The PRUSelect Vantage is an investment-linked insurance plan (ILP) that mainly focuses on investments. It is an investment solution that provides multiple fund options to maximise returns in volatile market conditions.

Here’s our review of Prudential’s PRUSelect Vantage.

My Review of the Prudential PRUSelect Vantage

Compared to other ILPs in the market, what makes PRUSelect Vantage interesting is that its surrender charge only applies to the initial account.

With only 2 years worth of premiums that are vulnerable to the surrender charge, this is essentially much much lower than most ILPs that charge the entire account value.

There are also currently no minimums imposed if you’d like to reduce your regular premiums, as long as it meets the minimum investment amounts.

There’s not much difference in terms of flexibility compared to other ILPs apart from its inability to make premium top-ups or increase the regular premium amounts.

There’s no official premium holiday for the PRUSelect Vantage per se, but there is a way for you to take a premium holiday after the Initial Contribution Period should you need it.

As long as you have funds in your accumulation account, your basic policy will remain in force as units will be deducted from this account to pay for the policy.

However, should there be no more funds left, it will continue up to 12 months before your policy is terminated.

I see this as a good thing. If you really can’t afford to pay premiums due to financial difficulties, your premium holiday is indefinite (as compared to limitations set by other ILPs) as long as you have sufficient funds in your accumulation account.

In terms of bonuses, the PRUSelect Vantage is much lower than policies like the HSBC Life Pulsar, Manulife InvestReady III, and Tokio Marine GoClassic. Bonuses are important to offset much of your fees.

Speaking of fees, the PRUSelect Vantage has one of the highest fees during the ICP, of which it drops to 2.25% + $144 per annum. Compared to other ILPs, 2.25% is high too.

Not forgetting that if you convert $144 into a percentage, at the minimum investment amount ($750/month), $144 is 1.6% yearly. This means that your fees will go up to 3.85% after the ICP if you’re investing lower amounts of money.

Lastly, the information on the historical returns of funds available is limited to 3-year annualised. This value is less accurate than 5-year or 10-year annualised returns as it is subject to more market movements.

As 2020 was a good year for the stock market, the 3-year returns you see are on the higher side of things.

Despite my thoughts on the PRUSelect Vantage, I don’t think it’s a bad product.

In fact, I think it’s suitable for individuals who are not well-versed financially and have a Prudential agent whom they can trust. Personally, I still prefer Manulife InvestReady III and the Singlife Savvy Invest for a balanced approach, and the FWD Invest First Plus for the highest potential returns.

Despite this, it’s still one of the best ILPs due to the coverage it provides. But if you’re looking for an investment plan, then coverage shouldn’t be your main goal.

So you might want to consider checking out your alternatives or getting an unbiased financial advisor’s second opinion on whether the Prudential PRUSelect Vantage is your best choice.

We recommend starting your search by reading our post on the best investment plans in Singapore.

From there, talk to one of our MAS-licensed partners, who has helped hundreds of Singaporeans with their investing journey, for a second opinion.

Click here to get a free non-obligatory chat.

Now let’s dive deep into what the Prudential PRUSelect Vantage has to offer.

Criteria

- Minimum premium payment period of 5 years

- Minimum premium amount of S$750 monthly

General Features

The features of PRUSelect Vantage are as follows:

Premium Payment Terms & Options

Under PRUSelect Vantage, you can pick a fixed premium payment term of 5, 10, 15, or 20 years on the policy application. The premium payments are available in Singapore dollars (SGD). The tables below show the minimum premium amounts for the types of premium payment frequency and terms available.

For 5-year premium payment term:

| Monthly | Quarterly | Half-yearly | Yearly |

| S$3,000 | S$9,000 | S$18,000 | S$36,000 |

For 10, 15, and 20-year premium payment terms:

| Monthly | Quarterly | Half-yearly | Yearly |

| S$750 | S$2,250 | S$4,500 | S$9,000 |

Premium Allocation

If you choose to invest with PRUSelect Vantage, 100% of your regular premium payments will be used to buy any of the PRUSelect Vantage funds available.

Premium Accounts

PRUSelect Vantage has 2 premium accounts.

- Initial account holds premiums received in the first 24 months (Initial Contribution Period) of your policy.

- Accumulation account holds the subsequent premium payments.

Plan Flexibility

Vary premium

Though you don’t have the option to top-up your regular premium amount, you can reduce them. However, the new reduced premium has to be at least the minimum value set out above. The reduction will only kick in on your next premium payment date.

Do note that you will incur a charge if you reduce your premium payments during the Initial Contribution Period (ICP). This charge is calculated with the following formula:

- 100% of extracted amount X Percentage of premium reduced.

- Extracted amount refers to initial account value minus first-year bonus paid.

