 25th to 36th | 9th to 12th | 5th to 6th | 3rd | 40% |

| 37th to 72nd | 13th to 24th | 7th to 12th | 4th to 6th | 5% |

| 73rd to 108th | 25th to 36th | 13th to 18th | 7th to 9th | 3% |

| 109th and thereafter | 37th and thereafter | 19th and thereafter | 10th and thereafter | 0% |

A 5% premium charge will be incurred per top-up for premium top-ups.

Fund-Related Fees

As the TM FlexiCover invests in its own sub funds, the returns you see on your fund-level returns do not include fund-level fees.

This means that when you look at the returns from the fund factsheet, you will need to deduct this fee from the returns.

Based on a quick look, the fund management fees range between 0.75% to 1.50%, depending on your selected fund.

Accounting and Valuation Fee, Custodian Fee, and Bank Charges

The accounting fee is charged at 0.03% per annum of the respective sub fund’s asset value. It is applied daily and payable to the custodian.

Additionally, each sub-fund will also incur custodian and bank charges.

Similar to fund-related fees, all the above charges will be subtracted from the unit price of the sub fund.

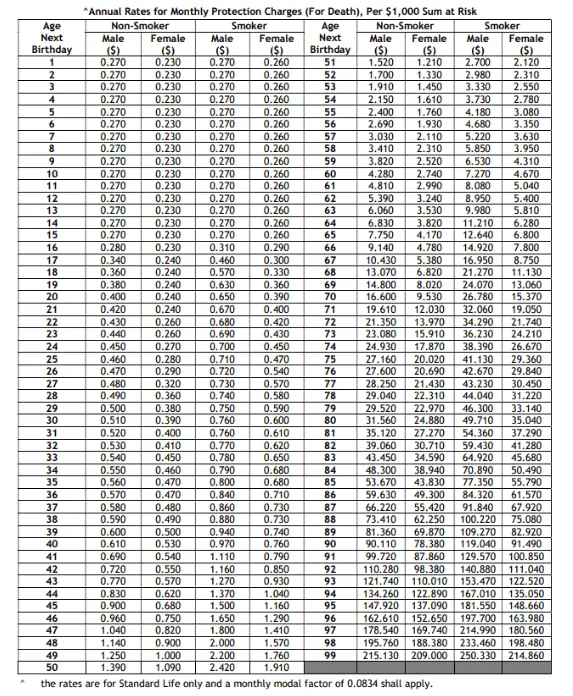

Monthly Protection Charge

The monthly protection charge is computed in accordance with the sum at risk* of your basic policy, using the monthly protection charge rates.

The monthly protection charge rates are as follows:

The rates for your basic policy are non-guaranteed. Tokio Marine may adjust the rates at their discretion and will provide 30 days’ notice in writing should there be changes.

Note that your policy will continue to incur monthly protection charges even if it is on a premium holiday.

*The sum at risk is computed using the formula: Basic sum assured – Value of regular premium units

There is only a sum at risk if your total account value is below your basic sum assured.

Administrative Charge

A monthly administrative fee of 0.72% per annum of the value of regular premium and top-up units will be charged in the first 25 years of your policy.

An administrative charge of $100 will also be incurred when you exercise the life replacement option.

This amount is subject to changes based on Tokio Marine’s discretion, and you will be preempted of any changes.

Summary of Tokio Marine’s TM FlexiCover

| Cash and Cash Withdrawal Benefits | |

| Cash Value | Yes |

| Cash Withdrawal | Yes |

| Health and Insurance Coverage | |

| Death | Yes |

| Total Permanent Disability | No |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |

| Health and Insurance Coverage Multiplier | |

| Death | No |

| Total Permanent Disability | No |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |

| Optional Add-on Coverage | Yes |

| Additional Features and Benefits

Life Replacement Option Investment Dial-up Option No Lapse Guarantee Privilege Quit Smoking Discount |

Yes |

My Review of the Tokio Marine TM FlexiCover

With a monthly premium starting as low as $125, Tokio Marine’s TM FlexiCover policy provides basic protection against the unexpected event of death, while offering a range of 8 riders to choose from.

I like the riders offered as they are not accelerators – giving you additional coverage – which not many insurers offer.

With the policy’s flexible options, you can revise your protection and investment mix to meet life’s changing priorities.

You may increase or decrease your regular premium at any time according to your financial capacity too!

The Life Replacement Option also enables you to give your policy to your family members who require it more.

The TM FlexiCover also has features such as the Premium Holiday and No Lapse Guarantee Privilege, which safeguards your policy from cancellation in case of insufficient funds or no payment.

On the flip side, the policy does not provide comprehensive insurance coverage (unless you add riders), since it only disburses a death benefit payout.

They also only have 13 funds for you to choose from – with the best-performing fund having only a 6.89% annualised return over 5 years.

Net fund returns are effectively 5.39% p.a. when fund management fees of 1.5% are included.

To pour oil into the fire, you still have the ILP level charges of $5/month, 0.75% p.a., and 5% premium charges – effectively lowering your overall net returns.

As this is a traditional insurance-focused ILP – we don’t recommend it.

Rather, I’m of the opinion that many will be better off getting a term insurance plan or a whole life insurance plan together with an investment-focused investment plan.

Doing so separates your insurance from your investments while giving you more value for every dollar you pay.

However, that’s just my opinion.

It would be best to talk to a reliable financial advisor to determine if the Tokio Marine TM FlexiCover is for you.

We partner with unbiased MAS-licensed financial advisors to help you with this.

Click here for a free non-obligatory chat!