If investing your money with the security of a reputed bank is your wish, UOB UTrade Robo is a great choice.

This bank-run robo advisory platform is great in the sense that it takes care of your expenses not only in the field of fee charges but in the field of investment too.

With its smart tools and advanced technology, the platform helps you reach your investment goals through its modern portfolio theory.

If you are curious to know every aspect of the whole panorama related to this digital financial advisor, read on.

What is UOB UTrade Robo?

UOB UTrade Robo is a robo-advisory platform offered by one of Asia’s largest brokerage firms UOB Kay Hian.

It works as an automated personal digital fund manager.

With its headquarter in Singapore, UOB UTrade robo has 80+ branches worldwide.

Its investment policy encompasses the 20 largest stock markets across the globe letting you invest across geographical regions surrounding Southeast Asia, the United Kingdom, Greater China, and North America.

The robo advisor opens up an investment platform for high-net-worth individuals, retail investors, large corporations, and institutions.

With several investment products, UOB UTrade robo lets you invest primarily through cost-effective index exchange-traded funds (ETFs).

Creating low-cost customised portfolios with cost-effective and tax-efficient ETFs is their strategy to ensure efficient higher returns.

The portfolios with this robo advisor are extensively diversified across multiple geographies and asset classes.

Their asset allocation principles are based on the investment objectives, investment horizon, and risk appetite of investors.

Your goal, — whether it be your retirement planning, investment for your children’s education, future savings to purchase properties, or something else, — your goal is the base, upon which they decide your investment horizon and the required risk level.

Thus, you are provided investment options to invest in both low-risk and high-risk asset classes.

Interestingly, the platform offers you exposure to the miracle of compounding.

You can invest through UOB UTrade robo even if you are not from Singapore. The only requirement is to fulfil their account-opening-related requirements – which we’ll be covering later.

However, the only funding option here is through cash investment.

UOB UTrade Features

Investment Methodology

UOB UTrade Robo’s automated investment strategy is based on maximising investment returns while minimising the prospective costs on the grounds of a client’s financial goals and risk tolerance.

They divide this methodological process into 6 steps as follows.

1. Identification of Investable Asset Classes

At the first stage of setting the investment trajectories for you, UOB UTrade Robo identifies the set of major investable asset classes.

For the construction of portfolios, they have identified equities, commodities, and fixed income as the broad asset classes.

To further ensure asset classes have ‘investability’ and sufficient diversification, from within each broad asset class, they pick representations from varied geographies and risk segments.

2. Cost-efficient Fund Selection

According to the robo advisor’s auto fund management strategy, they pick the right exchange-traded fund (ETF) as the representative of a particular asset class on the grounds of its cost.

They choose the least expensive fund by calculating the overall expenses it involves including fund expenses and costs incurred by the investor such as payable taxes.

The whole selection process involves picking the largest as well as lowest cost ETFs from leading markets and geographical entities across the globe.

There are again 6 fundamental criteria based on which they select their ETFs —

- It should work as the Representative of the asset class.

- It should have Low Expense Ratios.

- The ETF has to be Tax Efficient.

- It should be Market Capitalisation-weighted with no sector tilts.

- Physical Replication is essential for ETFs.

- Liquidity is a must. Except for Singapore-focused funds, the Net Asset Value related to ETFs investing in any other markets should be cut off by US$1b.

The representative chosen for a particular asset class is ensured to cover a remarkable part of the respective asset class.

To illustrate, the fund the robo advisor chose for US equities tracks the S&P 500 index.

This fund has an 80% coverage of the total market capitalisation for US stocks.

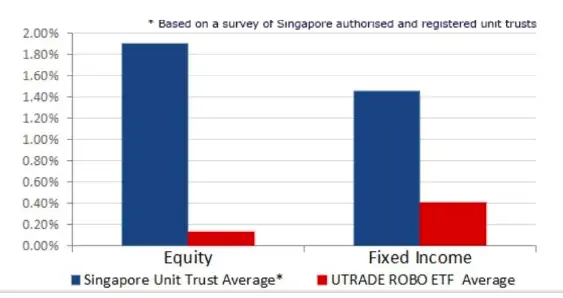

When it comes to expense ratios, the expense ratios offered by UOB UTrade Robo are actually competitive, providing you with ETFs with considerably lower expense ratios compared to other financial advisory platforms based in Singapore.

They’ve shown with a graph (as shown in the screenshot below) how their selected equity and fixed income ETFs stand at just 0.13% and 0.4% expense ratios successively compared to 1.90% and 1.45% expense ratios of equity and fixed income unit trusts available in Singapore.

Apart from that, the platform tries to choose ETFs that are tax-efficient. And that’s to lower the impact of withholding taxes on the ultimate investment return.

By examining the ETF strategy based on the asset class and its market-based criteria, they try to minimise witholding taxes for you by choosing the right ETFs.

UOB UTrade Robo has a tendency of choosing traditional ETFs with market capitalisation weightage.

Clearly, the portfolios reach a state of marginalisation caused by this larger tilt towards market capitalisation. However, they believe that liquidity involved in the selected ETFs works as a harmoniser in this respect.

Further, the diverse allocation of asset classes and geographies also works to mitigate this bias.

To avoid counterparty risks, the platform picks funds that track their benchmark indices primarily based on the relevant underlying securities instead of using synthetic replication or derivatives to achieve that purpose.

3. The Modern Portfolio Theory

UOB UTrade Robo follows the concept of Modern Portfolio Theory (MPT) proposed by the Nobel laureate Harry Markowitz as the basis of their Mean-variance optimisation (MVO) process.

The MPT theory is about reducing investment risks involved in a portfolio through diversification.

This is the algorithm applied in the asset allocation process related to the investment portfolios at UOB UTrade.

The essence of this theory as applied by the robo advisory platform is that the intermingling of varied and unrelated assets can potentially reduce the risk level (indicated by “variance”) of a portfolio for a given level of expected return (indicated by “mean” return).

Thus, by effective implementation of this theory attempts to expose your portfolio to a better risk-adjusted return.

4. Establishment of the Investor’s Goal and Risk Profile

UOB UTrade Robo then establishes in the portfolios your investment goals and risk appetites based on your answers to the initial questionnaire.

From there, your portfolios are assigned a relevant risk level.

This allotment of the risk level depends upon 2 factors —

- Your investment horizon

- Expected future contributions and withdrawals

When the investment horizon selected by you is longer, then your risk level also tends to be higher.

The platform assigns an investor with a 2-year time horizon for the lowest risk portfolio, while the highest risk portfolio is assigned to one with a time horizon of at least 30 years.

Likewise, if you tend to make higher expected future contributions with longer withdrawal paths involved, you are assigned a higher risk-level portfolio.

5. Implementation and Rebalancing

UOB UTrade Robo rebalances your investment portfolios based on market volatility.

Your portfolio with the platform is rebalanced when your investment account is topped-up.

It’s done every 6 months or when UOB Kay Hian’s portfolio managers decide there’s a need.

6. Recalibration of the Risk Level

As a measure to reduce the volatility, the risk level of an investment portfolio is adjusted by the platform according to your progress towards the set investment goals.

They believe that this helps in improving a portfolio’s final outcome.

Portfolios

As hinted earlier, UOB UTrade provides you with portfolios with considerably wide global diversification as well as diversified asset allocation.

These portfolios are constructed using cost-effective exchange-traded funds (ETFs).

Based on the portfolio strategies designed, the portfolios are divided into 3 different categories —

- Conservative Portfolio

- Moderate Portfolio

- Aggressive Portfolio

Although they state that these portfolios previously (before March 2020) involved risk scores of 30, 70, and 100 respectively out of a maximum of 100, the current risk scores are not mentioned on their official website.

The multi-asset portfolios are designed to invest across stocks, bonds, and commodities.

The globally diversified portfolios are aimed at minimising single security risk.

As for expected returns related to these portfolios, they state that based on the recommended portfolio, the projected returns usually range between 1.5% (related to the lowest risk portfolio) to 7% (related to the highest risk portfolio) per annum over the long-term.

However, these demarcations are not fixed.

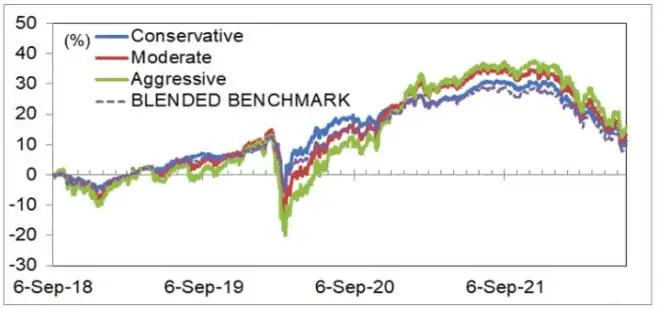

They’ve demonstrated the overall performance of their portfolios through a graph along with a list as shown in the following screenshot and the accompanying table.

Take note that they’re comparing it against a blended benchmark consisting of “50% in global aggregate bond index, 25% in a developed markets stock index, 25% in an emerging markets stock index”.

So this benchmark isn’t any usual benchmark you’d use such as the S&P 500.

Here are UOB UTrade Robo’s returns:

Varied Investment Products

Primarily, the UOB UTrade platform lets you invest through calculatingly selected low-cost ETFs picked from a reservoir of 7,700 globally listed ETFs that are liquid.

As for the vast expanse of underlying asset classes, the platform provides you with exposure across a vast range of securities, including stocks, options, bonds, futures, CFDs, unit trusts, and forex.

