If you are an investment enthusiast, but can’t take any time out from your busy schedule to manage and maintain your investments, DBS has a solution for you.

Curious?

Well, read on.

What Is DBS digiPortfolio?

DBS digiPortfolio is a cost-efficient digital investment platform offered by DBS bank launched in February 2019, providing you with ready-made investment portfolios.

The platform works with cooperation between humans and artificial intelligence to ensure the growth and protection of your wealth.

DigiPortfolio’s professionals will manage your portfolio for you without you needing to worry about it.

DigiPortfolio introduces 2 portfolios with global as well as Singapore-based regional Asiatic diversification.

You get to invest in these portfolios through exchange-traded funds (ETFs) carefully selected by digiPortfolio’s human expert team of portfolio managers.

Take note that you need a multi-currency account with DBS digibank to get started with digiPortfolio.

The convenience of the platform lies in the fact that they allow you to invest in different types of investment accounts including individual, joint, corporate, and trust.

Investment Strategy

DBS digiPortfolio practices a relatively simple and transparent investment strategy designed by comprising fixed income (bonds) and equity ETFs in the investment portfolios.

This investment strategy is constructed to support their objective of achieving the best possible returns based on a specific periodic cycle while managing risk.

They aim at obtaining stable income streams through bonds while achieving capital growth through equities.

The platform’s experts regularly observe the market.

Together with their Chief Investment Officer (CIO) team of macro strategy analysts, they make the necessary adjustments in your portfolio if the need comes.

However, this adjustment can change the original proportion of asset class allocation.

Their risk management strategy for investment portfolios works by considering acceptable price fluctuations for achieving specific returns.

Along with that, the investment strategy focuses on alleviating downside risks by the application of a wise decision-making process.

Whenever necessary, their investment team practices rebalancing of the portfolios.

It is done to ensure the effectiveness of the portfolios; — done on the basis of their quarterly reviewing of the portfolios.

This rebalancing unquestionably enhances the flexibility of the portfolios notwithstanding the market conditions.

DBS digiPortfolio sets a long-term goal for the investment portfolios comprising usually 3 to 5 years.

Investment Portfolios

DigiPortfolio introduces 2 investment portfolios, each comprising 3 different risk levels.

Thus, you get 6 risk levels in total with this platform.

Also, your portfolio is constructed through 2 levels of careful screening and selection processes, for which, the portfolio management team and Chief Investment Office team are equally responsible.

The process starts once you select your portfolio preference and risk appetite.

So now, let’s peek through these portfolios and check what’s available for you.

Asia Portfolio

This particular portfolio is designed to enable you to invest in the Asiatic markets with a focus on Singapore.

The currency supported by this portfolio is SGD, which you use to invest in Singapore-listed ETFs.

This portfolio lets you invest in major Southeast Asian markets like Singapore, China, Japan, India, etc.

You don’t need any prior qualification to invest in this regional portfolio, while it’s not the case with the other portfolio we’re discussing below.

However, you need a minimum investment amount of SG$1,000 as a prerequisite for investing in the Asia portfolio.

Now, it is unconventional that they’ve mentioned clearly that this specific portfolio consists of 6 to 7 ETFs.

This is quite uncommon with any other robo advisors in the market who don’t really mention their portfolio allocations.

They’ve even mentioned the exact ETFs dealt with by every portfolio risk level:

- NIKKO Straits Times Index ETF

- NIKKO StraitsTrading Asia ex Japan REIT ETF

- Xtrackers MSCI China ETF

- Lion-OCBC Hang Seng Tech ETF

- ABF Singapore Bond Index ETF

- NIKKO SGD Investment Grade Corporate Bond ETF

- iShares MSCI India Index

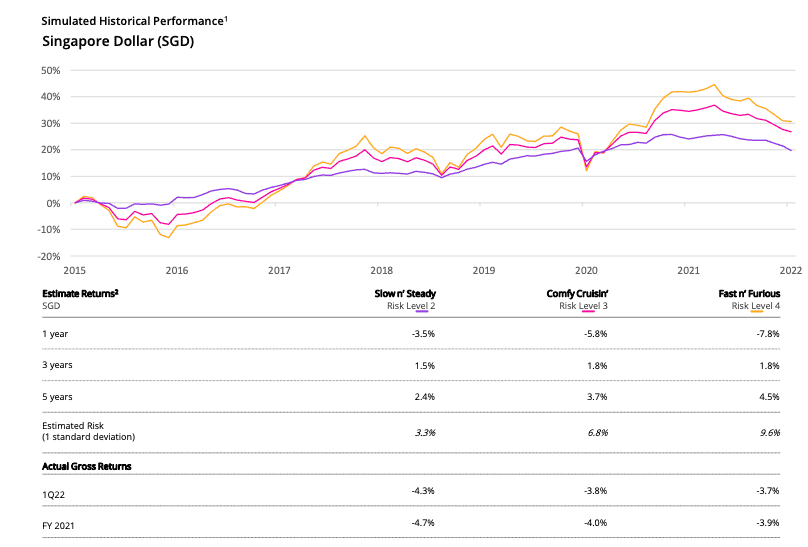

As for the historical performance of this portfolio, they’ve got a graph showing overall performance. Let’s look at the graph in the following screenshot —

Let’s see the different risk levels introduced by this portfolio and the properties they involve within them.

Risk Level 1: Slow n’ Steady

This portfolio is primarily focused on fixed income bonds to ensure the steadiness of income as indicated by its title.

However, to manage and increase the potential returns, they’ve included a calculated allocation to equities too.

The asset allocations practised by this risk level are as follows —

- Fixed income (bonds): 78%

- Equities: 18%

- Cash: 4%

Thus, this risk level is on the safer side with the lowest possible risk involved in it.

But, this also indicates that with the highest allocation to bonds and the lowest allocation to equities, the potential return will also be the lowest compared to the other 2 risk levels.

Risk Level 2: Comfy Cruisin’

This is a medium-risk portfolio, where, let’s say, equity ETFs and fixed income ETFs go hand-in-hand with near equal allocations.

This portfolio aims at maximum possible returns while maintaining a steadiness of income.

Asset allocations shared by Comfy Cruisin’ are as follows —

- Equities: 53%

- Fixed income: 43%

- Cash: 4%

With a comparatively higher allocation to equities, this portfolio is constructed to provide investors with higher potential returns.

But, the risk level is managed and maintained by adding a conscious and calculated scope for stable income generation with bonds.

Risk Level 3: Fast n’ Furious

If you have a very high-risk appetite, this particular portfolio will be the perfect match for you.

It includes the highest allocation to equities, where some percentage of fixed-income bonds is also included to manage risk.

Still, you don’t get a 100% allocation to equities as practised by some of the reputed robo advisory platforms.

Asset allocation as held by this risk level —

- Equities: 78%

- Fixed income: 18%

- Cash: 4%

Long-term investments in this portfolio will result in relatively better returns due to the higher allocation to equities.

However, that means that you’ll be exposed to potentially higher risks too with this portfolio.

Global Portfolio

This portfolio gives you diversified exposure to the global market with a focus on UK-listed ETFs.

However, to be able to invest in this portfolio, you need to pass a Customer Account Review.

The standard currency for investment here is USD.

US$1,000 is the minimum investment amount with the Global portfolio.

The portfolio holds 8 to 11 ETFs again available in 3 different risk levels.

Let’s have a look at which ETFs this portfolio invests in —

- iShares MSCI World

- iShares MSCI China A

- VanEck Vectors Gold Miners

- iShares Global Infrastructure

- iShares JPM USD EM Corp Bond

- iShares Global Corp Bond

- iShares Core Global Agg Bond

- Vanguard 1-3Y USD Corp Bond

- iShares Core S&P 500

- X MSCI EUROPE

- HSBC MSCI AC Far East Ex Japan

- Vanguard FTSE Japan

There’s no lock-in period or any other extra charges in this portfolio too.

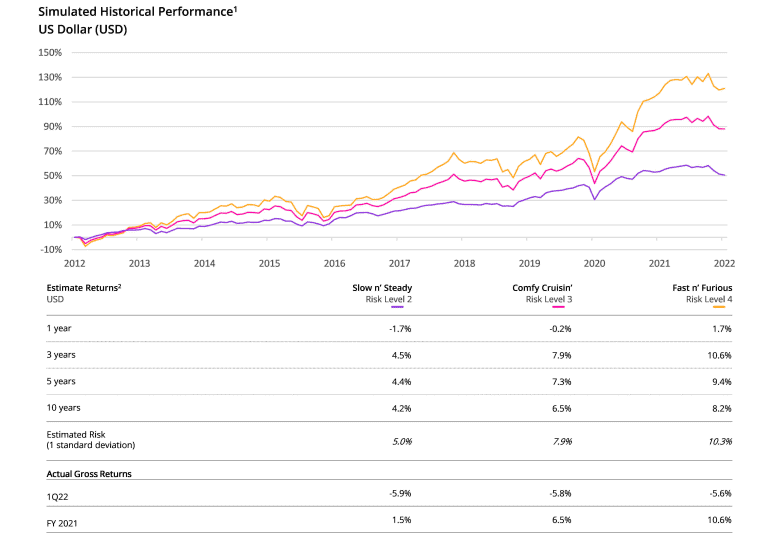

Investing in a portfolio requires you to consider its historical performance carefully.

Here’s a screenshot of the historical returns for this portfolio:

So, it’s time to discuss the different risk levels as held by this portfolio.

Risk Level 1: Slow n’ Steady

As the first risk level in the previous portfolio, this particular portfolio is also a low-risk one, investing mainly in fixed income investment instruments ensuring the stability of the portfolio.

