This post will review PRUWealth (SGD) and PRUWealth III (USD). Note that the PRUWealth (SGD) and its successors are obsolete as of writing this on May 2023.

If you are looking for a smart way to save money over the long term and secure your future, Prudential’s PRUWealth (SGD/USD) is an ideal choice.

As an endowment and savings plan, you can choose to regularly save for 5, 10, or 20 years, or opt for a single premium, until you reach the golden old age of 100.

In this post, we review everything Prudential’s PRUWealth offers.

Keep reading to discover more about Prudential PRUWealth (SGD) and PRUWealth (USD)!

My Review of the Prudential PRUWealth (SGD/USD)

PRUWealth is an okay endowment plan that is designed to help you accumulate wealth and achieve your financial goals in the long run.

PRUWealth is a smart move for anyone looking to secure their financial future. Its flexible ownership options are a smart choice for couples looking to save for future milestones together.

Once the policy matures, you will receive the maturity benefit, which is the total amount of money you’ve saved, plus any bonuses added to the policy.

One of the key benefits of PRUWealth is that it allows you to partially withdraw your savings when you need it, making it a flexible option to fund key milestones in your life, such as buying a home or starting a business.

This can provide peace of mind and financial security, knowing that you have a pool of savings that you can access when you need it.

As a policyholder, you may be eligible for a loyalty bonus, a non-guaranteed bonus added to the policy value each year. The bonus is dependent on the policy’s performance and is not guaranteed.

However, we very much prefer the upgraded version – Prudential’s PRUWealth Plus over PRUWealth due to it having more premium payment terms available (single, 5, 10, 15, or 20 years) – giving you more flexibility and lower monthly premiums.

The PRUWealth Plus also has a policy term up to 130 years as compared to PRUWealth’s 100 years, making it perfect for legacy planning (we actually consider it the best for legacy planning).

However, both PRUWealth & PRUWealth Plus are endowment plans, which means you only get a lump sum payout instead of monthly income.

For retirement income, consider a retirement plan instead. Most policies let you accumulate your payouts and cash out a bigger sum later.

So unless you immediately need an endowment plan, a retirement plan is usually a better alternative as you have more flexibility in payouts.

Additionally, the PRUWealth may not be a wise choice if you’re after high returns. Prudential’s participation funds are one of the lowest in the market, whereas NTUC Income’s and Manulife’s par funds tend to perform better over mid- to long-term periods.

You can also consider looking into an investment plan instead of a savings plan for high returns.

Also, it’s of course, always wise to compare different endowment plans so that you can choose one that’s best suited for you.

This is especially important as you’re about to pay premiums for up to 20 years, with a policy term of up to 100 years old.

So before hastily jumping into the first plan recommended to you, you should get a second opinion and compare other options available.

Thousands of our readers have engaged our MAS-licensed partners for comparisons & second opinions – all for free – without any obligations to purchase.

If comparing or getting a second opinion is something you’re keen in, we can connect you to our partners, FOC too!

Click here for a free, non-obligatory chat.

Let’s now explore what Prudential’s PRUWealth offers:

Criteria

- Policy Term (Life Assured): Up to 100 years

- Premium Payment Term (USD Policy): Single Premium, 5, or 10 years

- Premium Payment Term (SGD Policy): 5, 10, or 20 years

General Features

Premium Payment

The PRUWealth (USD) lets you make a single premium or regular premium over 5 or 10 years.

For the PRUWealth (SGD), you have the option of 5, 10, or 20 years of regular premiums.

If you opt to pay via regular premiums, you can pay every month, every 3 months, every 6 months or every year.

Payout Options

When your policy reaches its maturity date, which is the anniversary before you turn 100 years old, you will receive a maturity benefit as a single payment.

This includes all bonuses owed to you, subtracting any amounts owed to Prudential.

