The PRUWealth Plus (SGD) is a participating endowment plan designed to help you build wealth until you reach 130 years old.

With PRUWealth Plus (SGD), you get financial protection in case of death or accidental death.

This plan also offers you flexible payment options, ranging from a single payment to payments spread over 5, 10, 15, or 20 years.

Read on for our review of the PRUWealth Plus (SGD).

My Review of the PRUWealth Plus (SGD)

The PRUWealth Plus (SGD) is a decent savings plan designed to help you grow your wealth and achieve your long-term savings goals confidently.

The policy safeguards you and takes care of your loved ones in the unfortunate event of death or total disability.

You can choose from different premium payment terms, and for single premium plans, you can choose to pay with cash or use your Supplementary Retirement Scheme (SRS) funds.

In times of need, you can defer premium payments for up to 2 years.

If you face a job loss, the policy will pay a one-time payout of up to 50% of your annual premium.

Moreover, if a loved one passes away, the policy will waive all premiums for up to 1 year.

Additionally, this policy offers a capital guarantee after the 10th year, regardless of market conditions – which I think is great.

Finally, you can appoint a secondary life assured, joint ownership, or change the life assured.

This allows you to plan and ensure that your savings can continue to grow and be passed on to future generations.

I also think that the PRUWealth Plus (SGD) is a plus as compared to the PRUWealth, pun intended.

However, after comparing many endowment plans, we find that there are better endowment plans in Singapore to choose from.

For instance, if you’re looking for an endowment plan for the highest guaranteed returns, then the Singlife Choice Saver is the best endowment plan for you.

And if a flexible endowment plan is something that’s important to you, then the Manulife ReadyBuilder (II) is not only the most flexible plan available but also gives you the highest possible returns (guaranteed + non-guaranteed portions).

If you can’t tell yet, there isn’t a “best policy”, but rather what’s best for you.

To decide if the PRUWealth Plus (SGD) is the best for you, you’ll need to analyse your own financial goals, risk tolerance, and budget.

Thus, it’s best to get a second opinion from an unbiased to see if the PRUWealth Plus (SGD) is best for you or if there are better options available in the market.

If you need someone to get a second opinion from, we partner with MAS-licensed financial advisors to assist you with this.

Click here for a free non-obligatory second opinion.

Let’s now explore what the Prudential PRUWealth Plus (SG)D has to offer.

Criteria

- Policy Term: Up to 130 years old

- Premium Payment Terms: Single premium, 5, 10, 15, or 20 years

General Features

Premium Terms

You can choose to pay for PRUWealth Plus (SGD) either as a single lump-sum payment or through regular payments over 5, 10, 15, or 20 years.

If you choose the regular premium option, you will need to pay the premiums in cash for the entire chosen payment term.

These payments can be made monthly, quarterly, half-yearly, or yearly.

You may purchase the policy via cash or your SRS funds if you choose the single premium payment term.

Policy Term

The policy will mature on the policy anniversary that occurs just before the original primary life assured turns 130 years old.

Payout Options – Maturity Benefit

When the policy reaches its maturity date, a lump sum payout is offered, and the amount will be between 187.62% to 871.57% of the Face Value of the policy, depending on various factors.

Additionally, it will include all the bonuses added to the policy over time.

However, it’s important to note that any outstanding amounts you owe to the policy will reduce the maturity benefit amount.

Protection

Death Benefit

For Regular Premium

In the unfortunate event of the life assured’s death, the Death Benefit will be determined in either of the below 2 ways, and the higher amount will be paid out:

- The Death Benefit will be 101% of the total premiums paid for the basic policy up to the time of death, minus any surrendered bonuses, if applicable.

- The Death Benefit will be 101% of the surrender value, which is the policy’s value if the policyholder decides to end it prematurely, minus any outstanding amounts owed to the insurance company.

However, if the life assured’s death is due to an accident, the payout will be the higher between:

- 105% of the total premiums paid for the basic policy up to the time of death, minus any surrendered bonuses and,

- 101% of the surrender value, minus any outstanding amounts owed to the insurance company.

