The AIA Pro Lifetime Protector (II), also known as the AIA PLP, is an investment-linked whole life insurance policy.

It’s supposedly a flexible solution that lets you tailor your insurance coverage and investments to fit your ever-changing needs in life.

From peace of mind to wealth accumulation, AIA Pro Lifetime Protector (II) has optional benefits tailored to your needs.

It offers optional add-ons for early critical illness, critical illness, and total and permanent disability.

And that’s not all!

A diverse range of investment-linked sub-funds helps you create a personalised investment strategy and unlock the potential for future returns.

This post reviews the AIA Pro Lifetime Protector to help you decide if it’s the best policy to meet your needs.

Spoiler alert; we don’t recommend it.

Read on to find out why.

My Review of the AIA Pro Lifetime Protector (II)

With AIA Pro Lifetime Protector (II), you can explore the possibility of enhancing your coverage when life throws a curveball.

With the flexibility to increase your insurance benefits up to S$200,000, you can give yourself added peace of mind during pivotal life stages.

Furthermore, with its no-lapse policy, you can enjoy guaranteed protection in the first 10 years.

One thing I like about AIA Pro Lifetime Protector (II) is increasing your protection through its long list of riders.

Although the AIA Pro Lifetime Protector (II) may sound like a great option due to its multiple features, it has many downsides.

Firstly, this is an investment-linked whole-life policy, which combines whole life insurance coverage with an investment-linked policy.

These policies are looked down upon, and for good reason – they combine insurance and investments – which we don’t usually recommend either.

Your premiums are used to pay insurance coverage and investments, and there is no limited pay option – so you’re expected to pay premiums for life.

This is not a problem with term and life plans; and if you have an investment-focused ILP, you can usually stop investing after X years.

Many insurance agents try to sell the idea of your investments paying for your insurance coverage when you’re older.

Though this is an interesting concept – the insurance charges get higher when you’re older, which will drain your investments quickly.

Should the market decline, you risk not having enough in your account and having to top up the balance in cash – you don’t want that when you’re retired and no longer working.

That’s why it’s better to opt for a safer route, especially when it comes to retirement planning.

I personally prefer using a term life insurance plan, a multi-claim critical illness insurance plan, and having my investments elsewhere.

Alternatively, you can look into a whole life insurance plan with ECI/CI riders with an investment-focused ILP if you’re not confident investing by yourself.

Either of these methods doesn’t put your investments at risk while providing you with the needed insurance coverage, perhaps even at a lower cost.

Most importantly, you’re not expected to pay premiums for life.

However, if you’re fine with the risks that come with a policy like this, then I recommend getting a second opinion from an unbiased financial advisor to see if the AIA Pro Lifetime Protector (II) is for you or if there are better alternatives that suit your needs.

You’re about to make a financial commitment for the rest of your life, with your insurance coverage and retirement funds relying on this policy.

So it’s best to get a second opinion just to confirm if the AIA Pro Lifetime Protector (II) suits your financial plans.

If you need someone to get an unbiased second opinion from, we partner with MAS-licensed financial advisors who have helped hundreds of our readers in similar situations as you are.

Click here for a free, non-obligatory second opinion.

Continue reading to read more about the AIA Pro Lifetime Protector (II) in detail.

Criteria

- Minimum regular premium of $100/month.

- Minimum sum assured of $25,000.

General Features

Premium Payments

Like other policies, AIA uses 100% of your net premium to buy units in the sub-fund. You can top premiums at any time while the policy is still running.

Premium payments are regular; you can pay monthly, quarterly, semi-annually, or yearly.

| Regular Premium Frequency | Minimum Amount Payable |

| Monthly | $100 |

| Quarterly | $300 |

| Semi-annual | $600 |

| Annual | $1,200 |

You may also vary your regular premium without incurring any charges.

If you want to increase it, you can only do so after the 1st policy year if you’ve made the minimum premiums necessary, subject to the maximum amounts (not disclosed).

Should you want to decrease it, it’s only possible after the 2nd policy year, subject to the minimum premiums.

Protection

Death Benefit

If death occurs, your beneficiaries will receive the death benefit based on your chosen option – Plus or Max.

With the Plus option, your beneficiaries will receive a lump sum of the insured amount and the current value of your policy minus any fees or charges.

Meanwhile, if you choose the Max option, your loved one will receive; the insured amount, top-up premiums, minus any withdrawals, or your policy value.

Under both options, the death benefit terminates once paid out.

Option to Increase Insured Amount upon Milestone Events Benefit

You can increase your sum insured if you hit any of the following milestone events before you’re 60:

- You turn 18 years old,

- You get married,

- Birth of your child,

- Adoption of a child, or

- Death of your spouse

The maximum increase is the lower of $100,000 or 50% of the original sum insured.

This benefit can be exercised twice, meaning the highest you can increase is $200,000 over 2 rounds.

