PRUSelect Vantage Premier policy is a single premium investment-linked policy allowing you to invest in any available funds.

You can take this policy on a single life-assured basis or for a maximum of 2 policy owners and 3 lives to be insured.

The policy is available for both investments via cash or your Supplementary Retirement Scheme (SRS).

Keep reading to discover more about the PRUSelect Vantage Premier policy!

Criteria

- Minimum single premium of $50,000.

- Minimum investment period of 2 years.

General Features

Premium Payments

The PRUSelect Vantage Premier is a single premium policy with options to pay in cash or using your SRS funds.

The minimum single premium is $50,000.

Protection

Death Benefit

Reassuringly, if 2 people own the same policy and one passes away, ownership will automatically be transferred to the survivor.

In cases where both owners pass away simultaneously, or there is more than one life assured on the policy, the last surviving individuals will receive the death benefit.

Death Due to Accident

In the event of an accident causing death after the policy’s start date, the plan will pay out the higher of either:

- The full value of all units in your Account or;

- 105% of premium payments made plus top-ups minus withdrawals.

With this policy, the Accidental Death benefit becomes effective after the Cover Start Date, and it’s only accessible if the death occurs within twelve(12) calendar months after the accident.

If the Accident happens before the Cover Start Date, the value of all the units in your Account will be paid instead.

Further, this coverage for this benefit ceases on the last surviving assured’s 85th birthday Policy Anniversary.

Death Due to Other Causes

If death occurs due to other sources, the beneficiaries will receive all the units in the account minus any outstanding repayments.

Key Features

Second-year Bonus

During policy year 2, you will receive a second-year bonus if your top-up or single premium investment is at least $250,000.

This bonus will be calculated as a percentage of your investment minus any withdrawals.

Here is a table to illustrate this;

| Investment | The Bonus Rate |

| $250,000 to $499,999 | 0.50% |

| Over $500,000 | 0.75% |

Loyalty Bonus

You can earn a bonus equivalent to 0.50% of your average account value provided that you satisfy the following criteria:

- Each tranche or lot must have completed 60 months.

- Your administration charge payment must be up to date, and

- Your account value should be at least $50,000.

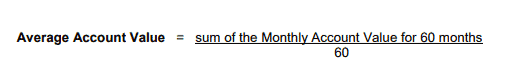

Here is the formula for the Loyalty Bonus requirement:

This Loyalty Bonus will be paid to you after every 60-month term for each individual tranche.

However, this is only if you fulfil the requirements for the Loyalty Bonus and your policy is still active.

Premium Top-ups

This policy allows premium tops up of one-time payments of at least $20,000, with each top-up treated as its own tranche.

Fund Switching

The policy allows you to switch funds to other PRUSelect funds. There are no charges for switching funds.

You will be notified of the minimum amount for each fund switch at the time of application.

Partial Withdrawals

You can make partial withdrawals of at least $1,000.

After partially withdrawing your fund, your account value must be at least $10,000.

Policy Surrender

You can surrender your policy at any time during its tenure after 24 months have passed.

Changing the Life Assured

This policy allows you to have up to 3 persons as the life/lives assured.

During the policy term, you can either add or remove the life assured in this policy.

However, these changes can only be made twice throughout the policy term.

PRUSelect Vantage Premier Fees and Charges

Administration Charge

The administration charge is 0.8% per annum, applied to your latest policy account value at the time of billing.

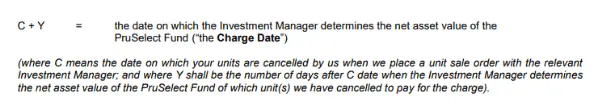

This is an amount charged from the second month following the Cover Start Date and on the same date monthly.

The following is the formula for calculating the administration charge:

Premium Charge

Not officially listed as a charge you’ll incur, but it’s worth mentioning that you will incur a premium charge or a sales charge every time you make premium payments.

Be it a top-up or your initial single premium, you will incur a 2.5%% premium charge before your funds are invested into the respective funds selected.

Withdrawal / Surrender Charge

A partial withdrawal/surrender charge applies depending on the number of completed months of the single premium or top-up amount from its respective Cover Start Date, as shown in the following table:

| Number of Completed Months | Fees |

| 1 to 12 months (Year 1) | 1.6% |

| 13 to 24 months (Year 2) | 0.9% |

| Over 25 months (Year 3 Onwards) | 0% |

Thus, you will need to track when (1) you made your single premium payment and (2) when each of the top-ups was made because withdrawal charges will be different.

It is unclear whether you can select which tranche you’d like to withdraw from, but I believe you should be able to. Check with your financial advisor first.

PRUSelect Vantage Premier Top 10 Performing Funds

The Prudential PRUSelect Vantage Premier invests in unit trusts.

| Name of fund | 3-Year Historical Average (%) | Risk Level |

| Allianz GIF – Oriental Income – AT – SGD | 21.07 | Higher Risk |

| Allianz GIF – Oriental Income – AT – USD | 20.79 | Higher Risk |

| Janus Henderson HF – Janus Henderson Horizon Global Technology Leaders – A2 USD | 18.80 | Higher Risk |

| Eastspring Inv. Unit Trusts – Global Technology – SGD | 18.80 | Higher Risk |

| FTIF – Franklin U.S. Opportunities Fund – A Acc USD | 17.56 | Higher Risk |

| FTIF – Franklin U.S. Opportunities Fund – A Acc SGD | 17.56 | Higher Risk |

| Schroder ISF – Greater China – A | 15.50 | Higher Risk |

| Schroder Int. Choice PF – Emerging Markets | 14.00 | Higher Risk |

| United Gold & General Fund – SGD | 12.53 | Higher Risk |

| JPM Funds – Emerging Markets Equity Fund – A Acc SGD | 12.50 | Higher Risk |

Accurate as of April 2021

Summary of PRUSelect Vantage Premier

| Cash and Cash Withdrawal Benefits | |

| Cash Value | Yes |

| Cash Withdrawals | Yes |

| Health and Insurance Coverage | |

| Death (Including Accidental Death Benefit) | Yes |

| Total Permanent Disability | No |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |

| Health and Insurance Coverage Multiplier | |

| Death | No |

| Total Permanent Disability | No |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |

| Optional Add-on Coverage | No |

Difference Between PRUSelect Vantage and PRUSelect Vantage Premier

Both PRUSelect Vantage and PRUSelect Vantage Premier provide access to similar high-quality funds, but each offers its own way for you to invest.

The PRUSelect Vantage allows you to invest through regular premium terms of 5,10,15, and 20 years.

On the other hand, PRUSelect Vantage Premier allows single premium payments.

The PRUSelect Vantage also offers optional riders, such as Crisis Waiver III and Payer Security III.

Read our review of the PRUSelect Vantage here.

My Review of the PRUSelect Vantage Premier

It’s clear to me that the PRUSelect Vantage Premier is targetting high-net-worth individuals with its high single premium payment.

It also gives you access to various unit trusts managed by global fund managers instead of just PRULink funds.

Thus, with the PRUSelect Vantage Premier, you can enjoy diverse investment options to build wealth while benefiting from death and accidental death coverage.

There is also a 2.5% premium charge on top of the 0.8% p.a administration charge. I would say that this is a comparatively low charge as compared to other ILPs in the market.

However, you could obtain even lower charges with more flexibility if you invest via iFAST.

For iFAST investments, you can invest any amount and choose from a wide range of funds – even institutional/accredited investor funds – without any surrender charges any lock-ups.

You can also negotiate with your financial advisor to reduce the sales charge (or premium charge) to 1% to 2% and Asset Under Management Charges (AUM) to 0.5% to 1% per annum.

The lower fees and a bigger range of funds could give you even better returns in the long term. Talk to your Prudential agent (or other agents) about iFAST to learn more.

Of course, I have to say that iFAST only allows investing via your CPF Investment Account and cash, so if you want to invest your SRS funds, then the PRUSelect Vantage Premier is something you can consider.

Ultimately, it’s important to remember that everyone has their own individual financial goals and circumstances.

That’s why no one-size-fits-all policy can be recommended to everyone.

It’s always a good idea to search for the best investment policies and then speak with a trusted financial advisor who can assess your specific needs and recommend a policy that aligns with your goals and priorities.

This way, you can make an informed decision about the policy that will work best for you.