The GREAT Wealth Advantage 3, or GWA3, is Great Eastern’s most popular investment-linked policy and the successor to GREAT Wealth Advantage 2 and the Great Wealth Advantage.

If you were recommended the GREAT Wealth Advantage and are looking to understand if it’s good, you’re at the right place.

Keep reading for more on our review of the GREAT Wealth Advantage 3.

Review of GREAT Wealth Advantage 3

I think the GREAT Wealth Advantage 3 is a great investment-linked policy for those looking to invest between $100 to $200/month.

The GREAT Wealth Advantage 3 has the lowest minimum investment (starting at $100 monthly) amongst major investment-focused ILPs in the market.

This makes it highly attractive for those just getting started with investing who want someone to help them with it.

This regular premium plan offers a combined approach of insurance and investment, providing a safety net for circumstances such as death, total and permanent disability, and terminal illness while also offering growth potential.

Flexibility is what characterises the GREAT Wealth Advantage 3.

It offers 3 distinct investment plans:

- Choice 5

- Choice 10, or

- Choice 15

This lets you select the plan that suits your financial aspirations and cash flow capabilities. Whether you can only commit for the next 5, 10, or 15 years, the GREAT Wealth Advantage 3 has premium terms for you.

You also have a great selection of GreatLink funds to choose from, which are performing decently well.

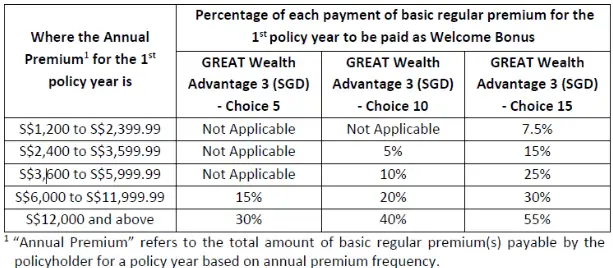

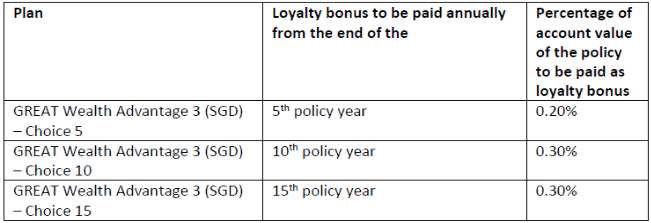

As a boost in your investment, the plan offers a Welcome Bonus of up to 55% during the first policy year and yearly Loyalty Bonuses awarded as recognition of your commitment to regular investments.

These bonuses enhance the value of your policy and encourage continuous financial planning.

The plan also allows for transferring policy ownership or changing the assured persons.

This ensures that your investment can continue to grow and support the financial health of your loved ones, thus securing a legacy for future generations.

However, it’s worth noting that one downside of the Great Wealth Advantage 3 is its high fees – especially if you’re on Choice 10 or Choice 15, investing less than $500/month.

As you’ll see in our Compulsory Fees & Charges section, the total fees you pay per annum can go up to 4.75%, excluding the monthly $5 fees.

After calculating the returns, the GREAT Wealth Advantage 3 only brings in an ROI of 287.18%, which is lower than the GWA2 (330.55%).

Of course, the actual fees you’ll incur are likely to be lower depending on the funds selected and your monthly investment amount, so take this calculation with a pinch of salt.

But putting the same conditions when calculating returns for ILPs, policies like the Manulife InvestReady III and the Singlife SavvyInvest perform way better with an ROI of up to 516.63%.

Before purchasing the GREAT Wealth Advantage 3, it’s advisable to get a second opinion from an unbiased financial advisor to determine if it’s really the best for you or if there are better alternatives in the market.

As a start, the Manulife InvestReady III and the Singlife SavvyInvest are 2 of the best ILPs in Singapore right now, so start there.

If you’re looking for a second opinion, we partner with MAS-licensed financial advisors who have helped thousands of Singaporeans with their investing needs.

Click here for a free, non-obligatory second opinion.