Take note that this is up to AIA’s discretion – which means that you might have to undergo medical underwriting.

AIA Pro Lifetime Protector Riders

Total Disability Accelerator II Rider

If a total and permanent disability occurs, this add-on offers up to 100% of your coverage.

Total Critical Accelerator II Rider

Upon being affected by any of the 73 major critical illnesses listed in your policy, you will be granted a coverage amount from your basic policy, valid until age 100.

Lifetime Critical Cover Rider

This add-on protects you against up to 150 multi-stage critical illnesses until you reach 100.

Notably, the Power Reset feature ensures you receive many claims for a maximum cap of 300% of the coverage amount and covers an additional 15 special conditions – similar to a multi-claim ECI/CI plan.

Relapse Benefit Rider

You can boost your protection with the Lifetime Critical Cover rider, designed to shield you from relapses of any of the 5 critical illnesses.

Early Critical Protector Waiver of Premium (II) Rider

With this add-on, in the unfortunate event of being diagnosed with one of 149 multiple-stage critical illnesses, you will not pay future premiums.

Critical Protector Waiver of Premium (II) Rider

With this add-on, in the unfortunate event of being diagnosed with one of 72 major critical illnesses, you will not pay future premiums.

Child Critical Cover Rider

This add-on protects your child against 25 childhood medical conditions up to the age of 21 years. After that, the child may convert it to a lifelong policy.

Early Critical Protector Payor Benefit (II) Rider

With this rider, your child’s policy premiums will be waived up to their 25th birthday should death, diagnosis of the listed 49 multiple-stage illnesses, or total and permanent disability occur to you.

Payor Benefit Comprehensive Special (II) Rider

With this rider, your child’s policy premiums will be waived when they turn 25 years should death, total and permanent disability, upon diagnosis of the listed 72 major critical illnesses occur to you.

Key Features

Increasing and Reducing The Insured Amount

With the AIA Pro Lifetime Protector (II), you can increase your insured amount subject to certain conditions.

The minimum amount to increase or decrease your sum insured is $5,000, and approval is subject to meeting AIA’s terms.

Increasing Sum Insured

There are 2 ways to increase your sum insured – through the “Option to Increase Insured Amount upon Milestone Events” benefit or just a generic increase.

I covered the Option to Increase Insured Amount upon Milestone Events Benefit above. This section will talk about a generic increase.

The minimum amount you can increase at any time is $5,000.

Decreasing Sum Insured

Similar to increasing your sum assured, the minimum amount to decrease is $5,000.

In the product summary, AIA states:

“You may reduce the insured amount provided that it does not result in the reduction of Regular Premiums during the first 2 policy years, subject to our terms and conditions”.

What I understand from this is that you can decrease within your first 2 policy years, you just have to make sure that the reduction’s new premiums can’t be lesser than your initial regular premium.

So you’ll probably have to increase the sum insured first if you want to decrease it in your first 2 years.

AIA also mentions:

“In the later part of your policy duration, should your financial liability be reduced, you have the option to reduce the insured amount to 5 times the annual regular premium amount while keeping your regular premium amount the same”.

I’m not too sure what this means. Either I can reduce my sum insured by up to 5x while maintaining my regular premium amount, or I can reduce the sum assured to up to 5x my annual regular premiums.

The former means that more of my premiums will be allocated to the investment portion of this policy.

The latter means that if my annual regular premium is $1,200 ($100/month), then I can reduce it to $6,000 ($1,200 x 5).

But there’s a minimum sum insured of $25,000, so that means my annual regular premium has to be minimally $5,000.

I believe the former makes more sense, but correct me if I’m wrong.

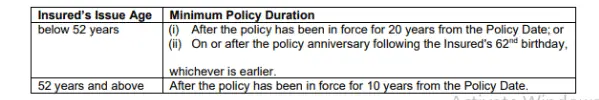

Oh, you also have to meet the minimum policy duration before you can do this:

Premium top-ups

Premium top-ups are allowed by the AIA Pro Lifetime Protector, subject to a minimum top-up of $1,000.

Special Bonus

AIA Pro Lifetime Protector (II) offers a special bonus of 2% on your regular premiums. Typically, this happens under different frequencies, as shown in the following table;

| Frequency of Regular Premium Paid | From |

| Annual | 10th payment |

| Semi-annual | 19th payment |

| Quarterly | 37th payment |

| Monthly | 109th payment |

Partial Withdrawal

You will be glad to know that you can partially withdraw your policy from its second year.

The minimum partial withdrawal is S$1,000, and there must be a minimum of S$1,000 left in your account.

Fund Switching

You can request a unit switch for any or all units in one fund, which can be switched to other available funds within the policy. The minimum amount you may switch is S$50.

Automatic Fund Rebalancing

This feature allows you to set predefined allocations across various ILP-sub funds. And, without any extra steps, it will automatically rebalance your holdings regularly to maintain those allocations.

AIA Pro Lifetime Protector Fees and Charges

Premium charge

A premium charge is applied whenever you make a premium payment.

For regular premiums, the percentage charge depends on the amount of the regular premium, as shown in the following table;

| Policy Year | Premium Charge |

| 1 | 80% |

| 2 | 55% |

| 3 | 50% |

| 4 | 8% |

| 5 & above | 0% |

A 5% premium charge is deducted every time you make top-ups.

Premium Holiday Charge

You will incur a premium holiday charge of $50 per month when your policy takes a break during the initial 2 policy years.

Surrender Charge

This charge is levied on your account when you surrender your policy.

The applicable rate is shown below;

| Policy Year | Surrender Charge Factor |

| 1 | 75% |

| 2 | 50% |

| 3 & above | 0% |

Policy Fee

A policy fee of $5 per month is charged to your account.

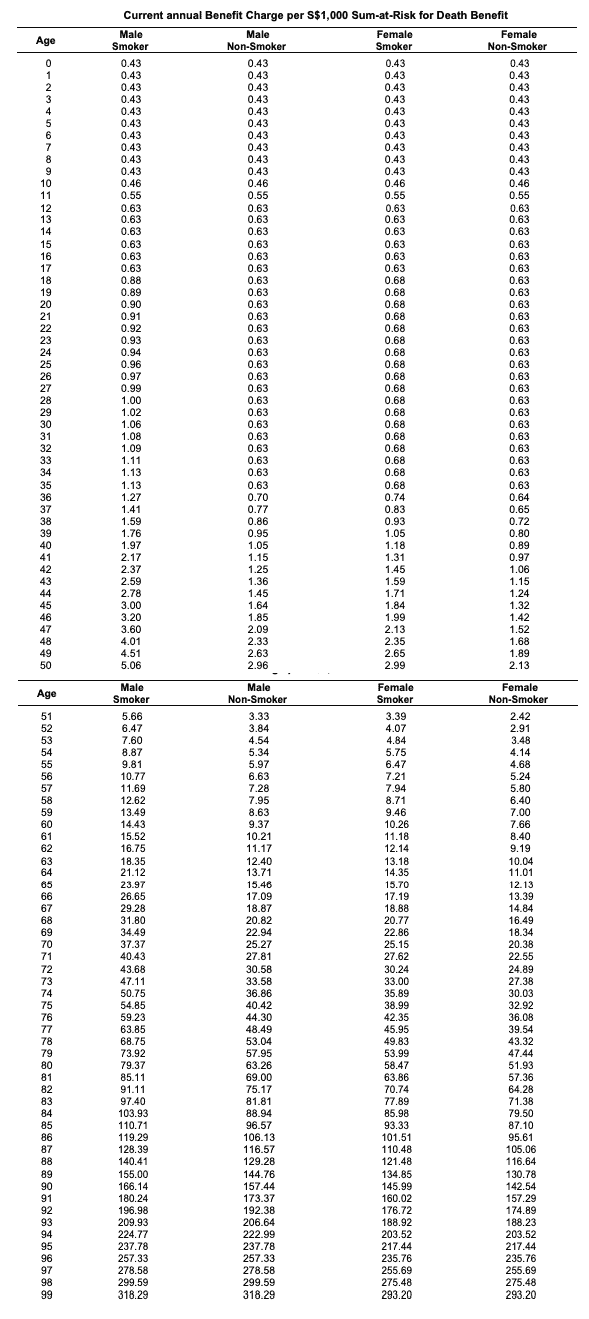

Benefit Charge

This coverage fee is charged monthly for your insurance coverage, including when your policy is on a break.

The formula to calculate the benefit charge is:

Benefit Charge = Applicable Monthly Benefit Charge Rate x Sum-at-Risk

For Plus plans, the sum-at-risk = insured amount; for Max plans, the sum-at-risk = insured amount + top-ups – withdrawals – policy value.

The Charge Rate depends on your gender, age, and smoking status, as seen below:

Fund Management Charge

Like other ILPs, the AIA Pro Lifetime Protector (II)’s funds levies fund management charges.

Fund management charges can range from 0.5% to 3%, depending on your invested funds.

Take note that the AIA PLP invests in an insurer sub-fund instead of directly into the unit trusts; this means that you’re paying an additional layer of fees.

Click here to understand more about insurer sub-funds and directly invested sub-funds.

Summary of the AIA Pro Lifetime Protector

| Cash and Cash Withdrawal Benefits | |

| Cash Value | Yes |

| Cash Value Benefits (non-guaranteed) | Yes |

| Health and Insurance Coverage | |

| Death | Yes |

| Total Permanent Disability | No |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |

| Health and Insurance Coverage Multiplier | |

| Death | No |

| Total Permanent Disability | No |

| Terminal Illness | No |

| Critical Illness | Yes |

| Early Critical Illness | Yes |

| Optional Add-on Riders | Yes |