Exposure to equities attempts to achieve a better return.

Asset allocation proportions as held by this portfolio —

- Fixed income: 73%

- Equities: 20%

- Cash: 7%

Risk Level 2: Comfy Cruisin’

This portfolio involves medium-risk by holding a higher allocation of equities and a comparatively lower allocation to fixed income.

As you can see, the portfolio is allocated among equities and fixed income bonds at substantial percentages in order to ensure higher investment returns while maintaining stability.

Asset allocation proportion of Comfy Cruisin’ portfolio —

- Equities: 58%

- Fixed income: 38%

- Cash: 4%

Risk Level 3: Fast n’ Furious

Included in the Global portfolio of DBS digiPortfolio, this is the highest risk level with the highest allocation to equities and a small allocation to fixed income bonds.

So, Fast n’ Furious will give you a potentially higher return, where the risk is also high.

Similarly, it’s not 100% allocated to equities.

Asset allocation proportion conveyed by this risk level —

- Equities: 83%

- Fixed income: 13%

- Cash: 4%

Human and Robo Cooperation

The DBS digiPortfolio combines human and technical efforts to give you the best returns possible.

As mentioned earlier, they have an expert team of professionals, who, along with the CIO team, do the best possible construction and management of your portfolio.

They strive regularly to make investment easy for you, where you don’t require to think about your asset management.

As for their robo technology, the platform holds underlying codings for automation in processes like monitoring, back-testing, and rebalancing to enhance the efficiency and transparency of the platform.

Ready-made and Hassle-free Investment

As you already know, the portfolios with the platform are ready-made, where no effort on your part is needed.

Also, the platform is quite user-friendly.

As their experts do everything for you including constructing, maintaining, and manipulating your portfolio whenever necessary, you experience a kind of hassle-free investment with DBS digiPortfolio.

DBS digiPortfolio Fees

It’s really remarkable that DBS digiPortfolio charges only one affordable annual fee of 0.75% that you need to pay every year.

There are no other fees including platform fees, withdrawal fees, sales charges, switching fees, etc, etc.

Thus, this suggests that, if you invest SG$1,000 or US$1,000; your payable annual management fee is SG$7.50 per year or US$7.50 a year.

Minimum Deposits and Withdrawals

The minimum investment amount with DBS digiPortfolio is $1,000, whether you invest in SGD or USD.

As for the minimum withdrawal amount, it is required to maintain the minimum investment amount in your account if you’re making partial withdrawals.

Funding and Withdrawal methods

Funding and withdrawal are only available through multi-currency DBS accounts.

To deposit or withdraw funds, the following simple processes are needed to be followed.

- Login to your account. If you are using their mobile app, then log in to it, and if not, log in to iBanking in that case.

- If you’ve logged in to iBanking, select digiPortfolio available in the top ribbon. If otherwise, then click on the Invest button visible at the bottom.

- Now, if you are using iBanking, switch to Top-up or Withdraw. If you are using the mobile app, then you need to select digiPortfolio before that. Following that, choose the portfolio you want to make a deposit to or withdrawal from, and then click on Top-up or Withdraw.

- In the next step, input transactions and click on the Next button.

- Now, you’re all ready to top up or withdraw funds. Don’t forget to review the details carefully before clicking on the Submit button.

Once you submit your top-up or withdrawal request, it’ll normally take 5 business days.

For withdrawals, the funds will automatically be credited to your selected crediting account.

Is DBS digiPortfolio Safe?

Since DBS digiPortfolio is offered to you by DBS Bank, a reputed and highly secured digital bank operating from Asia, it’s quite safe to invest with the platform.

Apart from that, DBS Bank obtained the highest credit ratings from 3 top credit rating agencies worldwide.

They also don’t support any third-party platform in respect of transactions, so there’s lesser room for exploitation from other institutions.

Who Is DBS digiPortfolio Best for?

Considering DBS digiPortfolio’s user-friendliness and cost-effectiveness, it can be the best choice for beginners.

To add on, the platform’s hard-working teams of professionals again make it convenient for newbie investors, where they don’t need to do anything.

Conclusion

DBS digiPortfolio sounds worth investing in providing the aforementioned features and benefits.

But, like with any other investment platform, several shortcomings are present here also.

You can use it easily and at a low cost, without burdening yourself with investing knowledge.

But, the portfolios here are limited, with limited risk levels and diversification available.

Because of this, we prefer Syfe Wealth.

Syfe Wealth is another cost-effective and reputed robo advisor, and we consider them the best in Singapore.

Syfe Wealth provides you with several types of portfolios with varied diversification and risk levels.

In short, with Syfe, you are able to choose from a reservoir of portfolios depending upon your choice of asset allocation and risk appetite.

Feel free to read our review on Syfe.

Interested to invest with Syfe?

Click on this link to open an account using our Syfe promo code to get months’ worth of fees waived!