TM Protect Cancer is a cancer insurance plan providing coverage against early and late-stage cancers.

This means you can fully concentrate on your recovery without worrying about finances.

This plan is renewable every year, and it’s intended for adults aged 30 to 65. You can keep this coverage in place until you reach the age of 85.

It provides you with peace of mind by ensuring you’re financially supported in case of a cancer diagnosis during the coverage period.

Here’s our review of Tokio Marine’s TM Protect Cancer.

My Review of the TM Protect Cancer

TM Protect Cancer is a no-frills cancer insurance plan that gives individuals a financial safety net upon a cancer diagnosis.

In the case of an early-stage cancer diagnosis, the policy provides a lump sum payment of 50% of the sum assured.

This payout allows you to explore additional medical treatments or options that may not be covered by regular health insurance plans.

Even after claiming for early-stage cancer, the remaining sum assured will be paid out if advanced-stage cancer is subsequently diagnosed, as the policy will continue to remain in force.

However, your premiums and the sum assured will be reduced to reflect the amount paid out.

If the diagnosis indicates advanced-stage cancer, TM Protect Cancer pays out the full sum assured in a single lump sum.

This payout can be used to cover immediate out-of-pocket expenses, whether they are medical or non-medical in nature.

TM Protect Cancer stands out for its simplicity.

It requires just 7 health-related questions during the application process.

There are no medical examinations or supplementary questionnaires involved, making it an accessible option for coverage.

Once accepted, TM Protect Cancer provides guaranteed renewability.

This means that regardless of any changes in your health condition in the future, you can be confident that your coverage will continue.

Hence, if you are looking for an insurance plan that offers a wider range of critical illnesses beyond cancer, you may want to consider other critical illness insurance plans.

We recommend you talk to an unbiased financial advisor to find out if it really fits your needs and what alternative cancer insurance plans that might be better.

We partner with unbiased MAS-licensed financial advisors who have helped thousands of our readers find the perfect insurance policy for them.

If you’d like to talk to them too, click here for a free non-obligatory session.

Now here’s more on the Tokio Marine TM Protect Cancer:

Criteria

- Entry Age: 30 – 65 years of Age Next Birthday

- Maximum Life Assured Age: 85 years

- Minimum Sum Assured: $50,000

- Maximum Sum Assured: $150,000

General Features

Premium Terms

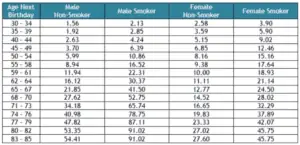

TM Protect Cancer’s premiums must be paid continuously throughout the coverage term. These premium rates differ based on your age as of your next birthday, your gender, and whether you are a smoker or non-smoker.

You can pay your premiums annually or monthly (only available through GIRO). This flexibility allows you to select a payment option that suits your preferences and budget.

Here is the Annual Premium Rate table per $1,000 Sum Assured by Age Band:

Policy Term

The TM Protect Cancer is a yearly renewable policy.

Protection

Death Benefit

In the unfortunate event of the life assured’s passing while the policy is active, a death benefit of $5,000 will be provided.

This benefit is paid out to the designated beneficiaries, and following this payout, the policy will come to an end.

Cancer Benefit

TM Protect Cancer provides protection for early-stage and advanced-stage cancer.

However, the Cancer Benefit is only paid when the life assured survives for more than 7 days from the date of a cancer diagnosis.

If the life assured unfortunately passes away within 7 days of the cancer diagnosis, the Death Benefit will be paid out, and the policy will terminate.

Additionally, the diagnosis of early-stage or advanced-stage cancer should occur not less than 90 days from the policy’s issue date, the last reinstatement date, or the date of any increase in the sum assured, whichever is the latest.

Here are the payouts for early-stage or advanced-stage cancer:

Early Stage Cancer Payout

If the life assured is diagnosed with early-stage cancer, a 50% of the sum assured payout is offered.

This benefit is a one-time payment and can only be claimed once.

After this payout, the sum assured will be reduced by the amount paid out, and future premiums will be adjusted accordingly.

Advanced Stage Cancer Payout

In the event that the life assured is diagnosed with advanced-stage cancer upon the initial diagnosis, TM Protect Cancer will pay out the full sum assured

Following this payout, the policy will terminate.

If the life assured had already claimed for early-stage cancer and is subsequently diagnosed with advanced-stage cancer, the payout shall be the remaining sum assured.

Summary of TM Protect Cancer

| Cash & Cash Withdrawal Benefits | |

| Cash Value | N/A |

| Cash Withdrawals | N/A |

| Health & Insurance Coverage | |

| Death | Yes |

| TPD | N/A |

| Terminal Illness | N/A |

| Critical Illness | Yes, cancer only |

| Early Critical Illness | Yes, cancer only |

| Health & Insurance Coverage Multiplier | |

| Death | N/A |

| TPD | N/A |

| Terminal Illness | N/A |

| Critical Illness | Available |

| Early Critical Illness | Available |