The Manulife ReadyBuilder (II) is a participating endowment plan that helps you ease your long-term financial worries.

It’s one of the most flexible endowment plans packed with features many can’t resist.

For those who are financially more stable, the Manulife ReadyBuilder (II) also allows you to change the life insured to continue growing the accumulated funds under this policy, serving as a form of legacy planning.

Here’s our review of the Manulife ReadyBuilder (II) – the new version of the Manulife ReadyBuilder.

My Review of the Manulife ReadyBuilder (II)

Manulife ReadyBuilder (II) is a plan that offers you a combination of flexibility, protection, and the opportunity for wealth accumulation, giving you control over your financial future and providing support during challenging times.

Apart from giving you the flexibility to choose different premium payment term options, the Manulife ReadyBuilder (II) has a unique feature that allows you to withdraw your policy’s cash value anytime to fund your life goals.

Add that to the various benefits such as the Retrenchment Benefit, TPD Premium Waiver Benefit, and the Premium Freeze Option; this policy is highly suitable if you are a worrywart and feel uncertain about your future financial situation.

If you are also worried about your children, you can finally set your mind at ease as the Manulife ReadyBuilder (II) allows for a Change of Life Assured, allowing you to pass on your policy to your children.

This not only allows you to continue protecting your children even after you have passed on, but it also allows you to secure their financial future by continuously growing the policy’s cash value.

Unlike Manulife’s other savings plans, the Manulife ReadyBuilder (II) stands out by not only providing you with a long-term solution but also allowing you to accumulate your wealth over time for a lump sum payout upon surrender or maturity.

While this makes the Manulife ReadyBuilder (II) suitable for those not in a rush to get cash, individuals looking for policies that can regularly supplement their income might want to consider other plans with regular payouts.

For these, we recommend the NTUC Income Gro Retire Flex Pro or the Manulife RetireReady Plus (III) as they’re both highly flexible annuities with excellent performing participating funds – the highest 2 in the market.

However, if you’re looking for an endowment plan for legacy planning or planning for your child’s education, the Manulife ReadyBuilder (II) is an excellent choice.

With all these, we’ve awarded the Manulife ReadyBuilder (II) as one of the best endowment plans in Singapore across 2 categories.

Nonetheless, it is still recommended that you seek a second opinion from an unbiased financial advisor to determine if the Manulife ReadyBuilder (II) is the right endowment plan for you.

This is because you’re about to pay premiums for up to 20 years and hold the policy until you’re 120.

This long-term commitment means that you should spend extra time finding out your alternatives and ensuring that the Manulife ReadyBuilder (II) suits your long-term plans while being flexible enough to accommodate changing needs.

If you’d like someone to talk to for a second opinion, we partner with MAS-licensed financial advisors who have worked with thousands of our readers in the exact same situation as you are now.

Click here for a free second opinion.

Let’s now explore what the Manulife ReadyBuilder (II) has to offer.

Criteria

- Policy Term: Until the Insured is 120 Years Old

- No Medical Underwriting Required

General Features

Policy Term

The Manulife ReadyBuilder (II) has a fixed policy term to cover you until you reach the age of 120.

Nonetheless, don’t worry!

The guaranteed breakeven point will roughly be in your 15th policy year – which means that you’re guaranteed to receive minimally all your money back if you surrender after 15 policy years.

In other words, you’ll get more if you surrender past 15 years due to the non-guaranteed portion.

Premium Payment Term

With the Manulife ReadyBuilder (II), you can choose between a single premium payment or a regular premium payment term of 5, 10, 15, or 20 years, ensuring that you are able to enjoy the flexibility of choosing your preferred premium payment term to suit your needs and life goals best!

Additionally, if you choose to make regular premium payments, you will be glad to hear that premiums are level and guaranteed, meaning that you will constantly be paying the same amount throughout your entire premium payment term without any shocking changes.

Payout Options

As part of its unique selling point, the Manulife ReadyBuilder (II) boasts the financial flexibility that is offered to customers.

This includes the amount of accessibility that policyholders are given to their policy’s cash value, allowing them to support key milestones or goals in their lives.

If your Manulife ReadyBuilder (II) is in force, and whenever cash value is available, you will have access to your policy’s cash value in the following ways.

Withdrawal of Bonus

Under this key feature, Manulife allows you to fully or partially withdraw any accumulated Reversionary or Surrender Bonuses.

However, do note that any bonus withdrawal will reduce the total Death Benefit and the future cash value of the policy.

Surrender the Policy

For those who prefer not to withdraw only the bonus, you also have the option of surrendering your policy either in full or partially.

Those who choose to surrender the policy fully can withdraw the available balance in its entirety.

However, if you opt for a partial surrender, the minimum amount for each withdrawal will be $500. This also reduces the sum insured, total surrender value, total Death Benefit, and future premiums payable (if any).

It is also important that you carefully consider the implications of surrendering the policy as this would amount to an early termination (for a full surrender) of the policy, and early termination costs would apply.

As a result, the final amount payable to you might be zero or less than the total premiums paid, putting you at a disadvantage.

Maturity Benefit

On the other hand, if the policy has not been terminated or surrendered on the maturity date, you are eligible to receive the following benefits:

- The guaranteed surrender value;

- The accumulated reversionary bonus (if any); and

- The non-guaranteed surrender bonus at the maturity date (if any).

However, any outstanding amounts owed to Manulife will be deducted from the total amount payable.

After the Maturity Benefit has been claimed, your Manulife ReadyBuilder (II) will cease to be effective.

Protection

Death Benefit

The Death Benefit is paid out should the life insured unfortunately pass away while the policy is in effect.

If your beneficiary or loved ones are to claim the Death Benefit, they will receive the higher of these 2 options:

- 105% of the total premiums paid on the basic plan, excluding any advance premiums made; or

- 101% of the total surrender value.

In both cases, the final amount receivable will be less any amounts owed to Manulife.

Once the payout is made, your policy will come to an end.

Terminal Illness (TI) Benefit

The TI Benefit acts as an early payment of the Death Benefit for those insured who happen to be diagnosed with a terminal illness (TI).

This means the payout amount would be the same as the Death Benefit, as seen in the section above.

To be eligible for the TI Benefit, the TI diagnosis must:

- Be expected to result in the life insured’s demise within 12 months;

- Be confirmed by a medical examiner and agreed by Manulife’s appointed medical examiner; and

- Occur during the policy term while the policy is still active.

For policyholders who concurrently own more than 1 active Manulife insurance policy covering TI and critical illnesses (CI), the maximum claimable amount from Manulife (TI/CI limit) would be $2 million, of which the TI limit is set to be $1 million.

If the above situation occurs, which results in the full sum assured under your Manulife ReadyBuilder (II) not being fully paid out, the policy remains active with a reduction in all the assured sums.

Total and Permanent Disability (TPD) Benefit

Unlike the Death and TI Benefits above, or TPD Benefits in other policies, the Manulife ReadyBuilder (II) does not offer you a lump sum payment if you suffer a TPD.

Instead, Manulife helps you cope with your situation by waiving off any future premiums on your basic policy, provided your disability persists for a minimum of 6 consecutive months.

The benefits of this?

You can still enjoy the other features of the Manulife ReadyBuilder (II), and the money you had set aside for your premium payments can now be redirected to support your daily needs.

However, this also means that this benefit is only active until your 70th birthday or the end of your premium payment term, whichever is earlier.

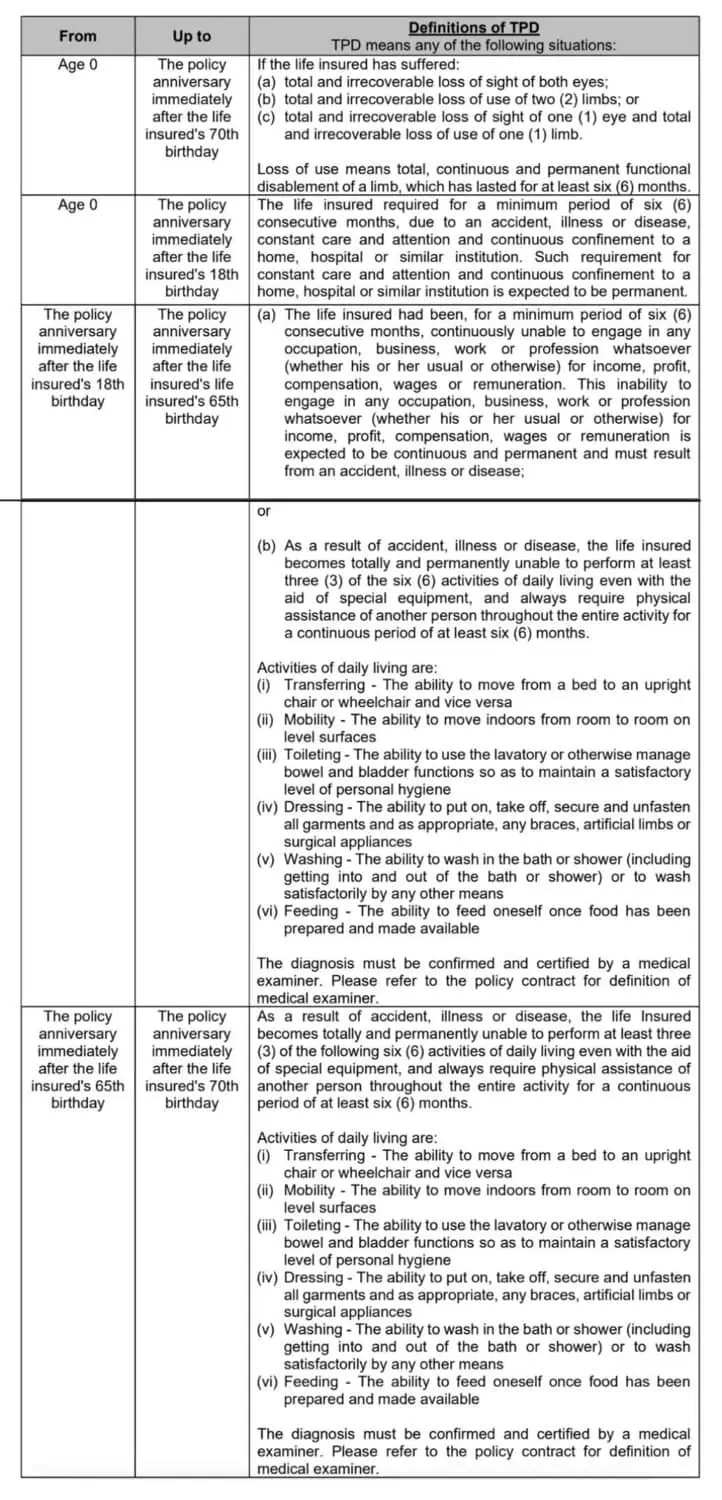

Depending on your age, the definition of TPD, which allows you to claim this benefit, would differ according to the table below:

Optional Add-ons

While Manulife offers optional riders for CI, death, or TPD, these are only applicable to regular premium policies.

This means that those who choose to pay a one-time single premium cannot purchase any add-ons for their basic policy.

If you wish to increase your protection, you can add riders for critical illness, death, and total and permanent disability.

However, as little information can be found online about the specifics of these riders, those interested may wish to contact Manulife or their financial advisor to find out more details about the coverage and costs.

Key Features

Retrenchment Benefit

As a form of protection against today’s uncertain job market, Manulife includes a Retrenchment Benefit in your Manulife ReadyBuilder (II) to help you cope with any loss of employment.

Under this benefit, Manulife will pay you a lump sum equal to 50% of the total annual mode premium.

The total annual mode premium is equivalent to a year’s premium based on the annual payment frequency for the basic plan and any supplementary benefits attached to it.

To claim the Retrenchment Benefit, the following conditions must be met:

- The insured has to be unemployed for a minimum of 30 consecutive days following their retrenchment;

- The 30 days have to occur during the premium payment term or up to your 65th birthday, whichever is earlier;

- There must not be a previous or existing claim for the Retrenchment Benefit under this policy; and

- The request has to be submitted using Manulife’s prescribed form within 6 months from the date of retrenchment.

If the retrenchment benefit has a coverage period that is shorter than your policy’s premium payment term, the premiums payable after the retrenchment benefit ends will be adjusted accordingly to exclude premiums for this benefit.

As the Retrenchment Benefit is a one-time benefit, it will be deemed terminated once the claim is successful.

In addition, this benefit will also be terminated if the policy is assigned to a corporation or an individual.

Premium Freeze Option

In the event that you are tight on cash at the moment, the Premium Freeze Option allows you to temporarily defer your premium payments for 1 year while keeping your policy active.

This allows you to sort out your budget and save up during this period to pay your premiums while still enjoying the same protection as usual.

However, there are certain requirements and limitations to activate this option:

- Your policy must be in force for at least 2 years with 2 full annual premium payments made;

- The premiums due can only be deferred for 1 year during each Premium Freeze;

- The premium payment term and your policy maturity date will be extended by 1 year;

- The end date for the Death, TI, TPD Premium Waiver, and Retrenchment Benefits will be extended by 1 year;

- Reversionary Bonus will not be declared during this 1-year deferment period; and

- Retrenchment Benefit will not be effective during this 1-year deferment period.

Depending on your selected premium payment term, the number of times you can apply for the Premium Freeze Option during your policy term changes as well.

| Premium Payment Term | Number of Premium Freeze Options |

| 5 Years | 1 Time |

| More Than 5 Years | Up to 2 Times |

Change of Life Insured Option

For those who plan on using their Manulife ReadyBuilder (II) as a form of legacy planning, you can pass on the policy to your loved ones by activating the Change of Life Insured Option.

Do note that you can only request to change the life insured after a minimum of 2 years from the policy’s issue date.

Those who plan on changing the life insured should have a legitimate financial or familial relationship with the new life insured which justifies your interest.

The number of times you are allowed to change the life insured would also depend on your position as the policy owner.

| If the Policy Owner is a | Number of Times You Can Change the Life Insured During the Policy Term |

| Corporation | Unlimited Times |

| Individual | No More than 2 Times |

Bonuses

Reversionary Bonus

Once the policy has been in force for a minimum of 3 years, Manulife may declare a bonus annually.

While the Reversionary Bonus rate is non-guaranteed and subject to changes, Reversionary Bonuses that have been declared are guaranteed to be added to your policy, regardless of the fund’s performance.

Based on an illustrated Investment Rate of Return (IRR) of 4.25% p.a., the Reversionary Bonus rates would be $4 per $1,000 sum insured, with an annual compounding rate of 1.20% throughout the policy term.

For those wondering how you can receive the accumulated Reversionary Bonus, this bonus can be received in different ways.

It will be payable upon the insured’s passing, in the event of TI, when the policy matures, or when you surrender the policy for its cash value.

Those who choose to surrender the policy will only be entitled to the surrender value of the accumulated Reversionary Bonus, which is less than the accumulated amount that has been declared and guaranteed.

Surrender Bonus

The Surrender Bonus is a feature that is specifically applicable when you decide to surrender the policy.

Similar to the Reversionary Bonus, the Surrender Bonus is only payable after the 3rd policy year if the policy is still active and you have made at least 3 full annual premium payments.

The Surrender Bonus is calculated as a percentage of the cash value associated with the accumulated Reversionary Bonus. However, the exact percentage will be determined at the time of surrender.

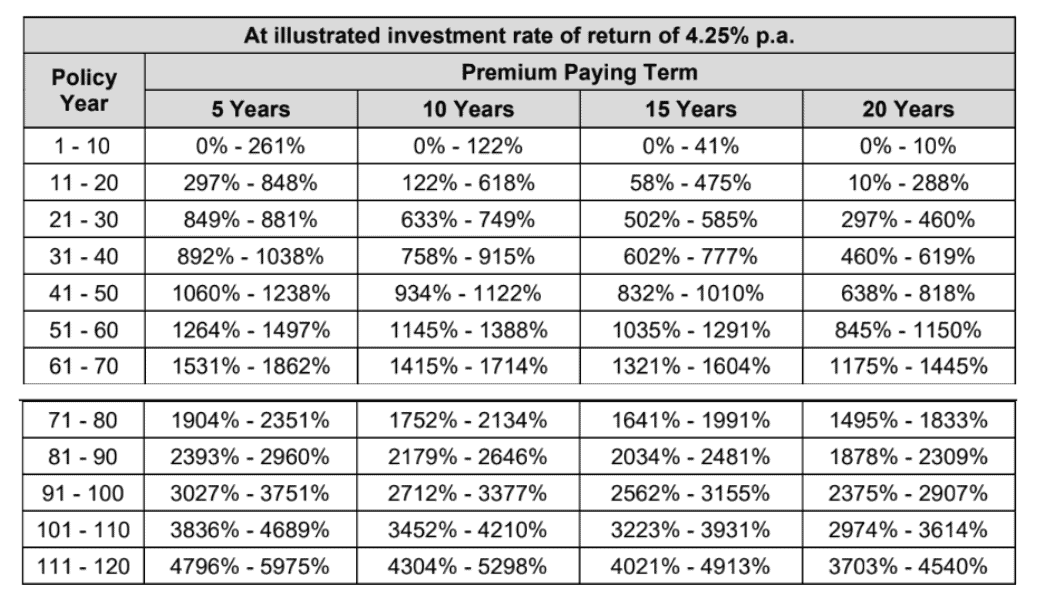

At an illustrated IRR of 4.25% p.a., you may find the corresponding Surrender Bonus rates below:

Manulife ReadyBuilder (II) Fund Performance

Investment Mix

For those who are interested in finding out where your money is invested, you may refer to the table below, which is accurate as of 31st December 2022.

While the strategic allocation indicates the participating fund’s planned allocation, the actual allocation refers to where your money actually is in real time.

| Strategic Asset Allocation | Current Asset Allocation | |||

| Asset Class | Target | Minimum | Maximum | |

| Fixed Income | 70.0% | 64.0% | 76.0% | 73.1% |

| Public Equity | 25.0% | 24.0% | 36.0% | 25.0% |

| Private Equity | 2.5% | 1.5% | ||

| Real Estate | 2.5% | 0.4% | ||

From the above, we can see that Manulife’s fund has a good distribution of short and long-term investments, indicating a well-diversified portfolio which reduces the portfolio risk.

This ensures a higher chance of getting more returns on these investments as a whole, increasing the potential non-guaranteed benefits you would receive.

In addition, the current allocation of assets is close to Manulife’s target allocation and within the stipulated range.

This highlights Manulife’s fund managers’ effort to ensure that the fund performs as close to its expected performance as possible, minimising any anomalous returns that would affect your non-guaranteed benefits.

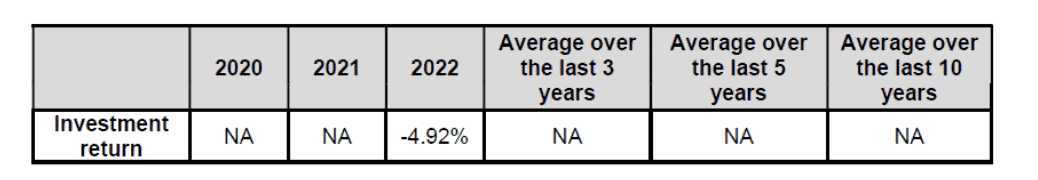

Investment Rate of Return (IRR)

Since the participating sub-fund was only established in April 2021, no information is available regarding its IRR before 2022.

Accurate as of 31 December 2022.

Even though the investment rates of return before 2022 are unavailable, policyholders do not need to worry as such data would not guarantee or indicate future performance.

Investment returns can fluctuate, and past performance does not necessarily predict future results.

With that in mind, It is always advisable to carefully consider the participating fund’s investment strategy, market conditions, and other relevant factors when making investment decisions.

To compare Manulife’s participating fund’s performance against that of other major life insurers, we can look at the chart below to analyse the 3, 5, and 10-year geometric average net investment returns:

Despite initially having one of the lowest few returns, Manulife’s overall return has been gradually increasing over the years, and their efforts have been reflected with a 7.68% average return in 2017-2019.

This shows the emphasis Manulife has on improving their participating fund’s performance, and policyholders can be comforted by the fact that this effort from Manulife will continue in the foreseeable future.

In addition, Manulife’s high ratio of non-guaranteed benefits reserve to total assets also showcases their commitment to fulfilling non-guaranteed benefits to their customers, avoiding a feeling of being shortchanged among their policyholders.

Nonetheless, keep in mind that financial ratios may vary across companies and over time. While these data are being used for analysis, they do not guarantee any future performances or trends.

Total Expense Ratio (TER)

Another financial indicator that can be used to analyse a fund would be its total expense ratio (TER) which is the total expenses incurred by the participating fund compared to its assets.

When you make premium payments, an expected amount of expenses is already factored into the premium.

Hence it is not an additional cost for you as a policyholder.

However, if the actual level of expenses ends up being significantly different from the expected level, it can still impact the non-guaranteed benefits you may receive.

For this participating fund, the past years’ TERs are as shown below.

| 2019 | 2020 | 2021 | Average of Last | |||

| 3 Years | 5 Years | 10 Years | ||||

| TER | 3.67% | 3.30% | 2.35% | 2.98% | 3.43% | 3.39% |

Accurate as of 31 December 2022.

The data above shows that the TER has been decreasing over the years, which is ideal for investors as a lower expense ratio translates to lower chances of a reduction in non-guaranteed benefits.

The report below also shows how the participating funds of different insurance companies performed in expense management between 2017 to 2019:

At the industry level, Manulife had the 2nd highest expense ratio between 2017 and 2019, which puts it above the industry average.

However, the decreasing average expense ratio over the years is also a promising sign for Manulife’s participating fund, a reason for you to be optimistic about this fund’s future.

Manulife ReadyBuilder (II) Fees and Charges

While the Manulife ReadyBuilder (II) does incur some expenses as part of its participating fund, all of the expected expenses have already been accounted for when determining the amount of premiums payable.

As such, you can rest your mind at ease knowing you will not face any sudden or extra charges throughout your policy term.

Illustration of How Manulife ReadyBuilder (II) Works

No Change of Life Insured

Jason is 25 years old, and he decides to purchase the Manulife ReadyBuilder (II). He chooses to pay a monthly premium of $500 for a period of 10 years.

| Policy Year | Jason’s Age | Sequence of Events |

| 0 | 25 | Jason purchases the policy. |

| 10 | 35 | Total Premiums Paid = $60,000

Jason’s premium payment term for his Manulife ReadyBuilder (II) comes to an end. |

| 25 | 50 | Illustrated IRR of 4.25% p.a.:

Illustrated Cash Value = $114,362 (>1.91x Total Premiums Paid) Jason chooses to let the amount continue growing over the next few years. |

| 45 | 70 | Illustrated IRR of 4.25% p.a.:

Illustrated Cash Value = $242,982 (>4x Total Premiums Paid) Without any need for the cash, Jason continues accumulating the cash value of his Manulife ReadyBuilder (II). |

| 60 | 85 | Illustrated IRR of 4.25% p.a.:

Illustrated Cash Value = $415,931 (>6.93x Total Premiums Paid) Jason decides to cash out his policy and he is entitled to receive the total cash value of his Manulife ReadyBuilder (II). |

Change of Life Insured

Janice is 30 years old and has decided to purchase a Manulife ReadyBuilder (II) plan. She chooses to pay a monthly premium of $600 for a period of 5 years.

| Policy Year | Age | Sequence of Events | |

| Janice | John | ||

| 0 | 30 | – | Janice purchased the policy. |

| 5 | 35 | 0 | Total Premiums Paid = $36,000

Janice’s premium payment term for her Manulife ReadyBuilder (II) comes to an end. Janice also appointed her newborn son, John, as the policy’s new life insured. |

| 23 | 53 | 18 | When John turns 18, Janice transfers the policy ownership to John, and John is now the new policy owner. |

| 30 | 60 | 25 | Illustrated IRR of 4.25% p.a.:

Illustrated Cash Value = $93,202 (>2x Total Premiums Paid) John does not require the money at this point in time. Hence he continues to leave the funds to accumulate and grow. |

| 50 | 80 | 45 | Illustrated IRR of 4.25% p.a.:

Illustrated Cash Value = $193,952 (>5x Total Premiums Paid) Without any need for cash, John continues accumulating the cash value of his Manulife ReadyBUilder (II). |

| 55 | 85 | 50 | While Janice, unfortunately, passes away, the life insured and policy owner has already been assigned to John. |

| 65 | 95 | 60 | Illustrated IRR of 4.25% p.a.:

Illustrated Cash Value = $333,524 (>9x Total Premiums Paid) John decides to cash out his policy, and he is entitled to receive the total cash value of his Manulife ReadyBuilder (II). |

Summary of Manulife ReadyBuilder (II)

| Cash and Cash Withdrawal Benefits | |

| Cash Value | Available |

| Cash Withdrawal | Available |

| Health and Insurance Coverage | |

| Death | Available |

| Total Permanent Disability (TPD) | Available |

| Terminal Illness (TI) | Available |

| Critical Illness (CI) | N/A |

| Early Critical Illness | N/A |

| Health and Insurance Coverage Multiplier | |

| Death | N/A |

| Total Permanent Disability | N/A |

| Terminal Illness | N/A |

| Critical Illness | N/A |

| Early Critical Illness | N/A |

| Additional Benefits | |

Optional Add-ons (Riders)

|

|