AIA Pro Achiever 3.0 is an investment-focused investment-linked policy (ILP) that offers a unique strategy to empower you to cultivate and expand your wealth.

As the successor to AIA Pro Achiever 2.0 and AIA Pro Achiever, this plan has enhanced features, coverage options, and benefits.

With AIA Pro Achiever 3.0, you can create a personalised investment strategy that aligns with your financial goals and risk appetite.

In this review, we shall explore the features, coverage options, and benefits of AIA Pro Achiever 3.0.

Keep reading!

My Review of AIA Pro Achiever 3.0

The AIA Pro Achiever 3.0. is a decent investment-focused investment-linked policy if you like the funds offered by AIA.

Right from the start, 100% of your premiums are invested, which means your money starts working for you immediately.

AIA Pro Achiever 3.0 offers up to a 75% welcome bonus in the first 3 policy years to boost your capital.

This is much higher than the previous version, giving you only up to 10% in welcome bonuses.

Additionally, from the 10th policy year onwards, you’ll receive a special bonus of 5%, which will increase up to 8% from the 21st policy year onwards when you continue to pay the premiums regularly – the same as the previous version.

The ILP provides flexible Initial Investment Periods (IIPs) of 10, 15, or 20 years, allowing you to choose the option that best suits your needs and investment timeline.

This is a change from the previous versions, which only allows you to choose from an IIP of 12 or 10 years, respectively.

In addition, this version offers exclusive access to AIA Elite Funds and AIA Guided Portfolios on top of the array of funds AIA offers.

Features like the Premium Pass got an upgrade, offering you the flexibility to take a break from premium payments for up to 36 months or until your finances turn around.

AIA Pro Achiever 3.0 provides coverage for death and an additional payout in case of accidental death in the first 2 policy years.

You can also transfer your plan to your spouse or child for policy continuity.

Here are the downsides:

Supplementary charges are at 3.90% annually, which is really high.

The Manulife InvestReady III charges only 1.41% yearly for the first 20 years and 0.71% annually thereafter.

The Singlife Savvy Invest charges 2.5% for the first 10 years and 0.65% thereafter, while the FWD Invest First Plus charges about 3% yearly on just your annualised regular premiums.

The funds offered by these ILPs are also way superior.

They have access to accredited investor funds with much higher returns after including the fund-level fees.

The returns you see on AIA’s fund are not inclusive of fund-level fees – so your net returns are effectively lower.

While it is true that some policies in Singapore may charge lower fees and charges, it’s important to consider the overall features and benefits offered by the policy.

To select the best ILPs, you need to consider the flexibility regarding the minimum investment period, fees, funds offered, and flexibility.

This is especially important as ILPs are a long-term commitment. You don’t want to make the wrong decision now, which will cause you distress in the future (trust me, we see this happen too often).

If you need a second opinion on the AIA Pro Achiever 3.0 as to whether it is good for you or if there are potentially better options based on your needs, we partner with MAS-licensed financial advisors to help you with this.

Click here for a free, non-obligatory second opinion.

Here’s the AIA Pro Achiever 3.0 in detail:

Criteria

- Minimum Monthly Premium: S$200

- Minimum investment period: 10, 15, or 20 years

General Features

Premium Payment Terms

The AIA Pro Achiever 3.0 is a regular premium ILP (Investment-Linked Policy) that can only be paid with cash and cannot be funded with your SRS (Supplementary Retirement Scheme) funds.

Here is the table showing the minimum regular premium amounts based on different payment frequencies:

| Payment Frequency | Minimum Regular Premium (S$) |

| Annual | 2,400 |

| Semi-annual | 1,200 |

| Quarterly | 600 |

| Monthly | 200 |

Minimum Investment Period

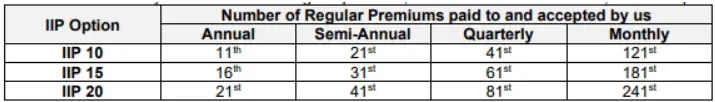

The AIA Pro Achiever 3.0 offers 3 initial investment periods (IIP): 10, 15, and 20 years based on your needs.

Because of this, you will need to continue to minimally invest for either 10, 15, or 20 years – depending on which you choose.

The IIP ends only after you’ve paid your regular premium, as shown in the following table:

Activating the Premium Pass or Premium Holiday feature once or multiple times can extend the IIP beyond the usual 10, 15, or 20 policy years.

This extension will continue until the relevant regular premiums have been fully paid.

Maturity Benefit

Upon maturity of the AIA Pro Achiever 3.0, you will receive the maturity benefit, and the policy terminates after the payment.

Protection

Death Benefit

The death benefit is a critical component of this policy, providing financial support in the unfortunate event of the insured’s passing.

The amount payable will be higher of:

- All the regular premiums paid, the total top-ups, and premium reduction top-ups, minus withdrawals.

- The policy value.

The amount payable is less any charges and applicable fees.

However, note that the death benefit is not payable if a secondary insured was appointed before the insured passed away.

After payment of the death benefit, the policy ends.

Accidental Death Benefit

The Accidental Death Benefit is equivalent to 100% of all regular premiums paid.

This means that if the insured passes away due to an accident, AIA will pay out the total amount of regular premiums paid to the beneficiaries.

However, certain conditions must be met for the Accidental Death Benefit to be paid out:

- The insured’s death must occur within 90 days from the accident date.

- The death must occur within 20 years from the policy issue date.

- It will not be paid if a secondary insured was appointed before the passing of the primary insured person.

Optional Add-on Riders

Critical Protector Waiver Riders

Future premiums of your policy, as well as any eligible riders, will be waived if there’s a diagnosis of the listed critical illness with the following riders:

- Early Critical Protector Waiver of Premium (II) or

- Critical Protector Waiver of Premium (II).

Payor Benefit Riders

AIA Pro Achiever 3.0 offers several Payor Benefit Riders that aim to secure your child’s future in the event of unforeseen circumstances such as critical illness diagnosis, passing away or disability with the following riders:

- Early Critical Protector Payor Benefit (II) or

- Payor Benefit rider;

- Payor Benefit Comprehensive Special (II)

This rider waives future premiums until the child reaches 25 years.

Key Features

Welcome Bonus

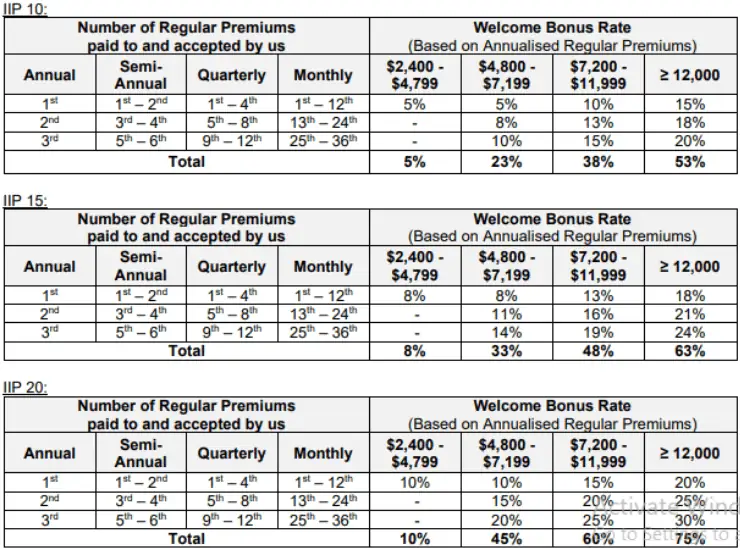

AIA Pro Achiever 3.0 offers attractive welcome bonuses to boost your initial capital.

These bonuses are an extra incentive to enhance your investment potential and maximise returns.

You will qualify for the welcome bonus if you consistently pay your premiums for the first 3 policy years.

However, the exact amount of the welcome bonus depends on:

- Your yearly regular premium

- Your chosen IIP option

The welcome bonus rates for various IIP options are shown in the following tables:

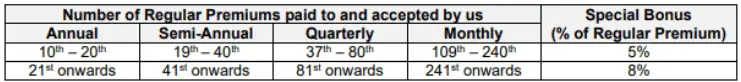

Special Bonus

The Special Bonus is an additional perk the AIA Pro Achiever 3.0 plan offers.

You become eligible for this bonus upon payment of the regular premium at specific intervals:

- After the 10th annual regular premium payment.

- After the 19th semi-annual regular premium payment.

- After the 37th quarterly regular premium payment.

- After the 109th monthly regular premium payment.

These milestones represent significant commitments to the policy, and the Special Bonus serves as a reward for reaching these milestones.

The following table shows the special bonus rates:

For the 10th to 20th annual premium received, a Special Bonus of 5% of the regular premium will be payable.

This means you will receive an additional 5% of your regular premium as a bonus, providing added value and boosting your investment.

From the 21st annual premium received onwards, the Special Bonus increases to 8% of the regular premium.

This higher bonus percentage rewards your continued commitment to the policy and further amplifies the potential growth of your investments.

Appointment of a Secondary Insured

A unique feature of the AIA Pro Achiever 3.0 plan is the option to appoint a secondary insured.

This provides a level of continuity and ensures that the policy benefits can continue to be enjoyed even after the original insured passes away.

However, certain conditions must be met for you to appoint a secondary insured:

- This option is only available while the original policy remains active and the insured is alive.

- An application to change the secondary insured will supersede any current appointment. This means that if you decide to appoint a new secondary insured, the previous appointment will be cancelled.

- The secondary insured must be less than 70 years old at the time of appointment.

- The secondary insured can be the original policyholder, his or her spouse, or their child who is below 16 years of age.

- The insured cannot appoint a secondary insured if there’s an existing nomination of beneficiary, the insured has passed away, or there’s a trust under the policy.

The death of the original insured in the AIA Pro Achiever 3.0 plan has several implications. This structure is designed to ensure the policy continues running and the benefits are paid out appropriately.

If you wish to appoint a beneficiary or create a trust, you must first cancel the secondary insured appointment. This is because the policy cannot have both a secondary insured and a nominated beneficiary or trust.

If the insured passes away after a secondary insured has been appointed, the latter becomes the new insured and the policy continues running. If the new insured then passes away, the death benefit will be paid out to the beneficiaries.

Premium Pass

For every 5 years, or upon reaching the 10th semi-annual, 20th quarterly, and 60th monthly premium payment, you earn what’s formally known as a Premium Pass, provided that you have diligently paid your annual premiums.

Think of it as a loyalty reward for keeping your financial commitments in check.

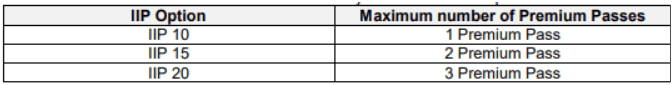

The number of premium passes you can accumulate has a cap, which will depend on your chosen Initial Investment Period (IIP).

Here’s how it works:

- If you choose the IIP 10 option, you’re allowed to have 1 premium pass. This means you can skip paying your premium once during your policy term.

- Choosing the IIP 15 option allows for 2 premium passes. This allows you to skip your premium payments twice during the policy term.

- The IIP 20 option gives you the maximum benefit of 3 premium passes. This allows you to skip your premium payments 3 times during the policy term.

Here is a table to summarise:

Each premium pass can be activated multiple times, allowing you to take a break from paying premiums for a cumulative duration of up to 12 policy months.

It’s like hitting the ‘pause’ button on your financial obligations, allowing you some extra time to sort out your finances.

Top-Up Premiums

The AIA Pro Achiever 3.0 lets you make premium top-ups to your policy, starting at a minimum of S$1,000 for each top-up.

A premium charge shall apply (covered later).

Automatic Fund Rebalancing

You are given the option to utilise the Automatic Fund Rebalancing feature.

This feature allows your holdings in different ILP sub-funds to be automatically rebalanced regularly, ensuring they conform to pre-specified fund allocations.

When you opt for fund rebalancing, AIA will adjust your funds to align with any changes in the specified rebalancing over time.

It’s important to note that any switches that are less than $50 or 1% of the policy value (whichever is lower) will not be carried out.

Automatic Fund Switching

You can set up automatic fund switching for your AIA S$ Money Market Fund investments.

This allows you to switch your investments to other specified ILP sub-funds on a monthly or quarterly basis, according to the terms and conditions set by AIA.

The minimum total amount for periodic switching is $50.

Additionally, there is a minimum initial balance requirement of $1,000 in the AIA S$ Money Market Fund.

Partial Withdrawals

Once you have made the:

- 3rd annual

- 6th semi-annual

- 12th quarterly, and

- 36th monthly

Regular premium payments, you can request a partial withdrawal from your policy value.