For Single Premium

In the unfortunate event of the life assured’s death, the Death Benefit for single premium policies will be determined as the higher amount between:

- 101% of the single premium paid, minus any surrendered bonuses, if applicable.

- 101% of the surrender value, which is the policy’s value if the policyholder decides to end it prematurely, minus any outstanding amounts owed to the insurance company.

Likewise, if the life assured’s death is due to an accident, the amount that will be paid to the beneficiaries will be the higher of:

- 105% of the single premium paid, minus any surrendered bonuses, if applicable, or

- 101% of the surrender value, minus any outstanding amounts owed to the insurance company.

It’s important to note that once a Death Benefit claim is paid out in both premium terms, the policy will terminate.

Optional Add-on Riders

Early Stage Crisis Waiver

The Early Stage Crisis Waiver is a valuable benefit that offers premium waivers for a specified period upon diagnosing early-stage critical illness conditions.

Here’s how it works:

- If the insured is diagnosed with an early-stage condition, the Early Stage Crisis Waiver provides a premium exemption for a duration of 5 years. During these 5 years, you will not have to pay any premiums.

- Additionally, this waiver allows for a second-time claim. This means that if diagnosed with another early-stage condition within the specified period (5 years), one can make a claim again and enjoy the premium exemption for another 5 years.

- In the case of intermediate-stage conditions, the Early Stage Crisis Waiver provides a longer period of premium exemption. Upon diagnosis, the insured is exempted from paying premiums for a duration of 10 years.

Crisis Waiver III

Crisis Waiver III offers a waiver of premiums upon the diagnosis of any one of the 35 critical illnesses approved by Prudential.

Payer Security Plus

This rider protects your loved ones from premium payments in the unfortunate events of death, total and permanent disability, or critical illness.

Key Features

Capital guarantee

Prudential’s PRUWealth Plus (SGD) ensures the return of the initial invested amount. This guarantee takes effect under the following circumstances or conditions;

- For a policy with a single premium payment term, the capital guarantee is applicable after the 10th year.

- If the policy has a premium payment term of 5 years or 10 years with annual premium payments, the capital guarantee comes into effect after the 15th year and 18th year, respectively.

- For policies with a premium payment term of 15 years or 20 years with annual premium payments, the capital guarantee is applicable after the 19th year.

In addition, you should take note that the capital guarantee will only apply if there have been no policy alterations, such as partial surrender, since the policy’s inception.

Otherwise, it may no longer be applicable.

Disability Waiver Benefit

The Disability Waiver Benefit applies to regular premium policies only.

If the life assured becomes totally and permanently disabled before reaching the age of 70 or before the end of the premium payment term (whichever comes earlier), Prudential will waive the future premiums.

This means you won’t have to make any more premium payments, and the policy will continue in force without any interruptions.

However, any premiums that were due and already paid before the disability waiver starts will not be refunded.

The waiver only applies to future premium payments.

The disability must be confirmed by a registered medical practitioner and fall under the list of circumstances approved by the insurance provider.

Premium Defer Benefit

The option to defer paying the premiums for a certain period is only available for regular premium policies in PRUWealth Plus (SGD).

This is possible if your policy has accumulated a surrender value of at least 100% of the total premiums for 2 years.

The premium deferment period can be up to 2 years, but it will end earlier if your premium payment term ends before the 2-year period ends.

How this benefit works is Prudential will give you an interest-free policy loan to cover your premium payments during the deferment.

This loan will not affect your surrender value, but you must repay the policy loan amount at the end of the deferment period.

Otherwise, a yearly interest rate will be charged on the loan amount.

During the premium deferment period, you won’t be required to make premium payments, but your policy will still be in force, providing coverage and benefits as usual.

Family Waiver Benefit

This special waiver of premiums is a feature available exclusively for regular premium policies in PRUWealth Plus (SGD).

If a loved one from the policyholder’s immediate family – like a spouse or child – sadly passes away before the end of the premium payment term, Prudential will waive the payment of premiums.

This waiver applies to the main policy and any supplementary benefits for up to 1 year.

It starts from the next premium due date following the date of death of the immediate family member up to the end of the premium term.

However, any premiums that were already due and paid before the waiver start date will not be refunded.

The Family Waiver Benefit will cease once all the premiums have been paid in full.

Lastly, you can only claim this benefit once for each policy.

In case of subsequent unfortunate events, the benefit won’t be available again.

Retrenchment Benefit

This one-time payment is given as a lump sum and applies to both regular premium policies and single premium policies in PRUWealth Plus (SGD).

This benefit provides financial support if you experience retrenchment during specific periods of the policy.

It applies under the following terms:

For regular premium policies:

- You are retrenched during the premium payment term and before the policy anniversary just before you turn 65.

- You remain unemployed for at least 30 continuous days from the date of retrenchment.

In this case, the payout is 50% of a full year of premiums based on your chosen payment frequency (annualised premium) as of the date of retrenchment.

For single premium policies:

- You are retrenched within the first 5 policy years and before the policy anniversary just before you turn 65 years old

- You remain unemployed for at least 30 continuous days from the date of retrenchment.

In this case, Prudential will pay you 10% of the single premium amount as of the date of retrenchment.

To apply for the Retrenchment Benefit, you must do so within 6 months from the date of retrenchment.

The benefit is only payable if the retrenchment occurs after 90 days from the policy’s start date or reinstatement date.

Additionally, you must have been working in Singapore, and the company you were working for should be registered in Singapore.

Change of Life Assured

With this feature, you can pass your PRUWealth Plus (SGD) coverage to another individual.

Once the change is made, the coverage for the original life assured individual ends, and the new life assured will be covered from the new cover start date.

Even after this change, the policy’s coverage end date (the policy anniversary before the original life assured turns 130 years old) will remain the same.

However, all supplementary benefits associated with the original life assured will cease.

In addition, there are specific conditions and restrictions depending on your policy type.

For instance, if you have a regular premium policy, you can execute it only after paying all the required premiums.

Whereas for Single Premium policies, you can only make the change after 2 years have passed from the policy’s cover start date.

Secondary Life Assured

An additional person the policy will cover in addition to the primary life assured can be appointed, changed, or removed during the policy term while the original policy owner(s) are still alive.

To appoint a secondary life assured, the following conditions should be met:

- It can only be done if you have a legitimate financial interest in the life of the secondary life assured.

- There shouldn’t be an existing nomination of beneficiary or trust on the policy.

- The appointment is not applicable for policies paid using Supplementary Retirement Scheme (SRS) funds.

The secondary life assured’s coverage will be subject to the policy terms and conditions, including the sum assured and any applicable benefits.

Surrender Benefit

The Surrender Benefit refers to the amount you will receive if you choose to surrender your PRUWealth Plus (SGD) before its maturity date.

The Surrender Benefit consists of the guaranteed and non-guaranteed surrender values.

For policies with a single premium payment term, you will receive the immediate surrender value upon surrendering the policy.

For policies with regular premium payments, the surrender value will be available to you after 36 months from the date of your first premium payment, but only if you have paid premiums for a minimum of 36 months.

Bonuses

The PRUWealth Plus (SGD) includes both guaranteed and non-guaranteed benefits.

It’s important to note that the guaranteed benefits, such as those listed above, will be paid no matter how well the participating fund is doing.

On the other hand, non-guaranteed benefits are subject to variability. These benefits comprise Reversionary and Performance Bonuses.

They offer added value and potential for greater returns in accordance with the future experience of the participating fund.

Reversionary Bonus

You are eligible for the reversionary bonus after making 2 years’ worth of premium payments.

It has a projected rate of $8.50 per $1,000 face value and $19 per $1,000 on accumulated reversionary bonuses.

Performance Bonus

The performance bonus is a specific percentage of the total reversionary bonuses earned, which is paid either upon policy surrender or policy maturity.

The actual amount you receive depends on when you terminate your policy.

The following table shows the illustrated performance bonus rates for PRUWealth Plus (SGD):

| No. of completed years in force | Performance Bonus as a percentage of accumulated reversionary bonus |

| 1 | 0.0% |

| 2 | 0.0% |

| 3 | 5.0% |

| 4 | 5.0% |

| 5 | 10.0% |

| 6 | 15.0% to 20.0% |

| 7 | 20.0% to 40.0% |

| 8 | 25.0% to 60.0% |

| 9 | 30.0% to 80.0% |

| 10 | 30.0% to 100.0% |

| 11 | 35.0% to 99.0% |

| 12 | 40.0% to 98.0% |

| 13 | 45.0% to 97.0% |

| 14 | 50.0% to 96.0% |

| 15 | 53.0% to 95.0% |

| 16 | 53.0% to 94.0% |

| 17 | 54.0% to 93.0% |

| 18 | 54.0% to 92.0% |

| 19 | 55.0% to 91.0% |

| 20 | 55.0% to 90.0% |

| 21 | 56.0% to 89.0% |

| 22 | 56.0% to 88.0% |

| 23 | 57.0% to 87.0% |

| 24 | 57.0% to 86.0% |

| 25 | 58.0% to 85.0% |

| 26 | 58.0% to 84.0% |

| 27 | 59.0% to 83.0% |

| 28 | 60.0% to 82.0% |

| 29 | 60.0% to 81.0% |

| 30 | 61.0% to 80.0% |

PRUWealth Plus (SGD) Fund Performance

Asset Allocation

As PRUWealth Plus (SGD) is a participating endowment plan, it invests the money collected from policyholders to buy sub-fund units.

This aims to generate returns to give you bonuses and grow the pool’s value over time.

Hence, when investing in an endowment or annuity plan, you should not overlook the significance of the par fund’s performance.

As of 31st December 2022, your premiums are allocated as shown in the table below:

| Type of Asset | Allocation Goals (%) | Asset Allocation (%) |

| Bonds | 47.5 | 58.4 |

| Equities | 29.5 | 25.8 |

| Property | 10 | 8.9 |

| Other Assets, such as policy loans and cash | 13.0 | 6.9 |

| Total | 100% | 100% |

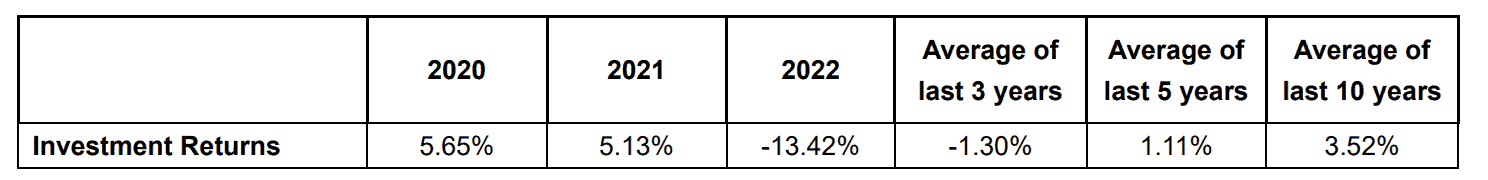

Past Fund Performance

By participating in asset investment, you have the potential to earn higher returns than traditional savings accounts.

However, it’s important to note that investments come with inherent risks, and the policy’s value can fluctuate based on the performance of the assets.

The following table shows the net past return rate of the participating fund, whereby the expenses have already been subtracted:

This diagram shows the performance of some par funds in Singapore.

Looking at the geometric 3, 5, and 10-year net investment returns for par funds, you will find that Prudential is definitely a standout choice, consistently making the highest returns amongst all insurers.

However, note that the data is dated (from 2010 to 2019) and does not reflect future performance.

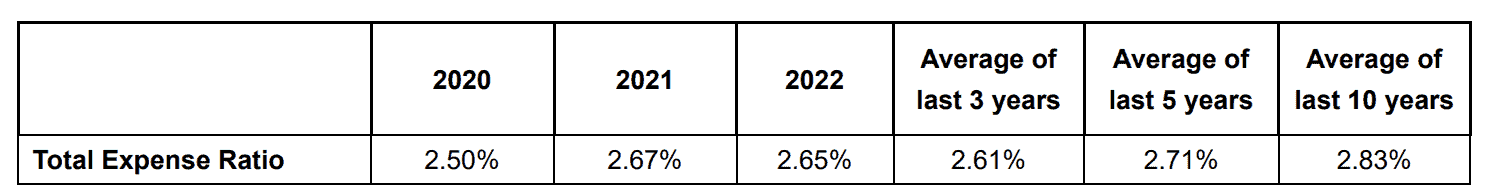

Total Expense Ratio

You can also look at the Total Expense Ratio of the participating fund to analyse its performance.

This ratio is a way to measure how much money a fund spends on various costs compared to the total amount of money it manages.

When you have a policy with a participating fund, these expenses are already included in the premiums you pay.

Hence, you don’t have to pay extra for them.

However, if the actual expenses end up being much higher or lower than what was expected, it can affect the non-guaranteed benefits you receive from the fund.

Hence, investors should carefully consider the Total Expense Ratio when choosing an investment fund since lower expenses can lead to better net returns over the long term.

To give you an idea of how the fund for PRUWealth Plus (SGD) has been managing its expenses in the past, you can look at the table below, which shows the Total Expense Ratios for previous years:

Accurate as of 31 December 2022.

From the table, the previous 3-year average is lower than the 5 and 10-year averages.

This indicates that in the recent past few years, the fund has been performing better in cost management than over 5 years ago.

It’s also important to compare the Average Expense Ratio of different insurers within the same industry to make informed investment decisions.

Here’s a table you can use to compare the expense ratios with those of other insurers between 2017 and 2019:

On average, Prudential wasn’t the best performing during the years surveyed, performing slightly above the industry average.

However, from the most current data above, there is a great improvement of 2.99% in 2017 to 2.65% in 2022.

Please note that the data is dated (from 2017 to 2019) and does not reflect future performance.

It’s important to note that while expense ratios are a factor to consider, you should consider other factors, such as historical performance and investment strategy, before making any investment decisions.

PRUWealth Plus (SGD) Fees and Charges

PRUWealth Plus (SGD) is affected by how well the fund it’s based on is doing.

For this reason, certain expenses related to the fund can be charged to the policy based on a set of rules called the Total Expense Ratios table.

These expenses include:

- fees paid to fund managers,

- costs related to claims for death or terminal illness,

- marketing expenses,

- commission fees paid

- fees for managing new business, and other overhead expenses.

However, you will be happy to hear that these expenses have already been included in your premium calculations, and you will not be charged separately for these fees.

Illustration of How PruWealth Plus (SGD) Works

Let’s take a closer look at how PruWealth Plus (SGD) can work for Marcus, an Operations Manager with a 5-year-old daughter named Ellie.

Marcus wants to save money for his family’s needs, such as Ellie’s education or family vacations, and he can set aside $8,000 per year for 5 years.

If Marcus plans to save on a long-term basis without withdrawing any money from his policy, here’s what his savings could potentially look like:

- After 30 years: Marcus’s savings would grow to $106,825, which is more than 2.6 times the total premiums he paid over the years.

- After 40 years: His savings would grow to $156,227, which is more than 3.9 times his total premiums paid.

- After 50 years: His savings would grow to $224,344, which is more than 5.6 times his total premiums paid.

- After 60 years: His savings would grow to $323,200, which is more than 8 times his total premiums paid.

Summary table of the above benefits

| Year | Savings Value | Multiple of Premiums Paid |

| 30 | $106,825 | More than 2.6x |

| 40 | $156,227 | More than 3.9x |

| 50 | $224,344 | More than 5.6x |

| 60 | $323,200 | More than 8x |

Summary of the PRUWealth Plus (SGD)

| Cash & Cash Withdrawal Benefits | |

| Cash Value | Available |

| Cash Withdrawals | N/A |

| Health & Insurance Coverage | |

| Death | Available |

| TPD | N/A |

| Terminal Illness | N/A |

| Critical Illness | N/A |

| Early Critical Illness | N/A |

| Health & Insurance Coverage Multiplier | |

| Death | N/A |

| TPD | N/A |

| Terminal Illness | N/A |

| Critical Illness | N/A |

| Early Critical Illness | N/A |

| Additional Benefits | |

Optional Add-on Riders

|

Available |