Prudential PRUActive Retirement(II) is a retirement annuity plan that offers guaranteed income in your golden years.

The plan is packed with multiple features and benefits such as the option to change your payout period, riders, Total and Permanent Disability benefits, and much more.

In this discussion, we explore in-depth the features of Prudential PRUActive Retirement II to help you decide on the option that works best for you.

Here’s our review of the PRUActive Retirement II.

My Review of Prudential PRUActive Retirement II

The Prudential PRUActive Retirement II is a worthwhile consideration if you are looking for a policy to provide guaranteed retirement income.

It easily secures your golden years thanks to the guaranteed monthly payouts and the non-guaranteed income.

Advantages of PRUActive Retirement II

- It’s a savings scheme that protects your money against uncertainties

- The plan is highly customisable and offers flexibility to choose when to retire and receive your payouts.

- Guarantees monthly payouts in the future

- Allows the use of SRS funds to offset single premium payments

- You can re-invest your monthly payouts to receive higher income in the future

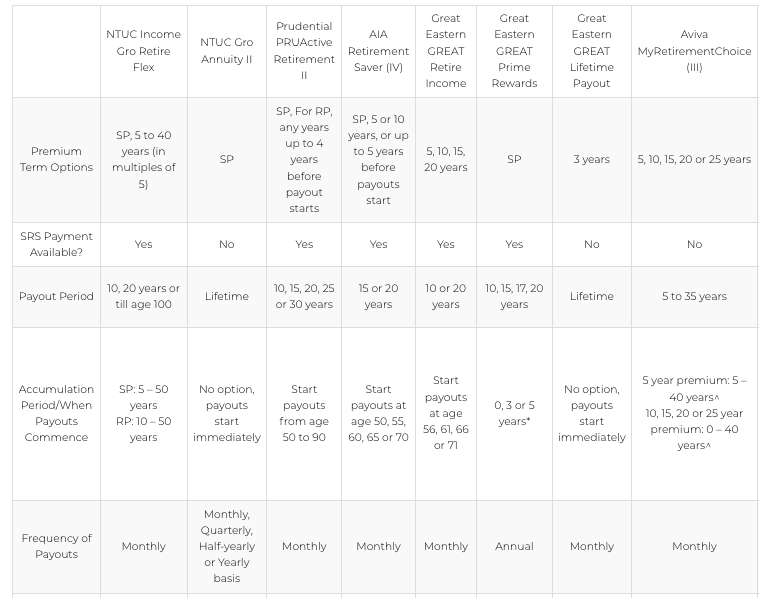

Comparing Prudential PRUActive Retirement II with other annuity plans

Subject to;

- Entry Age, premium payment term, and accumulation period less than or equal to 80 ANB

- Additional payout plus basic monthly payout

- All policies payable in cash

As you can see, there are a lot of similarities among the various plans, such as flexible premium term options and freedom to choose the payout period and when to start receiving your payouts.

The plan is the most flexible when it comes to choosing the payout period options since it starts at 50 to 90 years old.

Furthermore, it has 5 payout period options: 10, 15, 20, 25, and 30 years.

Beyond that, Prudential PRUActive Retirement II has unique features that make it a top choice for many.

For example, SRS payments are available if you opt for a single premium plan.

In addition, the Accidental Disability benefit covers you if you suffer from permanent disability after an accident.

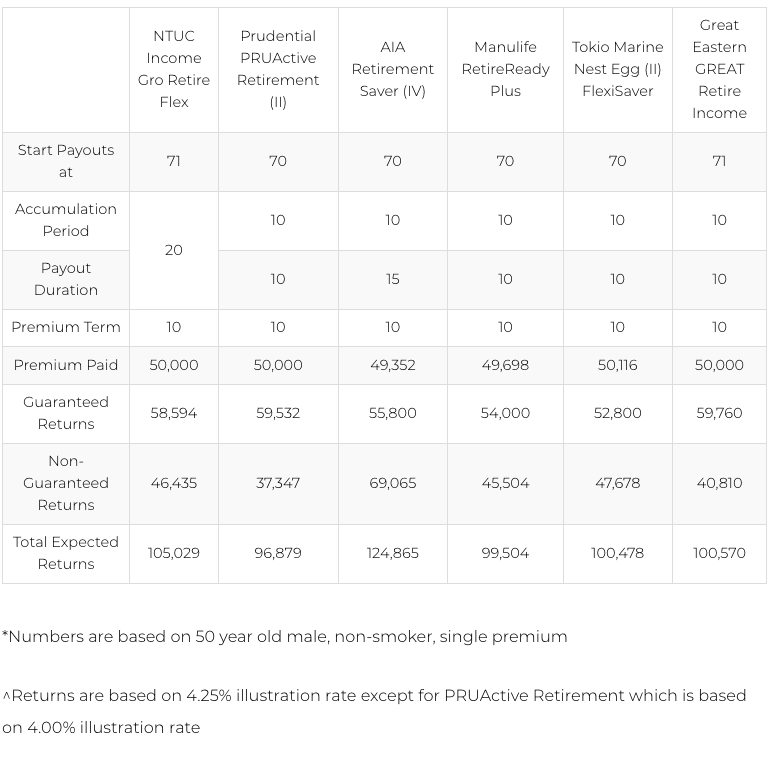

Expected returns

When choosing a plan, the guaranteed payout is one of the things to keep in mind. The table above highlights the performance of Prudential PRUActive Retirement II against other annuity plans.

Even though it doesn’t take the 1st position, Prudential PRUActive Retirement II scores well when it comes to guaranteed returns.

On the downside, the non-guaranteed returns are lower than other market players, effectively affecting the total expected returns.

In our comparison of the participating fund performance across insurers in Singapore, Prudential’s par funds are ranked 5th amongst 8 insurers – with 3 and 5-year returns producing negative annualised results.

This is worrying as you are relying on the par funds returns for your retirement income, and poor performance will negatively impact how much you’re receiving.

I recommend other plans such as the Manulife RetireReady Plus III and NTUC Income Gro Retire Flex Pro as they have the top 2 best performing participating funds in Singapore.

Not only that, but both of them are featured-packed, giving you flexibility and customisability that no other retirement plan can offer.

And because of these, both the Manulife RetireReady Plus III and the NTUC Income Gro Retire Flex Pro are considered the best annuity plans in Singapore, winning multiple categories.

That said, no single retirement plan is perfect; it all depends on its ability to meet your future needs and offer a safe financial cushion during retirement.

If you’re afraid of choosing the wrong product, it’s wise to talk to an unbiased financial advisor who can help you compare alternatives in the market.

It’s also smart to get a second opinion on whether the PRUActive Retirement II is good for you.

If you’re interested in comparing policies or want to get a second opinion, we partner with MAS-licensed financial advisors who can help you with this.

Click here for a free non-obligatory chat.

Let’s now explore the PRUActive Retirement II in detail.

Criteria

Policy term

One unique advantage of Prudential PRUActive Retirement II is that it offers the flexibility to choose your retirement age and when to start receiving the payouts.

In this case, you can choose your retirement age from age 50.

Premium payments can be made using your SRS funds.

Flexible premium terms

The policy allows you to choose your preferred premium term between a single or regular premium term of any year up to 4 years before the selected retirement age.

For regular premiums, you can choose to pay monthly, quarterly, biannually, or yearly.

Flexible Payout options

With this plan, you can customise your payout period depending on individual needs.

For instance, you can receive the payouts from age 50 to 90 years and adjust whenever you want to match your needs.

In addition, you can change the payout period at least 2 months before the payments commence.

With this, you can choose 10, 15, 20, 25, or 30 years as your preferred payout period.

Features

Here are the features of Prudential PRUActive Retirement II.

Surviving Spouse Benefit

In the unfortunate event of death, your spouse can take over the policy as long as he/she is appointed.

This means if your spouse is a joint applicant for the policy, the Surviving Spouse Benefit takes effect.

Guaranteed and non-guaranteed income

The plan offers non-guaranteed income with the potential to increase each year depending on the Illustrated Investment Rate of Return.

Reinvestment of payouts

If you don’t want to receive the monthly payouts as yet, there is an option to reinvest the money, subsequently growing your retirement funds.

Protection

Other than guaranteed and non-guaranteed income, Prudential PRUActive Retirement II has multiple coverages which you will enjoy.

Total and Permanent Disability

The policy offers coverage against TPD during its term or before the anniversary after you reach 70 years whichever comes first.

The protection means that you’ll receive an accelerated payout if you suffer from TPD during the policy or if the disability occurs before you attain 70 years.

Accidental Disability Benefit

In the event of an accident, your future premiums are waived. Also, you’ll receive 2x monthly income if the accident leads to permanent disability.

This benefit is capped at S$6,250.

Death

The policy covers you for death. Subsequently, like other plans, this benefit automatically ends after a claim has been made.

Optional Add-On Riders

Besides the usual benefits, you can add supplementary benefits or riders to your plan to enhance your coverage.

Crisis Waiver III

Under this benefit, you’ll enjoy a waiver of premiums after a diagnosis of at least one of the 35 critical illnesses listed on the cover. The benefits extend up to 85 years.

Early Stage Crisis Waiver

Under this benefit, you’ll get a 5-year waiver period after a diagnosis of early-stage medical conditions.

This rider also allows you to make a second claim if it’s not for the same medical condition or falls within the same category.

Under the same rider, you can enjoy a 10-year premium waiver after a diagnosis of intermediate stage medical condition.

Payer Security Plus

With this rider, you can have a waiver of premiums of your spouse’s or child’s policy if the following occurs to you;

- Death

- Total and permanent disability

- Critical illness

Worth noting, this rider provides coverage up to the end of the premium term or upon turning 85, whichever comes earlier.

Prudential PRUActive Retirement II at a glance

Here is a summary of Prudential PRUActive Retirement II benefits

| Cash and Cash Withdrawal Benefits | |

| Cash value | Available |

| Cash withdrawal benefits: | Available |

| Health and Insurance Coverage | |

| Death | Available |

| Total Permanent Disability | Available |

| Terminal Illness | Available |

| Critical Illness: | Not available |

| Early Critical Illness: | Not available |

| Health and Insurance Coverage Multiplier | |

| Death | Not available |

| Total Permanent Disability | Not available |

| Terminal Illness | Not available |

| Critical Illness | Not available |

| Early Critical Illness: | Not available |

| Optional Add-on Riders | |

| Crisis Waiver III | Available |

| Early Stage Crisis Waiver | Available |

| Payer Security Plus | Available |

| Additional Features and Benefits | Monthly retirement income reinvestment

Accidental disability benefit Surviving spouse benefit Flexibility to adjust your payout tenure |

Illustration

To understand how PRUActive Retirement II works, here is an illustration.

Paul chooses PRUActive Retirement II as a way to ensure financial stability upon retirement. Without a doubt, the monthly payouts will guarantee financial stability amid cost uncertainties in future.

Therefore Paul can enjoy the life he desires even when he eventually leaves active employment.

Paul is a 32-year-old male who pays S$625 every month for 18 years as he wants a guaranteed income of $1,000 monthly.

By then, Paul will be 50 years old and will have paid S$135,000.

At 63 years, Paul retires from active employment and starts receiving his guaranteed and non-guaranteed income as shown in the table below.

| Age 32 years | Age 50 years | Age 63 years | Total Monthly

Income Payout Within 15 years |

Maturity Benefit

Payout |

Total Potential Payout |

| Starts to pay | S$135,000 total premiums paid | Retires and starts to receive Monthly

Income Payout for 15 years |

S$372,961 | S$38,926 | S$411,887 |

The total monthly income payout for Paul comprises of;

- Non-Guaranteed Monthly Income ($93)

- Step-up Income (Depends on par fund’s performance)

- Bonus Income ($325)

- Guaranteed Monthly Income ($1,000)

By the end of 15 years, Paul will have received a potential payout amount equivalent to S$411,887.

Points to note

- The non-guaranteed monthly income depends on the performance of the participating fund

- The Step-up income consists of non-guaranteed income declared in the past

- The calculations are based on an illustrated investment rate of return of 4.00% p.a

- The maturity benefit paid at the end is after deducting any debts that you owe to the policy.