A flexible endowment plan which allows you or your loved ones the option of making partial cash withdrawals at any time, the Great Eastern GREAT Wealth Multiplier aids you in attaining your financial needs/goals for the future.

Not only that, but this plan also provides you with peace of mind by guaranteeing your capital after a certain period.

My Review of the Great Eastern GREAT Wealth Multiplier II

The Great Eastern GREAT Wealth Multiplier II is an innovative endowment plan designed to cater to individuals seeking both a savings mechanism and financial protection.

This plan stands out for its flexibility in premium payments and withdrawal options, making it a potentially attractive choice for those looking to grow their wealth while retaining access to their funds for unforeseen needs. Below, we delve into the pros and cons of this plan to provide a comprehensive overview.

Pros

1. Capital Guarantee: One of the key advantages of the GREAT Wealth Multiplier II is the guarantee of your capital after the 15th or 20th policy year, providing peace of mind that your initial investment is protected. This feature is particularly appealing in uncertain economic times, offering a safety net for your savings.

2. Flexible Premium Payment Terms: The plan offers the option to choose between 5, 10, or 15-year premium payment durations, allowing you to align your investment with your financial planning and cash flow needs. This flexibility ensures that you can manage your premiums without overburdening your budget.

3. Partial Withdrawal Option: The ability to make partial withdrawals at any time is a significant benefit, providing liquidity to meet emergency financial needs or other life goals without surrendering the policy. This feature adds a layer of flexibility that is not always available in traditional endowment plans.

4. Supplementary Retirement Scheme (SRS) Compatibility: The option to use funds from your SRS account to pay for premiums enhances the plan’s attractiveness as a retirement planning tool. This feature allows for tax-efficient savings and aligns with long-term financial planning for retirement.

5. Appointment of Secondary Life Assured: The plan’s provision for appointing a secondary life assured ensures continuity and protection for your loved ones, making it an excellent tool for legacy planning. This feature allows the policy to continue providing coverage and potential growth even after the primary insured’s demise.

6. Decently Performing Participating Funds: The Great Eastern GREAT Wealth Multiplier II has a participating fund that performs decently amongst its peers. For instance, on average, Great Eastern ranks the 4th best amongst 8 other insurers, bringing in an annualised return of above 3% over 15 years.

Cons

1. Long-Term Commitment Required: The capital guarantee only comes into effect after the 15th or 20th policy year, depending on the premium payment term chosen. This requires a long-term commitment, which might not be suitable for those seeking shorter-term financial solutions.

2. Impact of Partial Withdrawals on Benefits: While the flexibility to make partial withdrawals is a pro, it’s important to note that doing so will reduce the basic sum assured value, potentially impacting the overall benefits and maturity value of the policy.

3. Limited Information on Riders: The lack of detailed information on available riders means potential policyholders may need to conduct further research or consult with a financial advisor to fully understand how to enhance their coverage.

The Great Eastern GREAT Wealth Multiplier II offers a blend of security, flexibility, and potential for growth, making it a compelling option for those planning for the future.

However, it’s essential to carefully consider the long-term nature of the commitment and the potential impact of withdrawals on the policy’s benefits.

When comparing endowment plans, we found that the NTUC Income Gro Saver Flex Pro is the best endowment plan in Singapore due to its flexibility and good potential returns.

The Manulife ReadyBuilder (II) offers the highest potential returns from an endowment plan as its participating funds are the best amongst all insurers across a 15-year period, while the Singlife Choice Saver has the highest guaranteed returns.

As you can see, depending on what you need or prefer, a different endowment plan might suit you better.

This is why you should always compare policies and perhaps even get a second opinion as to whether the Great Eastern GREAT Wealth Multiplier (II) is the policy for you.

With up to 10 years of premium payments required and a policy term of up to 15 years, you’re about to make a long-term financial commitment should you decide on the GREAT Wealth Multiplier (II).

You definitely don’t want to have made premium payments only to realise years later that this isn’t good for you.

If you need someone to give you a second opinion or want to compare policies, we partner with unbiased financial advisors who can help you with this.

Click here for a free comparison session.

Here’s more on what the GREAT Wealth Multiplier (II) offers.

Criteria

- Minimum premium payment term of 5 years

- No medical underwriting needed

Features

Policy Terms

You can choose between a policy term of 5, 10, or 15 years with the Great Eastern GREAT Wealth Multiplier II.

By choosing the 5- or 10-year premium payment duration, the capital that you invest in will be guaranteed after your 15th policy year.

Whereas for the 15-year premium payment, your capital is only guaranteed after your 20th policy year.

Premium Allocation

100% of your premiums paid will be allocated to purchase the participating fund units.

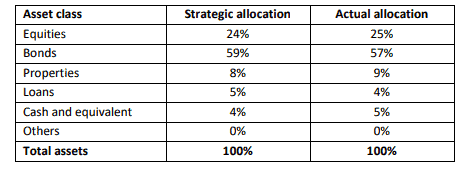

As of 31st December 2020, the allocation of your premiums is as shown in the table below.

Payout Options

As with most endowment plans, there are two payout options for you.

Firstly, you may make partial withdrawals at any time for any financial needs that you may need. Naturally, this would lower your basic sum assured value.

Secondly, you can also opt to not make withdrawals and let your money accumulate in the policy for greater returns

Maturity Benefits

You will receive a maturity benefit that is guaranteed along with any attaching bonuses if you are still alive at the maturity of your policy, which is when you turn 120 years old.

Flexibility

Option of using Supplementary Retirement Scheme for premium payments

You have the choice of using funds from your Supplementary Retirement Scheme (SRS) account to pay for your policy’s premiums.

By making payments with your SRS, your policy will be managed according to the SRS regulations and any changes made to them in the future.

Appointment of secondary life assured

Those who wish to purchase endowment plans do it with the intention of taking care of their loved ones after they pass away. With Great Eastern GREAT Wealth Multiplier II, you can further protect them by appointing them as a second life to be assured by your policy

In doing so, your spouse or child whom you’ve appointed will become the insured person upon your passing, effectively keeping your policy in force.

However, be mindful that any riders under you will cease upon the conversion of the life assured from you to your appointed family member.

Furthermore, take note that the policy term is kept the same and the policy maturity will still be the policy anniversary when you turn 120, despite the conversion.

Only when the following conditions are all fulfilled, can you then appoint a second life assured.

| a | You are an individual | |

| b | The insured person is still living | |

| c | Secondary life assured to be appointed has to be: |

|

| d | Secondary life assured to be appointed has to be within the minimum and maximum age of entry established by Great Eastern | |

| e | You have not made any nomination of a beneficiary with reference to your policy | |

| f | Your policy is not subject to a trust | |

| g | Funds from an account under the SRS are not used to pay your policy’s premiums | |

| h | There have not been more than 2 conversions under your policy | |

Nonetheless, you are able to annul the appointment of your secondary life before the death of the policy’s life assured.

Your appointment of a secondary life assured and the conversion has to be approved by Great Eastern.

Should the conversion not be approved despite a prior accepted appointment, you shall receive the death benefit which effectively ends your plan as well.

Your policy is only allowed to have a maximum of 3 conversions.

Bonus features

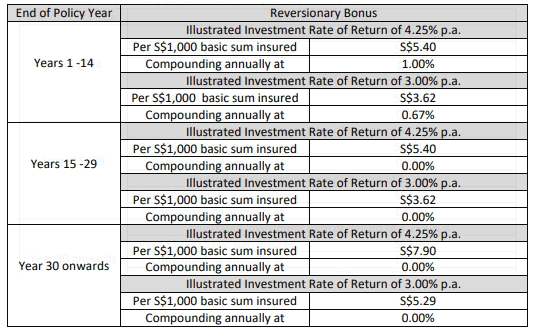

Your bonuses only become guaranteed after being announced by Great Eastern. This is due to the fact that bonuses are dependent on how the participating fund performs.

Reversionary Bonus

The reversionary bonus may be declared annually and will only be added to your guaranteed benefits after 3 policy years.

Terminal Bonus

You may receive a one-time terminal bonus, which is reviewed by Great Eastern annually when:

- You submit a claim which causes your policy to cease; or

- Your policy matures; or

- Your policy is surrendered by you.

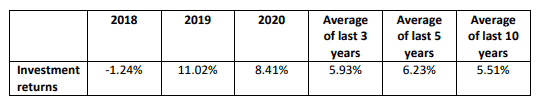

Past rate of return of the investment

Should you decide to take on the GREAT Wealth Multiplier II policy, you can refer to the following table showing past return rates (net of expenses) to have a gauge over the participating fund’s performance.

Do take note that past performance does not dictate the future performance of the fund.

Protection

Death benefit

In the event that the insured passes on, he/she shall receive the higher of

- 110% of annual premiums paid for the basic plan; or

- their guaranteed surrender value

Should the assured have any bonuses, it will be paid out as well.

Total and permanent disability benefit

If you happen to suffer from a total and permanent disability (TPD) which is supported by a registered doctor, you shall receive the death benefit in a lump sum.

The 2 types of TPD are Presumptive TPD and other forms of TPD.

| Types of TPD covered | Definition | Expiry of cover |

| Presumptive TPD |

|

Applicable on the whole term of coverage |

| Other forms of TPD

(Not Presumptive TPD) |

For Life Insured above age 15:

|

Other forms of TPD must be incurred before the life insured turns 65 |

For Life Insured below age 15

|

The maximum amount you can receive under this benefit is S$5 million.

Terminal Illness benefit

In the event that you’re diagnosed with a terminal illness (TI) whereby you are likely to pass away within a year’s time, you will also receive the death benefit.

Naturally, your diagnosis would have to be backed up by a specialist. At times, Great Eastern may need the diagnosis to be further confirmed by medical personnel that they appoint.

Surrender/Ending the Policy

If your policy has been effective for minimally 3 years and you have paid 3 years of premiums, you shall receive a surrender value when you surrender your plan.

By surrendering your policy early, you may incur high fees which may exceed the surrender value you expect to receive. This may result in the amount payable to you becoming lower than your premiums paid or even zero.

Besides surrendering your policy, your plan can be terminated upon the earliest of:

| a | The person assured passing away | Provided that:

|

|

||

| b | You being diagnosed with a TI and have an admitted a claim; or | |

| c | You suffering from TPD and have admitted a claim; or | |

| d | Your policy maturing or lapsing. | |

Hassle-free Application

There is no medical underwriting required under this policy making it hassle-free to apply for.

Coverage Add-ons (Riders)

There is no indication of any riders for the GREAT Wealth Multiplier on Great Eastern’s product summary and website.

Fees and charges

Due to the fact that fees and charges have already been factored into your premium amounts, this means that your premiums are net.

There are essentially no fees and charges for you if you decide to purchase the GREAT Wealth Multiplier II.

How much will I receive upon maturity of the Great Eastern GREAT Wealth Multiplier II?

If you have chosen the 5-year premium payment term (yearly payment of S$4,800), your total premiums paid of S$24,000 will be guaranteed upon your 15th policy year.

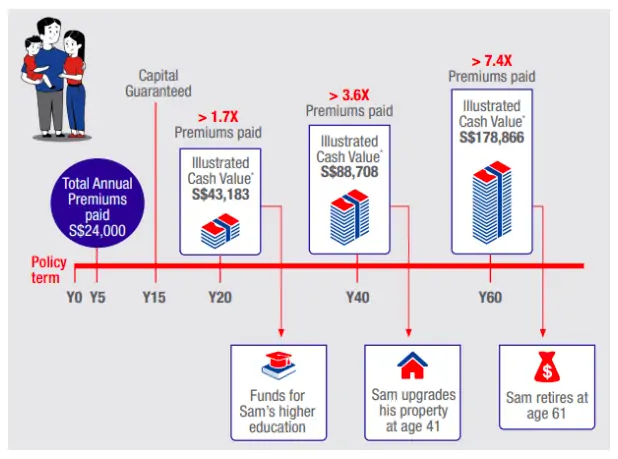

See the image below provided by Great Eastern.

The table above assumes the following:

- The return rate of investment is 4.75% per annum.

- A 35-year-old male who does not smoke purchased the policy for his child, Sam.

As we do not have the policy illustration of the GREAT Wealth Multiplier II, we are unable to show how much guaranteed and non-guaranteed cash value you can receive throughout the policy.

Based on the above image, Great Eastern estimates that you will 1.7x your capital in the 20th policy year, 3.6x in the 40th policy year, and 7.4x in the 60th year.

Do take note that no withdrawals were made and the illustration shows how much your total value of the policy is if you do not withdraw.