You may be looking for Shariah-compliant bonds.

Unfortunately, there’s no such thing as a halal bond as bonds are haram.

However, there is an alternative to bonds in Islamic finance – Sukuk.

So if you’re looking for halal investments, this post talks more about Sukuk and lists some of the best ones currently available.

Read on!

What Is Sukuk?

Sukuk, the plural of sakk, is an Arabic-derived word meaning financial certificates. These certificates are based on Islamic finance principles and were developed as a halal alternative to conventional Western fixed-income bonds.

For this reason, Sukuk are also commonly referred to as shariah-compliant/Islamic bonds.

The Sukuk are shariah-compliant bond-like instruments that allow the holder to have direct ownership of assets, projects, investments, or businesses.

In return for this undivided ownership, the Sukuk holder receives an earning/profit generated from the performance of that asset.

The concept of Sukuk bonds is not a recent one but has been practised ever since the classical period of Islam. This practice is evident by the first Sukuk transaction that took place in the 7th century in Damascus, Syria.

However, the common use of Sukuk in trades has been dated back to the 9th century since the rule of Haroon al Rashid of the Abbasid caliphate. During the Islamic pre-modern period, the term Sukuk was used to refer to documents representing financial obligations in commercial activities.

The Islamic Fiqh Academy of the Organisation of Islamic Cooperation (OIC), in February 1988, legitimised the application of Sukuk. The legitimisation helped promote Islamic finance, liquidity of balance sheets and provided Muslim investors with a means of short and medium-term investments.

Sukuk financial products started to rise in popularity with the first issuance in Malaysia, followed by Sudan, then Bahrain in 2001.

Seeing this rising trend, the Accounting and Auditing Organisation for Islamic Financial Institutions (AAOIFI) issued Shariah Standard No.17 in May 2003. This shariah standard covered investment Sukuk and was published to systematise the growing market.

The official definition of Sukuk provided by AAOIFI in this standard is; “Sukuk are certificates of equal value representing undivided ownership in tangible assets, usufructs, and services or (in the ownership of) the assets of particular projects or special investment activity.”

Over the years, the global market has seen popularity and development in the issuance of Sukuk by many governments and corporations.

Moreover, the Islamic Financial Services Board (IFSB) has defined Sukuk as; “certificates that represent proportional undivided ownership rights in tangible assets, or a pool of tangible assets and other types of assets. These assets could be in a specific project or a specific investment activity that is shariah-compliant.”

The development of Sukuk helped create a link between returns and cash flows of debt financing the purchased assets. The Sukuk, in turn, aided in the effective distribution of revenue generated from the investment assets.

How Does Sukuk Work?

Sukuk bonds work in accordance with the shariah finance principles. Since riba/usury is not permissible for Muslims, Sukuk are structured to generate earnings as profits rather than interests by using a tangible asset.

However, a legitimate Sukuk investment is required to comply with the following principles:

- The funded projects should benefit society rather than harm it.

- Activity for which the Sukuk is issued should be ethical and not involved in the production of haram goods and services.

- Contracts should be devoid of uncertainty (gharar), fraud and deceit.

- The Sukuk should be either based on or backed by an underlying asset.

- One-third of the underlying assets should be in tangible form for the Sukuk to be tradeable.

- The profit generated should not consist of riba/interest.

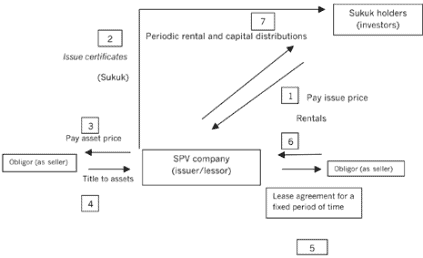

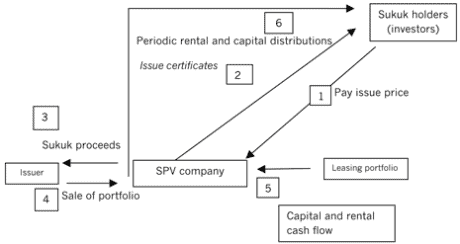

The general idea of how Sukuk works is that an originator (company or government) requiring capital initially forms a Special Purpose Vehicle/Entity (SPV/SPE). The SPV then issues Sukuk certificates to be sold to investors. These certificates are of equal value and are issued under the name of the investor.

Issuing under the investor’s name helps establish a claim of the holder’s ownership over the financial obligations stated by the certificate. Using the proceeds, the originator buys assets that could be monetary, tangible, usufructs or services, or a combination of these.

Usually, on the contract’s expiration, the originator buys the asset back from the SPV at a nominal value. The SPV then distributes the obtained proceeds to the Sukuk certificate holders.

In short, when investors buy Sukuk certificates, they gain ownership of assets purchased by the Sukuk issuer. The investors, in return, share periodic profit payments or rent generated by the linked asset. However, upon maturity, the holders receive back the principal amount they used for investing.

Types of Sukuk

Asset-Based

Asset-based Sukuk are debt-like instruments that resemble a conventional unsecured bond. However, to fulfil shariah’s requirements, it makes use of an asset in the contract.

The Sukuk issuer purchases the assets using the certificate funds and trades, invests, or leases them on behalf of the investors. In addition, the issuer promises to repurchase the asset at nominal value post maturation of the Sukuk certificate.

Asset-based Sukuk provides beneficial ownership only, and the underlying assets do not directly finance the returns. They are mainly financed by the cash flow of the obligor.

Furthermore, the investor has no recourse to the asset. The entire functioning of asset-based Sukuk has raised concerns over its compatibility with shariah finance principles.

Asset-Backed

Asset-backed Sukuk are equity-like investments involving transactions and assets transfer via the SPV between the holder and originator. The asset may include a tangible asset or a business venture.

Unlike the beneficial ownership offered by asset-based Sukuk, investors with asset-backed Sukuk share the risks of the underlying assets. The returns, however, are generated directly by the performance of the assets, and investors have recourse to it.

Although more shariah compatible, the Sukuk market is dominated by asset-based Sukuk.

On the basis of these 2, there are other notable types mentioned by the AAOIFI:

Mudharabah Sukuk

Sukuk al-Mudharabah, also commonly known as trust certificates, involves a profit-sharing and loss-bearing partnership. The investor provides capital to an enterprise or activity managed by the issuer.

In return, the profits generated are shared with the Sukuk holder at a pre-agreed ratio. However, in case of a loss, the effect will be borne by the investor only. Though, there is an exception for when negligence or misconduct by the issuer is the reason behind the loss.

Musharakah Sukuk

The Musharakah structure involves a partnership with profit and loss sharing between two or more parties. All parties contribute capital and share the profits according to a stated ratio and in case of a loss, share the burden equally.

Murabaha Sukuk

The Murabaha Sukuk is structured to function as a cost-plus profit margin sales contract. Assets are sold at a value containing the purchase cost along with a profit margin decided by the parties involved. The returns generated are paid in instalments or as complete payment at a specified date.

Ijarah Sukuk

The Ijarah Sukuk, also known as lease Sukuk, is one of the most common Sukuk structures used in Islamic financing. The issuer purchases an asset for leasing and returns the obtained rent to the certificate holder. Upon leasing, the holder gains ownership of the asset and receives rental payments either monthly, quarterly, or annually.

Istisna Sukuk

The Istisna Sukuk is also referred to as Islamic project bonds and is issued to manufacture and fund a specific project or asset. The issuer has to use their own material and deliver the complete asset on a specific date. This Sukuk structure is usually used to fund real estate projects and large-scale constructions such as power plants, roads, and more.

Wakala Sukuk

The Wakala Sukuk structure involves hiring another party to act on the investor’s behalf. An investor usually appoints an agent (wakeel) so that they can lend their expertise for investing funds strategically. The agent works to manage the investments for a specific time period and delivers profits. In turn, the investor has to pay a specific fee to the agent for their efforts.

Salam Sukuk

In the salam structure of Sukuk, the issuer takes advance payments at full price with the promise of purchasing the asset on a future date. Later, the purchased asset is sold at a cost-plus profit margin, and the proceeds are distributed to the holder at a specified date.

Mugharasah Sukuk

The Mugharasah Sukuk is an equal value Sukuk issued for funding various agricultural projects. In return, the certificate holders receive ownership of the funded land or plantation and gain profits off of it.

What Is The Difference Between Sukuk And Bonds?

Sukuk and bonds both provide payment streams to investors and are issued to raise capital for a project or business. Moreover, both are considered to be less risky investments compared to equities.

Although named as shariah-compliant bonds, there are a few differences between Sukuk and bonds:

- Sukuk involves partial ownership of the assets, while bonds are debt instruments.

- Returns received by the investor with Sukuk are in the form of profits generated by the underlying asset. On the other hand, bondholders receive periodic payments of interest.

- Asset appreciation causes the Sukuk to appreciate as well. In contrast, bonds yield mostly from their interest rates.

- The assets backing Sukuk are halal and comply with the shariah finance principles. On the other hand, bonds often contain riba, which is haram, and may finance businesses involved in unethical practices.

- The valuation of Sukuk bonds is purely based on the value of the underlying assets. On the contrary, a bond’s face value is primarily based upon the creditworthiness of the issuer.

Sukuk vs Halal Dividend-Paying Stocks

Asset-backed Sukuk are equity-like, yet there is a notable difference between Sukuk and dividend-paying stocks.

- The first difference lies in the payment returns. Sukuk are entirely dividend-based, while dividend-paying stocks can provide returns in either dividend, bonus shares, or capital gains.

- Sukuk are based upon shariah finance principles. However, dividend-paying stocks can belong to non-shariah compliant companies that may work with interests and function on unethical practices.

- The ownership in Sukuk is of a particular asset for a limited amount of time. Meanwhile, dividend-paying stock involves general ownership of multiple shares over an unlimited time period.

Advantages Of Sukuk

There are many advantages associated with Sukuk investment, such as:

- Corporations and governments can attract Direct Foreign Investment (DFI) with the help of using Sukuk.

- Sukuk offers reasonably-priced liquid investment along with stable returns to both Muslim and conventional investors.

- The tradeable nature of Sukuk makes them a liquidity management tool. A Sukuk allows investors, banks, or financial institutions to liquidate assets and enhance market liquidity as a financial tool.

- Sukuk promotes economic development and financial stability by ensuring that an existing economic activity backs the investment activity.

- Since Sukuk does not involve debt, it is relatively a low-cost financing instrument with minimum default risk.

- When Sukuk are issued for funding projects, they can generate employment as well.

Disadvantages Of Sukuk

Like any other investment, Sukuk can also contain some risks as well. Although the risks are relatively low, here are some disadvantages of Sukuk:

- Sukuk investments are sometimes indirectly exposed to fluctuations in interest rates. Hence, in such cases, whenever the market rate of interest rises, the value of Sukuk drops.

- Some issuers can also neglect adherence to shariah principles when issuing a Sukuk. This negligence can result in the loss of assets.

- Investors can also experience a delay in the liquidity of assets as Sukuk are held until maturity.

- Unfavourable fluctuations in market and exchange rates affect the value of Sukuk assets and can risk a fall.

- Unforeseen damage or loss can also reduce the value of underlying assets.

- Even though it is minimum, there is still a risk of default in Sukuk investment. The issuer may delay the payments, or the assets might even become irrecoverable.

- There is also a possibility of the SPV not reimbursing the holders. Moreover, the SPV might become unable to dispose of the assets after the contract ends.

Where To Invest In Sukuk?

Before investing in Sukuk bonds, make sure the underlying asset or project that is being funded is shariah compliant.

Governments and corporations both issue Sukuk investments. Investors can purchase these financial certificates from Muslim banks or during public offers through capital market operators and broker accounts.

Over the years, Sukuk investments have gained popularity in the global market. This popularity is the reason why many countries now offer sovereign and corporate Sukuk bonds for investors to attract capital investments.

Some countries that actively issue Sukuk certificates include:

- Bahrain

- Brunei

- Malaysia

- Singapore

- Indonesia

- Hong kong

- Saudi Arabia

- Iran

- Pakistan

- Bangladesh

- Kazakhstan

- Kuwait

- Qatar

- Turkey

- UAE

- Egypt

- Somalia

- Sudan

- The Gambia

- United Kingdom

5 Best Sukuk

According to Fitch Ratings, the year-over-year (YOY) analysis of total Sukuk issuance in 2021 revealed a strong growth of 36.1%. With getting to witness such results, the global Sukuk market is expected to grow more in 2022 as compared to the previous year.

Here are 5 best sukuk you should look more into in 2022:

1. Pakistan Global Sukuk (GoP Ijara Sukuk)

Recently on 31st January 2022, the Government of Pakistan issued one of their most premium Sukuk in the global market. This Sukuk is priced at $1 billion with a high fixed type profit yield of 7.95% on a semi-annual-based return payable.

The Government of Pakistan ijara Sukuk for 2022 proved an improvement compared to the previous 5-year Sukuk issued in 2017 with a profit rate of 5.6%. This current US dollar-denominated ijara Sukuk has a 7-year maturity period up to 31st January 2029.

Pakistan’s government issued this certificate through the Pakistan Global Sukuk Program Co.’s Trust Certificate Issuance Program with the purpose of funding several motorway projects.

Listed on the London Stock Exchange, the Ijara Sukuk received a Moody’s Investor Service rating of B3.

2. United Kingdom Sovereign Sukuk

On 1st April 2021, the British government issued their Sukuk of £500 million based upon the ijara structure.

This sovereign Sukuk is the second Sukuk issued by the United Kingdom, 7 years after their first one in 2014.

The United Kingdom became the first western country to issue sovereign Sukuk and has attracted investors from the Middle East and Asia as well.

This ijara Sukuk is listed on the London Stock Exchange and will mature on 22nd July 2026.

A profit rate of 0.33% is expected to come as rental incomes from several office properties of the central government.

3. Dubai Islamic Bank Senior Sukuk

The senior Sukuk is the first issuance seen by the UAE in 2022. This Sukuk is priced at $750 million with a fixed annual return payable profit rate of 2.74%.

Issued by Dubai Islamic Bank, the senior Sukuk has a maturity period of 5 years until 16th February 2027.

This Sukuk certificate is listed on Euronext Dublin and NASDAQ Dubai and has gained investors from Europe, Asia, and the Middle East.

The overall rating for this Sukuk by Moody’s Investor Service is A3.

4. Malaysia Wakala Sukuk

What makes Malaysia Wakala Sukuk the best is that it is the world’s first US dollar-denominated sustainability Sukuk for the sovereign sector.

The wakala Sukuk is based upon the government’s newly established framework for Sukuk and is issued through the SPV, Malaysia Wakala Sukuk Bhd.

This Sukuk is priced at $800 million with a fixed profit yield of 2.07%.

The proceeds used from the issuance will be used for green and social projects associated with the agenda of the United Nations Sustainable Development Goals (SDG).

Malaysia wakala Sukuk has a 10-year maturity period till 28th April 2031.

The Sukuk has received a Moody’s rating of A3 and has attracted investors from Asia, the Middle East, Europe, Africa, and The United States.

5. NOGAHolding Sukuk

In 2021, the NOGAHolding Sukuk was issued by the National Oil and Gas Holding Company situated in The Kingdom of Bahrain.

This particular Sukuk is priced at $600 million and has a fixed profit rate of 5.25%.

Furthermore, the maturity time period for NOGAHolding’s Sukuk is 8 years, ending on 8th April 2029.

Bahrain has been the significant issuer of Sukuk in the global markets for some time. Issuing Sukuk for the oil and gas sector has proved to be beneficial for Bahrain for attracting investors on a large scale.

Conclusion

Sukuk certificates are a halal alternative to conventional western bonds.

Although learning about Sukuk might seem daunting, the concepts are easy to understand with proper guidance.

Investing in Sukuk can turn out to be beneficial for you and would help promote a just and ethical financial system.

If you’re not sure how you can do this, you can always consult a financial advisor.

Frequently Asked Questions

Is Sukuk A Good Investment?

Sukuk is a good investment as it is free from the elements of uncertainty, contains no interest payments, and neither involves issuers of non-shariah compliant activities.

Moreover, Sukuk provides consistent income through fixed, regular payments generated by the performance of underlying assets.

Adding Sukuk to your investment portfolio is indeed an intelligent choice for lowering risks and preserving capital.