Also, your first-year bonus will be adjusted accordingly as if the reduced premiums are paid since policy commencement.

Switch Fund(s)

With so many PRUSelect Vantage funds that you can choose from, Prudential understands that you’ll have different tolerance for risk at different points of your life. Therefore, switching of funds has no fees, as long as your newly selected PRUSelect Vantage fund(s) is available.

You will also have to indicate the account (Initial or Accumulation) you want to switch funds from. However, it is typically known that the funds from the two accounts cannot be combined, and transfers cannot occur between them.

Furthermore, you will have to abide by the minimum amount to transfer out determined by the company upon your fund switch application.

Also, your unit’s remaining value not transferred out will need to meet the stipulated minimum amount; otherwise, the entire fund has to be switched out. This amount will be made known to you at the point of your application and can be changed by Prudential from time to time.

After submitting your application, you will have to wait for the investment manager to determine the net asset value (NAV) of the PruSelect Vantage fund you are switching out from.

Should your application be accepted, the fund units you indicated for switch out will be sold at the price on the unit sale date.

Partial Withdrawals

The partial withdrawal only occurs by selling units from your accumulation account, which is possible only when you have the minimum amount available in your account. The current amount eligible for withdrawal is S$1,000.

The remainder of the units present in your account should be at least S$5,000; otherwise, a partial withdrawal isn’t possible.

Once your withdrawal request is accepted, fund units instructed for withdrawal will be sold at the price on the unit sale date.

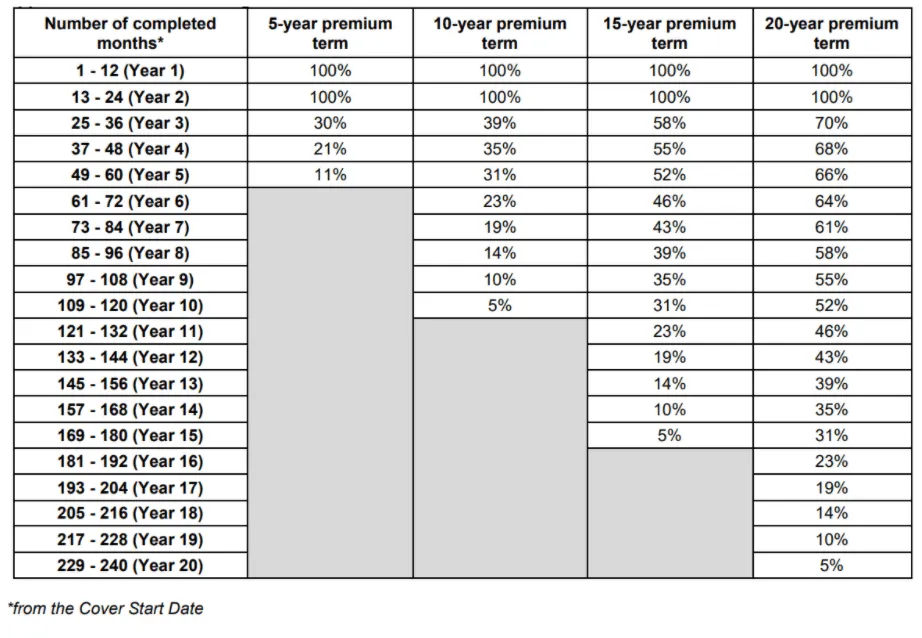

Surrender Policy

You can surrender your policy at any time. If your surrender application is accepted, Prudential shall pay you the surrender value as shown below.

- Value of your Account(s) less the surrender charge; and

- Any premium payments made with the intention of fund unit purchase but not yet bought, less any amounts owed to the company

Your surrender charge will be calculated as a percentage of your initial account. (See more in Fees Involved Section)

Likewise, your fund units will be sold at prices tabulated on the unit sale date.

Additional benefits

With PRUSelect Vantage, you can add benefits to your policy according to your needs. Naturally, these benefits come with extra premiums payable.

The following table shows the additional benefits you may add:

| Early Stage Crisis Waiver |

|

| Crisis Waiver III |

|

| Payer Security III / Payer Security Plus | Helps to look after your loved one’s policy in the case where death, critical illness, or total and permanent disability happens to you. |

|

|

| Early Payer Security |

|

| Other supplementary benefits | PruSmart Lady II, Fracture Care PA, and Early Stage Crisis Cover |

Take note that you can only select additional benefits at the start of your policy if you have chosen the 5 years premium payment term. For the other premium payment terms, you can add on benefits anytime after the commencement of your plan.

Protection

Death Benefits

Different death benefits are paid out depending if it was an accidental death or death from other causes. An accident here refers to an unforeseen and involuntary event directly causing death, independent of other conditions such as illnesses.

| Accidental Death | Death from non-accidental causes | |

| Payment amount | Higher of:

|

Value of both your accounts, subtracting any amounts outstanding to the company. |

| Conditions | The insured is shown to be covered for this cause of death on the certificate of life assurance and passes away from the respective cause. | |

| Coverage | Up to the policy anniversary before the person insured turns 75. | Not stated. |

*excludes premiums that pay for supplementary benefits (if any)

The value of your accounts is calculated using the fund unit price on the 2nd business day after Prudential gets notice of the person insured’s death together with his/her proof of death.

Suppose the person insured commits suicide within 12 months from policy commencement. In that case, the policy shall become invalid, and the premiums paid out will be refunded. The amount for refund will be determined after deducting any withdrawals made and amounts owed to Prudential.

Should the insured person pass away from a pre-existing condition within 12 months from policy commencement, the company pays the higher of:

- Value of both your accounts after subtracting any 1st-year bonus paid out to you; or

- Total premiums payments made by you minus any withdrawals and outstanding amounts owed to Prudential.

A pre-existing condition here refers to:

- any symptoms which cause you to seek medical help or treatment; or

- would have caused an ordinarily careful person to seek medical advice or cure before the cover start date of the benefit.

Policy Termination

Prudential has the right to terminate your policy in the following instances:

- Failure to make premium payment during the ICP; or

- 12 months have lapsed after failure to make premium payment after the ICP with no remaining units in the accumulation account; or

- any law is passed by the authorities that make it illegal to continue the PRUSelect Vantage fund; or

- the investment manager thinks that it is impracticable to continue that PruSelect Vantage fund; or

- authorisation of that particular PruSelect Vantage fund is revoked; or

- the Investment Manager finds that it is not the best choice for investors in that PruSelect Vantage fund to continue investing in that fund; and/or

- in the case of substantial changes, such as dissolution or merger, of any of the funds within the PruSelect Vantage fund range.

Lastly, you can also terminate the policy on your own accord by surrendering your policy. However, know that you will have to incur surrender charges.

Key Features

Like many other ILPs, the PRUSelect Vantage offers bonuses to their policyholders too.

First-year Bonus

The bonus amount depends on the yearly premium, and the calculation occurs as a fixed percentage of the initial 12 months premium amount paid.

The bonus value as observed is present in the table below:

| Minimum annualised premium | Premium Payment Term (Years) | Percentage of your annualised Premium (%) |

| S$60,000 and above | 5 | 5 |

| S$18,000 and above | 10 | 10 |

| 15 | 15 | |

| 20 | 20 |

*excluding premiums of supplementary benefits (if any)

Your first-year bonus will be paid out as additional fund units and are allocated to your initial account with every premium payment you make.

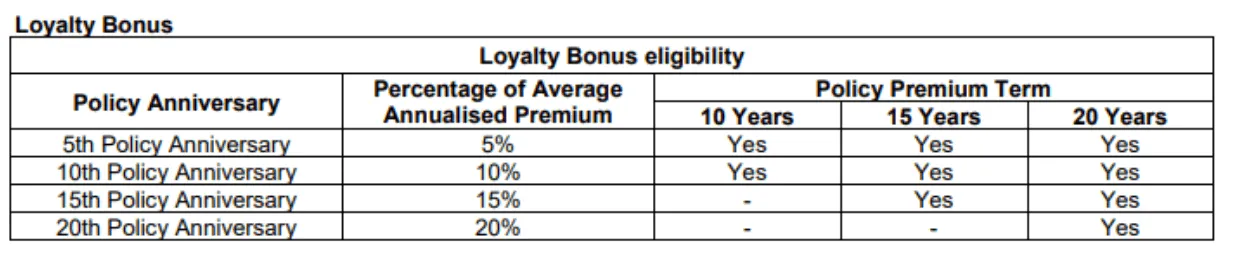

Loyalty Bonus

Your loyalty bonus is paid out 2 months after the 5th, 10th, 15th, and 20th policy anniversary if you qualify.

Your eligibility for the loyalty bonus is directly connected to the regular payment of premium amounts during your selected payment term. There are differences in loyalty bonuses for the different premium policy tenures picked.

For the 5-year premium payment term:

- Loyalty bonus of 0.5% of your average accumulation account value awarded to you after the 5th policy year.

- Converted into additional units and allocated into your accumulation account.

- Paid yearly as long as your policy is not terminated.

- The average accumulation account value is calculated as follows:

Total of your monthly accumulation account value less charges for 12 months* ÷ 12

*** This refers to the 12 months before your 5th Policy Anniversary and the successive 12 months before each Policy Anniversary.

For 10, 15, or 20-years premium payment term:

- Loyalty Bonus is a percentage of your average annualised premium based on the table below.

- Converted into additional units and added to the accumulation account.

- The Average Annualised Premium is tabulated with the following formula:

(Total premiums paid^ – any withdrawals) ÷ number of years premiums have been paid

^excluding premiums of supplementary benefits selected

Once the premium payment tenure lapses, your eligibility for the loyalty bonus also lapses in turn.

Prudential has the right to take back any loyalty bonus paid out to you if you perform any transactions causing your policy to be found ineligible subsequently.

Fund offerings

With the PRUSelect Vantage, you can choose to invest in one or more PRUSelect Vantage Fund(s) offered under the plan. Out of these, we have picked out the top 10 performing funds for you.

PRUSELECT Vantage’s Top 10 Performing Sub-Funds

The Prudential PRUSelect Vantage invests in unit trusts.

| Name of fund | 3-Year Historical Average (%) | Risk Level |

| Allianz GIF – Oriental Income – AT – SGD | 21.07 | Higher Risk |

| Allianz GIF – Oriental Income – AT – USD | 20.79 | Higher Risk |

| Janus Henderson HF – Janus Henderson Horizon Global Technology Leaders – A2 USD | 18.80 | Higher Risk |

| Eastspring Inv. Unit Trusts – Global Technology – SGD | 18.80 | Higher Risk |

| FTIF – Franklin U.S. Opportunities Fund – A Acc USD | 17.56 | Higher Risk |

| FTIF – Franklin U.S. Opportunities Fund – A Acc SGD | 17.56 | Higher Risk |

| Schroder ISF – Greater China – A | 15.50 | Higher Risk |

| Schroder Int. Choice PF – Emerging Markets | 14.00 | Higher Risk |

| United Gold & General Fund – SGD | 12.53 | Higher Risk |

| JPM Funds – Emerging Markets Equity Fund – A Acc SGD | 12.50 | Higher Risk |

Accurate as of April 2021

Whenever possible, we have extracted the offer to bid return percentage, inclusive of fund initial charges.

With all kinds of investment, there are always risks involved. Historical performances are not able to predict future returns. These 3-year annualised return rates are only an estimate. Always do your due diligence or seek advice from a trusted financial advisor if you are unsure.

Fees Involved

As with all ILPs, fees and charges are indispensable. PRUSelect Vantage is not an exception. Here is a list of the fees and charges involved:

| Policy Establishment Charge |

|

| Administration Charge |

|

| Policy Fees |

|

| Surrender Charge |

|

| Investment Charge |

|

For fees deducted by fund units, outstanding amounts caused by insufficient value in your respective accounts will be considered owed to the company.

Compulsory fees

Now, if you commit to the policy from start to maturity, you will essentially need to incur all the charges listed above besides the surrender charge.

- Policy Establishment Charge (4% from the initial account)

- Administrative Charge (0.75% from total value)

- Policy Fees – S$144 annually (S$12 per month)

This would mean the following fees for you.

| First 2 policy years (ICP): | 4.75% p.a. |

| During premium payment term after ICP: | 4.75% p.a. + S$144 annually |

| After premium payment term: | 0.75% p.a. + S$144 annually |

However, note that the fees above are an overestimation as the policy establishment fee is only charged on your initial account. These fees are charged monthly.

How much will I receive upon maturity of the PRUSELECT Vantage?

We engaged a Prudential advisor to do the calculation for you.

Assuming that you invest S$3,000 monthly for 20 years, let it compound for another 10 years, the funds perform at 10% per annum, and you made no withdrawals; you can expect the below:

|

First 2 Years |

|

| Monthly premium: | S$3,000 |

| Premium Payment Term: | 20 years (240 months) |

| Annual Fund Performance: | 10% |

| Fees in the first 2 years: | 4.75% |

| Net Fund Performance for the first 2 years: | 5.25% |

| Investment value: | $76,790.42 |

|

Next 18 Years |

|

| Fees in the next 18 years: | S$144 + 4.75% p.a. |

| Net Fund Performance in the next 18 years: | 5.25% – (S$144 x 18) |

| Investment value: | S$1,103,367.92 |

|

Last 10 Years |

|

| Fees in the last 10 years: | S$144 + 0.75% |

| Net Fund Performance in the last 10 years: | 9.25% – (S$144 x 10) |

| Total Investment Value over 30 years: | $S$2,670,391.14 |

Total Premiums paid after 30 years: S$720,000

Total Interest Earned: S$2,814,659.83

ROI: 270.89%

You will realise that the first-year and loyalty bonus has not been included in our calculations above. However, the bonuses have a role in offsetting the fees in the above computation.

Are you a Prudential advisor and have the breakeven table for the PRUSelect Vantage? Share it with us for a more accurate calculation of returns!

References

https://www.prudential.com.sg/products/investment/regular-contribution/pruselect-vantage-sgd