The AIA Smart Flexi Growth is a participating endowment plan designed to help you save for long-term milestones.

In this post, we comprehensively reviewed the AIA Smart Flexi Growth to help you decide if it’s the right plan to meet your needs.

Keep reading!

My Review of the AIA Smart Flexi Growth

The AIA Smart Flexi Growth assures you that your savings are protected and guaranteed when it matures – perfect if you’re risk-averse.

You can enjoy the convenience of customising your savings policy to match your unique needs by choosing your preferred payment period and policy term.

With this plan, you can secure your loved ones’ financial future thanks to the death benefit and the addition of riders to your policy to enhance protection.

On the downside, even though capital guarantee is an attractive feature of AIA Smart Flexi Growth, it applies only for 5-year & 10-year premium payment period options.

Also, there aren’t many features offered by the basic policy. For example, you can’t temporarily freeze premium payments in difficult times (like job retrenchments), change the life insured, or appoint a secondary life assured like the Manulife ReadyBuilder.

You also can’t make any partial withdrawals and must surrender in full – which many other endowment plans like the NTUC Income Gro Saver Flex Pro and the Singlife Choice Saver allow partial surrenders.

Whereas AIA Smart Flexi Growth has multiple advantages, it’s good to explore other options on the market regardless of the policy you choose.

I recommend starting with our post comparing the best endowment plans in Singapore and speaking with other financial advisors to explore your other options.

And if you’re about to commit to a policy with up to 30 years worth of premiums, it becomes even more crucial to compare and find the best plan for yourself.

If you’re interested in potentially finding an alternative endowment plan, we partner with unbiased financial advisors to help you find the best plan for your needs.

Click here for a free comparison session.

Here’s more on the AIA Smart Flexi Growth:

Criteria

- Minimum premium payment term of 5 years

- Minimum policy term of 15 years

General Features

Policy Terms

AIA Smart Flexi Growth policy offers a somewhat flexible policy term based on your selected premium payment term to meet your specific needs:

| Payment Period | Coverage Period |

| 5 years | 15 to 30 years |

| 10 years | 20 to 30 years |

| 15 to 30 years | Same as the premium payment term |

Protection

Maturity Benefit

Upon maturity, you will receive your guaranteed maturity amount and any bonuses added to your basic policy after deducting any amounts you owe under your policy.

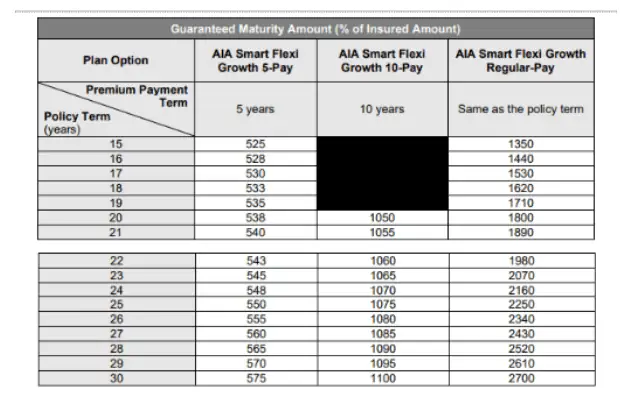

The maturity benefit depends on the premium payment term and policy term you have chosen, as shown in the following table:

Your policy automatically ends on the maturity date.

The Insured Amount equals the Annual Premium before any discounts for large case sizes.

This amount is not the death benefit; rather, it helps determine the Guaranteed Maturity Amount and bonuses associated with the policy.

Death Benefit

In the unfortunate event of death, the policyholder’s beneficiaries will receive 101% of the total premium paid or guaranteed cash value, including any bonuses earned on the basic policy.

Debts and outstanding charges are deducted, and the policy automatically ends.

The policy is also automatically terminated upon the death of the insured.

Add-On Riders

You can enhance your coverage with optional riders to provide additional coverage and protection against risks.

Premium Waivers

You can secure your future with the AIA Smart Flexi Growth plan and enjoy peace of mind knowing that your premiums and eligible riders, will be waived under the most challenging circumstances.

With their premium waiver riders, you will be protected against any of the 149 early, immediate, or early-stage critical illnesses through the Early Critical Protector Waiver of Premium (II) rider.

Alternatively, you may choose the Critical Protector Waiver of Premium (II) rider to cover you for 72 major critical illnesses.

These riders help ensure the policyholder can focus on recovery without financial stress.

Securing your child’s future

With eligible riders, your child’s premiums will be waived up to their 25th birthday.

This is only should they be diagnosed with any of the covered:

- 149 early, immediate, or major-stage critical illnesses,

- Total and permanent disability, or

- Upon the passing of the policyholder

with the Early Critical Protector Payor Benefit (II) rider.

Key Features

Full Surrender

You may fully surrender your policy for its cash value before maturity.

Subsequently, any debts and fees are deducted, and the policy automatically ends.

Please note that cancelling a life insurance policy ahead of time can have significant repercussions.

Not only are there expenses associated with early termination, but your premiums also may not be reimbursed. .

