The Aviva MyLifeIncome III has been rebranded to the Singlife Flexi Life Income.

Plan ahead and feel secure with a capital guaranteed annuity policy like the Singlife Flexi Income knowing that you are able to get a stable stream of passive income yearly for life.

Being one of the most popular retirement plan in Singapore, we definitely had to review it.

My Review of the Singlife Flexi Income

The Singlife Flexi Income is a great annuity plan that guarantees your capital after your premium payment period. Not only is your capital guaranteed, but it also grows at 0.25% yearly during your income payout period to counter the effects of inflation (although minimal).

On top of this, you receive cash payouts in the form of guaranteed and non-guaranteed portions.

This means that the money you invested is virtually risk-free as you receive both growth and payouts from this policy.

However, do take note that because it’s capital guaranteed, you receive lesser guaranteed cash benefits as compared to plans that are not capital guaranteed.

In fact, every year you’ll only receive $323 in guaranteed cash benefits yearly, with $1,836 as the non-guaranteed portion. Personally, I only look at the guaranteed portion and regard $1,836 as a bonus for the year.

It may seem meagre, because it actually is. However, when your policy matures, you’ll receive $17,765 in guaranteed cash benefits, $15,643 in capital growth, and your capital back.

This means with a $61,132 investment, you’ll receive $33,408 in guaranteed returns when your policy matures as per the illustration above. And this excludes the non-guaranteed portions of your returns!

Furthermore, you can use your SRS account to make a single-premium investment through the Singlife Flexi Income – an option to boost your retirement income from the money you can’t touch anyway.

Is this plan good?

I think this plan is not for those who are looking for wealth accumulation, capital growth, or even higher retirement income.

If you’re looking for a decent plan that gives you a higher retirement income and willing to take on additional risk, consider the Manulife RetireReady Plus III instead.

However, if you’re someone who needs the safety provided by the capital guaranteed feature, or already has investments and will require some form of supplemental retirement income, then the Singlife Flexi Income is something you should definitely consider.

Otherwise, you might want to check out other policies in our best annuity plans in Singapore comparison.

In that list, we took into consideration real-life scenarios, goals, and challenges that our readers share with our partners to create categories that most Singaporeans are able to relate with.

For instance, looking for the highest guaranteed payouts, a flexible retirement plan, and also one that’s filled with features?

The NTUC Income Gro Retire Flex Pro has been the most popular amongst our readers.

Singlife’s Flexi Retirement has also won 5 different categories in our list – and for many reasons.

Because there are so many considerations to take note of, it’s difficult to highlight which is the best retirement plan for you.

That’s why we always recommend reading our comparison post to understand the alternatives you have before pulling the trigger.

Next, you should seek a second opinion to whether the Singlife Flexi Life Income is truly the best for you or whether there are better options.

If you need someone to get a second opinion from, we partner with MAS-licensed financial advisors who are more than happy to assist.

Now let’s explore the Singlife Flexi Life Income in more detail.

Criteria

The following table shows the age range whereby you can apply for the Singlife Flexi Income plan, depending on your desired premium payment period.

| Premium payment term (years) | Premium paid with monies besides SRS (Age) | Premiums paid with SRS (Age) |

| Single | 1 to 70 | 19 to 70 |

| 3 | 1 to 70 | Not Applicable |

| 5 | 1 to 70 | Not Applicable |

| 10 | 1 to 65 | Not Applicable |

| 15 | 1 to 60 | Not Applicable |

| 20 | 1 to 55 | Not Applicable |

| 25 | 1 to 50 | Not Applicable |

As you can see, payments made by SRS are only applicable for single premium payments.

For premium payment methods other than SRS the minimum age is 1 and thus you are able to purchase this policy for your child.

