Understanding investments can be pretty complex when you are starting new.

But as a Muslim investor, figuring out what types of investments are allowed and prohibited for you can seem like a more complex and daunting process.

This is where our article on halal investing in Singapore will help you out.

Here, we have compiled an easy guide to finding halal stocks and other info that might aid you.

To make things even easier, we have also created a list of shariah screening apps and the 11 best halal stocks you can consider investing in.

How To Choose Halal Stocks

Here are a few things you can do to check and choose halal stocks:

Assess The Business Model

You need to check whether you are about to invest in stocks that follow Islamic principles or not.

Run a fact check about their practices and see if the products they manufacture and sell are ethical and halal.

Since Muslim investors are not allowed to invest in stocks of companies involved in haram products, going through their business model first would help you rule out non-compliance.

Research Thoroughly About The Runnings Of The Company

Many Muslim investors might face a problem that some companies could be involved in haram practices in the background.

While their business proposition might paint a picture of them based on ethical practices, the underlying reality may differ.

There are a lot of companies that run on haram practices such as functioning on riba (interest) etc.

To research more profoundly into the running of the company, check their annual reports and see whether they received revenue from non-shariah compliant investments or not.

Inspect The Non-Liquid To Total Assets Ratio

Non-liquid assets, also known as illiquid assets, cannot be directly converted to cash.

Compared to the total assets, the percentage of illiquid assets should be more than 20% for a halal stock.

Accounting And Financial Ratio Screening/Halal Investment Screening

Shariah screening allows Muslim investors to examine whether a company’s financial activities are according to the threshold percentages as stated by the shariah finance principles.

There are many shariah screening applications (discussed later) that you can use to check whether the company you are about to invest in is compliant with the Islamic finance principles or not.

The following rules are applied when screening for halal stocks:

- The ‘5% rule’ states that income generated from haram investments in a company should not be greater than 5% of their gross revenue.

- The percentage of total interest-bearing debt of a company should not exceed 33% compared to their total assets.

- The percentage of accounts receivable compared to the company’s total assets should not be greater than 45%.

List Of Halal Stock Screeners

To keep track of shariah-compliant companies, we have gathered a list of the few best halal stocks screeners that you can access through the internet.

These halal stock screeners look for stocks from various financial markets, so choose one that best suits what you’re looking for.

Zoya

Zoya by Zoya Finance allows you to screen for halal stocks and monitors shariah-compliant companies. This application enables you to access reports of multiple stocks from the US, Canada, and the UK.

It even lets you evaluate risks, create a watchlist of different stocks you are interested in, and send emails when there is a change in the compliance status of stock.

Get it here: https://zoya.finance/

Islamicly

The Islamicly application provides real-time information and lets you screen companies that offer halal stocks.

This halal stocks screener allows Muslim investors to check and keep track of shariah-compliant companies in major markets globally.

Get it here: https://www.islamicly.com/

Musaffa

Covering multiple exchanges, the Musaffa stock screener app allows you to track stocks from shariah-compliant companies.

The application covers halal stocks from countries like Singapore, the UK, the US, Canada, Indonesia, and Malaysia.

Musaffa’s screening process follows the methodology of the Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI) to produce detailed and accurate reports on stocks.

Get it here: https://musaffa.com/

Wahed

This halal stocks screener is created by Wahed Invest, an ethical investing platform for Muslim investors.

Besides managing financial investments, this application lets you search for halal stocks from over 50,000 companies worldwide.

Furthermore, Wahed provides information about the overviews, pricings financial ratios, and more. The app also contains a built-in zakat calculator to calculate your annual contribution.

Get it here: https://wahedinvest.com/

Halal Invest

The Halal Invest halal stocks screener is available as a website and application and lets you keep track of shariah-compliant companies.

You can receive information about various companies, news, charts, and even recommendations for stocks that you might be interested in.

The screener also creates a portfolio of all your added stocks and notifies you whenever the compliance changes.

Get it here: https://halalinvest.info/

Finispia

The Finispia halal stocks screener application checks for shariah-compliant stocks from over 90 countries globally.

This application functions on 5 Islamic investment methodologies that are scholar endorsed and provides daily updated data about your stocks.

