Prudential PRUCancer 360 is a standalone cancer insurance plan offering early, intermediate, and major cancer coverage.

Keep on reading our comprehensive review of the Prudential PRUCancer 360.

My Review Of PRUCancer 360

Prudential PRUCancer 360 stands out for its coverage period, which extends up to 100 years.

This extended coverage period makes Prudential PRUCancer 360 particularly appealing to those looking for long-term security.

This surpasses the coverage offered by most other insurers, typically capped at 85 years old.

Prudential PRUCancer 360, alongside Great Eastern GREAT CancerGuard, is most notable for offering one of the highest benefit limits, reaching up to $300,000.

This high benefit limit places Prudential PRUCancer 360 as an ideal choice for individuals seeking extensive coverage, especially in severe cancer cases.

PRUCancer 360, unfortunately, is not favourable when it comes to affordability.

MSIG CancerCare Plus and FWD Cancer Insurance emerge as the most budget-friendly options in the market.

Another drawback of Prudential PRUCancer 360 is that it doesn’t offer savings upon policy renewal, which TIQ Cancer Insurance by Etiqa does.

This makes TIQ Cancer Insurance by Etiqa a more attractive choice for those at a lower risk of critical illness.

While Prudential PRUCancer 360 focuses on providing comprehensive cancer coverage, it may not offer supplementary support benefits similar to FWD Cancer Insurance’s.

FWD Cancer Insurance is recognised for its FWD Care Recovery Plan, an additional support program beyond basic cancer coverage.

Premiums for Prudential PRUCancer 360 may increase with age, which could be a negative factor for individuals planning their long-term financial commitments.

On the other hand, AIA MultiStage Cancer Cover and Great Eastern GREAT CancerGuard are known for their fixed premium rates for those worried about escalating costs.

While the Prudential PRUCancer 360 may not be the cheapest, it offers a reasonable balance between cost and coverage, catering to those prioritising a blend of affordability and comprehensive protection.

When comparing other products and comprehensive benefits, Allianz Cancer Protect takes the lead, especially with its unique offerings, like a monthly income benefit upon major cancer diagnosis and coverage for infants and children.

With all that said, Prudential PRUCancer 360 offers significant benefits in terms of high coverage limits and an extended coverage period.

Other plans in the market may be more suitable for specific needs, such as affordability, comprehensive benefits, and fixed premium rates.

When choosing a cancer insurance plan, you must consider your unique requirements and financial situation.

That’s why you should start by reading our post on the best cancer insurance plans in Singapore so that you know your available alternatives.

Once you know your other options, you should take some time to get a second opinion from an unbiased financial advisor.

You’re about to make premium payments for this policy for the long-term, so you should do a bit more research to make sure you get what’s best for yourself.

If you need someone to get a second opinion from, we partner with MAS-licensed financial advisors who have helped hundreds of our readers with this.

Click here for a non-obligatory chat.

Let’s dive deeper into the PRUCancer 360.

Criteria

- Full and honest disclosure of all relevant facts is required in the application.

- Minimum sum assured of $10,000

- Maximum sum assured of $300,000

General Features

Premium Terms

The premium payment term for the policy is 5 years.

Premiums can be paid monthly, quarterly, biannually, or yearly.

Policy Terms

The policy term is 5 years and is renewable every 5 years, subject to certain conditions:

- You must be under 95 years old at the time of application.

- Payment of increased premiums based on the age of the life assured at the time of renewal.

- The policy must not have ended after a claim.

As this product has no savings or investment feature, there is no cash value if the policy ends or if the policy is terminated prematurely.

Protection

Death Benefit

Should the policyholder pass away, Prudential will pay the Death Benefit sum of $5,000, less any amounts owed to them.

Should you sadly pass away due to Cancer within 7 days from the date of the diagnosis, the death benefit will be paid instead of the Cancer Benefit.

Your whole policy ends once Prudential has paid a claim for this benefit.

Cancer Benefit:

You can select how much you want to be covered against cancer, starting from $10,000 to $300,000, with increments of $10,000.

If you’re purchasing the PRUCancer 360 for your child, and they are between 1 & 16 years old, the maximum sum assured is $100,000.

The cancer benefit will be paid out if you are diagnosed with any early or major cancer, but you must survive at least 7 days from the date of diagnosis.