Now let’s break down the GREAT Wealth Advantage 3 in detail:

Criteria

- Minimum regular premium of $100/month

- Minimum investment period of 5 years

- Minimum policy term of 10 years

General Features

Premium Terms

The plan offers 3 plan types:

- Choice 5

- Choice 10, or

- Choice 15.

The basic regular premium for each plan type is consistent and payable throughout the policy term and can be paid monthly, quarterly, half-yearly, or yearly.

Now, this is not explicitly stated, but based on the Premium Holiday charges, the difference between Choice 5, 10, and 15 is the minimum number of years you have to make your investments for.

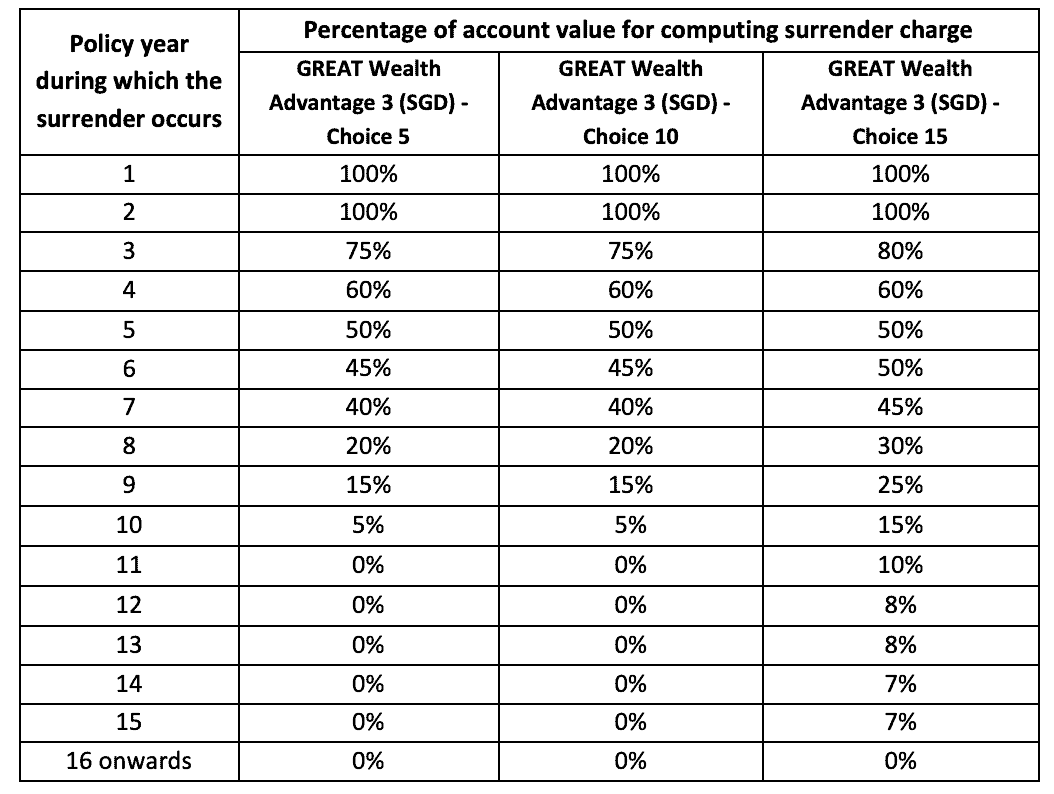

And based on the Surrender Charges, your minimum policy term – or the number of years you have to minimally hold the policy – also differs across plans.

Here’s the minimum investment period and policy terms for the GREAT Wealth Advantage 3:

| Minimum Investment Period | Minimum Policy Term | |

| Choice 5 | 5 | 10 |

| Choice 10 | 10 | 10 |

| Choice 15 | 15 | 15 |

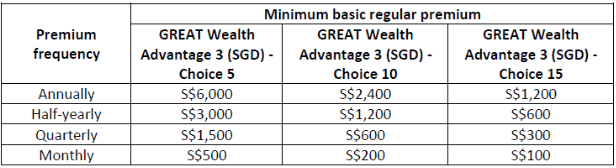

The minimum premium amounts are associated with each payment frequency, as shown in the table below:

Key Benefits

Death Benefit

In the event of the insured’s passing, the GREAT Wealth Advantage 3 offers financial security for you and your loved ones.

The Death Benefit is a lump sum and is valued as follows:

- The benefit may equal 105% of the total basic regular premiums paid plus 105% of the total single premium top-ups paid (if any). Of this, 105% of withdrawals, including withdrawal charges, will be deducted.

- On the other hand, the benefit may be equivalent to the policy’s account value, less any outstanding debt under the policy.

Total & Permanent Disability (TPD) Benefit

The Total & Permanent Disability (TPD) Benefit provided by the GREAT Wealth Advantage 3 offers you financial support if you experience Total & Permanent Disability confirmed by a registered medical practitioner.

The maximum TPD benefit is $5,000,000 for all policies and riders issued for each assured life.

With the TPD Benefit, the life assured must meet the following criteria:

- If you are over 15 years old and cannot perform any work, occupation, or profession that would enable you to earn or obtain any wage, remuneration, or profit before the policy anniversary on which you reach 65.

- If you are younger than 15 years old and are confined to a home, hospital, or institution that requires constant medical care and attention for at least 6 consecutive months.

- If you are incapacitated in the form of total and irrecoverable loss of:

-

- Your sight in both eyes

- Your use of 2 limbs at or above the wrist or ankle

- Your sight in one eye and the use of a limb at or above the wrist or ankle

Terminal Illness Benefit

If the life assured is unfortunately diagnosed with a Terminal Illness that is expected to result in their passing within the next 12 months, GREAT Wealth Advantage 3 will pay out the Death Benefit in one lump sum.

Key Features

Welcome Bonus

The GREAT Wealth Advantage 3 plan offers a Welcome Bonus as a token of appreciation when you make your first-year premium payment.

To qualify for the welcome bonus, you must pay the basic regular premium for the first policy year.

The table below shows the calculations as per your plan type:

Loyalty Bonus

With GREAT Wealth Advantage 3, you’ll receive a Loyalty Bonus at the end of the policy year, depending on your chosen plan.

Basic regular premiums must be up-to-date to get the Loyalty Bonus, and no withdrawals should have occurred during that policy year.

This bonus will be credited to your policy in the form of extra units in the investment-linked sub-funds.

Premium Holiday

Premium Holiday applies when you stop paying the basic regular premium after the first premium has been paid.

By doing this, your policy will be considered to be on a Premium Holiday.

However, while the policy is on a Premium Holiday, certain fees will still be deducted from your policy by cancelling units of an equivalent value from the investment-linked sub-funds.

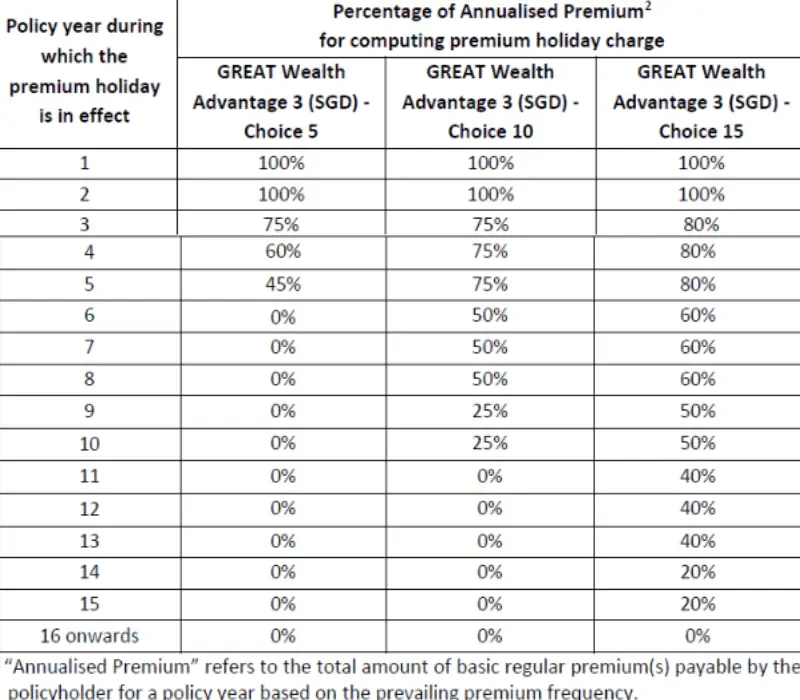

A Premium Holiday charge is applicable but refundable for plans type Choice 10 and Choice 15 after the first 5 policy years, and all basic premium payments are up-to-date.

Refer to the product summary for more details on the Premium Holiday charge refunds.

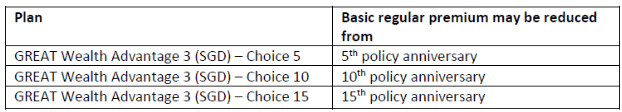

Basic Regular Premium Reduction

Should you find yourself in a financial predicament, you can reduce the amount of your basic regular premium after maintaining your policy for several years, as shown in the table below:

This adjustment will be effective from the next due date of payment.

Single Premium Top-ups

With GREAT Wealth Advantage 3, you can make Single Premium Top-ups after the start of your policy as long as you are up-to-date with all basic regular premiums.

If your policy is on Premium Holiday, you won’t be able to make single premium top-ups.

The minimum amount for each Single Premium Top-up is S$1,000, and the value of units allocated to your chosen funds must be at least S$200.

The maximum amount for Single Premium Top-up is subject to financial underwriting and will be determined from time to time.

Change of Life Assured

Changing the Life Assured means you can consider changing the person whose life is assured under the policy after the first year with a limit of 2 changes while the policy is active.

Fund Switching

You can request a Fund Switch, which means you can transfer all or any units from one fund to another available fund under the policy.

This can be done without additional fees, giving you the flexibility to manage your investments.

When initiating a fund switch, the value of units being switched from one fund to another must be at least S$500 or meet any minimum amount set from time to time.

Additionally, the value of the remaining units in the original fund after the switch should meet this minimum requirement.

Automatic Fund Rebalancing (AFR)

You can have your units in the various fund(s) automatically rebalanced every policy anniversary to conform to the apportionment you last instructed.

AFRs only happen if the fund value of a fund has deviated at least 5% from the last-instructed premium apportionment and the value of the deviation is at least $50.

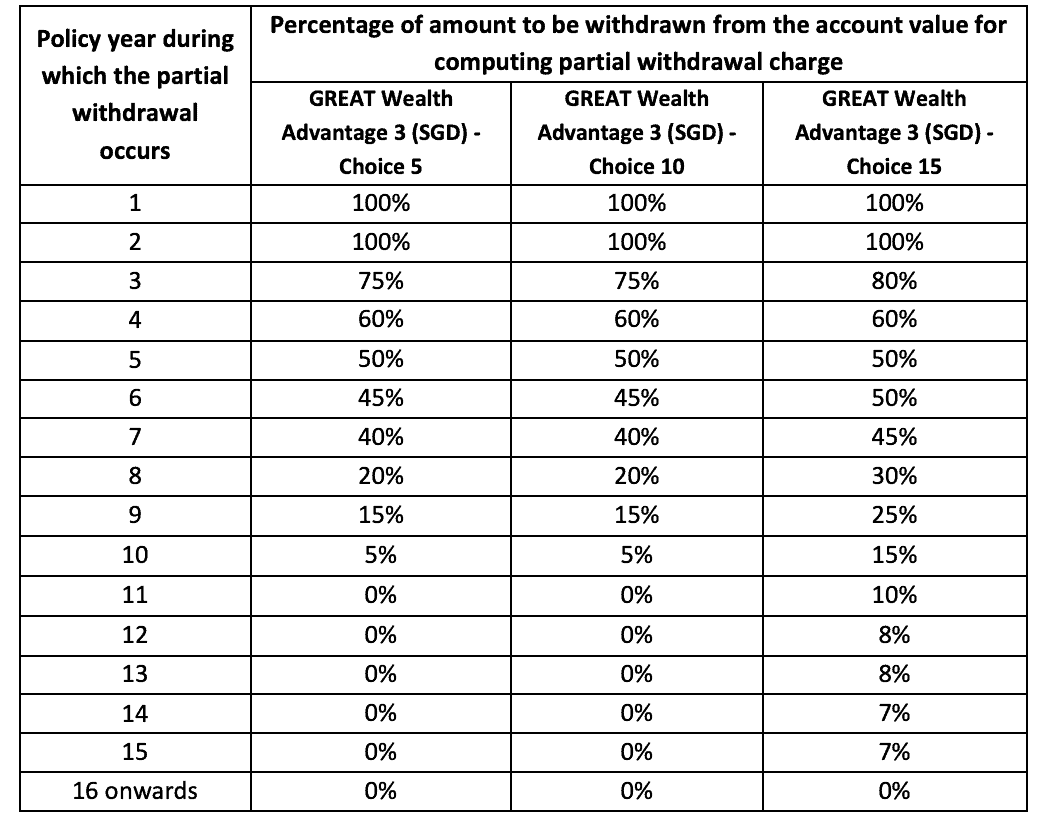

Partial Withdrawal

With GREAT Wealth Advantage 3, if you are running low on funds, you can request a partial withdrawal from your policy by cancelling some of the units in your fund(s).

There are some charges, though, when making a Patrial Withdrawal, which depends on the amount you choose to withdraw.

More on the charges in the Fees & Charges section later.

Currently, the minimum value of units you withdraw and the value of the remaining units in the fund after the withdrawal must each be at least S$500.

After the partial withdrawal, the remaining account value must be at least S$5,000.

GREAT Wealth Advantage 3 Top 10 Performing Funds

The Great Eastern GREAT Wealth Advantage 3 invests in its own ILP sub-fund (GreatLink funds), which are unit trusts.

Here are the top 10 performing GreatLink funds:

| Name | 5-Year Annualised Returns |

| GreatLink Lion Japan Growth | 9.51 |

| GreatLink Global Technology | 9.2 |

| GreatLink Sustainable Global Thematic Fund | 8.53 |

| GreatLink Global Perspective | 8.33 |

| GreatLink Global Equity Alpha | 7.97 |

| GreatLink Lion India | 5.7 |

| GreatLink Global Equity | 4.81 |

| GreatLink Singapore Equities | 2.28 |

| GreatLink Lion Vietnam | 2.1 |

| GreatLink Global Supreme | 1.99 |

Figures are accurate as of 19 June 2023.

Take note that the returns you see on the fund level exclude fund management fees and ILP-level fees.

I’ll cover more on this later.

GREAT Wealth Advantage 3 Fees & Charges

Policy Fee

The policy fee is calculated as a percentage of your policy’s account value and subtracted by cancelling units in the fund(s) where you have made your investments.

| Policy Year | Choice 5 | Choice 10 | Choice 15 |

| 1 to 10 | 2.50% | 2.50% | 1.50% |

| 11 to 15 | 0.60% | 0.60% | 1.50% |

| 16 onwards | 0.60% | 0.60% | 0.60% |

For the Choice 10 and Choice 15 plan types, there is an additional fixed monthly fee of $5 if your annual premium is less than $6,000 (or $500/month).

It’s unclear whether the monthly $5 fee is only for the first 10 or 15 years, or is it for as long as the policy is active.

It is safer to assume that the $5/month fee is forever, so that you can factor it into your returns.

Premium Top-up Charge

When you make a single premium top-up, a premium charge of 5% will be deducted from the top-up amount.

Based on your instructions, the remaining amount will be used to create and allocate units in the selected funds.

Premium Holiday Charge

A Premium Holiday Charge will be deducted monthly from the account value during the Premium Holiday.

This charge covers the administrative and operational costs associated with the Premium Holiday feature.

The monthly premium holiday charge is outlined in the table below:

Partial Withdrawal Charge

Here are the partial withdrawal charges for the GREAT Wealth Advantage 3:

Surrender Charge

Here are the surrender charges for the GREAT Wealth Advantage 3:

Fund Management Fee

The fund Management Fee covers managing and maintaining the investment funds and is deducted from the fund value at each asset valuation.

Looking at a few of the GreatLink fund management fees, this ranges between 1.5% and may increase to 2.25% per year.

Also, this charge is not reflected in your fund factsheet – so you’ll have to deduct this from your fund factsheet.

Compulsory Fees & Charges

While many fees and charges are listed above, not all of them may apply to you when you take up this policy.

For those who choose not to exercise any of the flexible options such as Premium Holiday, Partial Withdrawals, etc., the only fees you need to pay attention to would be:

| Policy Year | Choice 5 | Choice 10 | Choice 15 |

| 1 to 10 | 2.50% | 2.50% | 1.50% |

| 11 to 15 | 0.60% | 0.60% | 1.50% |

| 16 onwards | 0.60% | 0.60% | 0.60% |

Assuming you’re opting for the lowest minimum premium (most do) and are on the Choice 10 or Choice 15 policy (most are), you are sure to incur the $5 monthly fee.

For Choice 10 policies, that’s an additional 2.50% in yearly fees. This effectively makes your annual fees 2.5% in account value + 2.5% of your yearly premiums for the first 10 years and 0.60% + 2.50% after that.

For Choice 15, $5/month with $100/month investment is 5% of your premiums. Thus, your first 15 years will cost 1.50% + 5%, and it’ll be 0.60% + 5% after that.

There are also fund management fees of up to 2.25% per annum to factor in your returns.

Therefore, your final compulsory fees & charges for the GREAT Wealth Advantage 3 is:

| Policy Year | Choice 5 | Choice 10 | Choice 15 |

| 1 to 10 | 4.75% | 4.75% + 2.50% | 3.75% + 2.50% |

| 11 to 15 | 2.85% | 2.85% + 2.50% | 3.75% + 2.50% |

| 16 onwards | 2.85% | 2.85% + 2.50% | 2.85% + 2.50% |

Assuming the fees are 2.25% p.a.

How much will I receive upon maturity of the Great Eastern GREAT Wealth Advantage 3?

Assuming that you invest $100 monthly for 20 years and let it compound for another 10 years, the fund charges are 2.25% per annum, the funds perform at 10% yearly, and you did not take up any flexible options (Premium holiday, Partial Withdrawal, Early Surrender), you can expect the following for Choice 15 policies:

| First 15 years | |

| Monthly premium: | $100 |

| Premium Payment Term: | 15 years (180 months) |

| Annual Fund Performance: | 10% |

| Fees in the first 15 years: | 3.75% |

| Net Fund Performance for the first 15 years: | 6.25% |

| Investment value: | $28,717.20 |

| Next 5 Years | |

| Monthly premium | $100 x 5 years |

| Fees in the next 5 years: | 2.85% |

| Net Fund Performance in the next 5 years: | 7.15% |

| Investment value: | $47,482.04 |

| Last 10 Years | |

| Fees in the last 10 years: | 2.85% |

| Net Fund Performance in the last 10 years: | 7.15% |

| Policy Fee | $5 x 12 x 30 years = $1,800 |

| Total Investment Value over 30 years: | $92,922.02 |

Total Premiums paid after 20 years: $24,000

Total Interest Earned: $68,922.02

ROI: 287.18%

The welcome bonus and loyalty bonus have been omitted in our above calculation.

Based on the GreatLink factsheets, fund management fees range from 1.50% to 2.25% per annum. An estimated fund performance of 10% per annum would mean that a growth fund was invested in and a corresponding high fund fee as well.

Since the fund charges are stated in the product summary to be variable, we have assumed the fund charges to be 2.25% per annum in our calculations.

If you intend to take up this ILP, remember to factor the actual fund fees of your selected fund(s) into your calculations and consideration.

Your actual fund management fees are likely lower than 2.25% per annum.

Summary of the GREAT Wealth Advantage 3

| Cash & Cash Withdrawal Benefits | |

| Cash Value | Yes |

| Cash Withdrawal | Yes |

| Health & Insurance Coverage | |

| Death | Yes |

| TPD | Yes |

| Terminal Illness | Yes |

| Critical Illness | No |

| Early Critical Illness | No |

| Health & Insurance Coverage Multiplier | |

| Death | No |

| TPD | No |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |