Looking for a policy that allows you to save money for retirement while protecting you against death or severe illness?

Look no further – the NTUC Income Gro Retire Flex Pro could be perfect for you!

The NTUC Income Gro Retire Flex Pro is a participating annuity plan that offers you insurance coverage and invests part of your premiums in their par fund.

Here’s our review of it.

Read on to learn more about how the NTUC Income Gro Retire Flex Pro can benefit you!

My Review of the NTUC Income Gro Retire Flex Pro

The NTUC Income Gro Retire Flex Pro is an excellent annuity for those looking to obtain lifelong retirement income.

It also covers you for death, terminal illness, and disability, providing peace of mind knowing that your beneficiaries will be taken care of financially in these difficult situations.

To ensure that your policy continues even in the event of death, you can appoint a loved one as a secondary insured.

This ensures that the policy stays active, providing financial security to your loved ones.

During your retirement, you will receive regular monthly cash payments after your selected accumulation period.

Additionally, there’s a chance to receive extra cash bonuses on top of the monthly payments, although they are not guaranteed.

Depending on your needs, you can decide when to start receiving your monthly cash payouts.

You have the flexibility to select between 10 and 20-year periods or until you reach the age of 100.

The choice is yours, and you can even change it if needed.

You have the choice to accumulate your cash payouts with NTUC Income, where you can earn interest at a rate of up to 3.00% per year.

Alternatively, you can choose to receive the cash payouts directly and use the money as you wish.

Additionally, if you face retrenchment and remain unemployed for 3 months in a row, you will be waived to pay premiums for the following 6 months.

And you still have the option to defer another 6 months if you still can’t find a job.

Your policy will still be active during this period, so you don’t have to worry about lapsing it!

If I had to point out a bad thing about this policy, it is that the Retrenchment Benefit requires you to pay the deferred premiums in a lump sum after the deferment period.

This would be better if you could pay in instalments, especially after 12 months of unemployment.

But to be fair, 6 months of waivers and another 6 months of deferment is pretty generous.

As you can see, there’s much to like about the NTUC Income Gro Retire Flex Pro – and it’s easily one of the best retirement plans in Singapore.

Nevertheless, it’s best to get a second opinion from an unbiased financial advisor to see if the NTUC Income Gro Retire Flex Pro is really suited to your needs.

This is because you’re probably going to be investing in this policy for up to the next 40 years and will be relying on it for your retirement income.

The last thing you want is to pay premiums for many years and find out it doesn’t meet your needs.

If you need someone to get a second opinion from, we partner with MAS-licensed financial advisors who have worked with hundreds of our readers in similar situations as you are now – and they’re happy to assist you as well.

Interested in talking to our partners?

Click here for a non-obligatory consultation.

Criteria

For the policy to be valid, the policyholder must be at least 16 years old, while the insured’s age range depends on the policy’s premium payment term.

| Premium Term (Years) | Minimum Entry Age (last birthday) | Maximum Entry Age (last birthday) |

| Single Premium | 20 | 70 |

| 5 | 20 | 65 |

| 10 | 20 | 55 |

| 15 | 20 | 50 |

| 20 | 20 | 45 |

| 25 | 20 | 40 |

| 30 | 20 | 35 |

| 35 | 20 | 30 |

| 40 | 20 | 25 |

General Features

Premium Payment

With this plan, you can choose from either:

- A single premium payment term; or

- a premium payment term of 5, 10, 15, 20, 25, 30, 35, or 40 years

For the single premium term, you can pay in cash or your Supplementary Retirement Scheme (SRS) savings when you start the policy.

As for the other premium terms, you have the flexibility to make cash payments monthly, quarterly, half-yearly, or yearly.

Those considering this option will be glad to hear that the amount you pay for your premiums will not change throughout the policy term.

Policy Term

With Gro Retire Flex Pro, you can extend the policy term up to 100 years.

Payout Options – Cash Benefit

The NTUC Income Gro Retire Flex Pro also provides a Cash Benefit if the policy has not ended when the accumulation period ends.

In the event that the surrender value is less than $10,000, the policy will end, and the surrender value will be paid to you.

Alternatively, if the surrender value is more than $10,000, you will begin receiving a monthly cash benefit for the next 10, 20 years, or till age 100, depending on the payout period you choose.

You cannot change the payout period once you start receiving the monthly cash benefit.

You can opt to receive the Cash Benefit in the form of cash or accumulate it at an interest rate of 3.00% per year and withdraw the accumulated amount whenever needed.

Protection

Death Benefit

In the unfortunate event where the life assured passes away during the accumulation period, the benefits paid out will be 100% of the terminal bonus and the higher of:

- 105% of all the premiums paid (after deducting any fees); or

- The guaranteed portion of the savings accumulated up to that point

If death happens during the payout period, the benefits paid out will be:

- The higher of:

- 105% of all the premiums paid (after deducting any fees) less the monthly cash benefits received (except any received under the disability care benefit); or

- The guaranteed portion of the savings accumulated up to that point

- 100% of the terminal bonus less the monthly cash bonuses received

Additionally, any monthly cash benefits and bonuses that have not been withdrawn will be provided as part of the Death Benefit.

The benefit received will, however, be less any loan taken against the policy and any interest accrued.

It is also important to note that the Death Benefit will not be paid out if a secondary insured person has been appointed before the insured’s death.

Instead, the secondary insured will become the newly insured, and the policy will continue.

Terminal Illness (TI) Benefit

In a scenario where the insured is diagnosed with a Terminal Illness while the policy is still in effect, the insured will receive a Terminal Illness Benefit, which is similar to the Death Benefit.

If diagnosis occurs during the accumulation period, the benefits paid out will be 100% of the terminal bonus and the higher of:

- 105% of all the premiums paid (after deducting any fees); or

- The guaranteed portion of the savings accumulated up to that point

In a case where the diagnosis occurs during the payout period, the benefits paid out will be:

- The higher of:

- 105% of all the premiums paid (after deducting any fees) less the monthly cash benefits received (except any received under the disability care benefit); or

- The guaranteed portion of the savings accumulated up to that point

- 100% of the terminal bonus less the monthly cash bonuses received

As with the Death Benefit, any cash benefits accumulated and bonuses received during the policy will also be paid out as part of the Terminal Illness Benefit.

The benefit received will, however, be less any loan taken against the policy and any interest accrued.

It is also important to note that the Terminal Illness Benefit will not be paid out if a secondary insured person has been appointed before the insured’s diagnosis.

Instead, the secondary insured will become the newly insured and the policy will continue.

Key Features

Bonuses

A key feature of the NTUC Income Gro Retire Flex Pro is the bonuses generated by the profits from the Life Participating Fund.

However, it is important to note that the bonus rates are not guaranteed and that NTUC Income reserves the right to review future bonuses.

In spite of this, you will receive the guaranteed benefits and any bonuses that have already been added to your policy.

This plan offers 2 types of bonuses:

Cash Bonus

The cash bonus is an additional amount that may be paid alongside each monthly payout. It is determined yearly and can vary from year to year.

As the policyholder, you can choose to accumulate the cash benefit and bonus at the prevailing interest rate.

Terminal Bonus

Terminal bonuses are an additional amount that will be paid when you make a claim, when the policy reaches its maturity, or when you surrender the policy.

Secondary Insured Option

NTUC Income Gro Retire Flex Pro also allows you to appoint a secondary insured to ensure that the policy continues to offer coverage and benefits even in the event that the primary insured dies.

It is possible to exercise this option up to 3 times while the policy is active and before the primary insured’s death.

The secondary insured must be yourself, or your spouse (as long as both are below the age of 65 years old), or your child or ward (before the age of 18 years old) at the time of appointment.

Surrender Value

Depending on the premium payment term chosen for your policy, you are eligible to receive the cash surrender value if you fully surrender your policy.

| Premium Payment Term | When the Cash Surrender is Available |

| Single Premium Payment Term | Upon payment of the net single premium |

| Regular Premium Payment Term | After payment of premiums for at least 2 years |

It is advisable to carefully consider the potential costs and the surrender value before surrendering a policy.

Check your policy documents or talk to your financial advisor to determine your policy’s surrender value.

Protection Benefit Rider

The Protection Benefit Rider is a compulsory, non-participating, regular premium rider that provides the following benefits:

- Accidental Death Benefit

- Disability Care Benefit

- Retrenchment Benefit

This rider is only applicable for regular premium policies and cannot be removed.

Accidental Death Benefit

In the unfortunate event of accidental death (before the anniversary immediately after the insured reaches the age of 70), the policy pays up to 105% of all net premiums paid in addition to the Death Benefit provided.

However, if the insured person is involved in a restricted activity at the time of the accident, the benefit will be reduced to 63%.