Reversionary Bonus

The reversionary bonus (RB) is an annual bonus that can be credited to your policy depending on the performance of the participating fund.

This discretionary reward provides you with additional returns and long-term value over time.

Here is a table illustrating the RB rate with an Investment Rate of Return (IRR) of 4.25% per annum:

| Plan Option | RB Rate Per Annum |

| 5-pay | $45 per $1,000 insured amount. The compounding is at 4.5%. |

| 10-pay | $60 per $1,000 insured amount. The compounding is at 6.0%. |

| Regular-pay | $80 per $1,000 insured amount. The compounding is at 8.0%. |

Note: Past performances do not predict nor guarantee future results.

Once the RB has been declared and the proceeds are credited to your account, it forms part of your guaranteed returns.

Therefore, any subsequent revisions will not affect it.

But if you ever decide to surrender your policy, you’ll still get a proportionate surrender value of the accumulated RB.

Do note that certain criteria must be met before the RB can be surrendered, and any debts owed to the company under your policy will be deducted from the payouts.

Terminal Bonus

TB stands for Terminal Bonus, a non-guaranteed discretionary bonus that may be payable upon death, surrender, or maturity.

In essence, this bonus boosts the return on investment of your policy and adds extra value above any other bonus.

Whereas the Illustrated Investment Rate of Return is not guaranteed, the actual Investment Rate of Return will depend on the returns the participating fund earns.

Additionally, any bonus rates used in benefits illustrations are not guaranteed and may vary according to future fund performance.

All guaranteed benefits, including bonuses already credited to your policy, will still be provided regardless of future fund performance.

Future bonuses, including the annual and terminal bonuses, are not promised and will be regulated according to the performance of the participating fund.

AIA Smart Flexi Growth Par Fund Performance

Because the AIA Smart Flexi Growth is a participating endowment plan, your premiums are used to purchase fund units.

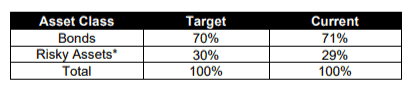

Firstly, it is important to note what asset classes your premiums are invested in.

As of 31st December 2021, your premiums are allocated as shown in the table below:

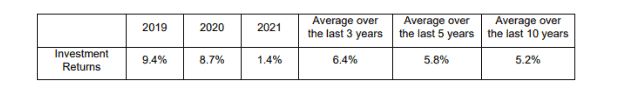

The following table shows the past net returns of the participating fund, whereby the expenses have already been subtracted.

As you can see, the average rate of return has been above 5% over the last 5 and 10 years.

Fees and Charges

You will not incur additional fees when you save with the AIA Smart Flexi Growth.

These fees and charges are already incorporated in the premium computation and will not be an additional or separate cost to you.

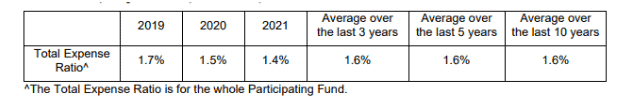

Total Expense Ratio (TER)

The TER is the ratio of expenses the fund incurs to its assets. Usually, these costs are included in the premiums that you pay.

If the actual expenses differ from the expectations, it could impact your non-guaranteed returns.

Here are the Total Expense Ratios for the participating fund:

Here’s the table you can use to compare the expense ratios of AIA to other insurers:

From the comparison, AIA has had an average of 1.6% TER over the last 10 years, one of the industry’s lowest.

How much will I receive upon maturity of the AIA Smart Flexi Growth

Sam, 35, signs up for AIA Smart Flexi Growth for his one-year-old son and intends to secure his university education.

He bumps up the cover with an Early Critical Protector Payor Benefit (II) rider to offer enhanced protection for his child.

In this case, he decides to settle on a 10-year premium payment term and a 20-year policy term.

Here is a table to illustrate the events:

| Policy Term | Event | Payments |

| Sam at Age 35 years

(Policy Year 1) |

Takes out the AIA Smart Flexi Growth Plan | 10-year premium payment term and 20-year policy term. |

| Annual Premium | $5,135 | |

| Early Critical Protector Payor Benefit (II) rider yearly premium (additional) | $225.94 | |

| Sam at 40 years

(Policy Year 5) |

Diagnosed with early critical illness | Premiums waived thanks to Early Critical Protector Payor Benefit II rider. |

| Sam at 55

(Policy Year 20) |

Receives a total Maturity Payout for the child’s university education | $85,359,

Consisting of: A guaranteed maturity value of $54,600 And A non-guaranteed bonus of $30,759 |

The figures in the example are based on an Illustrated IRR of 4.25% per annum.

However, note that these bonus rates are non-guaranteed, and the benefits payable might differ depending on the performance of the participating fund.

Summary of the AIA Smart Flexi Growth

| Cash and Cash Withdrawal Benefits | |

| Cash Value | Yes |

| Cash Withdrawal | Yes |

| Health and Insurance Coverage | |

| Death | Yes |

| Total Permanent Disability | No |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |

| Health and Insurance Coverage Multiplier | |

| Death | No |

| Total Permanent Disability | No |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |

| Other Benefits | |

Optional Add-on Riders

|

Yes |