The Manulife RetireReady Plus (III) is a regular-premium participating endowment plan that provides retirement income benefits.

Although classified as a savings plan, this plan is designed to help you plan for your retirement – similar to what an annuity plan is.

My Review of the Manulife RetireReady Plus III

Here’s my review: The Manulife RetireReady Plus III is a highly flexible retirement plan and undoubtedly one of Singapore’s most popular annuity plans.

With only a few policies offering you the ability to invest via your Supplementary Retirement Scheme, the RetireReady Plus III offers great value as it provides you with a guaranteed monthly income of your choice and the ability to obtain cash bonuses on top of it to supplement your retirement.

On top of these cash bonuses, there are also claim and surrender bonuses should Manulife declare it – of which many insurers do not offer the same.

In terms of protection, the Manulife RetireReady Plus III covers you for TPD, TI, and death, a feature that is provided by most retirement plans.

However, this retirement plan provides you with a loss of independence income benefit and retrenchment benefits that are not offered by any other plans in the market.

It also allows you to change your income payout period without changes to the premiums that you’ll pay, while giving you up to 2 years worth of premium freeze.

With all the flexibility and benefits it offers, the Manulife RetireReady Plus III is undoubtedly one of the best annuities plans in Singapore.

In fact, it’s so good we regarded it as the best in 4 different categories.

Of course, obtaining a second opinion is always best to see if it’s the right choice for you or if something else would work better.

For instance, the Singlife Flexi Retirement or the NTUC Income Gro Retire Flex Pro have also won multiple categories in our listing of the best retirement plans because we feel like they’re better suited to various types of individuals.

Because everyone is in different situations and have varying needs, it’s always best to get a second opinion to whether the Manulife RetireReady Plus III is truly the best for you or there might be better alternatives.

Get a free non-obligatory second opinion from one of our partners here.

Now for a full break down of this policy:

Criteria

- Minimum premium of S$694.24 yearly.

- No medical underwriting needed.

Features

Policy Terms

As RetireReady Plus III is a plan that helps you prepare for retirement, naturally you are able to select the retirement age, the guaranteed monthly income amount (GMI), and the income payout period which you desire.

The table below shows the retirement age and income payout period available for selection.

| Retirement Age | 50 | 55 | 60 | 65 | 70 |

| Income Payout Period | 5 years | 10 years | 15 years | 20 years | Lifetime |

You are also able to select from 4 different premium payment terms of 5, 10, 15, or 20 years. If you have the ability to, you can also choose to make a one-time single lumpsum premium payment.

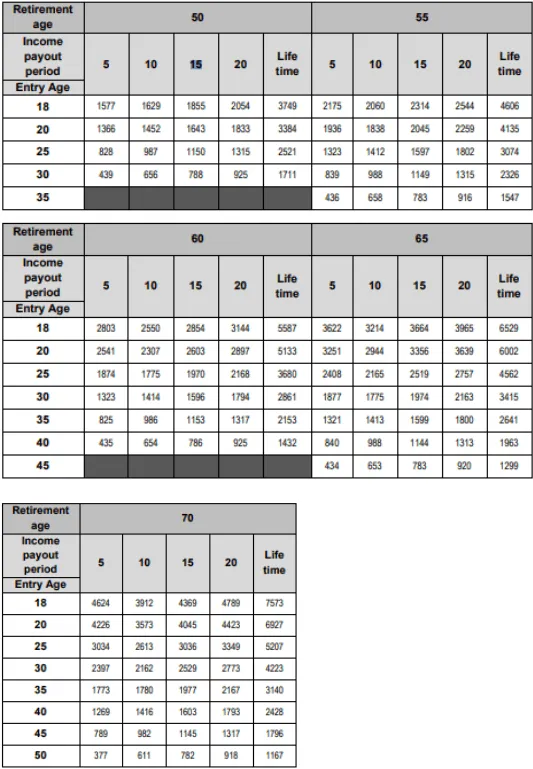

Assuming that you choose to begin payouts at the age of 50, whereby S$250 is paid out to you every month, the corresponding minimum premium amount for your selected payment term is as shown below.

| Premium payment term | Minimum annual premium amount (S$) | Minimum income payout period available under the selected term. |

| Single | 24,754.00 | 10 years |

| 5 years | 4,698.25 | 10 years |

| 10 years | 1,359.50 | 5 years |

| 15 years | 916.50 | 5 years |

| 20 years | 694.24 | 5 years |

The above table is set out under the assumption that the person insured is a 24-year-old female, who is a non-smoker.

As you can observe from the table, if you have chosen a single premium or a premium payment term of 5 years, you can pick any income payout period besides the 5-year one.

Premium Allocation

The minimum premium amounts you have to pay are net, meaning that fees and charges have already been taken into consideration. Thus, 100% of your premiums will be used to purchase the participating fund units.

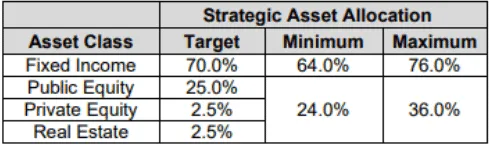

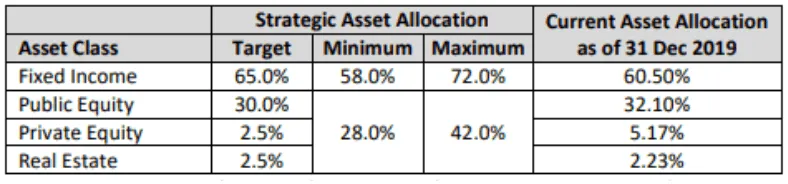

Manulife aims to use the following asset allocation to ensure that your policy stays solvent, attain the guaranteed benefit, and draw off new opportunities.

The majority of your guaranteed benefits are derived from bonds, which are a fixed income asset class. The fixed income asset class also includes cash and money market instruments.

The use of public equity, private equity, and real estate assets generates your non-guaranteed bonuses as they generate higher returns to investors.

Payment methods

Besides the typical option of making your premium payments in cash, you have the choice to pay with your Supplementary Retirement Scheme if you decide on a single premium and the plan is to insure yourself.

Payout Options

Payouts under RetireReady Plus III come in the form of retirement income benefit (RIB).

Once you reach the retirement age you have chosen, you can choose from the 2 payout options below.

- Receive your RIB; or

- Accumulate and reinvest your RIB with Manulife at a non-guaranteed interest rate.

By default, you will receive your RIB monthly if no option is selected.

If you decide to receive your RIB, you shall receive a guaranteed amount every month – selected before policy purchase – plus any cash bonus for the payout period you have chosen.

The cash bonus amounts are not guaranteed and Manulife would first deduct off any amounts you owe to them beforehand.

Of course, if your plan is terminated, the payouts will no longer continue.

However, should you decide to continue accumulating your RIB, do note that your interest rate is determined by Manulife and can change upon a 30 days’ notice.

Additionally, you will be happy to find out that at any point in time you have the ability to take out part of your entire retirement income plus income.

This is provided that you fulfil the minimum withdrawal value of S$500 or withdraw the remaining of your balance.

Do note that you can only withdraw the amounts after your selected retirement age.

Maturity Benefits

You will receive the following amounts when your plan matures, which effectively ends your policy as well.

- The last guaranteed monthly income amount (GMI);

- The last cash bonus; and

- Any reinvested RIB with interests.

Likewise, any amounts owing to Manulife will be deducted off from the payout amount first.

Flexibility

Flexibility to change the income payout period

Manulife understands that as you grow older your idea about retirement may change. Hence, the company allows you to make changes to your income payout period by just submitting a request to them.

This request can be submitted as soon as your policy commences and up to 2 years before the retirement age that you have decided on.

After the change request for your income payout period has been accepted by Manulife, your GMI will be adjusted accordingly but any ensuing premiums for both the basic plan and supplementary benefits stay the same.

Furthermore, if you are entitled to a cash bonus or loss of independence (LOI) income benefit, both amounts will now be based on the new GMI value.

The payable period of the LOI income benefit will also be adjusted to follow the new income payout period.

Premium freeze option

Premium freeze here refers to stopping premium payment for a year while your policy is still valid.

For this to apply, your policy must have been in force for 2 policy years, during which you have fully paid all premiums.

