The AIA Smart Wealth Builder (II) is a long-term participating endowment plan that can help you grow your money.

For those who are considering long-term savings plans, this may be the answer to your needs!

Apart from providing you with a lump sum payout that helps you to tackle issues requiring large sums of money, you are also given the option to appoint a Secondary Insured to continue with the policy as a form of legacy planning.

To determine if this is the right policy for you, we have written up a detailed review highlighting the AIA Smart Wealth Builder (II) features.

Continue reading to find out more!

My Review of the AIA Smart Wealth Builder (II)

With the AIA Smart Wealth Builder (II), you can save money over the long term and potentially earn higher returns through AIA’s participating fund.

Upon surrender or maturity, you will receive a guaranteed cash value alongside additional non-guaranteed bonuses before you reach the age of 125.

With protection against the 3 major scenarios of death, total and permanent disability, and terminal illness, you can be sure that your loved ones will be well protected financially should there be any unforeseen circumstances.

In addition, you also have the choice of signing up for the optional rider, which can protect you against a list of early critical illnesses which would otherwise rake up huge amounts of medical costs.

Those with children can also use this plan as a form of legacy planning through the secondary insured benefit.

Ultimately, this plan also offers you a lot of financial stability by offering you various payment terms to suit your needs and guaranteeing your capital after a stipulated time frame.

However, this policy may not be suitable for you if you seek a policy that provides you with a regular payout, considering that the AIA Smart Wealth Builder (II) is a lump sum payout policy.

If regular payouts are what you’re looking for, check out annuity plans instead.

Those interested in other forms of coverage, such as personal accident or life coverage, may not find this policy attractive, considering the different types of protection offered.

However, the AIA Smart Wealth Builder (II) did not make the cut in our list of the best savings plans in Singapore.

Based on our comparisons, there are other policies that offer more flexibility, features, and better fund performance.

For example, the Singlife Flexi Income is the best endowment plan, while the AIA Smart Flexi Growth is the best for the highest potential returns.

With that said, it is always important that you consider your needs and financial capability before making any long-term commitments.

Because what may be good for some might not be good for others.

And with a policy like the AIA Smart Wealth Builder (II), you’re going to be saving for the next 20 years. You want to make sure you choose the best for your needs right now.

The last thing you want is to invest in a policy that doesn’t meet your needs or find out that there are better alternatives in the market at the point of purchase.

This is why we always recommend our readers get a second opinion from an unbiased financial advisor before purchasing any insurance policies.

If a second opinion is what you’re looking for, we partner with MAS-licensed financial advisors who have helped hundreds of others in similar situations as you right now.

They’re happy to assist you in finding out if the AIA Smart Wealth Builder (II) is the best for your needs or if there are better choices.

Interested?

Click here for a free non-obligatory second opinion.

Criteria

- Premium payment terms: Single, 5, 10, 15, or 20 years

- Minimum premium of $1,500/year

- No medical underwriting required

General Features

Policy Terms

Considering that the AIA Smart Wealth Builder (II) is a long-term policy, the plan matures once the original insured person (yourself) reaches the age of 125.

The long policy term of 125 years also means that it is likely to be passed down to the next generation.

Premium Payment Terms

The AIA Smart Wealth Builder (II) allows you to select between the premium payment terms of a single premium, 5, 10, 15, or 20 years.

The minimum premium payable would then depend on the premium payment term selected.

| Premium Payment Term | Minimum Premium |

| Single Premium | S$20,000 Cash; or

S$15,000 SRS |

| 5 years | S$4,800 |

| 10 years | S$3,600 |

| 15 years | S$2,400 |

| 20 years | S$1,500 |

It is important to note that premiums for the AIA Smart Wealth Builder (I) plan are payable in USD, whereas the premiums for the AIA Smart Wealth Builder (II) plan are payable in SGD.

For coherence, the rest of this article will be written in SGD.

However, those who select the AIA Smart Wealth Builder (I) plan should note that only the single and 5-year premium payment terms are available.

Premium Allocation

Policyholders more interested in how your money is managed will be glad to know that it is invested in a participating fund managed by AIA’s very own investment arm.

As of 31st December 2021, the target and actual investment proportions are as such:

| Type of Assets | Target Allocation | Actual Allocation |

| Bonds | 64% | 64% |

| Risky Assets

(Common Stocks, Private Equity, etc.) |

36% | 36% |

| Total Assets | 100% | 100% |

Payout Options

Maturity Benefit

Once the original insured person has turned 125 years old, the policy will mature.

You will receive a lump sum payout comprising the guaranteed cash value and any bonuses added to your basic policy that have not been surrendered.

However, any amounts owed to AIA will also be deducted from this lump sum, and your policy will be deemed terminated.

Surrender Benefit

In the event that you require a lump sum of cash before the policy matures, you are also allowed to surrender your policy fully or partially.

For partial surrender (or withdrawal), the insured amount, future premiums payable (if any), and benefits will be adjusted according to AIA’s terms and conditions.

For full surrender, the policy will be automatically terminated.

However, any early surrender of the policy will also be subject to high costs, and it would be recommended that you reserve some liquid funds on the side to avoid an early surrender should you require cash flow.

Check your policy documents or with your financial advisor to determine your surrender charges.

Protection

Death Benefit

Should the insured pass away, their loved ones or beneficiaries are eligible to receive a lump sum payout under the death benefit.

This amount of benefit payable will be calculated based on the higher of the following options:

- 105% of the total premiums paid for the policy, including any premiums that were waived based on the insured amount (if any); or

- 101% of the policy’s guaranteed cash value, including any unsurrendered bonuses.

However, any outstanding amounts owed under the policy will be deducted before AIA makes this lump sum payout, and the policy will be deemed terminated.

However, it is important to note that AIA will only refund the premiums paid without interest if the insured takes their own life (regardless of sanity) within 1 year of the policy issue or reinstatement date, and no other payouts will be made.

Total & Permanent Disability (TPD) Benefit

For all insured persons, the total and permanent disability (TPD) benefit will be immediately paid out in the event of the following circumstances:

- Total and irrecoverable loss of sight of both eyes; or

- Loss by complete severance or the total and irrecoverable loss of use of 2 limbs at or above the wrist or ankle; or

- Total and irrecoverable loss of sight of 1 eye; and

- Loss by complete severance of 1 limb at or above the wrist or at or above the ankle; or

- Total and irrecoverable loss of use of 1 limb at or above the wrist or at or above the ankle.

If the insured suffers a TPD not listed above before their 70th birthday, the death benefit is paid as a single payment, and the policy terminates.

However, a physician or specialist must verify and certify this TPD diagnosis.

To receive the TPD benefit before the insured reaches 65 years old, the insured has to be incapable of earning any income consecutively for 6 months, with no possible improvements for an indefinite time.

If the insured is between the ages of 65 and 70, they would have to be incapable of performing at least 2 of the 6 activities of daily living and would require another person’s assistance for 6 consecutive months with no foreseeable improvements for an indefinite time.

The 6 activities of daily living would include:

- Transferring between a bed and a chair or a wheelchair

- Moving indoors from room to room

- Using the toilet while managing bowel and bladder functions to maintain a satisfactory level of personal hygiene

- Dressing and undressing clothes, braces, artificial limbs, and other surgical appliances

- Entering and exiting the toilet, alongside taking a bath or shower

- Consuming food that has been prepared

However, the TPD will not be paid out if the TPD arises from deliberately endangering oneself (including law violations and suicide), engaging in warlike operations, or participating in aerial activities not by commercial passenger airlines or the Republic of Singapore Air Force.

Terminal Illness Benefit

If the insured person is diagnosed with an illness likely to lead to their passing within 12 months of a specialist’s diagnosis (and confirmation by AIA’s appointed physician), the death benefit specified in the policy will be paid out.

However, you will not be eligible for the terminal illness benefit if the symptoms first occurred before the issue date or if the diagnosis is within 30 days of the policy issue or reinstatement date.

Nonetheless, an exception will be made if the pre-existing illness or condition was declared during the policy application and AIA still accepted the application.

In addition, the terminal illness benefit will also be withheld if the terminal illness arises due to Acquired Immunodeficiency Syndrome (AIDS) or infection by any Human Immunodeficiency Virus (HIV).

Key Features

Capital Guarantee

For those who purchase the AIA Smart Wealth Builder (I) policy, your capital will be guaranteed from the end of the 13th policy year.

However, for those who purchase the AIA Smart Wealth Builder (II) policy, your capital will be guaranteed slightly later, at the end of the 15th policy year (for single, 5, and 10-year premium payment terms).

Those who opt for the 15 or 20-year premium payment terms for the AIA Smart Wealth Builder (II) policy will have their capital guaranteed at the end of the 20th and 25th policy year, respectively.

Secondary Insured Option

While the policy is active, the original policyholder can choose to appoint a secondary insured person for the continuity of the policy in the event of the insured’s passing.

However, if the insured passes away, the secondary insured will assume the position of the new insured and the policy will continue, meaning that the death benefit will not be paid out.

In fact, the death benefit will only be paid out upon the passing of the new insured.

Those who plan on appointing a secondary insured note that the maturity date will remain unchanged, but any optional riders attached will be terminated.

Any premium payments will still remain payable to AIA.

AIA also mentions that only the original policyholder can appoint a secondary insured person, regardless of whether it happens during the policy application process or the policy term.

If you wish to appoint a secondary insured, only the original policyholder or his spouse or child (below the age of 16) can be appointed.

For AIA to recognise the appointment:

- The secondary insured must not be above the age of 50 (at the point of appointment);

- The policy must not already have a beneficiary nominated;

- There must not be a trust created under this policy; and

- The original policyholder and insured must be alive.

Reversionary Bonus

The RB (Reversionary Bonus) is a discretionary bonus that may be added to your policy every year, depending on the performance and experience of the participating fund.

Once the RB is declared and credited to your policy, it becomes guaranteed and will not be affected by any revisions in the following years.

However, if you decide to surrender your policy before it matures, the amount of RB you are entitled to will be a proportion of the total RB amount accumulated until that point.

The RB rates are determined by the Investment Rates of Return (IRR), which can be illustrated below, but it also depends on the future outlook of the participating fund.

| Policy Year | RB Rate | |

| Illustrated IRR of 4.25% p.a. | ||

| Yearly

(Starting From the End of the 3rd Policy Year) |

Per S$1,000 Basic Sum Insured | S$6 |

| Compounding Annually At | 2.50% | |

Terminal Bonus

On the other hand, the terminal bonus (TB) is a non-guaranteed additional bonus that may be paid out when a claim is paid, when the policy matures, or when the policy is surrendered.

The amount of TB you will get will also depend on the performance of the participating fund.

Likewise, the TB rates are also determined by the IRR, which can be illustrated below.

| Policy Year | TB Rate | |

| Illustrated IRR of 4.25% p.a. | ||

| 3 to 9 | TB as a % of Accumulated RB on Claim / Maturity | 20% to 20% |

| TB as a % of Surrender Value of Accumulated RB on Surrender | ||

| 10 to 20 | TB as a % of Accumulated RB on Claim / Maturity | 20% to 169% |

| TB as a % of Surrender Value of Accumulated RB on Surrender | ||

| 21 to 30 | TB as a % of Accumulated RB on Claim / Maturity | 181% to 260% |

| TB as a % of Surrender Value of Accumulated RB on Surrender | ||

| 31 to 40 | TB as a % of Accumulated RB on Claim / Maturity | 266% to 317% |

| TB as a % of Surrender Value of Accumulated RB on Surrender | ||

| 41 to 50 | TB as a % of Accumulated RB on Claim / Maturity | 325% to 381% |

| TB as a % of Surrender Value of Accumulated RB on Surrender | ||

| 51 and Above | TB as a % of Accumulated RB on Claim / Maturity | More than 385% |

| TB as a % of Surrender Value of Accumulated RB on Surrender | ||

AIA Smart Wealth Builder (II) Fund Performance

Past Investment Rate of Return

For those who are purchasing this policy as a form of investment or savings, it is crucial that you understand how the fund is performing before you subscribe to this long-term commitment.

As mentioned before, the premiums that you pay for this policy are invested into a participating fund managed by AIA’s very own investment arm.

To better grasp the situation, this is how the participating fund has performed over the last few years.

| 2019 | 2020 | 2021 | Average of Last | |||

| 3 Years | 5 Years | 10 Years | ||||

| Investment Returns | 9.9% | 8.8% | 2.3% | 6.9% | 6.1% | 5.6% |

Accurate as of 31 December 2021.

However, it is also important to note that the fund’s past performance may not be indicative of its future performance.

Nonetheless, it is evident that the participating fund has consistently performed well over the years, maintaining an average return of more than 5%.

Past Total Expense Ratio

Apart from the past IRRs, it is also important for you to understand the fund’s past total expense ratio (TER).

Since the TER reflects the percentage of the total expenses incurred by the participating fund in relation to its assets, a higher-than-normal TER would impact the non-guaranteed benefits you may receive from the policy.

Likewise, the table below illustrates the participating fund’s TER over the past few years.

| 2019 | 2020 | 2021 | Average of Last | |||

| 3 Years | 5 Years | 10 Years | ||||

| Total Expense Ratio | 1.7% | 1.5% | 1.4% | 1.6% | 1.6% | 1.6% |

While the past performance of the fund may not be indicative of its future performance, it is evident that the participating fund has been consistent in maintaining its TER over the past years.

Since lower expense ratios indicate that a larger portion of the fund’s returns will be passed on to investors, it is also important that you compare the expense ratios of participating funds across different insurers to determine if AIA is the company you wish to pursue a policy with.

Here is how AIA has been performing against other companies of similar stature.

From the above figures, it is clear that AIA has been performing way better than the market average, putting them as the company with the 3rd best average expense ratio.

Optional Riders

Early Critical Protector Waiver of Premium (II)

For those who are more worried about critical illnesses outside of the policy’s general protection features, fret not!

This policy also gives you the option of adding this benefit, ensuring your covered benefits remain active should you be diagnosed with an early critical illness.

This rider also includes the waiver of premiums payable for the covered and supplementary benefits if the insured suffers an early critical illness.

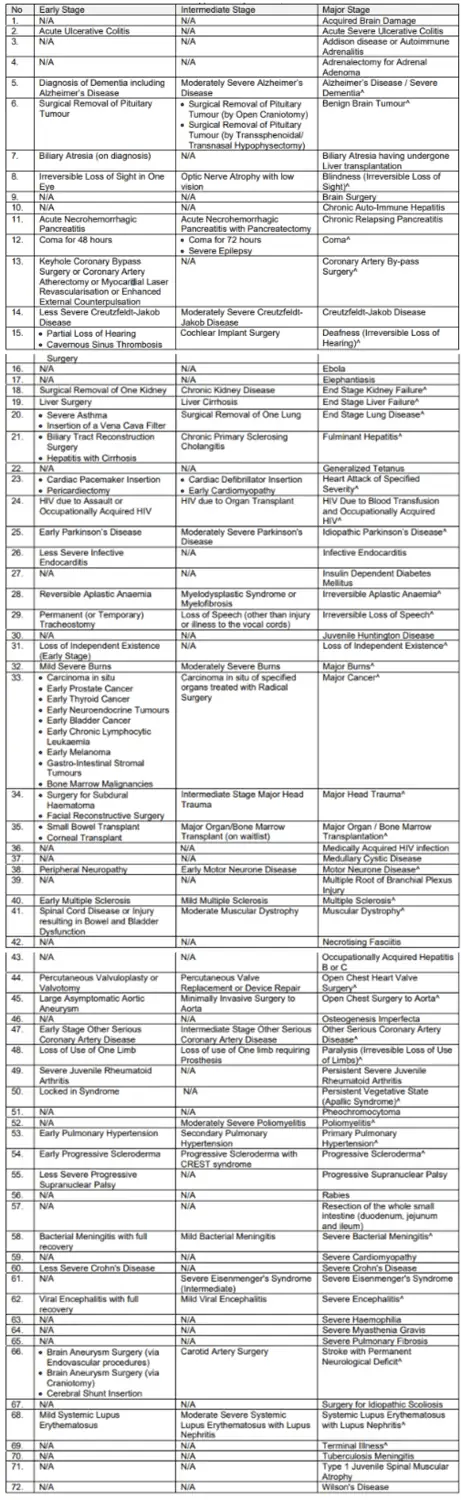

If you are wondering which conditions are covered under this additional rider, you may refer to the table below for more details:

You should note that premium rates for this rider are not guaranteed and are revised occasionally.

