What are halal ETFs?

How does it differ from other types of exchange-traded funds?

What are the best halal ETFs for me to invest in?

If these are some questions that you have, you’re in the right place.

Continue reading to find out more.

What is a halal ETF?

Halal ETFs are a type of investment fund that tracks the performance of a specific index that conforms to Islamic principles.

These funds are designed to provide investors with exposure to the performance of a particular asset class without having to invest directly in the underlying assets.

They may invest in halal stocks, Sukuk, and halal REITs.

11 Best Halal ETFs To Invest In

| ETF | TICKER | WHAT IT TRACKS | EXPENSE RATIO |

| Wahed FTSE USA Shariah ETF | HLAL | FTSE Shariah USA Index | 0.50% |

| Wahed Dow Jones Islamic World ETF | UMMA | Dow Jones Islamic Market International Titans 100 Index | 0.65% |

| Wealthsimple Shariah World Equity Index ETF | WSHR | Dow Jones Islamic Market Developed Markets Quality and Low Volatility Index. | 0.50% |

| SP Funds Dow Jones Global Sukuk ETF | SPSK | Dow Jones Sukuk Total Return Index | 0.65% |

| SP Funds S&P500 Shariah Industry Exclusions ETF | SPUS | S&P 500 Shariah Industry Exclusions Index | 0.49% |

| iShares MSCI World Islamic UCITS ETF | ISWD | MSCI World Islamic Net Total Return Index-USD | 0.60% |

| iShares MSCI Emerging Markets Islamic UCITS ETF | ISDE | MSCI EM Islamic Index | 0.85% |

| Saturna Al-Kawthar Global Focused Equity UCITS ETF | AMAP.L | None | 0.75% |

| iShares MSCI USA Islamic UCITS ETF | ISUS | MSCI USA Islamic Net Total Return Index | 0.50% |

| SP Funds S&P Global REIT Shariah ETF | SPRE | S&P Global All Equity REIT Shariah Capped Index | 0.69% |

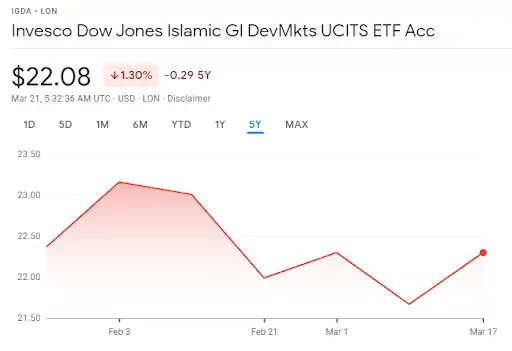

| Invesco Dow Jones Islamic Global Developed Markets UCITS ETF | IGDA | Dow Jones Islamic Market Developed Markets Index | 0.40% |

1. Wahed FTSE USA Shariah ETF (HLAL)

| Annualised Returns | 1-Year | 3-Year | 5-Year | 10-Year | YTD |

| HLAL | 42.38% | N/A | N/A | N/A | 11.74% |

We chose Wahed FTSE USA Shariah ETF as one of the best halal ETFs because it is a low-cost fund with a pretty decent expense ratio of 0.50%.

Wahed Invest launched the Wahed FTSE USA Shariah ETF in October 2019 in partnership with FTSE Russell, and the US Banks Lifted Funds Trust.

Listed on NASDAQ, this ETF has a ticker symbol HLAL and tracks the total return performance of the FTSE Shariah USA Index.

The ETF constitutes 224 stocks from large and mid-cap US-based companies that meet Shariah’s business activity and financial ratios screening criteria.

These stocks come from various sectors, but the most significant chunk is the technology sector constituting 37.4%.

The top 10 holdings as of March 2022 are

| COMPANY | WEIGHTING |

| Apple Inc | 17.76% |

| Tesla Inc | 5.64% |

| Johnson & Johnson | 3.14% |

| Procter & Gamble Co. | 2.49% |

| Exxon Mobil Corp. | 2.36% |

| Chevron Corp. | 2.16% |

| Pfizer Inc. | 2.02% |

| Lilly(Eli) & Co | 1.65% |

| Cisco Systems, Inc. | 1.62% |

| Thermo Fisher Scientific Inc. | 1.57% |

Wahed FTSE USA Shariah ETF offered an Annual Total Return of 28.59% in 2021 with a dividend yield of 0.8%.

The index is calculated in real-time and at closing and is semi-annually reviewed in March and September.

Moreover, the ETF’s shariah compliance is reviewed quarterly by Yasaar Ltd. in March, June, September, and December.

2. Wahed Dow Jones Islamic World ETF (UMMA)

| Annualised Returns | 1-Year | 3-Year | 5-Year | 10-Year | YTD |

| UMMA | N/A | N/A | N/A | N/A | N/A |

We chose Wahed Dow Jones Islamic World ETF to be on our halal ETFs list as it is the first ESG-aware ETF and has a reasonable expense ratio.

Wahed Invest launched this particular ETF in collaboration with Dow Jones and US Bank’s Listed Funds Trust in January 2022.

The ETF is listed on NASDAQ with the ticker UMMA and tracks the Dow Jones Islamic Market International Titans 100 Index.

This ETF is USD-based and invests in equity securities from emerging and developed markets of various countries, excluding US-domiciled ones.

Even though it is an actively managed ETF, the expense ratio is reasonable and is 0.65%.

The Wahed Dow Jones Islamic World ETF opens doors for investors seeking a diverse investment portfolio consisting of Environmental, Social, and Governance-aware global equities.

As of 2021, the ETF offered 102 constituents in various industries from 21 countries worldwide.

The top 10 constituents in 2022 include:

| COMPANY | WEIGHTING |

| Taiwan Semiconductors Manufacturing Co. | 7.17% |

| Samsung Electronics Co. | 4.14% |

| ASML Holding NV | 4.05% |

| Rogers Corp. | 4.04% |

| Roche Holding Ltd | 3.81% |

| Tencent Holdings Ltd | 3.80% |

| Nestle SA Reg | 3.15% |

| Novartis AG | 2.86% |

| Novo Nordisk A/S Class B | 2.58% |

| JD.com Inc | 2.48% |

The information technology sectors constitute a significant chunk of 27.1% of the ETF.

The country that provides the highest number of constituents is Japan.

Other countries include Australia, Brazil, Britain, Canada, China, Denmark, Finland, France, Germany, Hong Kong, Ireland, Italy, Netherlands, Russia, South Korea, Spain, Sweden, Switzerland, and Taiwan.

3. Wealthsimple Shariah World Equity Index ETF (WSHR)

| Annualised Returns | 1-Year | 3-Year | 5-Year | 10-Year | YTD |

| WSHR | N/A | N/A | N/A | N/A | 9.18% |

The Wealthsimple Shariah World Equity Index is the first Canadian shariah-compliant ETF introduced by Wealthsimple in October 2020.

It is listed on NEO Exchange with the ticker WSHR and replicates the Dow Jones Islamic Market Developed Markets Quality and Low Volatility Index.

The trustee is Mackenzie Investments and is bi-annually screened for Shariah compliance by Rating Intelligence Partners, the globally accepted Islamic advisory firm.

Wealthsimple Shariah World Equity Index ETF is one of the best halal ETFs because of its expense ratio and relatively low risk.

This Canadian dollar-based ETF focuses on equities from shariah-compliant companies, is passively managed with an expense ratio of 0.50%, and meets the ESG criteria.

The industry that constitutes the central part of this ETF is the consumer staples industry, making up 13.9%.

The top 10 holdings include:

| COMPANY | WEIGHTING |

| Nestle SA | 1.0% |

| Hong Kong and China Gas Co Ltd | 1.0% |

| CLP Holdings Ltd. | 0.9% |

| Waste Connections Inc. | 0.9% |

| Givaudan SA | 0.9% |

| Beiersdorf AG | 0.9% |

| McDonald’s Holdings Co Japan Ltd. | 0.8% |

| Singapore Telecommunications Ltd. | 0.8% |

| SGSSA | 0.8% |

| Walters Kluwer NV | 0.8% |

Due to the combination of quality stocks and low volatility, this ETF poses a low risk. The ETF offers a dividend yield of 0.34%, and distributions are done quarterly in March, June, September, and December.

4. SP Funds Dow Jones Global Sukuk ETF (SPSK)

| Annualised Returns | 1-Year | 3-Year | 5-Year | 10-Year | YTD |

| SPSK | 1.30% | N/A | N/A | N/A | 0.72% |

We selected SP Funds Dow Jones Global Sukuk as one of the best halal ETFs because it can provide you exposure to Sukuk investment and offers a reduced risk of duration and interest rates.

It is listed on NYSE Arca with the ticker SPSK and tracks the Dow Jones Sukuk Total Return Index. SPSK includes investment-grade Sukuk for various countries and is USD denominated.

The average weighted maturity is 5.93 years.

It includes holdings such as:

| SUKUK | WEIGHTING |

| KSA Sukuk Limited 3.628% | 4.46% |

| KSA Sukuk Limited 4.303% | 3.08% |

| SA Global Sukuk Limited 2.694% | 2.69% |

| KSA Sukuk Limited 2.969% | 2.37% |

| Perusahaan Penerbit SBSN Indonesia III 4.325% | 2.23% |

| Perusahaan Penerbit SBSN Indonesia III 4.4% | 2.03% |

| Perusahaan Penerbit SBSN Indonesia III 4.15% | 1.99% |

| KSA Sukuk Limited 2.25% | 1.81% |

| IsDB Trust Services No. 2 SARL 1.262% | 1.81% |

| SA Global Sukuk Limited 1.602% | 1.79% |

The expense ratio of SP Funds Dow Jones Global Sukuk ETF is 0.65% and offers dividends of $0.03 per month.

5. SP Funds S&P500 Shariah Industry Exclusions ETF (SPUS)

| Annualised Returns | 1-Year | 3-Year | 5-Year | 10-Year | YTD |

| SPUS | 36.88% | N/A | N/A | N/A | 19.99% |

The SP Funds S&P500 Shariah Industry Exclusions ETF made it to our list of halal ETFs because it can offer you exposure to the S&P500 index while complying with the shariah criteria.

It was launched in 2019 on NYSE Arca with the ticker symbol SPUS. This ETF tracks the S&P500 Shariah Industry Exclusions Index, which was developed by SP Funds in collaboration with S&P Dow Jones Indices LLC.

SPUS uses an industry exclusion method to exclude constituents like data processing, outsourced services, financial exchanges, and aerospace & defence.

The top 10 holdings in this ETF include:

| COMPANIES | WEIGHTAGE |

| Apple Inc | 12.40% |

| Microsoft Corporation | 10.76% |

| Alphabet Inc – Ordinary Shares – Class A | 3.95% |

| Alphabet Inc – Ordinary Shares – Class C | 3.81% |

| Tesla Inc | 3.69% |

| NVIDIA Corp | 3.12% |

| Meta Platforms Inc – Ordinary Shares – Class A | 2.41% |

| Johnson & Johnson | 2.17% |

| Procter & Gamble Co. | 1.73% |

| Home Depot, Inc. | 1.64% |

The technology sector constitutes 40.79% of the SP Funds S&P 500 Shariah Industry Exclusions ETF, making it the primary sector.

Moreover, it has an expense ratio of 0.49% and offers a dividend of $0.03 monthly.

6. iShares MSCI World Islamic UCITS ETF (ISWD)

| Annualised Returns | 1-Year | 3-Year | 5-Year | 10-Year | YTD |

| ISWD | 11.99% | 11.04% | 9.46% | 7.87% | 4.28% |

We selected iShares MSCI World Islamic UCITS ETF to be on our list of halal ETFs as it offers diversification by direct investment in equities from developed companies worldwide.

Domiciled in Ireland, iShares launched this US dollar-denominated ETF in December 2007 on the London Stock Exchange and Swiss Stock Exchange.

The ETF has the ticker symbol ISWD and tracks the MSCI World Islamic Net Total Return Index-USD. Black Rock Asset Management Ireland Ltd manages the ISWD fund.

iShares MSCI World Islamic UCITS ETF consists of stocks from various global companies such as:

| COMPANIES | WEIGHTAGE |

| Johnson & Johnson | 3.85% |

| Procter & Gamble Co | 3.06% |

| Exxon Mobil Corp | 2.95% |

| Chevron Corp | 2.68% |

| Pfizer Inc | 2.45% |

| Roche Holding AG | 2.32% |

| Cisco Systems Inc | 1.92% |

| Thermo Fisher Scientific Inc | 1.88% |

| Shell PLC | 1.78% |

| Abbott Laboratories | 1.73% |

Out of the 350 total holdings, the major part is constituted by the Healthcare sector accounting for 25.66%. ISWD has an expense ratio of 0.60% with a distribution yield of 1.56%.

7. iShares MSCI Emerging Markets Islamic UCITS ETF (ISDE)

| Annualised Returns | 1-Year | 3-Year | 5-Year | 10-Year | YTD |

| ISDE | 6.67% | 8.44% | 8.85% | 1.69% | 7.99% |

The iShares MSCI Emerging Markets Islamic UCITS ETF made it to our halal ETFs list because it offers exposure to emerging markets by direct investment in various global emerging markets companies.