Disability Care Benefit

If the insured is diagnosed with any of these disabilities due to accidental injuries of sickness – loss of speech, hearing, sight in 1 eye, or use of 1 limb, the Disability Care Benefit paid out will differ based on the period of diagnosis.

During the accumulation period, the benefits offered will include:

- A one-time payment equivalent to 6 times the monthly cash benefit

- Premium waivers for both the rider and its basic policy for as long as the disability persists

- An additional 50% of the regular monthly cash benefit, up to a maximum of $3,000, on top of each monthly cash benefit

The maximum total benefit amount one can receive is $1.1 million, including additional monthly cash benefits, lump-sum benefits, and waived premiums under the Disability Care Benefit.

This limit will apply to the same insured throughout the policy term.

Retrenchment Benefit

If you are retrenched from your job and remain unemployed for a continuous period of 3 months, you will not have to pay the basic policy and rider premiums for the NTUC Income Gro Retire Flex Pro.

The premium waiver will continue for a period of 6 months from the next premium due date.

Premiums can be deferred for an additional 6 months after the 5th month of premium waiver to help ease your financial burden during this challenging time.

At the end of the deferment period, you will be required to pay the deferred premiums in a lump sum.

Optional Add-On Riders

Cancer Premium Waiver (GIO)

You can further enhance your protection with the Cancer Premium Waiver (GIO) rider.

The Cancer Premium Waiver (GIO) rider is a non-participating, regular premium rider that waives future premiums and refunds 100% of premiums paid in the event that the insured is diagnosed with a major cancer.

| Coverage Range | 3 to 45 years |

| Maximum Entry Age (last birthday) | 65 years old |

It is important to note that the coverage should not extend beyond the insured’s 85th birthday or the premium term of the basic policy, whichever is earlier.

To qualify for rider benefits, the insured must survive at least 30 days after diagnosis.

Major Cancer Benefit

If the insured is diagnosed with major cancer after a year of coverage, the policy will waive future premiums for the rest of the coverage period.

The policy will refund 100% of the premiums for diagnosis within the first year.

Enhanced Payor Premium Waiver

The Enhanced Payor Premium Waiver is a non-participating, regular premium rider that waives future premium payments on the basic policy for the remaining term of the rider upon death or diagnosis of the insured with total and permanent disability (TPD) before the age of 70.

| Coverage Range | 2 to 84 years |

| Maximum Entry Age (last birthday) | 74 years old |

It is important to note that the coverage should not extend beyond the insured’s 84th birthday or the premium term of the basic policy, whichever is earlier.

Dread Disease Premium Waiver

The Dread Disease Premium Waiver is a non-participating, regular premium rider that waives future premium payments on the basic policy if the insured is diagnosed with a dread disease (except for angioplasty and other invasive treatment for coronary artery) while the rider is still active.

NTUC Income Gro Retire Flex Pro Fund Performance

Current Asset Mix

In general, the current allocation of assets closely aligns with the fund’s target allocation, with government and corporate bonds making up the majority of the fixed-income portion of the portfolio.

In order for the par fund to achieve its objectives and perform well, its managers will assess the performance of different investment options and adjust the allocation of funds to maximise returns and manage risks.

Below is the strategic and actual asset allocation as of 31st December 2022:

| Type of Asset | Allocation Goals

(%) |

Actual Allocation

(%) |

| Fixed-Income | 64 | 63 |

| Equities and Properties | 36 | 37 |

| Total | 100% | 100% |

Investment Rate of Return

Bonuses will vary over time as the rate of return on your investment is affected by macroeconomic factors and the business environment.

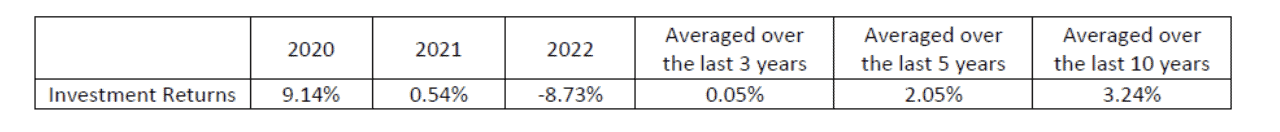

The table below shows the historical investment rates for this Participating Sub-Fund between 2020 and 2022.

A downward trend occurred in the fund’s performance in 2021 and 2022, reporting a negative return compared to 9.14% in 2020. Global economic factors may have contributed to this decline.

However, when compared to other companies, NTUC Income is performing average when it comes to their geometric net investment returns.

While this means that investing in other policies may provide you with better returns, it is also important to consider the other aspects of the policy, such as its key features and protection provided, to make a more well-informed decision.

Total Expense Ratio

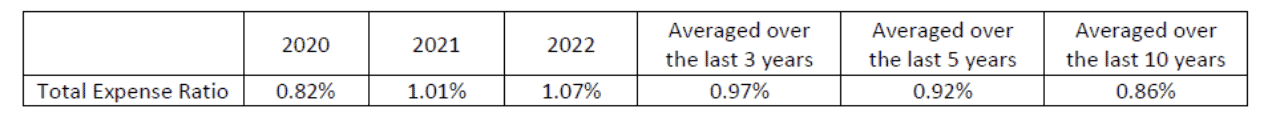

It is also crucial to understand your fund’s Total Expense Ratio (TER), which could provide you with an insight into the cost structure of the participating fund and how it may affect the policy’s overall performance and potential benefits.

When paying for your policy premiums, an expected level of expense is already factored into the premium amount. As a result, these expenses are not an additional cost to you.

In some cases, however, if the actual level of expenses deviates significantly from the expected level, it may affect the non-guaranteed benefits you can receive.

The table below shows the historical expense ratio for this Participating Sub-Fund between 2020 and 2022:

We can look at the table below to compare NTUC Income’s Total Expense Ratio against other companies.

The above table shows that NTUC income ranks the best in expense management, having the lowest and most consistent expense ratio in the market.

Its TER is also well below the industry average.

If you invest in this plan, you will likely see higher monthly cashouts and maturity benefits since the returns are higher.

NTUC Income Gro Retire Flex Pro Fees and Charges

A number of fees and charges are necessary to cover various costs and expenses involved in managing the NTUC Income Gro Retire Flex Pro fund.

Some direct costs include commissions paid to agents, administrative expenses, and claims fulfilment.

Other expenses, such as general administrative costs, are shared across multiple funds managed by the insurance company.

To ensure fairness and equity, these shared expenses are allocated to funds on the basis of a cost-sharing methodology that accounts for each fund’s specific operating costs.

By using this cost allocation methodology, NTUC Income aims to accurately reflect the actual costs of running the individual funds and ensure fair distribution of the financial burden.

Illustration of NTUC Income Gro Retire Flex Pro

Meet Stefan, a 30-year-old who wants to start planning for his retirement with the NTUC Income Gro Retire Flex Pro policy.

Here’s a quick breakdown of how he can benefit from the NTUC Income Gro Retire Flex Pro plan!

Premium Payments

To secure this plan, Stefan will need to make premium payments. He has chosen to pay his premiums on a yearly basis, which amounts to $17,487 per year.

He will continue making these premium payments for the next 10 years.

Retirement Goals

Stefan wants to receive a monthly cash benefit of $1,000 for 20 years starting from age 55.

This means that when he retires at the age of 55, he will receive a monthly payment of $1,000 for the next 20 years to support his retirement needs.

Non-Guaranteed Monthly Cash Bonus

The plan also offers a non-guaranteed monthly cash bonus. In Stefan’s case, the non-guaranteed monthly cash bonus is estimated at $1,411.

Depending on the performance of the participating fund, he can receive an additional monthly amount of around $1,411 on top of his monthly cash benefit.

Disability Care Benefit

In an unfortunate accident, Stefan loses the use of his arm after paying the 8th annual premium. He is, however, eligible to claim the Disability Care Benefit since he is enrolled in it.

Stefan receives a waiver on his remaining 2 years of premiums and does not have to pay the premiums for those 2 years.

In addition, he receives a lump sum of $6,000 as compensation for his disability.

He is also entitled to an additional 50% monthly payout of his original monthly cash benefit amounting to $500. This helps him better cope with the financial challenges caused by the disability.

Summary of NTUC Income Gro Retire Flex Pro

| Cash and Cash Withdrawal Benefits | |

| Cash Value | Available |

| Cash Withdrawal | Available |

| Health and Insurance Coverage | |

| Death | Available |

| Total Permanent Disability | Available |

| Terminal Illness | Available |

| Critical Illness | N/A |

| Early Critical Illness | N/A |

| Health and Insurance Coverage Multiplier | |

| Death | N/A |

| Total Permanent Disability | N/A |

| Terminal Illness | N/A |

| Critical Illness | N/A |

| Early Critical Illness | N/A |

| Additional Benefits | |

Optional Add-on Riders

|

Available |