However, those with an existing AIA Vitality Status are also eligible for premium adjustments for this optional rider.

| Vitality Status | Cumulative Premium Percentage Applied at Inception of this Supplementary Benefit | Annual Premium Adjustment Percentage |

| Bronze | 95% | +2% |

| Silver | +1% | |

| Gold | -1% | |

| Platinum | -2% |

The ‘Cumulative Premium Percentage Applied at each Policy Anniversary’ can be calculated as such:

Cumulative Premium Percentage Applied at each Policy Anniversary

= Cumulative Premium Percentage Applied at the Inception of this Supplementary Benefit or the Policy Anniversary Immediately Before the Current Policy Anniversary (Whichever is Later) + Annual Premium Adjustment Percentage

For example, if you hold a Gold AIA Vitality Status, the Cumulative Premium Percentage Applied at each Policy Anniversary will equal to 95% + (- 1%) = 94%.

At the next policy anniversary, the Cumulative Premium Percentage Applied at each Policy Anniversary will equal 94% + (- 1%) = 93%.

However, it is important to note that the cumulative premium percentage at any policy anniversary will have a minimum and maximum cap of 85% and 100%, respectively.

Additionally, if you don’t have an AIA Vitality Status 45 days before the policy anniversary (due to termination), you must pay the full premium for the optional rider.

AIA Smart Wealth Builder (II) Fees and Charges

Under this policy, any expenses incurred by the plan, such as agent fees, participating fund taxes, and other expenses, can be charged to the policy.

However, all of these fees and charges have already been included in the calculation of the regular premium payments, and there will be no extra or hidden charges that you would be liable for.

An Illustration of How the AIA Smart Wealth Builder (II) Works

Introducing Mr Chris, a 25-year-old working adult who has decided to buy the AIA Smart Wealth Builder (II) at a premium of S$6,000 per year for 5 years.

This plan allows him to decide when to make a full or partial withdrawal or if he wants to hold the policy to maturity.

| Policy Year | Age | Sequence of Events | |

| Chris | Doris | ||

| 0 | 25 | – | Chris purchases the policy. |

| 5 | 30 | – | Premium payment ends.

(Total Premiums Paid = S$30,000) |

| 10 | 35 | 0 | Chris becomes a father and appoints his newborn daughter, Doris, as the secondary insured for the policy. |

| 15 | 40 | 5 | 100% capital is guaranteed. |

| 20 | 45 | 10 | Illustrated IRR of 4.25% p.a.:

Illustrated Cash Value = S$53,340 (1.8x Total Premiums Paid) Chris could use the cash value to fund Doris’s education. However, Chris chooses to hold the policy to continue growing the policy’s cash value. |

| 35 | 60 | 25 | Illustrated IRR of 4.25% p.a.:

Illustrated Cash Value = S$96,833 (3.2x Total Premiums Paid) Chris could use the cash value to spend on some of his retirement goals. However, he still has some cash savings left and leaves the policy untouched until he passes away. |

| When Chris passes away, Doris continues as the new insured. | |||

| 50 | 75 | 40 | Illustrated IRR of 4.25% p.a.:

Illustrated Cash Value = S$168,409 (5.6x Total Premiums Paid) Doris decides to leave the policy untouched as she does not need the funds urgently. |

| 65 | 90 | 55 | Illustrated IRR of 4.25% p.a.:

Illustrated Cash Value = S$292,381 (9.7x Total Premiums Paid) Doris decides to surrender the policy. |

Summary of the AIA Smart Wealth Builder (II)

| Cash & Cash Withdrawal Benefits | |

| Cash Value | Available |

| Cash Withdrawal | No |

| Health & Insurance Coverage | |

| Death | Available |

| Accidental Death | Available |

| TPD | Available |

| Terminal Illness | Available |

| Critical Illness | Yes, with ECI rider |

| Early Critical Illness | Yes, with rider |

| Health & Insurance Coverage Multiplier | |

| Death | N/A |

| TPD | N/A |

| Terminal Illness | N/A |

| Critical Illness | N/A |

| Early Critical Illness | N/A |