This product has been withdrawn as of 2022.

You can read our guide on the best retirement annuity plans in Singapore to see if any of those suit your needs better.

The PRUGolden Retirement is a regular premium participating endowment plan that provides you with a lump sum amount upon maturity.

Similar to an annuity policy, this plan’s purpose is to support you with a monthly income so that you can enjoy your golden retirement years.

PRUGolden Retirement also provides financial protection against death and disability caused by accidents.

Here’s our review of it.

My Review of the Prudential PRUGolden Retirement

The Prudential PRUGolden Retirement is great for those looking for a simple annuity plan to supplement your CPF Life payouts.

They pay generous bonuses and the participating fund performance over the last 5-10 years are higher than the illustrated returns of 4.75%.

This is good as you’ll receive more non-guaranteed income in good years, but you will also have to consider that Prudential might average these returns out to take into consideration poor performing years.

After all, you shouldn’t be looking entirely at the non-guaranteed portion because they are… non-guaranteed. Consider them as bonuses.

Instead, look at how much you’ll pay, what you’re covered for, and the flexibility the plan offers. Since the premiums you pay depend on what you want your guaranteed monthly income to be, I will be comparing what you’re covered for and the flexibility of this plan.

Firstly, in terms of flexibility, the PRUGolden Retirement offers 3 riders for you to add on. That’s about it.

In terms of coverage, their TPD protection only covers you in case you suffer from disability due to an accident only. Moreover, this is limited to 12 months since the date you got into the accident.

What does this mean? This means that if you were to suffer TPD due to other conditions – illnesses or diseases, you are not covered.

Yes, many TPD occurrences are a result of accidents, but should you suffer from TPD from any critical illnesses or diseases, you don’t get an advanced payout and will only get it after you pass on.

Also, there seems to be no indication of an advanced payout for terminal illnesses either, something you should take note of.

If you’re looking to just get higher returns from the non-guaranteed portions and have protection elsewhere, the PRUGolden Retirement is for you.

Otherwise, a more flexible and comprehensive plan such as the Manulife RetireReady Plus III should be considered.

Ultimately, there are no good or bad plans. There is a place for every plan, and what works for me might not be the best for you.

You can read our guide on the best retirement annuity plans in Singapore to see if there are any alternatives that might be better for your needs.

Take into consideration what you’re covered for and how much coverage you have based on how much you’re paying on your current policies.

Once done, you should get a second opinion from an unbiased financial advisor to whether the PRUGolden Retirement is for you or if there are better policies that suits your needs.

If you need someone to assist you, we partner with MAS-licensed financial advisors who has helped over 1,000 of our readers in the past many years. They’ll be happy to assist you too!

Click here to get connected for free!

Now let’s break down what the PRUGolden Retirement offers.

Criteria

- No medical check-up needed

Features

Policy Terms

With PRUGolden Retirement, you can choose to pay either a fixed premium term of 5 years, or a standard premium term of up to 5 years before your chosen retirement age of either 60 or 65 years old.

You are also able to select your monthly income period of either 10, 15, or 20 years.

This retirement plan consists of a guaranteed and a non-guaranteed monthly income, along with a maturity bonus.

The non-guaranteed monthly income will be determined by the fund’s future performance, whereas the guaranteed monthly income will be paid regardless of the fund’s performance.

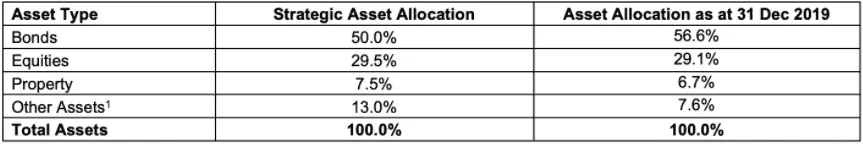

Premium Allocation

Do note that 100% of your premiums will be used to buy the participating fund units.

Prudential uses the following investment mix to maximise your returns, while making sure that you meet regulatory requirements and that your policy stays solvent.

Payout Options

Upon hitting the selected retirement age, you will start receiving your Monthly Income, split into 2 portions – guaranteed and non-guaranteed income.

The guaranteed income portion is based on the date you purchased this policy based on your premiums and premium payment term. The non-guaranteed portion depends on the performance of the participating funds.

The Non-guaranteed Monthly Income is paid together with the Guaranteed Monthly Income and makes up part of your Monthly Income.

Prudential allows you to choose between receiving your Monthly Income or letting it accumulate with the company during the policy term.

If you decide to leave the Monthly Income to accumulate with Prudential, they will apply a non-guaranteed interest rate annually for your savings to compound. Interest rates may change and you will be informed if it does.

Prudential will add the last year’s interest to your collected Monthly Income on every policy anniversary, and you will be credited interest on that total amount.

Prudential allows you to withdraw money from your gathered amount any time prior to your policy’s maturity date.

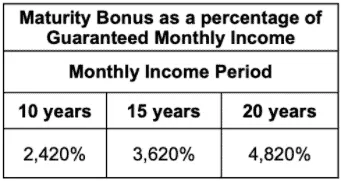

Maturity Benefit

You will receive your last Monthly Income instalment with your Maturity Bonus once the policy ends. The Maturity Bonus will be calculated based on a percentage of the Guaranteed Monthly Income, which you can see in the table below. Any accumulated Monthly Income will also be paid when the policy matures.

The Maturity Bonus is reviewed every year, at least.

Premium Payment

Your premium amount will be based on your desired retirement income. It’s best to talk with a financial planner about how much premium you would need to pay to suit your retirement needs.

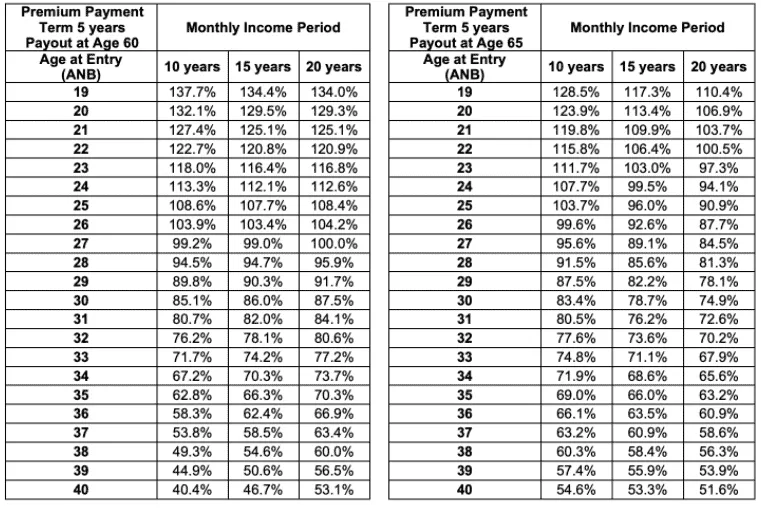

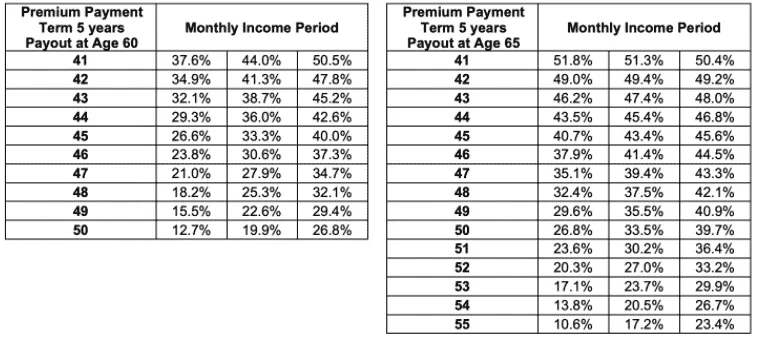

Non-Guaranteed Monthly Income

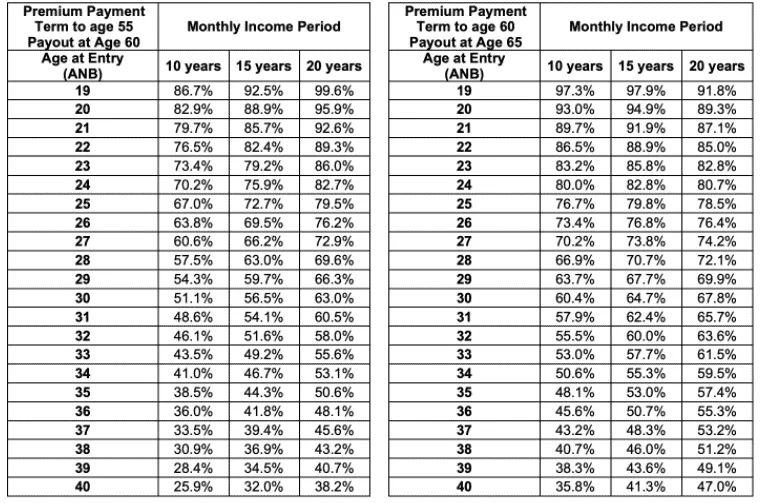

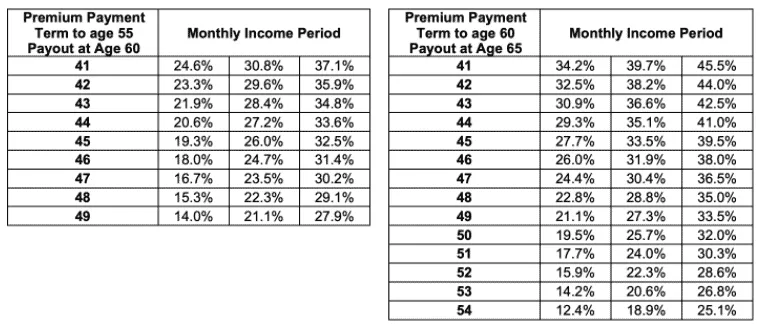

To better understand the monthly incomes rates, these tables below show that the Non-Guaranteed Monthly Income rates are a percentage of the Guaranteed Monthly Income.

The non-guaranteed benefits are shown at an investment rate of return of 3.25% and 4.75% annually.

Prudential’s policy is to keep the non-guaranteed Monthly Income at a stable level that can be sustained over the long term, but it can be adjusted under certain circumstances.

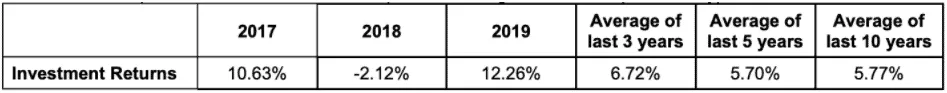

Investment Rate of Return

The following table shows the net past investment return rate of the participating fund, whereby the expenses have already been deducted.

Kindly note that past performance may not demonstrate future performance.

Protection

Death Benefit

For the death benefit, Prudential will pay 105% of the total premiums paid (excluding premiums for supplementary benefits), or 101% of the plan’s surrender value, whichever is higher, should the life assured pass away during the accumulation period.

With this policy, Prudential can deduct any sums you owe to them, overpaid Monthly Income because of the late notice of death, and any overpaid Disability Monthly Income because of the late warning of death.

This death benefit policy automatically ends once the Death Benefit claim is paid.

However, a prior condition from the date of re-establishment or within a year from the start date of the policy is not covered by this plan.

Disability caused by an Accident

| If you suffer from a disability due to an accident before your policy anniversary before the age of 70 years old. | Prudential will waive off your future premiums due (excludes any premiums paid for supplementary benefits), and they will pay a surge of disability monthly income to match the Guaranteed Monthly Income.

You will receive these payments until the maturity of the policy or upon passing away, whichever comes first. The maximum Disability Monthly Income payable under the policy is $6,250. |

| If you suffer from Total Permanent Disability (TPD) and are between the ages of 18 – 65 years old. | Prudential will waive off your future premiums due.

You will be eligible to waive off your premiums if you are disabled due to the following:

|

| If you are between the ages of 66 – 70 years old before the policy anniversary. | Prudential will pay and waive off any future premiums if you are permanently disabled due to the following:

|

The following are considered as ADLs:

|

|

Prudential states that in order for the life assured to be eligible for this benefit, the permanent disability must be caused within 12 months of the accident.

Surviving Spouse Benefit

The PRUGolden Retirement plan allows a single life assured to take up 2 policy owners. Joint ownership will be on a joint tenancy basis, and when one policy owner passes away, the policy will consequently be moved to the surviving owner.

On the off chance that both policy owners pass away simultaneously, responsibility for the policy will vest in the estate of the younger policy owner.

This is an optional benefit that is available for husbands and wives as joint policy owners. The Main Life Assured would be one of the policyholders, and the Successor Life Assured would be the other policyholder.

Prudential will pay out the Death Benefit in the event that the Main Life Assured passes away during the premium payment term, and the Surviving Spouse Benefit won’t be activated.

Conversely, if the Main Life Assured passes away after the premium payment term, Prudential will not pay out the Death Benefit, and the policy will continue for the life of the Successor Life Assured.

This retirement plan allows you to change who you select as the Successor Life Assured up to 3 times throughout the policy term.

Note that the disability caused by an accident policy only covers the life assured and does not cover or transfer to the Successor Life Assured with or without the activation of the Surviving Spouse Benefit.

When the Surviving Spouse Benefit is activated, the Disability Monthly Income will end. Moreover, all supplementary benefits will end too. No supplementary benefits are allowed on this policy once the Successor Life Assured becomes the new life assured.

Additional Coverage

You can add these supplementary benefits to enhance your coverage with PRUGolden Retirement.

Early Stage Crisis Waiver

This add-on allows you to waive your future premiums upon the medical diagnosis of an early critical illness. Click here to find out more information.

Crisis Waiver III

This add-on allows you to waive your future premiums if you are diagnosed with a critical illness. If you would like to understand the product features of this waiver, have a look at this site.

Payer Security Plus

Payer Security Plus allows you to protect your family. This add-on will guarantee that your family is covered in any event when you or your spouse cannot pay for the premiums due to unexpected conditions. Click here to find out more about this product.

Guaranteed Acceptance

There is a guaranteed policy acceptance and a medical check-up is not needed.

Fees and Charges

You will be relieved to learn that there are no direct fees or charges to you because they have already been factored into the premium calculation.

How much will I receive upon maturity of the PRUGolden Retirement?

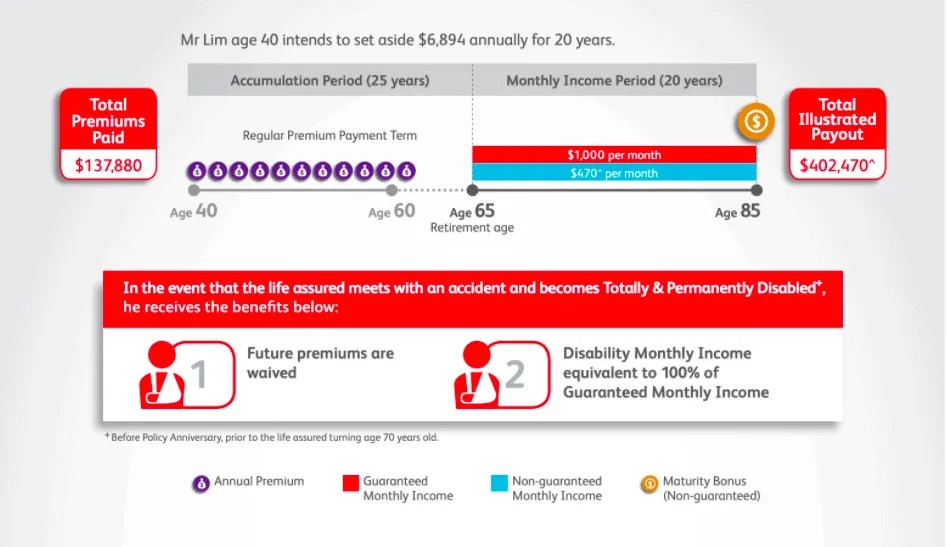

Let’s look at an example from the PRUGolden Retirement brochure of how this retirement plan works. Mr. Lim, who is 40 years old, wants to set aside $6,894 annually for 20 years. The image below shows Mr. Lim’s premiums and his payout.

As you can observe from the image, PRUGolden Retirement provides a guaranteed monthly income of $1,000.

The image above explains that after the premium payment term, the policy carries on until the chosen retirement age.

This whole period is the “Accumulation Period”.

This is then immediately followed by the “Monthly Income Period” of either 10, 15, or 20 years. Monthly income instalments are paid out during this period, and you can select your monthly income period when you apply for the policy.

Performance Updates

Prudential will send you an annual bonus update to keep you informed on the performance of the participating fund.

The document you will receive will also include the non-guaranteed Monthly Income rates and bonuses, and you will be notified whenever the rates or bonus change.