Premium Allocation

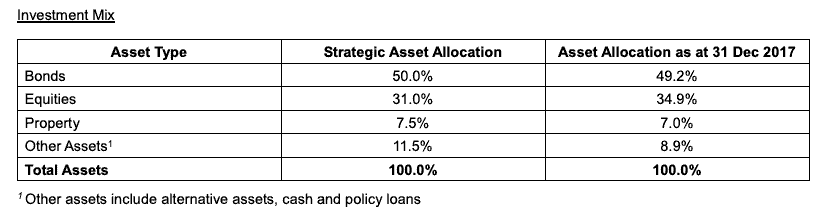

When selecting an endowment plan, it’s important to note what the participating funds invest in.

For the case of the PRUWealth (SGD), the following tables show the asset allocation as of 31 December 2017:

Unfortunately, we do not have access to and couldn’t find the PRUWealth (USD) product summary. Thus, we are unable to share more on its asset allocation.

Protection

Death Benefit

The Death Benefit is the amount of money paid to your loved ones when you pass away.

It will be either 105% of the total premiums you’ve paid (excluding any additional premiums for extra benefits) minus any amount you received from surrendering your bonus, or 101% of the surrender value minus any amount you owe the insurance company.

Subsequently, the policy will terminate after this payment.

Note that this payout is also only carried out if there wasn’t an appointment of a secondary life assured.

Add-on Riders (PRUWealth USD)

Crisis Waiver (USD)

The Crisis Waiver waives all future premiums up to the end of the premium payment term should you be diagnosed with 1 of the 35 critical illnesses (CI) covered under this rider.

Payer Security (USD)

Should you have purchased this policy for your spouse or children, this rider will waive future premiums in case of your death, total and permanent disability (TPD), or CIs.

This rider will expire upon the earlier of:

- When the payer turns 60,

- Life insured turns 25, or

- The end of the premium payment term.

Add-on Riders (PRUWealth SGD)

Prudential has removed the page on its website; all we can access is the Internet archive.

Based on the archive, the PRUWealth (SGD) has the following riders

- Early Stage Crisis Waiver

- Crisis Waiver III

- Early Payer Security

- Payer Security III

- Payer Security Plus

Unfortunately, we don’t specifically know what’s covered under these riders.

However, based on the names, here’s what we think:

The Early Stage Crisis Waiver likely waives your future premiums should you incur an early-stage critical illness.

The Crisis Waiver III likely waives future premiums should you incur a late-stage critical illness – just like the USD version.

For the latter 3, we found this brochure you can refer to.

Key Features

Capital Guarantee

If your PRUWealth (USD) policy is paid via a single premium, your capital (the amount of money you invested) will be guaranteed after the 10th year.

However, if you purchase a policy with a 5-year or 10-year premium payment term and you pay your premiums annually, your capital will only be guaranteed after the 20th year.

For PRUWealth (SGD), your capital is only guaranteed after the 20th year, regardless of your premium payment term.

This assumes you did not alter your policy or make any surrenders since inception.

Secondary life assured

You can add another person to your insurance policy as a secondary life assured, meaning they will take over the policy in case of your passing.

Further, you can add, change, or remove the secondary life assured up to 3 times while the policy is in effect.

Surrender Benefit

If you cancel your policy and surrender it after 36 months from the first payment, you will receive a guaranteed surrender value plus a non-guaranteed surrender value.

Check your benefit illustration to find the amount you can expect should you surrender your PRUWealth policy.

Automatic Premium Loan

You can borrow money from your policy through a Policy Loan or Surgical & Nursing Loan.

The terms and conditions of the loan may change from time to time.

For instance, the interest rate is not guaranteed, which could change over time.

Reversionary bonus

After your second policy year, you will receive the Reversionary Bonus. This bonus is guaranteed and will be added to the benefits you already receive from your policy.

Performance bonus

This is an additional amount of money you may get if you surrender your insurance policy or after your policy matures.

This bonus is a one-off that is calculated as a percentage of the total Reversionary Bonuses that have been added to your policy over time.

The exact amount of the Performance Bonus you receive will depend on when your policy ends.

Partial Surrender

With PRUWealth (USD), you can manage your changing needs if necessary and benefit from partial surrenders when necessary.

The minimum amount to make a partial surrender is not shared, nor are any fees involved. So do check with your financial advisor.

Also, making partial withdrawals will affect your overall policy value.

PRUWealth Fund Performance

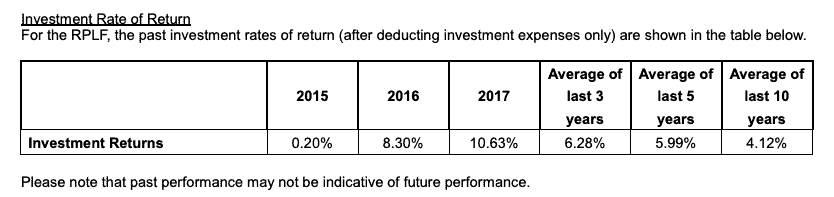

Here is the PRUWealth (SGD) fund performance as of 31 December 2017:

Unfortunately, we do not have access to and couldn’t find the PRUWealth (USD) product summary. Thus, we are unable to share more about its fund performance.

Expense Ratios

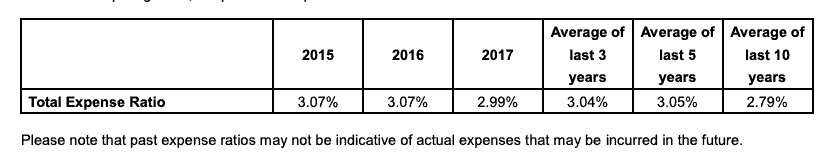

Here is the PRUWealth (SGD)’s expense ratio as of 31 December 2017.

Unfortunately, we do not have access to and couldn’t find the PRUWealth (USD) product summary. Thus, we are unable to share more on its expense ratios.

PRUWealth Fees and Charges

This plan is affected by how well the fund it’s based on is doing.

For this reason, certain expenses related to the fund can be charged to the policy based on a set of rules called the Total Expense Ratios table.

These expenses include;

- fees paid to fund managers,

- costs related to claims for death or terminal illness,

- marketing expenses,

- commission fees paid

- fees for managing new business, and other overhead expenses.

Despite these charges, it has already been calculated into the premiums you’ll be paying.

Illustration Of How PRUWealth (USD) Works

Introducing Jing, a 40-year-old non-smoking male looking to take control of his financial future with a long-term insurance savings plan.

With a keen eye for financial planning, he’s ready to commit U$5,000 annually for the next decade and has the flexibility to withdraw portions of his savings should the need arise.

With this level of foresight and dedication, Jing is well on his way to securing a stable financial future. PRUWealth (USD) is a smart investment avenue for Jing to accomplish his long-term savings goals.

He lets his policy accumulate over time without making any withdrawals, knowing the payoff will be worth it.

If he fully surrenders his policy at the following ages, he will receive varying lump sums as shown in the following table;

| Jing’s Age | Amount Received |

| 70 years | U$136,343 |

| 75 years | U$166,321 |

| 85 years | U$251,156 |

As you can see, the amount received exceeds 2 times the premiums paid.

Jing also has other options under this policy;

| Age | Option | Amount |

| 62 years | Take a dream vacation abroad | U$30,000 |

| 70 years | Gift his son | U$20,000 |

| 85 | Pass savings to loved ones | U$136,142 |

In the first scenario, with an IIRR of 3.25% per annum, Jing can choose to surrender his policy at ages 70, 75, and 85 for varying amounts ranging from U$93,145 to U$152,279.

Meanwhile, in the second scenario, he could receive U$57,580 at age 85 for the same investment rate of return.

Remember that bonus rates are not guaranteed and that actual benefits may vary.

Difference Between PRUWealth (SGD) and PRUWealth (USD) Policies

Prudential offers both PRUWealth (SGD) and PRUWealth III (USD). While they sound similar, the biggest difference between the 2 is the currency.

Both options provide saving opportunities with Prudential, but one is denominated in USD.

However, as PRUWealth (SGD) is an old plan, some of the features offered by PRUWealth III (USD) might differ from it.

For example, no partial withdrawals are available on the SGD version of this plan.

Nonetheless, this is an endowment plan, so withdrawals are usually not expected. So the real difference between both would be the currency you’re paying in.