If you pass away within 7 days from the date of diagnosis, we will only pay the Death Benefit.

A registered medical practitioner must diagnose the cancer.

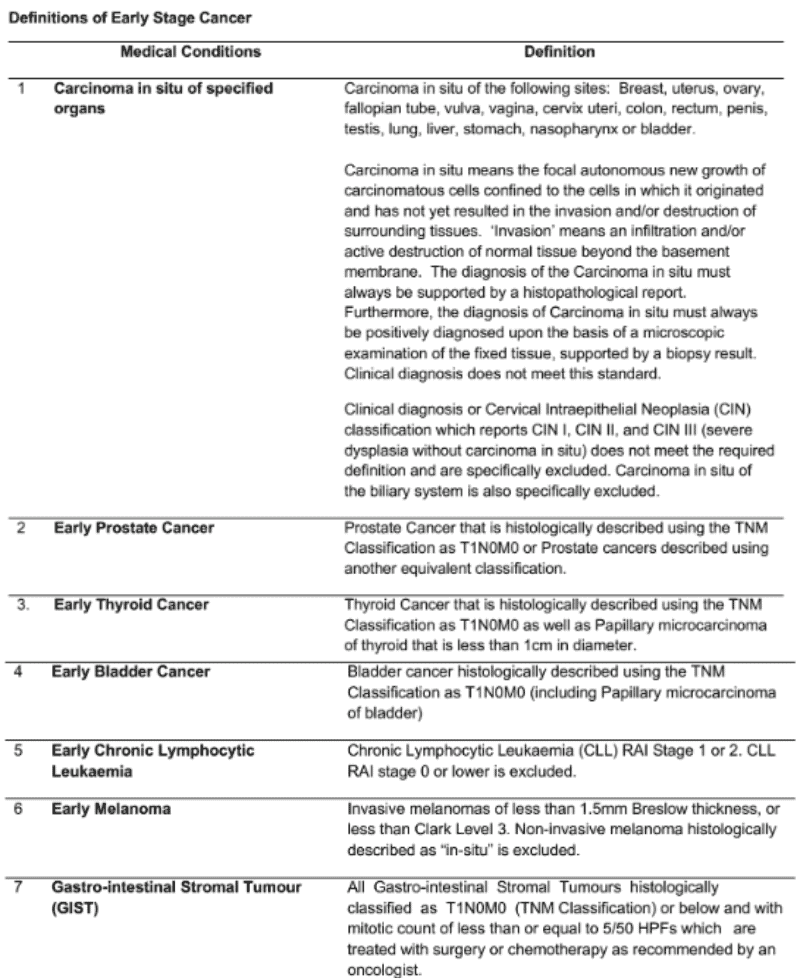

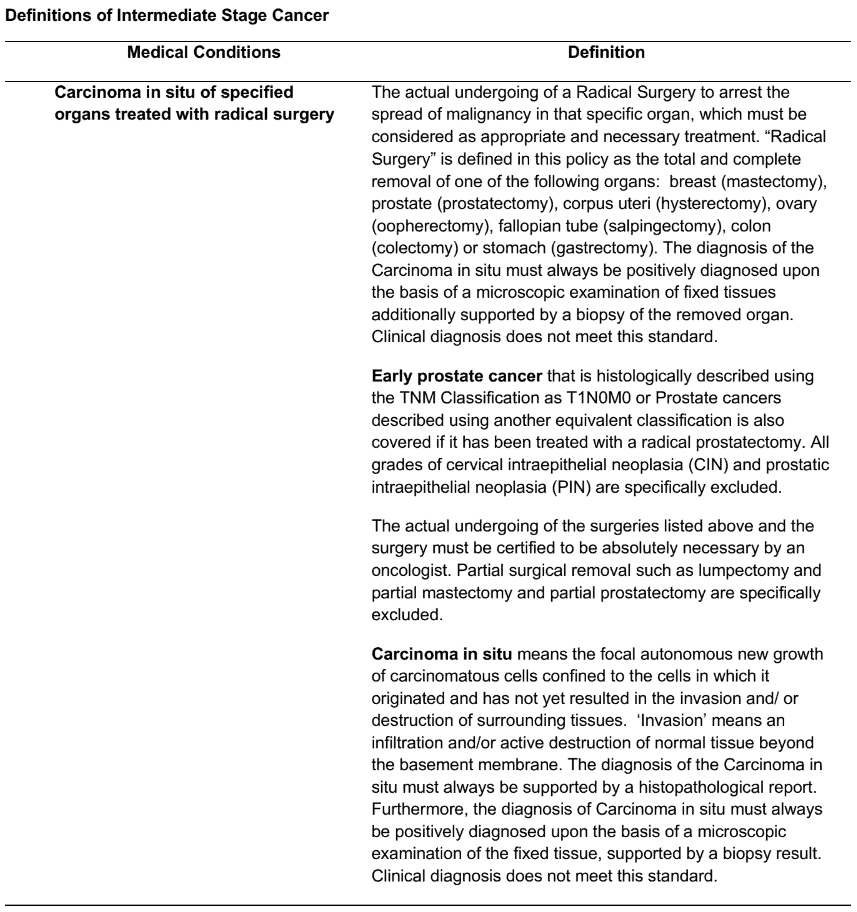

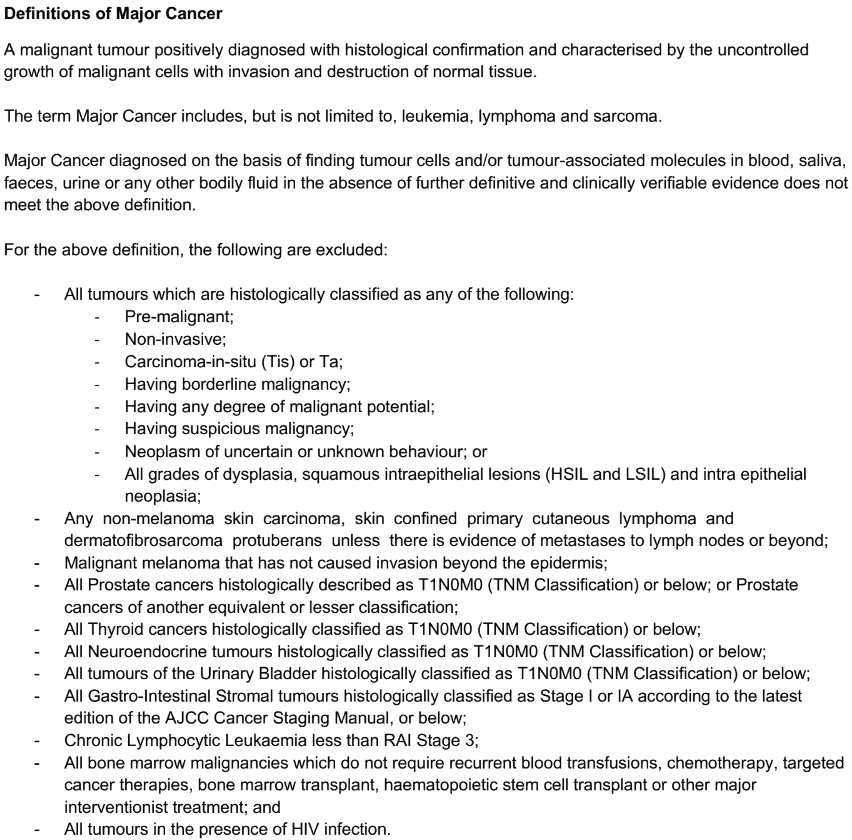

Here are the definitions of early-stage cancer covered under the PRUCancer 360:

Key Features of PRUCancer 360

Easy Application Process

There is no complicated application process for this policy.

You only need to answer 1 health question.

Coverage To The Age Of 100

This plan provides cancer coverage from age 1 up to the incredible age of 100 so you can live life to the fullest.

You can begin your protection journey with PRUCancer 360, an affordable solution to help you prepare for life’s uncertainties.

PRUCancer 360 Summary

| Cash & Cash Withdrawal Benefits | |

|---|---|

| Cash Value | No |

| Cash Withdrawal | No |

| Health & Insurance Coverage | |

| Death | Yes |

| Total Permanent Disability | No |

| Terminal Illness | No |

| Critical Illness | Yes, cancer only |

| Early Critical Illness | Yes, cancer only |

| Health & Insurance Coverage Multiplier | |

| Death | No |

| Total Permanent Disability | No |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |