The Great Eastern GREAT Wealth Advantage is an investment-linked plan (ILP) that mainly focuses on investments. This ILP boasts one of the highest number of flexible options for its policyholders.

My Review of the Great Eastern GREAT Wealth Advantage

The Great Eastern GREAT Wealth Advantage is a good option for those who are not that well-versed with investing and need a simple solution for themselves.

As this is an investment-focused ILP, you don’t have to worry about your investment funds going into insurance.

As compared to other ILPs in the market, the only features that stand out from this ILP are its 110% death & TPD benefits, its automatic rebalancing feature, and funds.

Most ILPs only provide 101% death and TPD benefit and don’t have a rebalancing feature – something your FA will have to do (which he/she might not).

Its in-house funds performed well based on the 5-year annualised rates, comparable to ILPs with access to strong funds.

However, these are GreatLink funds, which excludes fund-level fees & charges from their fund-level returns calculations. So what you see in the table below might not truly reflect their returns.

With bonuses of only 5% offered, it is incomparable to other ILPs that offer up to 30% bonuses. Fees wise, the first 10 years can be pretty expensive as fund management fees go up to 1.6% on top of the policy’s 2.5% per annum.

This is higher than other investment-linked plans in the market as well.

What I’m wary about the most regarding the Great Eastern GREAT Wealth Advantage is that there is a lot of information not readily available online.

This means that I will have to engage a financial representative and listen to his sales pitch before getting the information I need. For example, information on riders is not available.

Some terms & conditions for the flexibility offered also depends on the year you’re executing it – which means that I might incur additional charges.

Personally, I prefer Manulife InvestReady Wealth II for its flexibility & dividend funds and the Singlife Savvy Invest for its high growth potential.

Now don’t get me wrong, I am not trying to say that the GREAT Wealth Advantage is a bad product. In fact, I believe it’s one of the better ILPs in the market.

I’m merely making an objective comparison against what’s currently available.

In fact, we have a post comparing the best investment plans in Singapore that you might be interested in.

We highlight which ILPs are better for different individuals, situations, and goals – so it might be useful for you to start your research there.

Remember that any information written here is not meant to be construed as financial advice, and you should seek it from a licensed financial advisor.

If a financial advisor recommended you this plan, it’s always wise to seek a second opinion to whether you should get the GREAT Wealth Advantage and possibly explore alternatives that might suit you better.

To get a second opinion, click here for a free non-obligatory chat with one of our partners.

Criteria

- Minimum investment amount of S$200 per month

- Minimum investment period (MIP) of 10 years

General Features

The features of Great Eastern GREAT Wealth Advantage are as follows:

Premium Payment & Options

The minimum basic regular premium differs based on your chosen frequency of payments, as listed below.

- Monthly – S$200

- Quarterly – S$600

- Half-yearly – S$1,200

- Annually – S$2,400

Premium payment terms

Based on the Great Eastern GREAT Wealth Advantage’s product summary, there is a minimum premium term of 10 years. However, you are able to hold the policy indefinitely.

Premium Allocation

If you choose to invest with the Great Eastern GREAT Wealth Advantage, 100% of the basic regular premium will be used to buy fund units.

Free-look period

Similar to all policies, for the first 2 weeks after buying, you are able to revoke your decision to do so. In this instance, your paid out premiums minus any welcome bonus, changes in prices of funds invested in and costs incurred will be refunded to you.

Fund switching / Changing premium apportionment in funds

Great Eastern understands that your risk appetite and mindsets can change over the policy duration. Therefore, you are allowed to change the allocation of your premiums in each fund and switch up your invested fund(s) completely at no charge.

You are also allowed to do partial switching of funds. This is as long as the value of the units of funds switched into the new fund and the value in the remaining fund are both minimally S$500 after the switch.

Automatic fund rebalancing

Automatic fund rebalancing here refers to your units of your invested funds being sold or bought yearly so that your premium allocation follows your latest instructions accordingly. Rest assured that you will be informed 1 month before the rebalancing is done.

Automatic fund rebalancing is only performed when there is a 5% or minimally S$500 deviation from your apportionment instructions.

Due to the fact that premium top-ups, withdrawal from policy, and fund switches dramatically changes the fund apportionments, you will have to provide new instructions for fund allocation. This ensures that automatic fund rebalancing can continue to be executed on the next rebalancing date.

Plan Flexibility

Premium Holidays

Policyholders may decide to apply for a premium holiday and stop paying basic regular premiums after the first payment. Nevertheless, if you decide to apply for a premium holiday in the first 10 years, there will be a premium holiday charge. (Find out more under Fees Involved)

Fees and charges regarding the policy will continue to be deducted from your account value during the premium holiday. The policy will remain in effect and charges will continue to be deducted as long as your account value is positive.

The duration of your premium holiday is mostly determined by you. It ends when you pay your basic regular premiums again or when the fees can no longer be deducted from your account value.

In that instance, your account value will be stripped to zero and any remaining fees will be considered as debt to Great Eastern. Your policy will also be deemed to have lapsed at that point.

Reducing basic regular premium

As long as the premium payments are higher than the minimum amounts mentioned above, you may decide to reduce your basic regular premium amount at any time. However, this is subject to terms and conditions imposed by Great Eastern.

Also, your new reduced premiums amounts will only kick in on the next payment date.

Premium top-ups

You can also choose to make single premium top-ups to your policy as long as you are not on a premium holiday and have paid off your basic regular premiums falling due.

The minimum amount for top-ups is S$1,000 and should not exceed the maximum amount specified by Great Eastern for that period. On top of that, the premium top-up amount allocated to each fund should be at least S$200.

Furthermore, 95% of the single premium top-up amount will be used to buy fund units. This means that you’ll be incurring 5% in charges.

Partial withdrawal

At certain points in your life, you might need a relatively large sum of money to attain a dream you have or to tide you over a tough period. With Great Eastern GREAT Wealth Advantage, you are able to do a partial withdrawal at any time to do just that.

However should you decide to do a partial withdrawal in the first 10 policy years, there will be a partial withdrawal charge. (See more under Fees Involved)

Please take note that the withdrawal amounts, as well as the residual value in each fund, will have to be more than S$500.

Add supplementary benefits, according to your needs

There is also the option to add on benefits, such as protection against critical illnesses and disability. These additional supplementary benefits are paid for by selling units from invested funds in your policy.

However, information on the riders is not available online.

Protection

Death Benefits

If the life insured dies during his/her policy term, Great Eastern will pay the higher of:

- 110% of premiums paid plus 110% of top-ups paid less any withdrawal made; or

- account value

Total and permanent disability benefit

If the insured suffers from total and permanent disability (TPD), the Death Benefit will be paid in a lump sum amount.

There are two types of TPD namely, Presumptive TPD and Other forms of TPD.

| Types of TPD covered | Definition | Expiry of cover |

| Presumptive TPD |

|

Applicable on the whole term of coverage |

|

Other forms of TPD (Not Presumptive TPD) |

For Life Insured above age 15:

|

Other forms of TPD must be incurred before the life insured turns 65 |

|

For Life Insured below age 15

|

The maximum in which the company pays for TPD is S$5 million.

Terminal illness benefit

If the insured is given a definite diagnosis of a terminal illness, the Death Benefit will be paid in a lump sum amount.

Terminal illness here refers to a disease whereby a registered Medical Examiner establishes that the patient is likely to pass away within 12 months from the date of diagnosis.

Key Features

Welcome Bonus

You will be happy to find out that the Great Eastern GREAT Wealth Advantage offers a welcome bonus in your first policy year.

This welcome bonus is equivalent to 5% of your basic regular premium paid in that year.

Additional units of your invested fund(s) are added to your policy upon premium payments as the welcome bonus.

Naturally, you will not be able to receive this welcome bonus should you decide to apply for a premium holiday.

Loyalty bonus

Great Eastern also rewards loyal policyholders with a loyalty bonus from the 10th policy year onwards.

The bonus is awarded every time you make a basic regular premium payment from the 10th year onwards.

This is provided that the basic regular premiums in the first 9 years have all been paid off accordingly.

The loyalty bonus is tabulated with the following formula:

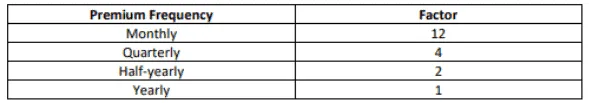

5% of [Basic regular premiums total withdrawals (if any) in the preceding policy year ÷ Factor],

The corresponding factors are shown in the table below, according to your chosen premium frequency.

Likewise, the loyalty bonus is also awarded as additional units of your invested funds.

Fund offerings

The Great Eastern GREAT Wealth Advantage offers 30 in-house funds from which you can choose one or more to invest your premiums.

Great Eastern GREAT Wealth Advantage’s Top 10 Performing Sub-Funds

The Great Eastern GREAT Wealth Advantage invests in unit trusts.

Take note that these are investing into ILP sub-funds instead of direct to the unit trust, which potentially carries additional fees.

| Name of Fund | 5-Year Historical Average (%) |

| Greatlink Global Technology | 24.64 |

| Greatlink China Growth | 19.72 |

| Greatlink Lion Vietnam | 17.55 |

| Greatlink Global Thematic | 17.38 |

| GreatLink Far East ex Japan Equities | 15.61 |

| GreatLink Equity Alpha | 13.55 |

| GreatLink Lifestyle Dynamic Portfolio | 13.55 |

| GreatLink Global Perspective | 13.51 |

| GreatLink Global Emerging Markets Equity | 13.45 |

| GreatLink Asia Pacific Equity | 13.30 |

Accurate as of April 2020

As with any kind of investment, there are always risks involved. Historical performances are not able to predict future returns. These 5-year annualised return rates only serve as an estimate. Remember to always do your own due diligence or consult a trusted financial advisor if you are unsure.

Fees Involved

Fees and charges are an integral part of all investment products. The Great Eastern GREAT Wealth Advantage is not an exception. The fees and charges which you may incur with this ILP are as follows.

| Policy Fee |

|

| Fund Fees and Charges |

|

| Premium Holiday Charge |

Total basic regular premium payable in that policy year X Percentage which corresponds to the same year

|

| Single premium top-up charge | Each single premium top-up that you add to your account value is subject to a 5% premium charge. |

| Changing premium apportionment rates fees | Currently, there are no fees for changing your premium apportionment rate. |

| Fund switching | Currently, there are no fees for switching your fund(s). |

| Automatic fund rebalancing fee | Currently, there are no fees for opting into automatic fund rebalancing |

| Adding supplementary benefits fee |

|

| Partial Withdrawal Charge |

Withdrawal Amount X Percentage which corresponds to the policy year of withdrawal.

|

| Early Surrender Charge |

Account Value at surrender X Percentage which corresponds to the policy year you wish to terminate.

|

Percentage Table

This percentage table is applicable to the Premium Holiday, Partial Withdrawal, and Early Surrender Charges for the Great Wealth Advantage.

| Policy Year | Percentage |

| 1 | 100.00% |

| 2 | 90.00% |

| 3 | 80.00% |

| 4 | 70.00% |

| 5 | 60.00% |

| 6 | 50.00% |

| 7 | 40.00% |

| 8 | 30.00% |

| 9 | 20.00% |

| 10 | 5.00% |

| 11 and above | 0.00% |

Besides the fund charges, single premium top-up charge, and adding supplementary benefit charge, you essentially do not have to pay for any other fees after the first 10 policy years.

Compulsory fees

With so many flexible options with charges, it might seem like there are many fees and charges to consider under the GREAT Wealth Advantage ILP. However, not all the charges may be applicable to you.

If you can commit to the policy from start to maturity, without the flexible adjustments, you will only need to take note of the following in the first 10 policy years.

- Policy Fee – 2.5% per annum of the account value

- Fund fees and charges – dependent on the selected funds (0.35%-1.6% as of 2020)

After 10 years, you will only have to pay for the fees and charges incurred for the fund.

Furthermore, you are able to take on certain flexible options, such as premium holiday, partial withdrawal, and early surrendering of policy at no charge.

Although fund-level fees and charges are usually included in the returns you see from your funds, it is unclear whether this is the same for Great Eastern funds.

For prudence purposes, I included the charges as part of the compulsory fees.

Policy Termination

The policy will be deemed to have reached maturity when:

- the life assured passes away, suffers from TPD, or is diagnosed with a terminal illness;

- all funds available for investment in the policy are closed for investing in; or

- you exercised your cancellation rights under the free-look period

Lastly, you may also choose to terminate the policy on your own accord, by surrendering your policy. However, do take note that a surrender charge will be incurred should you decide to cancel the policy in the first 10 years.

The final amount you receive for early surrender would be the price value of your cancelled funds on the next valuation date, minus any surrender charge.

How much will I receive upon maturity of the Great Eastern GREAT Wealth Advantage?

It is hard to give a proper estimate as there are some hidden rates not provided in the product summary, we’ll do our best to simplify it for you.

Assuming that you invest S$200 monthly for 20 years and let it compound for another 10 years, the fund charges are 1.6% per annum, the funds perform at 10% yearly, and you did not take up any flexible options (Premium holiday, Partial Withdrawal, Early Surrender), you can expect the following:

|

First 10 Years |

|

| Monthly premium: | $200 |

| Premium Payment Term: | 20 years (240 months) |

| Annual Fund Performance: | 10% |

| Fees in the first 10 years: | 2.5% + 1.6% |

| Net Fund Performance for the first 10 years: | 5.9% |

| Investment value: | $31,840.55 |

|

Next 10 Years |

|

| Fees in the next 10 years: | 1.6% |

| Net Fund Performance in the next 10 years: | 8.4% |

| Investment value: | $106,765.36 |

|

Last 10 Years |

|

| Fees in the last 10 years: | 1.6% |

| Net Fund Performance in the last 10 years: | 8.4% |

| Total Investment Value over 30 years: | $239,179.08 |

Total Premiums paid after 20 years: $48,000.00

Total Interest Earned: $191,179.08

ROI: 398.29%

The welcome bonus and loyalty bonus have been omitted in our above calculation.

Based on Great Eastern’s 2020 Annual Report, we have found fund management fees to range from 0.35% – 1.6% per annum. An estimated fund performance of 10% per annum would mean that a growth fund was invested in, and a corresponding high fund fee as well.

Since the fund charges are stated in the product summary to be a variable, we have assumed the fund charges to be 1.6% per annum in our calculations.

If you intend to take up this ILP, remember to factor the actual fund fees of your selected fund(s) into your calculations and consideration.