Checked out Syfe and wondering which is the best portfolio to consider?

Interested to invest in 100% stocks but afraid it might be too risky?

Considering Syfe’s Equity100 but don’t know if it’s for you?

Well, you’re in luck.

In this article, we review Syfe’s Core Equity100 and let you know our thoughts on it.

Continue reading.

What Is Syfe Equity100 Portfolio?

The Syfe Equity100 is a high-risk portfolio introduced by Syfe, which allocates 100% on equities.

Using the Smart Beta Strategy, this portfolio is focused on providing better risk-adjusted returns by investing in global equities.

Its dynamic factor allocation strategy based on the market’s cyclical trajectory helps get these risk-adjusted returns at their most potential.

Having static allocation to equities only, it’s clear that it is a high-volatility portfolio where you get to invest only in stocks.

However, Syfe attempts to lower risk by investing in globally recognised biggest companies with high liquidity.

You can invest collectively in over 1,500 stocks of the world’s top companies through the equity Exchange Traded Funds (ETFs) held by this portfolio.

What Does Equity100 Invest in?

As mentioned, Syfe’s Core Equity100 portfolio invests in global stocks, and 100% stocks only. However, instead of investing in stocks directly, Syfe lets you invest in stocks related to the world’s top companies like Microsoft, Amazon, Facebook, Walmart, Alibaba, Procter & Gamble, etc. through ETFs.

Intending to minimise costs and maximise returns, Syfe picks the ETFs that are liquid and involve low expense ratios.

Moreover, designed using the Smart Beta Strategy, other 3 factors including growth and value, volatility, and country exposure are also considered when choosing the ETFs.

Following a global diversification strategy, this portfolio helps you invest in over 1,500 global stocks through broad-based ETFs.

With this, your portfolio gets exposure to long-term growth, while at the same time saving you from any market drop in any specific country.

ETFs Invested In

Following the portfolio’s global diversification methodology, Syfe’s Core Equity100 portfolio lets you invest in the following funds –

- Consumer Staples Select Sector SPDR Fund (XLP)

- Invesco QQQ Trust (QQQ)

- iShares Core S&P 500 UCITS ETF (CSPX)

- iShares Core S&P Mid Cap ETF (IJH)

- iShares S&P 600 Small-Cap ETF (IJR)

- iShares MSCI EAFE ETF (EFA)

- iShares Core MSCI Emerging Markets ETF (IEMG)

Syfe facilitates your collective investment in more than 1,500 companies in the US, developed market countries in Europe, Australia, and Asia, and emerging market countries such as China, India, and South Korea through the above-mentioned ETFs.

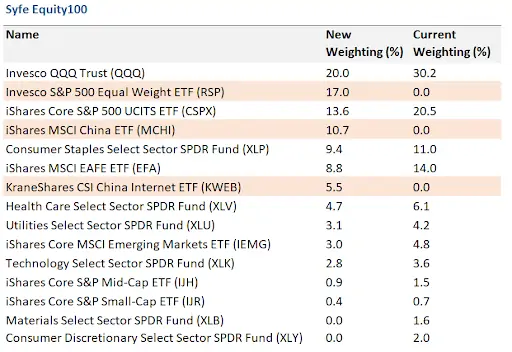

Based on their periodic rebalancing, Syfe introduces certain new additions to their list of ETFs related to this portfolio –

- iShares MSCI China ETF (MCHI)

- KraneShares CSI China Internet ETF (KWEB)

- Invesco S&P 500 Equal Weight ETF (RSP)

Here’s the updated list published on their website –

Geographical Allocation

According to the third factor related to the Smart Beta Strategy, which is country exposure, the Equity100 portfolio lets you invest in diversified global stocks to lower the risk index.

Its enhanced exposure to China and Chinese tech stocks allows you the opportunity to invest in the country’s robust growth potential and consumer spending trends.

ETFs such as iShares MSCI China ETF (MCHI) and KraneShares CSI China Internet ETF (KWEB) represent this particular tilt of this portfolio that ultimately allows you to invest in companies like Alibaba, Tencent, Baidu, and Meituan.

Syfe is hopeful that these Chinese stocks will outperform in the near future.

Here’s an in-depth discussion on the portfolios tending towards different market exposures based on geographical allocation –

US Market Exposure

Three primary ETFs giving you US market exposure are iShares Core S&P500 UCITS ETF (CSPX), iShares Core S&P Mid Cap ETF (IJH), and iShares S&P600 Small-Cap ETF (IJR). These ETFs let you invest in companies like Microsoft, Apple, Amazon, Tyler Technology, Factset Research, Wingstop, Topbuild Corp, etc.

Chinese Market Exposure

Two significant ETFs letting you invest in the Chinese market already mentioned above let you invest in companies like Alibaba, Tencent, Ping An Insurance, Baidu, Meituan, Pinduoduo, JD.com, etc.

Developed and Emerging Markets Exposure

ETFs like iShares MSCI EAFE ETF (EFA) let you invest in over 900 large and mid-cap stocks from a broad range of companies in Europe, Australia, and Asia.

Whereas iShares Core MSCI Emerging Markets ETF (IEMG) lets you invest in more than 2,000 stocks from emerging market countries including China, South Korea, India, and Brazil.

With these 2 ETFs, you get exposure to companies like Nestle, AstraZeneca, Toyota, LVMH, Alibaba, Tencent, Samsung, Reliance Industries, etc.

Sector Allocation

Since this portfolio’s focus is on growth, large-cap companies, and low volatility, it selects ETFs that can provide the investors with these 3 while bringing better returns at the same time.

While coming to growth and value, Syfe Equity100 balances these 2 factors by including tech-heavy ETFs like Invesco QQQ ETF (QQQ), and small-cap value-focused ETFs like Invesco S&P 500® Equal Weight ETF (RSP).

These let you invest in companies like Apple, Facebook, Nike, and Chipotle.

Besides, the other sectors introduced by this portfolio are Consumer Staples, Healthcare, and Utilities.

These multiple sector ETFs come with low volatility to provide you with the highest risk-adjusted returns for the lowest amount of volatility.

With this, your portfolio will pick stocks dealing with companies such as Mondelez, Johnson & Johnson, and Duke Energy.

Note: As strategised by Syfe’s Smart Beta algorithms, Syfe Equity100 follows a rebalancing procedure to manage its risk-adjusted returns. According to that, depending upon the market’s cyclical variations, the weightage of stocks is adjusted (reduced or extended) twice a year to dig out the best possible return for the investors. With this perspective, this portfolio has recently enhanced its tilt towards the Chinese market, still holding the highest allocation to the US-domiciled stocks though. Thus, although many factors and algorithms work behind the percentage breakdown of allocations, it is clear that the allocations are dynamic and not static. So, you cannot practically get any exact and stable breakdown for the allocations based on any geographical boundaries or sectors.

Smart Beta Strategy

While discussing Syfe’s Equity100 portfolio, its Smart Beta Strategy is the central leading factor for this portfolio.

Through optimisation of equity allocations, it assures better risk-adjusted returns for the investors at a potentially lower cost.

The Smart Beta Strategy is rules-based and quantitative. With thorough selection and rebalancing, it aims to outperform traditional market capitalisation-weighted benchmarks.

Furthermore, it seeks to capture systematic returns.

As mentioned previously, this strategy focuses on 3 factors. The following is an elaboration of this.

Growth and Value

Instead of focusing exclusively on growth or value factors in choosing the stocks, the Beta Strategy tends to have a balance between the two.

With this intention, it includes both tech-heavy and value-based stocks as mentioned in the previous section of this discussion. This potentially enhances the efficiency of the portfolio.

Volatility

To better adjust the risk index, it is necessary to have a low volatility level. With this purpose, Smart Beta Strategy introduces multiple SDPR sector ETFs like Consumer Staples, Healthcare, Utilities, and Technology in this portfolio.

This way, using this tilt, you can invest in companies like Procter and Gamble Company, Coca-Cola, Walmart, Mondelez, Johnson & Johnson, Merck & Co., Pfizer Inc., Abbott Laboratories, NextEra Energy, Dominion Energy, Duke Energy Corporation, Southern Company, Apple, Microsoft, and Nvidia.

Country Exposure

With this strategy, you can see an enhanced exposure to China and Chinese tech stocks, provided that the market potential related to the country is increasingly growing.

Dynamic factor allocation

The Smart Beta follows factor diversification tacticsIt indicates that with this portfolio’s Smart Beta Strategy, you can potentially enhance returns or reduce risks by exposing the portfolio to meaningful factors.

So, what are the factors? As Syfe explains, factors are the drivers of investment returns.

These factors are keys that provide the investors with a higher probability of returns.

However, there are numerous factors that work with this algorithm to provide you with higher risk-adjusted returns with the minimum risks and volatility involved.

So when the algorithm determines a specific stock type, sector, or geography will perform better, it will dynamically reallocate resources accordingly.

However, not all factors, but only a few of them such as value, size, momentum, and volatility are significant and can influence your portfolio meaningfully.

Factor diversification is more important than asset-class diversification in minimising the risks and maximising the returns – which is what makes Syfe’s Equity100 stand out.

Thus, as Syfe’s Core Equity 100 portfolio is completely structured on factor diversification, it completely supports this strategy powered by the Smart Beta Strategy.

Syfe Potential Returns

Compared to the other core portfolios, the Syfe Core Equity100 portfolio demonstrates a better return.

As shown on Syfe’s official website, they have an annualised return of 2.5% for 1 year, 14.7% for 3 years, and 13.4% for 5 years.

| Years | Annualised Returns |

| 1 | 2.5% |

| 3 | 14.7% |

| 5 | 13.4% |

Comparing against a global benchmark – the MSCI World Index – Syfe’s Core Equity100 has consistently outperformed them in their backtesting and actual performances.

Here’s a list of its returns for the last 5 years –

| Years | Past Returns |

| 2022 | -6.45% |

| 2021 | 13.73% |

| 2020 | 23.06% |

| 2019 | 30.37% |

| 2018 | -4.28% |

Syfe Fees

Syfe introduces one of the lowest fee structures among all the Robo advisors based in Singapore.

For the Syfe Equity100 portfolio, Syfe charges an annual management fee of 0.35% – 0.65%, which is equal to all its core portfolios.

| Investment Amount | Management Fees |

| $1-$19,999 | 0.65% |

| $20,000+ | 0.50% |

| $100K+ | 0.40% |

| $500K+ | 0.35% |

Who Is Syfe Equity100 for?

As it is 100% based on equities, the portfolio is designed to get higher long-term returns while involving equally higher risk.

Thus, investors willing to receive higher returns while accepting higher market volatility in the long term are ideal ones for this particular portfolio.

Again, in case you have a greater interest in getting maximum exposure to global equities, then this portfolio is ideal for you too.

Whether you should invest in this portfolio or not depends upon your risk appetite, your interest, your economic state, and your prior investment experience.

If you are a newbie, it is recommendable to pick a low-risk portfolio at the first stage, so that you get well-acquainted with the whole picture of investment rather than risk your investments.

However, it’s still dependable, as Syfe takes good care of your portfolio using their better risk-adjusted return algorithms as discussed.

Overall, we really like Syfe’s Equity100 and use it personally.

It provides us with global and sector diversification, great returns, and low fees – highly recommended!

Interested in the Syfe Core Equity100?

Click here to check for sign-up promotions before you sign up!