Features

Policy Terms

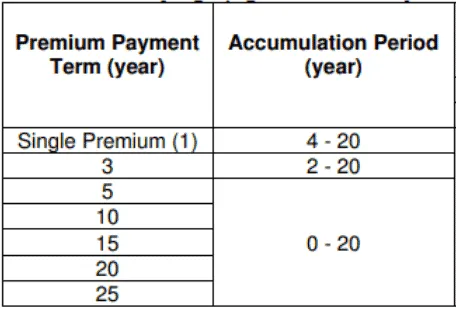

With Singlife Flexi Income, you have the opportunity to choose a premium payment term of 3, 5, 10, 15, 20, or 25 years. Should you have the financial capability to do so, you may also opt for a single premium.

Except for the single premium payment option, you are able to decide on your desired premium payment frequency as follows.

- Monthly

- Quarterly

- Half-yearly

- Yearly

You are also able to select your desired accumulation depending on the payment term you have chosen as shown below.

The Accumulation Period is the duration from the end of your premium payment term till you receive your first Yearly Income payout.

Premium Allocation

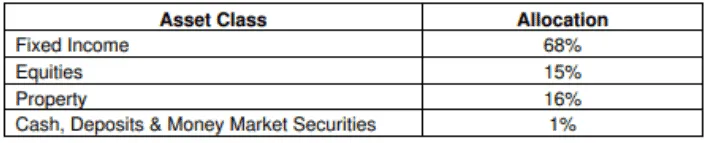

As the Singlife Flexi Income is a participating endowment plan, part of your premiums is used to purchase fund units.

As of 31st December 2019, the allocation of your premiums is as shown in the table below.

Premium Payment Options

The following table displays the possible methods you can use to pay your policy’s premiums.

| Payout Options Types | Single premium payment term | 3, 5, 10, 15, 20, 25 year premium payment term |

| Monies | Cash, Cheque, Bank Draft |

|

| SRS | Possible | Not Possible |

Payout Options

Payouts under the Singlife Flexi Income are paid out to you yearly starting after your Accumulation Period.

Of course, any amount that is owed to Singlife will first be deducted from your payout.

You shall receive the following in your Yearly Income payout:

- Guaranteed Cash Benefit (0.95% of the Sum Assured); and

- Any non-guaranteed Cash Bonus

As with most endowment policies, you can choose to receive the Yearly Income from Singlife or choose to invest this amount back with the company. However, the reinvestment interest rate is non-guaranteed and is set by Singlife.

If you have paid your policy’s single premium with your SRS, the Yearly Income payout will also be paid back to your SRS account.

Naturally, there will no longer be any Yearly Income paid out at the earliest of when the insured person passes away, is diagnosed with a terminal illness (TI), or policy termination. However, you will receive the death benefit (more on this later).

Bonus features

The bonuses provided by Singlife under Singlife Flexi Income are mainly from surpluses earned from the participating fund.

Cash Bonus

So long as your policy is in effect after the accumulation period, you may be entitled to cash bonuses that are calculated based on a rate. This cash bonus rate would have to be declared by Singlife.

If announced, this cash bonus is one of the components of your Yearly Income payouts and may be paid yearly.

However, as with all bonuses, they are not guaranteed and would be dependent on how well the policy’s participating fund fares.

Booster Bonus

Your Booster bonus will be paid out to you every year together with your Yearly Income, under the same payment method you have chosen. This bonus is also determined by a Booster bonus rate.

This Booster bonus will be paid out to you starting from the later policy anniversary of:

- you turning 60 years old; or

- 20 policy years after the end of your accumulation period.

Likewise, the bonus is based on how the participating fund performs and is paid out only when declared by Singlife.

In the event that the insured person passes away or suffers from TI, this Booster bonus will cease moving forward. Of course, if your policy is terminated the bonus will be stopped too.

Terminal Bonus

Upon the death of the insured person, the death benefit will be paid out earlier due to TI, or the surrender of your policy, you might be able to receive a non-guaranteed terminal bonus.

This Terminal bonus is also not guaranteed and only paid out to you if declared by the company at their determined rate.

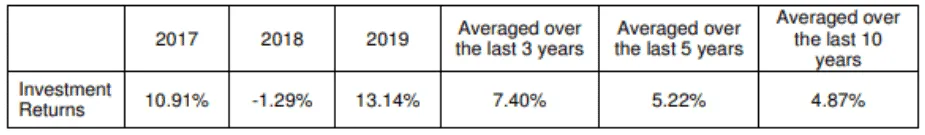

Past rate of return of the investment

The following table shows the net past return rate of the participating fund, whereby the expenses have already been subtracted.

Protection

Death Benefit

At the onset of the insured person’s death, the following amount will be paid out.

The payout will include the higher of:

- 101% total premiums you have paid (does not include advance premiums or premiums paid for riders); or

- Your Guaranteed Cash Surrender Value

Furthermore, you shall also receive any declared Terminal bonus.

If you have previously chosen to reinvest your Yearly income and Booster bonus back with Singlife, this value plus any interest accumulated shall be paid out to you at this time.

For all mentioned payouts above, any amount owing to the company will first be deducted.

Terminal Illness (TI) benefit

If you are deemed to be suffering from a TI, the death benefit shall be paid out to you in advance as your TI benefit.

According to Singlife, TI refers to a conclusive diagnosis of a sickness whereby the insured is predicted to pass away within a year from the diagnosis date.

The TI has to be diagnosed by a specialist and confirmed by another registered medical practitioner appointed by the company.

Flexibility

Policy Loan

With your Singlife Flexi Income plan, you have the option to take on a loan from your policy. You can borrow a maximum of 65% of your Cash Surrender Value net of any amounts owed to Singlife, at a non-guaranteed interest rate.

However, you will also have to abide by the minimum loan amount and policy loan rate set at that point in time.

Do note that if you have paid your premiums with your SRS monies, you will not be eligible for this policy loan option.

Surrender/Ending the Policy

In the case where you decide to surrender your policy totally, you shall receive a Cash Surrender Value in a round sum. Of course, by surrendering your policy you are effectively terminating your plan as well.

Besides fully surrendering your plan, you also have the choice to surrender part of your plan to receive some of your Cash Surrender Value.

However, be mindful that with a partial surrender, your sum assured will be reduced accordingly, which lowers your Yearly Income and Booster Bonus during your income payout period as well

Similarly, if you have made your premium payments with SRS monies, the Cash Surrender Value lump sum will also be returned to your SRS account.

The table below displays when your plan will get a cash value based on the payment duration you have picked.

| Premium payment term | When does my policy acquire a cash value? |

| Single | Upon policy commencement and the receipt of your single premium. |

| 3 years | From the beginning of your 2nd policy year |

| 5, 10, 15, 20, 25 years | From the beginning of your 3rd policy year (Provided you pay your premiums regularly and on time. |

Singlife Flexi Income Surrender Value

Your full surrender value comprises your guaranteed Cash Surrender Value and any Terminal bonus declared.

The guaranteed Cash Surrender Value you shall receive is equal to your total premiums paid as at the earliest of:

- The end of your accumulation period; or

- The end of your 8th policy year (Only for single premium payment); or

- The end of your 13th policy year (For 3-year premium payment term); or

- The end of your 15th policy year (For 5, 10, or 15 years premium payment term); or

- The end of your 25th policy year (For 20 or 25 years premium payment term)

Beginning from the 5th policy year after your accumulation period ends, your guaranteed Cash Surrender Value will compound at a rate of 0.25% per annum

Typically, terminating any life insurance policies early would incur high fees which would first be deducted from your total surrender value before payout to you.

Hassle-free Application

There is no medical underwriting required under this policy making it hassle-free to apply for.

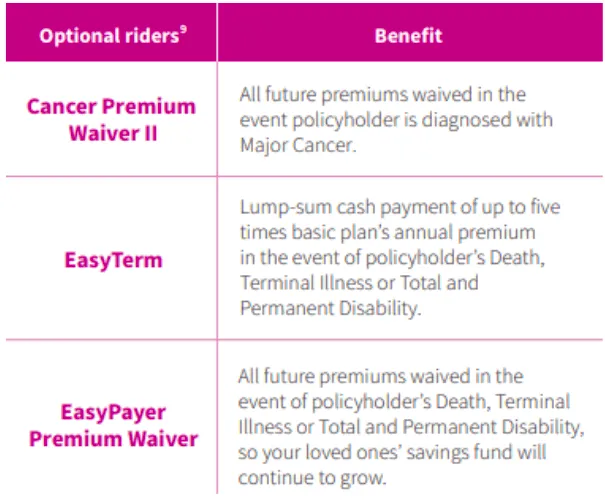

Coverage Add-ons (Riders)

You have the choice to add on the riders as shown in the table below for additional security and peace of mind.

Besides these riders, you may also speak to your trusted certified financial advisor for more riders you can consider attaching to your plan.

Fees and charges

You will be happy to note that there are essentially no fees and charges for the policy as the minimum premium amounts mentioned above are net, meaning that the fees and charges have already been factored in beforehand.

How much will I receive upon maturity of the Singlife Flexi Income?

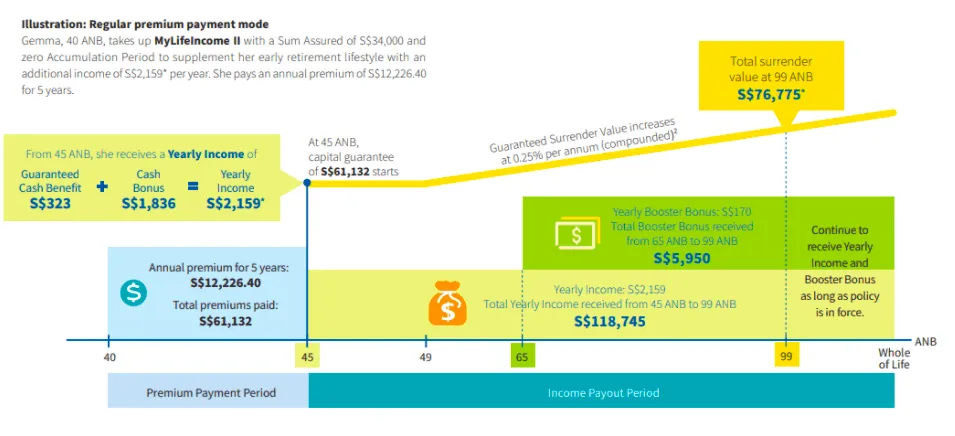

The plan above is under the assumption that the participating fund is performing at a 4.75% rate of return (ROR).

In the scenario where you don’t make any withdrawals and accumulate the full amount, save S$12,226.40 yearly, choose the 5-year payment term and accumulate your funds for 20 years, you will receive a total potential Yearly Income sum of S$118,745 upon turning 99 years old.

You may also receive any Booster bonus declared by Singlife. You will begin receiving your Yearly Income at the age of 45, which will be S$2,159 as seen in the diagram.

Below are the calculations:

Total Premiums Paid: S$12,226.40 x 5 years = S$61,132

Total Sum of Yearly Income to be received: | |

| Guaranteed (Cash Benefit): | S$323 x 55 years = S$17,765 |

| Non-guaranteed (Cash Bonus): | S$1,836 x 55 years = S$100,980 |

| Total: | S$17,765 + S$100,980 = S$118,745 |

From the age of 45, your premiums paid of S$61,132 will become guaranteed and will grow at the rate of 0.25% per annum. This shall be your guaranteed Surrender Value.

The total sum of Non-Guaranteed Booster bonus: S$5,950 (from age 65 to 99)

*Yearly payouts starting from the 20th policy year after your accumulation period ends.

In the case that you decide to fully surrender your policy at age 99, you would have or shall receive a complete figure of S$201,407, as broken down below.

| Guaranteed: | S$17,765 (Cash Benefit) + S$76,775 (Surrender Value) |

| Non-guaranteed: | S$100,980 (Cash Bonus) + S$5,950 (Booster Bonus) |

| Total Received: | S$17,765 + S$76,775 + S$100,980 + $5,950 = S$201,407. |