GREAT Cancer Guard is a standalone cancer insurance plan designed to give you financial protection if you’re diagnosed with any cancer stage.

Looking for a fuss-free cancer insurance plan that covers up to $300,000?

Only Great Eastern’s GREAT Cancer Guard does it.

Here’s our review; keep reading.

My Review of Great Eastern’s GREAT Cancer Guard

The GREAT Cancer Guard is a simple, fuss-free cancer insurance protecting you from early to late stages of cancer.

You won’t have to undergo a medical examination, making the application process much simpler and faster.

If you are diagnosed with cancer, the GREAT Cancer Guard provides a lump sum payout of up to $300,000, regardless of the cancer stage.

This money is meant to support you during your recovery journey and is easily Singapore’s highest cancer insurance coverage!

You can use it for various purposes, such as medical treatments, paying bills, or any other expenses you may have.

The GREAT Cancer Guard was awarded the best cancer insurance plan twice in our comparison list – so we’d say it’s pretty good.

The only downside to the GREAT Cancer Guard is that it has the highest premiums amongst other cancer plans in Singapore.

If budget is a concern, then you can check out FWD’s Cancer Insurance, as it’s the cheapest cancer plan in Singapore.

But if budget isn’t a concern, and you’re open to exploring getting more comprehensively covered for critical illnesses, then consider getting a multipay critical illness plan instead, or at least FWD’s Big 3 CI – which covers stroke and heart attacks too.

Not sure if this is for you?

I suggest getting a second opinion from an unbiased financial advisor.

As cancer and critical illnesses are a common occurrence in Singapore, it becomes critical that you take some time to conduct a bit more research so that in case you’re hit with them (touchwood), you’re sufficiently covered and have enough money to recover without worrying about your finances.

If you need someone to get a second opinion from, we partner with unbiased financial advisors who can assist you with this.

Click here for a second opinion.

Let’s now explore the Great Eastern GREAT Cancer Guard in detail:

Criteria

- Policy Term: 1 year (renewable)

- Minimum sum assured: $50,000

- Minimum Assured age: 17 years old

- Maximum Insured age: 85 years next birthday

General Features

Policy Term

The Great Eastern GREAT Cancer Guard is a renewable plan and is renewable yearly.

This means that your policy terms are always 1 year, and should you renew it, it will be extended for another year.

You may renew your policy every year until you turn 85.

However, renewables are usually not guaranteed and are up to Great Eastern’s approval (similar to all other renewable plans).

Premium Payment Term

The premium payment term for GREAT Cancer Guard is the same as the policy term, and you may choose to pay monthly, quarterly, biannually, or yearly.

The premiums are levelled, which means that they will not increase after each policy term.

As this is a critical illness (CI) policy, the premiums might still increase at the end of every policy term based on factors such as your age, health status, gender, and smoking status.

Confusing? I know.

This is because every early critical illness (ECI) and critical illness coverage – a standalone ECI/CI plan, whole life with ECI/CI rider, and term plan with ECI/CI rider – don’t have guaranteed premiums yearly.

So there is always a chance of it increasing.

Select Your Sum Assured

You can select up to 5 sums assured based on what you need starting at $50,000.

Here are all the sums assured and the respective plan you can opt for:

| Plan | Lite | Plan A | Plan B | Plan C | Premier |

| Sum Assured | $50,000 | $100,000 | $150,000 | $200,000 | $300,000 |

Key Features

Cancer Benefit

If you’re diagnosed with cancer for the first time in your lifetime, GREAT Cancer Guard will provide a lump sum payout based on your chosen plan.

This lump sum will be paid in one go to support your recovery.

With the GREAT Cancer Guard, you can receive a lump sum payout of up to $300,000, regardless of the stages of cancer.

The money is meant to assist you in your recovery journey and can be used for various purposes, such as medical treatments, bills, or other expenses.

Once you receive this benefit, your policy will come to an end.

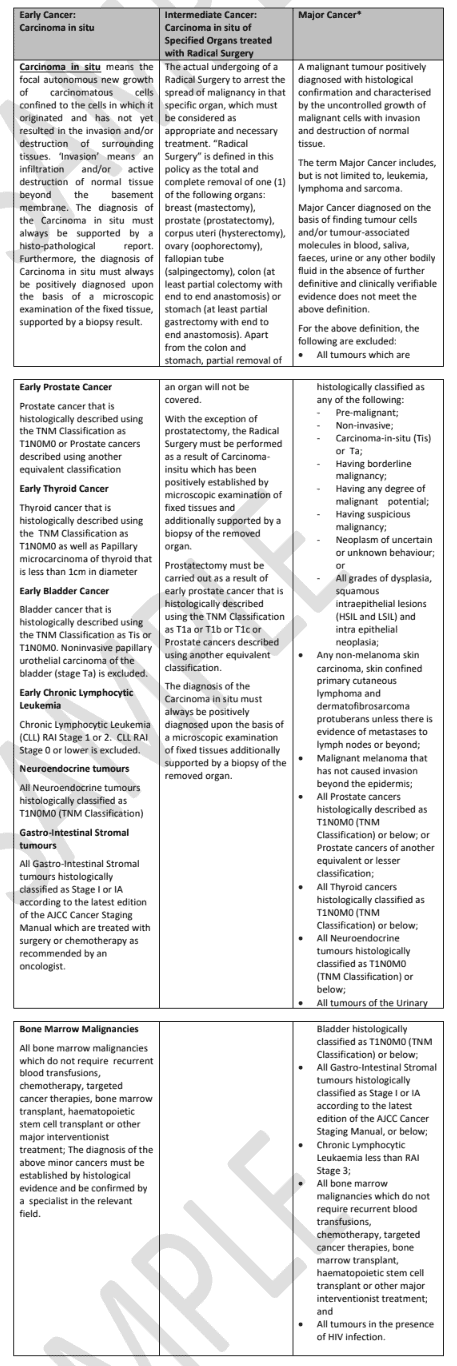

Here are the cancers and definitions covered by the GREAT Cancer Guard:

Summary of the GREAT Cancer Guard

| Cash and Cash Withdrawal Benefits | |

| Cash Value | No |

| Cash Withdrawal | No |

| Health and Insurance Coverage | |

| Death | No |

| Total Permanent Disability | No |

| Terminal Illness | No |

| Critical Illness | Yes, cancer only |

| Early Critical Illness | Yes, cancer only |

| Health and Insurance Coverage Multiplier | |

| Death | No |

| Total Permanent Disability | No |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |