Are you looking for halal dividend stocks and ETFs?

Do you want to invest in companies that pay dividends while being Muslim friendly?

In this article, I’ll show you what makes dividends halal and list the best halal dividend stocks and ETFs for investors who want to diversify their portfolios while investing in halal companies.

If you’re interested in learning more about halal dividend stocks and investment opportunities, then read on.

Are Dividend-Paying Stocks Halal?

Dividend-paying stocks can lie in both halal and haram categories. Specific criteria need to be considered when labelling a stock as a halal dividend stock or halal dividend ETF.

This mainly depends on the company’s business practices, the products they sell, their nature, and how much debt it is under.

If a company has all these criteria meeting the Shariah rulings, it is considered Shariah-compliant. It can therefore be considered a halal option.

Hence, dividend-paying stocks are halal as long as the company does not engage in haram practices.

You can read more on what makes investments halal here and how to choose a halal stock here.

Why do Companies Pay Out Dividends?

Dividends are payments that a business or corporation makes to its shareholders. These dividends come from the profit and revenue that the company generates.

Dividends are a way for investors to gain revenue from the investments that they make in a company. The more dividends a company pays out, the more investors the company will attract.

With these dividends, companies can encourage their investors to stay and continue investing. However, this doesn’t mean that every company pays out dividends and a company that doesn’t pay dividends is bad.

Only companies with a steady revenue can afford to pay out dividends from their profits. Budding businesses usually keep their profits as they need these investments to grow.

When their business grows, the value of their stock increases (also called capital gains), which can be higher than the dividends you receive.

Meanwhile, well-established companies benefit from investors and generate enough revenue to pay a portion of their profits back to investors.

Thus, selecting between capital gains or dividend payments depends if you’re a growth investor, value investor, or dividend investor.

Why are Dividends Halal?

As mentioned above, dividends only come from a company’s profits and have nothing to do with interest. Hence, they are considered halal. However, the company’s business practices and overall debt also determine whether a dividend is halal or haram.

As long as the company you’re investing in generates profits from halal sources, its stocks will be considered Islamically lawful to invest in.

7 Best Halal Dividend Stocks & ETFs to Invest in

- Home Depot

- Johnson & Johnson

- Qualcomm

- Diamondback Energy

- Wahed FTSE USA Shariah ETF

- Wahed Dow Jones Islamic World ETF

- SP Funds S&P500 Sharia Industry Exclusions ETF

| Stock | Ticker | Returns in 2021 | Expense Ratio | Net Assets | Dividend Payout Ratio | Dividend Yield |

| Home Depot | HD | 58.61% | N/A | $131.45b | 43.9% | 2.55% |

| Johnson & Johnson | JNJ | 20.71% | N/A | $61b | 56.2% | 2.55% |

| Qualcomm | QCOM | 20.04% | N/A | $757.3m | 27.5% | 2.22% |

| Diamondback Energy | FANG | 20% | N/A | $23b | 12.7% | 2.17% |

| Wahed FTSE USA Shariah ETF | HLAL | 29% | 0.50% | $164m | N/A | 0.94% |

| Wahed Dow Jones Islamic World ETF | UMMA | N/A | 0.65% | $22m | N/A | 2.51% |

| SP Funds S&P 500 Sharia Industry Exclusions ETF | SPUS | 36% | 0.49% | $132m | N/A | 1.10% |

1. Home Depot

Home Depot is a global retailer that sells home improvement accessories. The company has over 2,298 stores spread across 50 states. These include Puerto Rico, the U.S. Virgin Islands, Guam, the District of Columbia, 10 Canadian provinces, and even Mexico.

The Home Depot stock is one of the most popular halal dividend growth stocks to invest in. The profit margin has increased substantially over the years and currently stands at 10.9%. The dividend yield is 2.55%, and the latest dividend is $1.90 per share.

This stock also currently holds a market value of $304.13 billion.

As the brand operates and expands in North America, Home Depot estimates that it has an addressable market of $900b. They have plans to focus on increasing shopping experiences through digital technologies and more streamlined operations to stand against inflation.

Home Depot has revenue growth of nearly 1.87%, but what makes this stock shariah-compliant? Home Depot’s dividend stock is halal because the company sells garden equipment, lawn products, decor, maintenance and repair tools, and even rental equipment.

The revenue generated from services or products mentioned above is halal and it operates within halal standards.

2. Johnson & Johnson

Johnson & Johnson, AKA JNJ, is a well-known healthcare firm that manufactures medical equipment, medicines, and consumer products. It is a legacy firm that has been in business for almost a century and is among the world’s largest and most diverse health enterprises.

It is one of the only two corporations in the United States with a AAA prime credit rating. The firm, which has a 130-year history, aims to enhance access to affordable goods and healthcare products for many customers.

JNJ is considered a halal dividend stock to invest in because its primary source of income is pharmaceutical products. The company also launched its vaccines for COVID-19, which earned them a lot of revenue.

JNJ generated $2.13 per share on $24.8 billion in revenues in the fourth quarter of 2021. Adjusted profit increased by about 15%, while sales increased by 10%.

The dividend yield currently stands at 2.55% as well.

COVID-19 vaccination sales were excellent and generated $1.62 billion in revenue. As a result, this business now expects to make about $3 billion to $3.5 billion in vaccine sales in 2022.

Overall, Johnson & Johnson’s medical equipment division had the most growth, with revenues increasing by about 18% on a reported basis.

Drug sales increased by more than 14%, while consumer health sales increased by 4%.

Due to this company’s constant efforts to enhance its products through new innovations, it has performed well as a stock and is among the best ones to invest in currently.

The company has cleared screening and is considered one of the best halal dividend stocks to invest in.

The median price target for Johnson & Johnson among the 16 analysts that provide 12-month price projections is $184 with the highest estimate of $215, and the lowest estimate being $163.

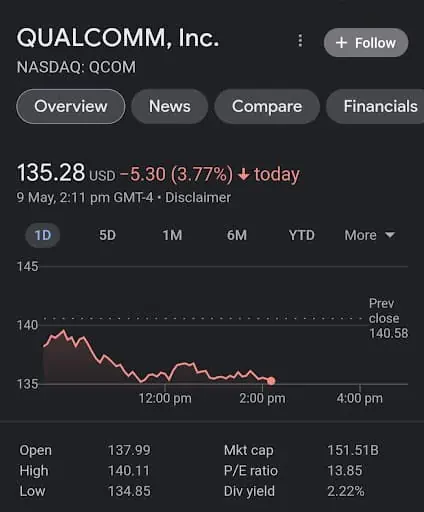

3. Qualcomm

Qualcomm is a company that deals in software, semiconductors, and wireless technology services. It is an American brand that has headquarters in Delaware, San Diego, and California.

The company holds patents to TD-SCDMA, WCDMA, CDMA2000, 3G, 4G, and even 5G. They are experts at mobile communication services and have achieved success by working on these services.

Since the company focuses on mobile communication, software, and artificial intelligence, no haram earnings are involved. This is why the Qualcomm stock is a popular Shariah-compliant dividend.

The reason why Qualcomm’s dividend stock attracts many is not only the halal income; the profit margin is a whopping 27.7%, and the dividend payout ratio stands at 27.5%.

Qualcomm has also backed up the Samsung S22 model launch in many countries by offering its mobile services with the device. It has been predicted that this will lead to a further 70% boost in Qualcomm’s success.

The revenue growth of the Qualcomm stock is 11.03%, while the forward dividend yield is 2.13%. With a market capitalisation of $151.651 billion in 2022, investing in Qualcomm might be a good idea.

4. Diamondback Energy

Diamondback Energy, or FANG, is yet another of the best halal dividend stocks to consider. In a nutshell, it’s an impartial oil and gas business specialising in the purchase, production, and investigation of natural oil and gas deposits.