Investor Education

The robo advisory platform under discussion tends to provide the investors with holistic education.

Their experts keep on sharing ideas, tips, and strategies on a regular basis through seminars.

Its team of trading representatives also facilitates a dedicated service to its clients.

Besides, their research team is also focused on helping you at taking efficient fact-based investment decisions with their extensive client-focused analyses.

UOB UTrade Fees

The UOB UTrade has a straightforward fee structure.

This platform introduces one of the lowest fee structures amongst bank-owned robo advisory platforms based in Singapore.

The best thing with the platform is that it doesn’t have any platform fees.

Also, there are no upfront sales or brokerage charges for your initial investment along with subsequent or recurring investments.

Furthermore, the periodic rebalancing or reviewing of your portfolio doesn’t have any cost either.

However, 8 bps transaction fees will be charged if you initiate portfolio rebalancing more than once a year by changing your investment goal and risk profile.

Also, UOB UTrade doesn’t charge you for withdrawals and account closure.

The following table shows their detailed fee structure based on your total account value —

| Assets Under Management (AUM) / Investment Amount | Fees (% p.a.) |

| Up to S$50,000 | 0.88 |

| S$50,000 – S$100,000 | 0.68 |

| S$100,000+ | 0.50 |

Also, a 7% GST is applicable on your annual management fees.

Minimum Deposits, Maintenance, and Withdrawals Fees

With UOB UTrade Robo, you need a minimum initial investment amount of S$5,000, while the minimum subsequent investment amount is S$500.

Also, you need a minimum account maintenance amount of S$5,000 with this platform to keep your investment account active.

As for the minimum withdrawal amount, there’s no mention of that on their website.

Funding and Withdrawal Methods with UOB UTrade Robo

The platform provides several funding methods to fund your investment account with them.

As listed below —

- Bill payment via internet banking with UOB, DBS/POSB, HSBC, and Standard Chartered

- PayNow

- Physical deposits made via cash or cheque

- Sending of a payable cheque to UOB Kay Hian Private Limited

Once your funds arrive at your investment account, the platform will invest the amount on the next business day, or as soon as possible.

In the case of a bank transfer, it normally takes 1 to 3 business days to process the funding request.

As for withdrawal, you can withdraw your money earnt through the platform from your UTrade Robo trust account.

You are free to withdraw your funds whenever you require to do that.

Notably, the platform doesn’t make payments to any third parties.

Is UOB UTrade Robo Safe?

Safety is not an issue with UOB UTrade Robo as it is owned by UOB Kay Hian, which, along with being the largest broker in Singapore, is again backed by the UOB Group, which is one of the financial powerhouse of Singapore.

Thus, being a bank-run platform, it has the safety and security given by a reputed bank.

Who Is UOB UTrade Best for?

Considering these 4 factors including the competitive fee structure, the user-friendly platform, broad diversification, and the educational investment-related guidance, it can be stated that UOB UTrade Robo is best for beginner investors.

Among all the bank-owned robo advisory platforms operating across Singapore, it is evident that only UOB UTrade stands out from the rest, providing a low fee structure that is devoid of any additional charges.

Additionally, for a new investor without much investment knowledge, such a diverse portfolio will control volatility by diversifying geographically as well as asset-classes.

Also, their educational investment advisory will help newbie investors choose the right investment trajectory by making the right financial decisions.

One more consideration is that, rather than investing in a new or low-rated robo advisor, UOB UTrade can be a great option for any investor with its prospective bank-provided security, smart tools, and technology involved.

But, despite all this, UOB UTrade’s substantial minimum investment and account maintenance amounts give sufficient reason not to recommend it to an average newbie investor.

Conclusion

Apparently, considering its transparent and reasonable fee structure, UOB UTrade Robo proves to be the best bank-owned robo advisory platform based in Singapore from one point of view.

From another point of view, if we point toward its minimum investment requirements, it is far beyond the reach of most retail investors.

Apart from that, almost all other features related to it starting from multiple asset allocation to global diversification, are quite standard across different robo advisors in Singapore.

However, if you compare its fees, it’s not the lowest among all the Singapore-based robo advisory platforms, although it is the lowest compared to the bank-run ones.

Clarity involved in investment products and their allocation ratio is again an issue with this platform.

Advancing your steps towards an investment provider without knowing where you’re actually going to invest is not something recommendable.

In such a scenario, you can consider setting up your investment using Syfe Wealth, another digital robo advisory platform.

Syfe Wealth is also a safe, secure platform to invest your hard-earned money with lower fees as compared to UOB UTrade Robo.

Syfe Wealth offers a globally diversified portfolio with multiple asset allocations, while at the same time letting you know where your investments are going.

If you want to learn more about Syfe Wealth, you can go through our definitive guide on Syfe.

We suggest opening your Syfe Wealth account by clicking on this link and using our referral code.

This way, you’ll get months worth of fees waived.