Get it here: https://www.finispia.com/

The 11 Best Halal Stocks To Invest In

- Abbot Laboratories

- Pfizer

- Johnson & Johnson

- Coursera Inc

- TJX Companies Inc

- Microsoft Corporation

- Duolingo Inc

- Adobe Inc

- Unilever PLC

- Chevron Corp

- Engro Corp

To narrow down your search and make your decision easier, we have compiled the best halal stocks that comply with Islamic finance.

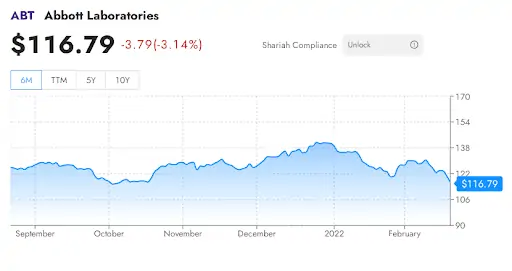

1. Abbott Laboratories

https://halalinvest.info/company/ABT

Abbott Laboratories (ABT) is an American multinational company belonging to the healthcare sector. This company was founded in 1888 and has its headquarters in Illinois, US.

The reason why Abbott Laboratories made it to our list is that the business is well-rounded. This company excels in developing, manufacturing, and selling various healthcare products.

Their specialities include producing medical devices, diagnostic kits, pharmaceutical drugs, and nutritional supplements/products.

With the development of coronavirus testing kits, Abbott laboratories achieved a new level in 2020 and announced revenue of $34.61 billion.

In the Q4 of 2021, their COVID-19 testing kit sales were $2.3 billion globally. Furthermore, in 2021, the company witnessed a growth in full-year sales of about 24.5%, with an organic sales growth of 22.9%.

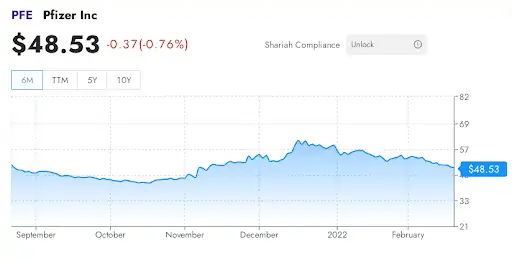

2. Pfizer

https://halalinvest.info/company/PFE

Similar to Abbott Labs, Pfizer (PFE) is also a healthcare multinational company. Established in 1849 in New York City, Pfizer functions as a pharmaceutical and biotechnology corporation.

Pfizer’s revenue is generated from producing medicines and vaccines worldwide for immunology, cardiac health, oncology, neurology, and endocrinology.

What makes Pfizer one of the best halal stocks is that since 2000 the company has carried out over 4000 projects for greenhouse gas reduction to help the environment.

With the development of the COVID-19 vaccine, Pfizer announced Q4 revenue of $23.84 billion in 2021. The full-year revenue for 2021 came out to be $81.3 billion, which proved an operational growth of 92%.

3. Johnson & Johnson

https://halalinvest.info/company/JNJ

Johnson & Johnson (J&J) is a shariah-compliant American multinational company. Established in 1886 in New Jersey, US, Johnson & Johnson operates in 60 countries and sells its products in more than 175 countries worldwide.

Besides manufacturing medical devices and pharmaceutical products, the company also produces consumer packaged goods.

A proof that J&J is one of the best stocks is that in 2021 it ranked no. 36 on the Fortune 500 list and reported overall sales of $93.77 billion.

This was a 13.6% increase compared to the sales in 2020.

The company also has an environment-friendly role in reducing water and energy consumption and switching to non-polyvinyl chloride packaging for liquids.

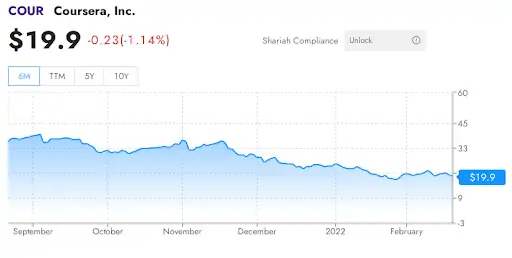

4. Coursera Inc.

https://halalinvest.info/company/COUR

Coursera (COUR) is an online education platform founded in 2012 in the US.

What made Coursera on our best halal stocks list is that it collaborates with various universities and organisations to provide online courses, certifications, and degrees from various fields to students all across the globe.

This education platform is available in multiple languages and, in 2021, had an estimated 92 million users.

For 2021, the total revenue was $415.3 million, which was a 41% increase compared to the $293.5 million revenue in 2020.

5. TJX Companies, Inc.

https://halalinvest.info/company/TJX

TJX Companies (TJX) is a multinational company founded in 1987 in Massachusetts, US.

This corporation is one of the best halal stocks to invest in. It specialises in off-price departmental stores and sells various products such as apparel, furniture, beauty products, and more.

In 2021, TJX Companies reported overall annual revenue of $32.137 billion.

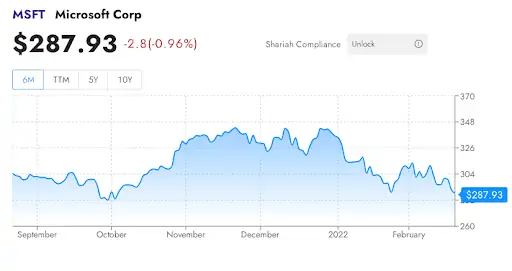

6. Microsoft Corporation

https://halalinvest.info/company/MSFT

Founded in 1975, Microsoft (MSFT) is an American multinational corporation in the technology industry.

Microsoft belongs in our best halal stocks list as it is one of the 5 biggest information technology companies in America.

This corporation specialises in computers, computer software, consumer electronics, and other technology-related services.

Compared to 2020, Microsoft reported an 18% increase in their annual revenue, calculated to be $168.1 billion.

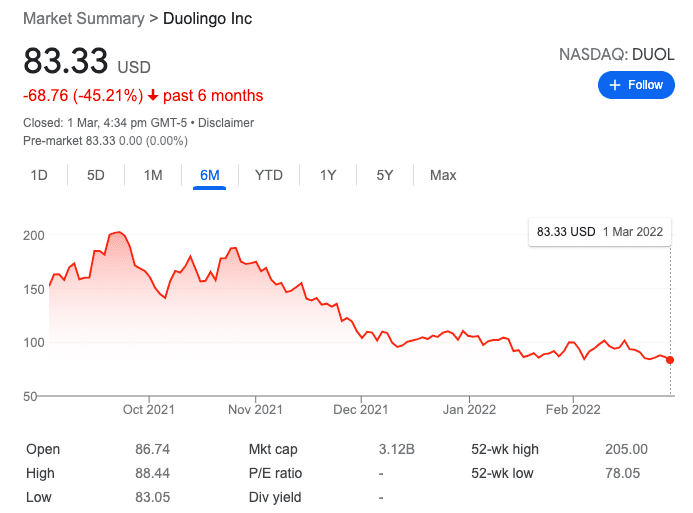

7. Duolingo Inc.

Duolingo (DUOL) is an American online language learning platform publicly released in 2012.

Available as a website and mobile app, it lets you avail of over 103 courses in up to 40 various languages.

Duolingo’s users can learn vocabulary, pronunciation, grammar, and more through the reading material, translations, stories, etc., provided on the app.

We chose Duolingo to be on our halal stocks list because of its overall performance in the stock market.

The company became a publicly traded one in 2021 and reported a striking annual revenue of $220 million. This kind of performance can lead to even better stock results in the near future.

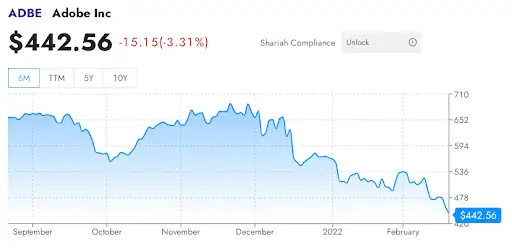

8. Adobe Inc.

https://halalinvest.info/company/ADBE

Adobe Inc. (ADBE), formerly known as Adobe Systems Inc., was founded in 1982 and is an American multinational company that specialises in computer software.

The company develops and sells various software for graphics, photography, animation, illustration, video, and more.

In 2021, Adobe announced annual revenue of $15.785 billion.

Although expensive, Adobe is considered one of the best halal stocks as it can prove beneficial for long-term investment.

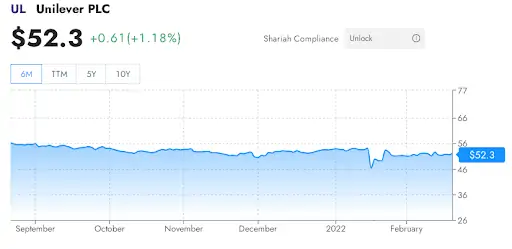

9. Unilever PLC

https://halalinvest.info/company/UL

A British multinational company for consumer goods, Unilever plc (UL/ULVR), was founded in 1929 in London, England.

This company has been known for being the biggest producer of soap globally.

Unilever classifies as one of the best halal stocks because of the revenue it receives from its wide variety of products.

Other than producing soaps, Unilever also produces other consumer goods such as food products, supplements, cleaning agents, personal care products, and more.

The company has its listing on the London and New York Stock Exchange and, in 2021, reported annual revenue of £52.444 billion.

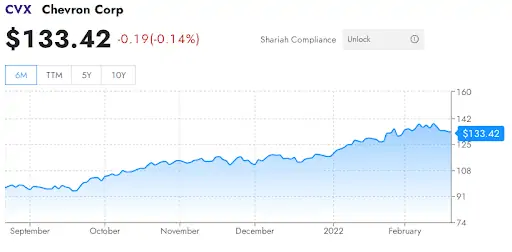

10. Chevron Corp.

https://halalinvest.info/company/CVX

Founded in 1879 and formerly known as Pacific Coast Oil Co., Chevron (CVX) is an American multinational energy corporation.

It dominated the petroleum industry globally as one of the Seven Sisters from the 1940s to the mid-1970s.

Currently active in over 180 countries worldwide, Chevron deals with various aspects of oil and natural gas such as production, refining, transport, etc.

Chevron is on our best halal stocks list because with oil and gas prices on the rise, investing early in stocks can turn out to be beneficial in the long run.

In 2021, Chevron reported annual revenue of $94.7 billion and ranked 27th on the Fortune 500.

11. Engro Corp.

https://dps.psx.com.pk/company/ENGRO

Engro Corp. (ENGRO) is a multi-industry company under the PSX (Pakistan Stock Exchange).

This corporation was founded in 1965 in Karachi, Pakistan, initially as a fertiliser company. Later, it grew into a conglomerate that operated through petrochemicals, food, and agriculture, energy and related infrastructure, and telecommunication infrastructure.

The corporation reported a 25% increase in yearly revenue of RS. 311.59 billion in 2021 compared to RS. 248.82 billion in 2020. Engro Corp. made it to our best halal stocks list due to its good value for international investors.

Conclusion

With the mentioned ways of finding halal stocks, you can research shariah-compliant investments on your own or use available screening apps.

To invest in a company’s stock market, make sure to check the business model, the source of income, and if the company runs on interest beforehand to manage your wealth properly.

Ready to get these stocks? Our preferred brokerage account is moomoo as it provides the lowest fees in the U.S. market.

Still in need of further guidance?

Our team at Dollar Bureau lets you connect with unbiased financial advisors who help you make smart decisions for your financial needs.

Click here to get guidance now.

FAQs

Is Tesla A Halal Stock?

Tesla is a halal stock as its interest-bearing debt does not exceed 33%. On the other hand, the illiquid to total assets ratio is greater than 20%, which complies with the shariah screening principles.

Is Apple A Halal Stock?

It is debatable whether Apple is a halal stock because some of its revenue comes from haram sources. However, the percentage of income from haram sources does not exceed the 5% rule. Moreover, the interest-bearing debt also does not exceed 33%. While some screeners label Apple as a halal stock, most are still unsure about its status.

Is Coca Cola A Halal Stock?

Coca-Cola (KO) is screened as a halal stock by many screeners. The company manufactures and sells various beverages and concentrates that are non-alcoholic.

Although the income generated from haram products does not exceed the 5% mark, it is debatable whether Coca-Cola is a halal stock as the interest-bearing debt is greater than 33%. This makes it a questionable company to invest in as a Muslim.

Is Investing In Google Halal?

Whether Google or Alphabet Inc. (GOOGL) is a halal stock is debatable. Some screeners pass investing in it as halal, while others label it questionable. Although the business model is shariah-compliant, some of its revenue is generated from haram sources and includes interest.

Is Nvidia Stock Halal?

Nvidia Corp. (NVDA) is a halal stock. The corporation works for artificial intelligence computing and operates through computer networking and graphics.

The income generated from haram sources is less than 5%, along with an interest-bearing debt that does not exceed 33%. Therefore, Nvidia is a good stock for Muslims to invest in.