Once your application for a premium freeze is accepted, your regular premiums and premiums for any riders taken on will not need to be paid for 1 year, starting from the next premium payment date.

If you have selected the 5-year premium payment term, you can only apply for the premium freeze once. Should you have chosen the other premium payment terms (10,15, and 20 years), you can apply for the premium freeze twice.

The main changes that will occur when you decide to apply for a premium freeze is that

- You do not need to make premium payments;

- Only the retrenchment payout benefit and retirement income benefit is not applicable during this period;

- The maturity date and premium payment term will be pushed back a year for each time the premium freeze option is exercised;

- The benefit end date for your death, terminal, and LOI income benefit, as well as your waiver of premium on TPD, will be prolonged for a year each time the option is exercised.

Bonus features

Bonuses are not always warranted and depend on how well the plan’s participating fund is doing. The bonus levels you will receive are announced every year after considering the fund’s performance.

Cash Bonus

Cash bonuses may be declared by Manulife and paid out to you as part of your monthly RIB starting from your chosen retirement age.

However, please remember that these cash bonuses are not guaranteed until they are announced to be paid out in that particular year.

The monthly cash bonus amount calculation is as follow:

Monthly cash bonus = (Cash bonus rate[%] X GMI) / 12 months

This cash bonus percentage differs depending on how old the person insured is at policy issuance, your gender, the retirement age, premium payment term, and period of income payout that you choose.

For instance, if the life insured is a male who has chosen the 20-year premium payment term, he will receive the following cash bonus amounts.

The above tables are under the assumption that the cash bonus rate is 4.35% per annum, which is also an illustrated rate of return of the participating fund. This also shows that the cash bonus rates will increase and decrease accordingly with the returns generated by the policy’s fund.

Surrender Bonus

When you surrender your policy starting from the last policy year that you need to make premium payments, you might be entitled to a surrender bonus.

This bonus will be calculated as a percentage of your GMI and is payable to you only if declared by Manulife.

Claim Bonus

In the event that you make a terminal illness (TI) or death claim, you will be able to receive a claim bonus only if it has been announced by Manulife. Like the surrender bonus, the claim bonus is shown as a percentage of your GMI as well.

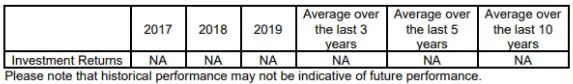

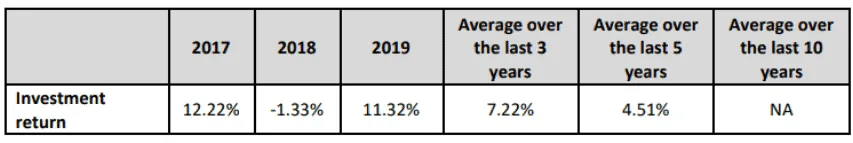

Past rate of return of the investment

The following table shows the net past return rate of the participating fund, whereby the expenses have already been subtracted.

As the Manulife RetireReady Plus III is a brand new plan just released in April 2021, there are no historical returns for you to refer to.

However, we make the assumption based on the Manulife ReadyBuilder‘s fund performance below:

As you can see, there are slight differences in the asset allocations between both policies – a 5% variance in fixed income and public equity.

Assuming the same assets are purchased with different allocations, we estimate that the fund performance for the RetireReady Plus III would be slightly lower than the ReadyBuilder’s performance.

Protection

The coverage under Manulife RetireReady Plus III is as follows:

Loss of independence (LOI) income benefit

An LOI income benefit will be paid out to you if you suffer from a severe disability during your chosen income payout duration.

Once your deferment period, which is 90 days from the date you made your claim, has passed, you shall receive the LOI together with your next RIB payment.

In order to be eligible for this benefit, you will need to meet Manulife’s definition of LOI as shown below.

| Definition/Criteria | Benefit offered | ||

Even with the help of special equipment, the person insured is unable to do any 2 out of the 6 activities of daily living.

|

| ||

Even with the help of special equipment, the person insured is unable to do minimally 3 out of the 6 activities of daily living.

|

| ||

| Person insured has any of the disability illnesses* shown below: |

| ||

| Irreversible Loss of Speech |

| ||

| Deafness |

| ||

| Major Head Trauma |

| ||

* You will have to obtain a medical examiner’s certification for the disability illness you are suffering from. ** Click here for the 6 activities of daily living | |||

If the condition suffered by the insured person eventually improves or becomes worse, the benefit amount offered will also change accordingly.

The LOI benefit is terminated at the onset of the following situations:

- Death of the insured person;

- Policy maturity; or

- The person insured no longer fits Manulife’s LOI definition as mentioned above.

The insured will be eligible for LOI income benefit again if he or she is subsequently found to fulfil the LOI definition.

Retrenchment payout benefit

Got laid off? You’ll be happy to know that the RetireReady Plus III policy pays out a retrenchment benefit for that, on the condition that you also remain unemployed for minimally 30 continuous days from your retrenchment date.

A request for the retrenchment payout benefit, using Manulife’s prescribed form, has to be provided to them within 6 months from your retrenchment date.

You are eligible for this benefit provided that this event happens to you before you turn 65 years old.

With the retrenchment payout benefit, a lump sum valuing 50% of your total annual mode premium will be made out to you.

Your total annual mode premium refers to the amount of premium you have to pay in a year for your basic plan and attaching supplementary benefits.

Should you turn 65 before the end of your premium payment term, the subsequent premiums payable shall not include the amount required for this benefit.

This is because you will not be covered for this benefit from the policy anniversary immediately after you turn 65 years of age.

You are allowed to receive the retrenchment payout benefit only once during your plan’s term and the benefit will be abolished after payout to you.

Do take note that this benefit is not applicable for policies owed by corporations and for new persons insured who entered into the policy at age 65.

Waiver of premium on total and permanent disability (TPD) benefit

If you suffer from a TPD before your premium payment term ends or before your TPD expiry date, you will be eligible for a waiver of future basic premiums.

The TPD expiry date refers to the anniversary date of your policy right after you turn 70 years old.

The disability must last for at least 6 continuous months before a claim can be admitted.

The TPD definition differs according to the insured person’s age, as shown in the table below.

| Period classification | TPD Definition |

| Before the insured person’s 18th birthday* | Due to an accident or sickness, for 6 successive months:

|

| Duration after the insured person’s 18th birthday* and after his / her 65th birthday* | Due to an accident or sickness, for 6 consecutive months:

OR

|

| Duration after the insured person’s 65th birthday* and the TPD expiry date | Due to an accident or sickness, for 6 consecutive months:

|

| At any age before the TPD expiry date | For minimally 6 months, the insured has

|

| * The exact date occurs on the policy anniversary right after the indicated birthday. | |

Death benefit

On the onset of death of the insured, the following amounts will be paid out depending on when the death occurs.

| When does the death occur? | Death benefit amount |

| Person insured passes away before the income payout period and the policy is in force. | The higher of:

And any claim bonus. |

| Person insured passes away during the income payout period and the policy is in force. | The higher of:

And any claim bonus and accumulated RIB plus interest. |

* Does not include advance premiums and any premiums paid for supplementary benefits. ** Does not include any premiums paid for any supplementary benefits. | |

Once the death benefit has been paid out, the policy will be terminated.

Terminal illness (TI) benefit

Under the RetireReady Plus III Plan, you will receive the death benefit as a lump sum, if you are determined to be suffering from a terminal illness (TI) within the policy term.

Manulife deems TI as a sickness whereby you are expected to pass away 12 months from the diagnosis date. The diagnosis has to be provided by a medical examiner and confirmed by another medical examiner appointed by the company.

Take note that the human immunodeficiency virus (HIV) is not covered by this benefit.

However, the maximum amount to be paid out for TI and critical illness (CI) is S$2,000,000, out of which the maximum limit for TI is S$1,000,000.

Any TI benefits paid out to you shall lower your TI/CI limit for the future, as well as your guaranteed monthly income (RIB). Afterwhich, your income payout period cannot be changed.

If your TI claim is less than your full sum insured, your eligibility for death benefit under your plan will still be in effect.

Surrender/Ending the Policy

Your Manulife RetireReady Plus III policy ends at the earliest of the following:

- Your written request to surrender the plan is received by Manulife;

- Your benefits end date;

- When the maturity benefit is paid out to you;

- When the policy lapses;

- When the death benefit is fully paid out to you due to TI claim or other supplementary benefits is eligible for full accelerated death benefit; or

- When the person insured passes away.

If you decide to surrender your plan on your own accord, you shall receive the following:

- Your guaranteed surrender value;

- Any accumulated RIB with interest; and

- Any surrender bonus.

The payable amount listed above is valid under the condition that you cleared off all your premium payments for 2 years.

Like always, the value you receive will be net of any amounts you owe to Manulife.

Manulife ReadyRetire Plus III Surrender Value

Your plan’s surrender value will depend on your basic plan and you will need to further consult a Manulife financial advisor for this.

Coverage Add-ons (Riders)

There’s not much information provided on the riders, but based on our discussion with Manulife agents, these are the riders offered for the RetireReady Plus III:

- Cancer care premium waiver

- Critical care waiver

Fees and charges

You will be pleased to find out that there are essentially no fees and charges for the policy as the minimum premium amounts mentioned above are net, meaning that the fees and charges have already been factored in beforehand.

Hassle-free Application

You will not need to answer any questions regarding your health in your application for this plan, which means no underwriting is needed. You can put your mind at ease that your application is guaranteed to be accepted by Manulife.

How much will I receive upon maturity of the Manulife RetireReady Plus III?

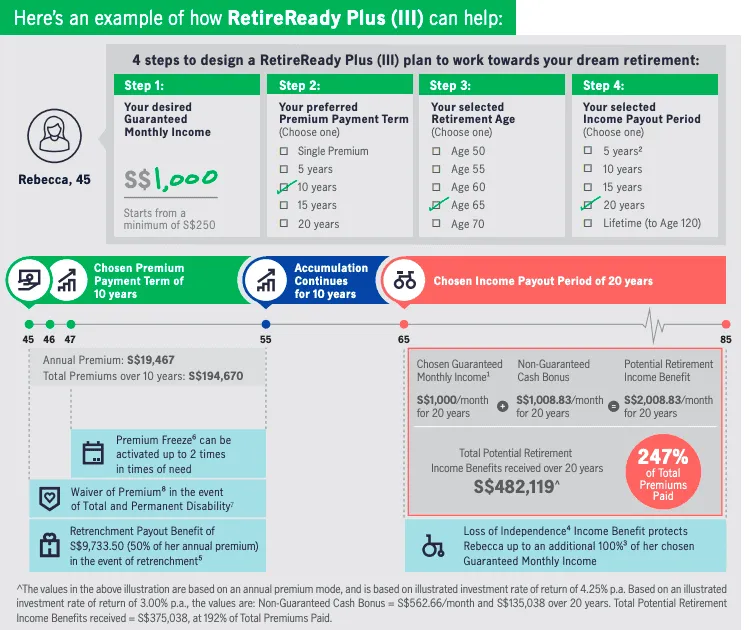

The plan above is under the assumption that the participating fund is performing at a 4.75% rate of return (ROR) and that your premiums are paid annually.

In the scenario where you don’t make any withdrawals and accumulate the full amount, save S$19,467 yearly, and choose the 10-year term, you will receive a total potential RIB of S$482,119 at age 85. Naturally, you will begin receiving your monthly RIB at your selected retirement age of 65, which will be S$2,008.83 as seen in the diagram.

Below are the calculations:

| Total Premiums Paid: | S$19,467 x 10 years = S$194,670 |

| Guaranteed Portion: | S$1,000 x 12 months x 20 years = S$240,000 |

| Non-Guaranteed Portion: | $1,008.83 x 12 months x 20 years = S$242,119.20 (Projected ROR: 4.75% per annum) |

| Total Received: | S$482,119 |

The diagram also shows certain benefits and flexible options you may be eligible for under the policy.

References

https://www.manulife.com.sg/en/solutions/save/retirement/retire-ready-plus.html

https://www.comparefirst.sg/wap/prodSummaryPdf/198002116D/WA_ERRP3_SP_PdtSum.pdf