Its operations are primarily focused in West Texas’ Permian Basin.

Recently, the firm released its fourth-quarter and full-year financial results. To begin with, overall revenue for the quarter was $2.02 billion, up from the $769 million the year prior.

In terms of income, the firm earned $3.63 per share in the most recent quarter, exceeding consensus projections of $3.38. In addition, the energy business raised its annual dividend by 20% to $2.40 per share and returned $515 million in cash to its shareholders.

Due to FANG’s ambitious growth prospects and sustainable financial status, it has great potential as a dividend stock.

5. Wahed FTSE USA Shariah ETF

The FTSE Shariah USA Index was created in collaboration with Yasaar Ltd, an independent consulting firm and renowned authority on Shariah law.

Yasaar Ltd produced a fatwa AKA Islamic legal opinion that recognised the index as Shariah-compliant. Yasaar’s academics come from all of the significant Shariah schools of thought.

The Wahed FTSE USA Shariah ETF or HLAL, which debuted in 2019, is the largest halal ETF in the United States. It invests passively in an index of equities that adhere to Islamic law and is considered a halal dividend ETF.

HLAL is a Sharia-compliant low-cost fund with a 0.50% expense ratio. Furthermore, HLAL surpassed the S&P500 in both 2020 and 2021.

HLAL holds nearly 200 shares in the United States, excluding corporations with excessive debt, extortive institutions, and companies dealing in alcohol, weapons, adult content, pork, gambling, and tobacco.

Major companies like Apple, Tesla, and Johnson & Johnson were their top holdings as of December 31, 2021. Currently, their assets amount to a total of $164 million.

6. Wahed Dow Jones Islamic World ETF

The Wahed Dow Jones Islamic World ETF (UMMA), which debuted in January 2022, invests in Shariah-compliant stocks outside the United States in developed and developing economies. ESG factors are also included in UMMA investments.

Tech companies like TSMC, Samsung Electronics, and Tencent Holdings are among the top holdings of this halal dividend ETF.

To keep themselves shariah-compliant, stocks in firms dealing in alcohol, cigarettes, firearms, pork-based foods, traditional financial services, and adult entertainment are excluded from the fund.

This highly active ETF has a 0.65& expense ratio and manages over $22 million in assets. However, because it is a relatively new addition, there is no data on its returns and general performance. It is too early to assess their returns at this time.

7. SP Funds S&P 500 Sharia Industry Exclusions ETF

SP Funds is a Shariah-compliant finance fund manager. They handle their funds following the guidelines provided by the Accounting and Auditing Organization for Islamic Financial Institutions or AAOIFI. Also, they work with the assistance of Imam Omar Suleiman, their ethical advisor.

The SP Funds S&P500 Sharia Industry Exclusions ETF (SPUS) was launched in 2019 and invested in firms in the S&P500 index. However, this halal dividend ETF excludes companies that do not conform to Islamic law regarding their investments.

Alcohol, gambling, guns, cigarettes, pornography, pork production, and insurance companies are all excluded from SPUS. Furthermore, any company with more than 33% in debt is also excluded from its investments.

SPUS has a 0.49% expense ratio. The fund had around 200 holdings as of December 2021. Apple, Microsoft, and Google were among their leading tech stocks.

Worth noting that, SPUS still outperformed the S&P500 in 2020 and 2021.

Conclusion

We hope we’ve helped you in identifying some of the best halal dividend options.

All you have to do now is sign up for a brokerage account and make your investment.

As many of these options are available in the US markets, you can consider checking out Webull.

If you’re open to more than just stocks and ETFs, you can consider halal REITs. They generally come with higher and more consistent dividend yields.

Otherwise, you can take a look at Sukuk (a halal bond). They don’t pay out dividends per se, but if passive income is what you’re looking for, it’s a great alternative too!

If you’re not confident, you should engage a financial advisor to help you invest instead.