Similar to the ISWD ETF, this ETF was also launched in 2007, domiciled in Ireland, is USD denominated, and has the same fund manager.

The ETF has the ticker symbol ISDE and tracks equities from the MSCI EM Islamic Index, listed on London Stock Exchange and Berne Stock Exchange.

As of 2022, the ETF has 324 holdings from various sectors, out of which the technology sectors make up 42.02%.

The top 10 holdings include:

| COMPANIES | WEIGHTING |

| Taiwan Semiconductor Manufacturing | 21.93% |

| Samsung Electronics Ltd | 11.95% |

| Reliance Industries Ltd | 4.09% |

| CIA Vale Do Rio Doce SH | 3.51% |

| SK Hynix Inc | 2.39% |

| Al Rajhi Bank | 2.21% |

| Samsung Electronics Non-Voting Pre | 1.86% |

| Saudi Basic Industries | 1.34% |

| Saudi Arabian Oil | 1.08% |

| Samsung SDI Ltd | 1.02% |

ISDE has an expense ratio of 0.85% and a distribution yield of 1.90%.

8. Saturna Al-Kawthar Global Focused Equity UCITS ETF (AMAP.L)

| Annualised Returns | 1-Year | 3-Year | 5-Year | 10-Year | YTD |

| AMAP.L | 7.32% | N/A | N/A | N/A | 7.56% |

The Saturna Al Kawthar Global Focused Equity UCITS ETF made it on the best halal ETFs list as it contains a basket of high-quality stocks from various ESG global companies.

Launched in September 2020, this ETF is listed on the London Stock Exchange with the ticker symbol AMAP/ AMAL.

It is actively managed by Saturna Capital Corporation and does not track a specific Index. The Saturna Al Kawthar Global Focused Equity UCITS ETF has 40 holdings.

The top 10 holdings out of the 40 include:

| COMPANIES | WEIGHTING |

|---|---|

| Edwards Lifesciences Ord | 2.84% |

| Cisco-T Ord | 2.81% |

| Accenture Plc-A Ord | 2.80% |

| Schneider Electric Se | 2.71% |

| Apple Ord | 2.69% |

| Nintendo Ord | 2.69% |

| Novozymes Ord | 2.68% |

| Tokyo Electron Ord | 2.63% |

| Roche Ord | 2.62% |

| Aveva Group Ord | 2.62% |

The ETF has an expense ratio of 0.75%.

9. iShares MSCI USA Islamic UCITS ETF (ISUS)

| Annualised Returns | 1-Year | 3-Year | 5-Year | 10-Year | YTD |

| ISUS | 15.53% | 12.11% | 10.06% | 9.92% | 6.75% |

The iShares MSCI USA Islamic UCITS ETF made it on this list of halal ETFs as it can offer you exposure to a wide range of US-based companies.

Similar to the two iShares ETFs above, this too is domiciled in Ireland, USD-denominated, and has BlackRock Asset Management Ireland Ltd. as the fund manager.

The ETF is listed on the London Stock Exchange with the ticker symbol ISUS and tracks the MSCI USA Islamic Net Total Return Index.

Out of the 115 total equity holdings, the healthcare sector makes up 30.26%.

The top 10 holdings include:

| COMPANIES | WEIGHTING |

| JOHNSON & JOHNSON | 6.61% |

| PROCTER & GAMBLE | 5.25% |

| EXXON MOBIL CORP | 5.07% |

| CHEVRON CORP | 4.60% |

| PFIZER INC | 4.22% |

| CISCO SYSTEMS INC | 3.31% |

| THERMO FISHER SCIENTIFIC INC | 3.25% |

| SALESFORCE.COM INC | 2.98% |

| ABBOTT LABORATORIES | 2.97% |

| MERCK & CO INC | 2.90% |

The ISUS ETF has an expense ratio of 0.50% and a distribution yield of 1.09%.

10. SP Funds S&P Global REIT Shariah ETF (SPRE)

| Annualised Returns | 1-Year | 3-Year | 5-Year | 10-Year | YTD |

| SPRE | 25.17% | N/A | N/A | N/A | 17.63% |

We selected this ETF for our best halal ETFs list as it can be a low-cost investment option that can provide you exposure to Shariah-compliant real-estate-related assets.

Being a REIT ETF, the SP Funds S&P Global REIT Shariah ETF combines the characteristics of real estate and a trust fund.

SP Funds launched this ETF in 2020 on NYSE Arca with the ticker SPRE and tracks S&P Global All Equity REIT Shariah Capped Index.

As of 2022, there are 44 holdings, out of which the top 10 include:

| COMPANY | WEIGHTING |

| Prologis Inc | 12.47% |

| American Tower Corp. | 12.15% |

| Crown Castle International Corp | 11.67% |

| Equinix Inc | 10.05% |

| Public Storage | 4.84% |

| Equity Residential Properties Trust | 4.81% |

| Avalonbay Communities Inc. | 4.80% |

| Weyerhaeuser Co. | 4.73% |

| Mid-America Apartment Communities, Inc. | 4.24% |

| SEGRO plc | 3.83% |

The ETF focuses only on the real-estate sector and generates stable rental income earnings. This ETF has an expense ratio of 0.69% and offers a monthly dividend distribution of $0.07.

11. Invesco Dow Jones Islamic Global Developed Markets UCITS ETF (IGDA)

| Annualised Returns | 1-Year | 3-Year | 5-Year | 10-Year | YTD |

| IGDA | N/A | N/A | N/A | N/A | 8.19% |

We chose Invesco Dow Jones Islamic Global Developed Markets UCITS ETF for our halal ETFs list due to its impressive expense ratio of 0.40%.

In January 2022, Invesco launched its Ireland domiciled ETF on the London Stock Exchange and the Swiss Exchange with the ticker symbol IGDA.

This ETF tracks the performance of the Dow Jones Islamic Market Developed Markets Index and is US dollar-denominated. Furthermore, this equity-based fund is managed by Invesco Capital Management LLC.

The technology sector is the primary sector and accounts for 32.79%.

Top 10 holdings of IGDA include:

| COMPANY | WEIGHTING |

| APPLE INC | 7.14% |

| MICROSOFT CORP | 6.08% |

| AMAZON.COM | 3.87% |

| TESLA INC | 2.26% |

| ALPHABET INC-CL A | 2.25% |

| ALPHABET INC-CL C | 2.08% |

| NVIDIA CORP | 1.73% |

| Meta Platforms INC | 1.33% |

| JOHNSON & JOHNSON | 1.24% |

| PROCTER & GAMBLE CO | 0.97% |

Invesco Dow Jones Islamic Global Developed Markets UCITS ETF seeks to track stocks from the developed global markets.

As it is a fairly new ETF, its performance is not yet available.

Conclusion

That’s it for the list of the best halal ETFs!

Interested in getting these ETFs?

Sign up for an online trading platform and make your first trade!

Not sure how? Here’s our guide to buying ETFs.

I hope that this post has been helpful for your journey toward halal investing!

Frequently Asked Questions

Is S&P500 ETF Halal?

All S&P500 ETFs are not entirely halal. Many ETFs track the S&P500, which has a mix of shariah and non-shariah compliant companies. Since the shariah criteria state that haram operating revenue should be less than 5%, various S&P500 ETFs exceed it and are non-shariah compliant. However, some halal ETFs you can invest in mimic the S&P500 or track the S&P500 Shariah Index. These shariah-compliant ETFs include SPUS, SPSK, SPRE, HLAL, ISWD, ISUS, and ISEM.

Is VOO Stock Halal?

VOO stock is not halal as it contains shares from many companies that are not shariah compliant. VOO or Vanguard S&P500 ETF invests in US’s top 500 publicly traded companies. Of the sectors involved in 2022, financial services constitute 13.61% which are not allowed to invest according to the shariah finance criteria.

Is SPY ETF Halal?

The SPY ETF is not halal. It is the ticker for SPDR S&P500 ETF Trust. This ETF mainly invests in companies involved in non-shariah compliant practices. Moreover, the weighting of the financial sector accounts for 13.7%. Since investing in financial services is not permissible, SPY is a non-shariah-compliant ETF.

Are Leveraged ETFs Haram?

Leveraged ETFs are considered haram as they are a highly risky investment strategy. Leveraged ETFs use financial derivatives and debt to increase the daily gains of an underlying index. Even though they can amplify returns, the risk of loss is amplified, making the capital not secure. Therefore, a leveraged ETF is not shariah compliant.

Are Ark Invest ETFs Halal Or Haram?

Whether Ark Invest ETFs are halal or haram is questionable as many ETFs are haram while some are considered halal. Most of the stocks held by Ark Invest ETFs are from non-shariah-compliant companies. Some clear examples of haram Ark Invest ETFs include the ARKG, ARKQ, and IZRL. However, there are some ETFs by Ark Invest, such as the ARKX, which include permissible stocks. Prior to investing in an ETF by Ark Invest, make sure to screen it to confirm its compliance with the shariah finance criteria.