Robo advisors are currently in trend whenever the question of investing comes in. But, rather than starting with any robo advisor available in the market right away, you compare them.

No matter whether you’re an experienced investor or just starting out, choosing the right investment platform always involves some pondering, and certain calculations.

In this post, we’re comparing 2 of the popular Singapore-based robo advisory platforms — Syfe and AutoWealth.

Read on to decide which one will be the best fit for you.

Investment Strategy

Syfe’s Investment Strategy

Before we go to Syfe’s investment strategy, let’s see the investment options offered by the platform.

Syfe Wealth primarily introduces 4 types of portfolios:

- Syfe Core Portfolios

- REIT+

- Cash+

- Custom Portfolio

Within the Syfe Core Portfolios, there are 4 portfolios for you to choose from – Syfe Core Equity100, Syfe Core Growth, Syfe Core Balanced, and Syfe Core Defensive.

According to your preferences and risk appetite, you can select the right portfolio or portfolios for you.

Syfe Core

Being the most popular portfolio type, Syfe Core portfolios apply an investment strategy primarily encompassing 3 key takeaways —

- Diversification of asset classes

- Cost-effective nature of the investment portfolios

- A long-term goal

Here are the investment strategies of the 4 Syfe Core portfolios:

- Core Equity100: Involves the highest risk and potentially higher returns in the long run.

- Core Growth: Entails a high risk with maximum weightage to equities, while involving a long-term goal.

- Core Balanced: A medium-risk portfolio with moderate asset allocation towards equities, bonds, and gold. It involves a medium to a long-term goal.

- Core Defensive: The lowest-risk portfolio provides stable and steady returns at a shorter investment horizon.

Syfe follows a globally diversified asset allocation strategy.

Each Syfe Core portfolio shares varied allocations to asset classes including equities, bonds, and gold, each invested through exchange-traded funds (ETFs).

This global diversification strategy allows the portfolios to invest across diverse sectors and geographies with a broad expanse. This factor also determines the risk profile of the portfolios.

Thus, Syfe Core has portfolios for all kinds of investors with diversified risk-adjusted portfolios.

Your investment goal, your preferred time horizon, and your risk appetite determine which Syfe Core portfolio will do justice to you.

The investment strategy applied by Syfe Core portfolios involves 3 facets.

1. Asset Class Risk Budgeting

Using asset class risk budgeting, the portfolios are diversified based on risk tolerance.

Thus, each of the Core portfolios is set to represent a particular risk profile depending on the percentage of its allocation to different asset classes.

Core Equity100 is the highest risk-adjusted portfolio, while Core Defensive is the lowest risk portfolio, according to the above-numbered list.

Through asset class risk budgeting, Syfe Core portfolios focus on distributing portfolio risk across various asset classes.

Syfe’s investment strategy also includes rebalancing portfolios every 6 months to produce better long-term returns.

2. Smart Beta Strategy

The famous and award-winning Smart Beta strategy primarily focuses on factor investing.

Syfe employs a multi-factor approach to its portfolio strategy, where they believe certain factors impact the generation of risk-adjusted returns.

Syfe emphasises the factors of growth and value, volatility, and country exposure.

The Smart Beta strategy mainly applies to the portfolios’ equity component.

The Core Equity100 portfolio is a Smart Beta portfolio with 100% allocation to equities – which quickly rose to popularity in Singapore.

Thus, the equity selection of Syfe Core portfolios involves a mixed tilt towards growth and value stocks to ensure better returns by including both large-cap and small-cap stocks.

On the other hand, getting the highest risk-adjusted returns at lower volatility is another approach of this methodology, which leads the portfolios to cover multiple sector ETFs including consumer staples, healthcare, and utilities.

As for the geographical allocation, the portfolios are set to expose you to China and Chinese tech stocks, allowing you to benefit from the country’s substantial growth potential and consumer spending trends.

3. Stable Asset Allocation

As Syfe Core portfolios are designed for a long-term investment horizon, the asset allocation is meant to reduce volatility.

This is so because of the use of particular risk parameters to lower short-term portfolio reflexivity.

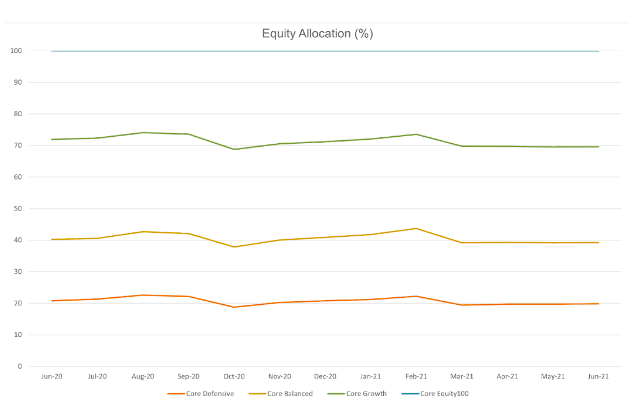

The following graph shows it —

As shown in this graph, the asset allocation of Syfe Core portfolios is stable regardless of market volatility.

As such, a dollar-cost average (DCA) strategy is best for its Core portfolios.

REIT+

REIT+ lets you invest in the best REITs (Real Estate Investment Trusts) in Singapore.

This provides a convenient way for you to invest in income-generating properties, including shopping malls, hotels, offices, etc., without incurring huge costs.

Being the first portfolio letting you invest in Singapore REITs, this portfolio gained remarkable popularity.

With it, you can invest in the SGX iEdge S-REIT Leaders Index at your ease.

As for the investment strategy, REIT+ uses Syfe’s Automated Risk-managed Investments (ARI) strategy.

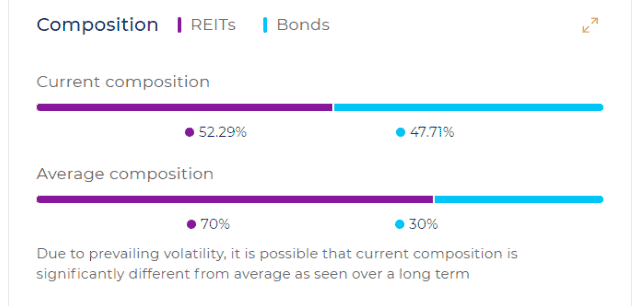

You can choose between the 100% REITs portfolio and the risk-managed portfolio combining REITs with Singapore government bonds.

Also, attractive dividend yields and automated dividend reinvestment are part of its investment algorithm.

Furthermore, there is a diversified sector allocation while including varied property sub-sectors including retail, office, industrial, hospitality, data centre, and healthcare.

Investing in REIT+ enables you to invest in the top 20 REITs based in Singapore.

Here also, you get your portfolio rebalanced twice a year.

Cash+

Syfe is a cash management account.

This portfolio helps you invest your idle cash to get a relatively higher projected return than bank savings accounts, thereby growing your cash.

Custom Portfolios

If you have your own investment strategy, you can go for this portfolio.

Here, you can pick from 100+ top ETFs curated by Syfe, and adjust the allocations according to your preferences.

Thematic Portfolios

There are 5 Thematic Portfolios offered by Syfe – ESG & Clean Energy, Disruptive Technology, Healthcare Innovation, China Growth, and Global Income.

Syfe considers these portfolios high-risk (even higher than Equity100), which are meant for you if you’re passionate about a specific investment theme.

We covered more in our review of Syfe here.

AutoWealth’s Investment Strategy

AutoWealth introduces a passive index tracking investment strategy.

This is a proven strategy consistently outperforming 80-90% of actively managed unit trusts worldwide over a 5, 10, 15 year period, thereby producing remarkably higher returns for investors.

Irrespective of market fluctuation, AutoWealth’s investment methodology focuses on diversification and portfolio allocation instead of single asset class portfolios. This ensures a better risk-adjusted return amidst a volatile market. Index-tracking ETFs again impact cost-efficient diversification.

This investment strategy is designed based on research from the SPIVA Scorecard published by Standard & Poor Dow Jones, which reveals that active investment approaches frequently underperform in any set investment horizon.

Thus, AutoWealth aims to give you investment returns of more than 80-100% of all active investment managers.

AutoWealth welcomes you to invest in asset classes across 8,000+ stocks and 600 government bonds comprising 4 major geographical regions — US, Europe, Asia Pacific (APAC), and Emerging Markets.

As for sector allocation, the AutoWealth portfolios encompass all major industries.

AutoWealth tracks 2 indices —

- MSCI All-Country World Index

- FTSE World Government Bond Index

The robo advisor introduces 4 investment portfolios based on 4 different risk levels.

Risk Profile 1: Preservation Portfolio

With the highest allocation to bonds and the lowest allocation to equities, this is the lowest risk-adjusted portfolio AutoWealth offers.

The portfolio gives precedence to capital preservation while generating dividends, capital appreciation, and portfolio diversification simultaneously due to the small allocation to equities.

So basically, this portfolio will give you a relatively lower return, due to the lowest risk involved.

Risk Profile 2: Conservative Portfolio

The Conservative Portfolio engages in a relatively high allocation to government bonds with a comparatively lower allocation to equities.

Although it involves a higher risk than the Preservation Portfolio, it’s still a low-risk portfolio.

The set allocation of asset classes leads this portfolio to provide you with secure regular bond coupons, dividends, and capital appreciation.

Although this portfolio involves some calculated risks, the main focus of the portfolio is safe investment growth without much risk involved.

Risk Profile 3: Balanced Portfolio

The Balanced portfolio indulges in a relatively high allocation to developed and emerging market equities, while allocating a smaller percentage to government bonds.

Thus, this portfolio involves relatively higher risk.

While a higher risk is involved, the Balanced portfolio can earn you higher prospective returns in the long term.

Along with dividends and capital appreciation, you can still obtain regular bond coupons due to this portfolio’s small allocation to bonds.

Risk Profile 4: Long-Term Growth Portfolio

Having the highest allocation to developed and emerging market equities and the lowest allocation to government bonds, the Long-Term Growth portfolio is the highest risk-adjusted portfolio offered by AutoWealth.

It is said that the portfolio can promise you the highest return in the long run.

The portfolio gives the most emphasis on capital appreciation and dividends.

However, considering the meagre allocation to bonds, expect more capital appreciation than dividends as compared to other portfolios.

Asset Classes

Syfe’s Asset Classes

Syfe deals with asset classes including equities, bonds, gold, and REITs. Let’s dive deep into the allocations of these asset classes with different portfolios.

Syfe Core Portfolios

-

Core Equity100

This high-risk portfolio involves an equity allocation of 100%. With a focus on US technology and Chinese stocks, this portfolio also allows you to invest in global equity ETFs to increase risk-adjusted returns.

-

Core Growth

This portfolio involves a higher allocation to equity ETFs while having an allocation to bonds and gold.

It allows the portfolio to capture the long-term growth potential while adjusting risks.

Here is the list of allocation percentages of different asset classes —

| Asset Classes | Allocation Percentage |

| Equity | 69.3% |

| Commodity | 5.3% |

| Bonds | 25.5% |

-

Core Balanced

Here, you’ll get a blended allocation of equities, bonds, and gold to maintain the balance between risk and return.

Here find the allocation to different asset classes —

| Asset Classes | Allocation Percentage |

| Equity | 38.5% |

| Commodity | 10.6% |

| Bonds | 51.0% |

-

Core Defensive

Being a low-risk portfolio, Core Defensive mainly focuses on bonds.

Let’s go through the asset allocation –

| Asset Classes | Allocation Percentage |

| Equities | 18.7% |

| Commodities | 8.8% |

| Bonds | 72.5% |

REIT+

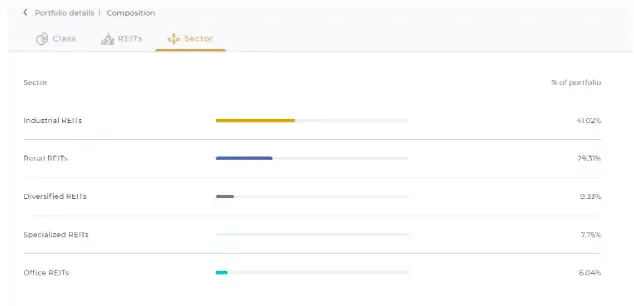

As for the 100% REIT portfolio, it invests in REITs with different sector allocations as represented by the following graph —

However, the REITs with risk management portfolio shares a different asset allocation as represented by the following image —

Cash+

Syfe Cash+ involves a 70% allocation of your assets to the LionGlobal SGD Enhanced Liquidity Fund SGD and 30% to LionGlobal SGD Money Market Fund.

Custom Portfolios

Syfe’s Custom Portfolios welcome you to invest in 100+ ETFs comprising the best low-cost, highly liquid, index-tracking ETFs.

AutoWealth’s Asset Classes

AutoWealth introduces only 2 asset classes — equities and bonds — invested via ETFs. However, you can get a good deal of geographical allocation with both asset classes.

Let’s see the different percentage allocations of the asset classes depending on their varied geographical entities.

| Portfolios | Asset Classes | Asset Allocation |

| Preservation Portfolio | U.S. Equity | 12.3% |

| Europe Equity | 4.9% | |

| Asia Pacific Equity | 2.8% | |

| U.S. Government Bonds | 27.5% | |

| International Government Bonds | 52.5% | |

| Conservative Portfolio | U.S. Equity | 24.6% |

| Europe Equity | 9.9% | |

| Asia Pacific Equity | 5.5% | |

| U.S. Government Bonds | 20.6% | |

| International Government Bonds | 39.4% | |

| Balanced Portfolio | U.S. Equity | 32.6% |

| Europe Equity | 13.1% | |

| Asia Pacific Equity | 7.4% | |

| Emerging Market Equity | 6.9% | |

| U.S. Government Bonds | 13.8% | |

| International Government Bonds | 26.2% | |

| Long-Term Growth Portfolio | U.S. Equity | 43.5% |

| Europe Equity | 17.5% | |

| Asia Pacific Equity | 9.8% | |

| Emerging Market Equity | 9.2% | |

| U.S. Government Bonds | 6.9% | |

| International Government Bonds | 13.1% |

Fees

Syfe Fees

Syfe introduces a very affordable and transparent fee structure even to beginner investors.

The below list showing different fees charged by Syfe will spontaneously convince you to try your hand at the platform.

| Investment Amount | Management Fees |

| No minimum | 0.65% |

| SGD 20k+ | 0.50% |

| SGD 100k+ | 0.40% |

Apart from this, Syfe Cash+ portfolio doesn’t have any other fees.

Plus, there are certain perks if you invest with Syfe —

- Unlimited free transfers to investment portfolios

- No minimum or maximum deposit requirement

- No lock-ups and no minimum balance are required

AutoWealth Fees

AutoWealth also shares a transparent fee structure, although it’s somewhat higher than Syfe.

| Fee Type | Total Fees |

| Management Fees | 0.5% per annum |

| Platform Fees | US$18 per annum |

*Note that platform fee includes all custody fees and transaction fees generated by the management of the investments.

AutoWealth doesn’t charge any additional fees for deposits, withdrawals, or the rebalancing of portfolios.

Plus, there are no hidden fees involved with AutoWealth.

They claim that their smart use of cutting-edge technology saves you substantial prospective fees.

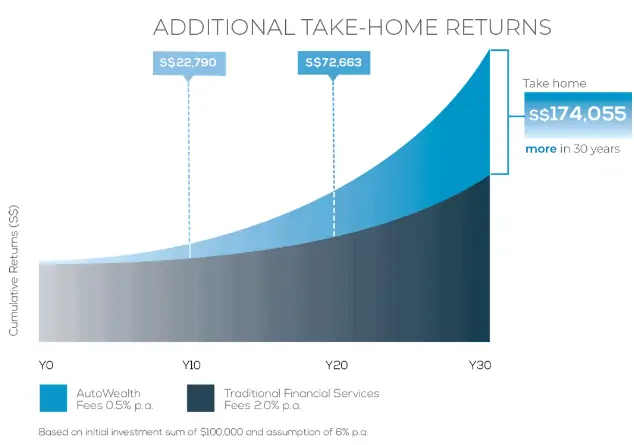

They show in a graph how much you can save with their flat and simplistic fee structure taking an assumed example of $100,000 as the initial investment sum —

However, at AutoWealth, you require a minimum investment amount of SG$3,000.

Potential Returns

Syfe’s Potential Returns

As each portfolio involves a different risk profile and time horizon, different portfolios produce different potential returns.

The following table reflects annualised past returns based on the last 1 and 5 years generated by different Syfe portfolios.

| Portfolios | Annualised Returns (1 Year) | Annualised Returns (5 Years) |

| Core Equity100 | -14.7% | 9.4% |

| Core Growth | -15.4% | 6.1% |

| Core Balanced | -16.1% | 3.5% |

| Core Defensive | -12.8% | 2.2% |

| REIT+ | -2.3% | 6.1% |

| Cash+ | 1.9% per annum | |

*Note that past returns don’t determine future returns.

AutoWealth’s Potential Returns

As discussed in the section related to AutoWealth’s investment strategy, the robo advisor aims to beat 80-100% of actively managed unit trusts.

However, returns generated by each portfolio will be different considering the asset and geographical allocations involved in each portfolio.

Let’s see the annualised potential returns of AutoWealth’s 4 portfolios on a 7-year basis.

| Portfolio | 7-Year Potential Return |

| Preservation Portfolio | 4.9% |

| Conservative Portfolio | 5.5% |

| Balanced Portfolio | 6.2% |

| Long-Term Growth Portfolio | 6.9% |

Other Features

Syfe

- Syfe’s Private Wealth platform meant for institutional investors is a remarkable offering. It allows you to invest cost-effectively with a management fee of 0.35% with a minimum investment requirement of SGD 500k+.

- A relatively new addition, Syfe additionally provides you with its trading platform Syfe Trade. You can trade US stocks and ETFs through this platform with 2 free trades monthly. Here, fractional trading is available from as low as USD 1.

- Syfe’s REIT+ portfolio allows you to be a part of responsible investing.

AutoWealth

- The instant you set to invest with AutoWealth, they allot a dedicated wealth manager to you, with whom, you can easily keep in touch via WhatsApp.

- Your funds are secure with AutoWealth with their separate custodian account – managed by Saxo.

- They provide you with comprehensive reports accounting for your assets.

- AutoWealth’s intelligent services are rich with a blend of human and technical touch.

Conclusion

Based on our comprehensive discussion, let’s compare the 2 robo advisors.

First, Syfe is relatively newer in the market, appearing in 2019, when AutoWealth already provided its services for 2 years (launched in 2017).

However, it’s seen that despite its younger age, Syfe received immense and instant popularity with its multifaceted service.

Let’s take a look at the investment portfolios.

Syfe, with a mingling of varied types of portfolios with all types of risk appetite, rocked the market.

Although AutoWealth introduces portfolios with diversified asset allocation too, Syfe simply holds an answer for everyone, while it’s not so much with AutoWealth.

Another significant factor is fees.

Syfe’s fees are simple, transparent, and low.

When you calculate AutoWealth’s fees by combining both the management fee and platform fee, it gets much higher.

With its no minimum investment requirement, Syfe is again preferable to AutoWealth with its S$3,000 minimum investment requirement.

Syfe also has an option for institutional investors, a feature lacking in AutoWealth.

Therefore, considering all this, we prefer Syfe. It’s beginner-friendly, has low fees, and performs well.