The minimum withdrawal amount is $1,000.

After the withdrawal is made, the remaining policy value must be at least $10,000.

Fund Switching

You may switch all or any of the units from a sub-fund to units of another ILP sub-fund(s) offered under the policy.

This allows you to reallocate your investments based on your preferences and investment goals.

There is a minimum total switch amount requirement of $50 for fund switching.

Varying Regular Premium

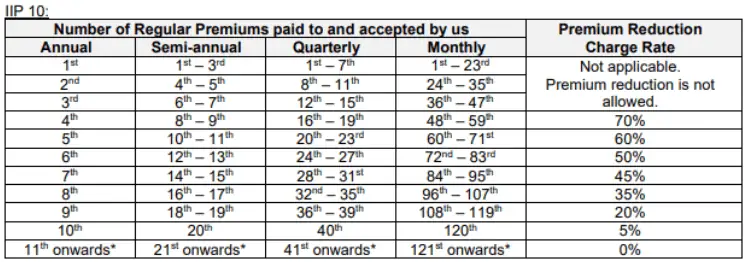

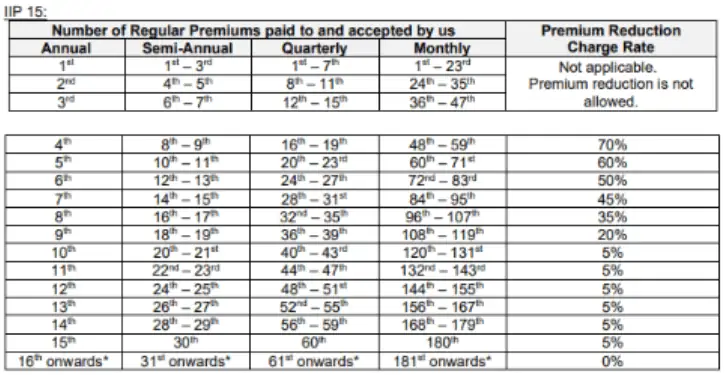

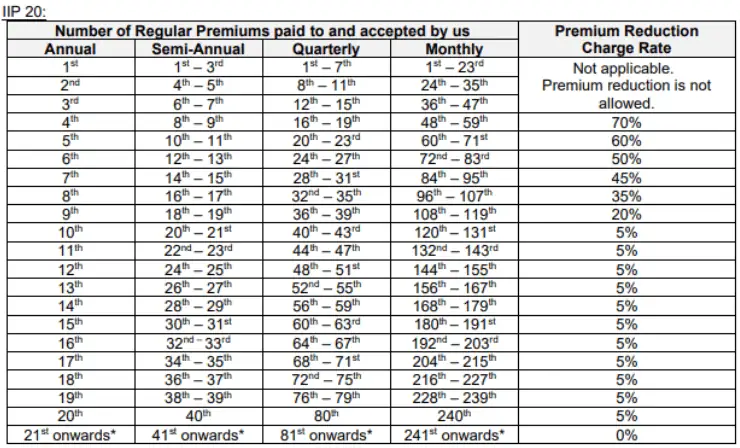

You can reduce your regular premiums only after you’ve paid all the regular premiums under the following periods:

- The 4th year for annual payment frequency.

- The 8th half-year for semi-annual payment frequency.

- The 16th quarter for quarterly payment frequency.

- The 48th month for monthly payment frequency.

If you choose to reduce your regular premiums during the IIP, a Premium Reduction Charge will be imposed.

It’s important to note that you cannot increase your regular premiums under this plan.

AIA Pro Achiever 3.0 Top 10 Performing Funds

The AIA Pro Achiever 3.0 invests in unit trusts via its own ILP sub-funds.

| Name of Fund | 5-Year Annualised Returns |

| AIA Global Technology Fund | 9.54 |

| AIA International Health Care Fund | 9.52 |

| AIA US Equity Fund | 7.2 |

| AIA Global Equity Fund | 6.29 |

| AIA Portfolio 100 | 4.59 |

| AIA Portfolio 70 | 3.79 |

| AIA India Equity Fund | 3.35 |

| AIA Portfolio 50 | 2.77 |

| AIA Global Property Returns Fund | 2.11 |

| AIA Portfolio 30 | 2.06 |

Accurate as of March 2023.

From: AIA ILP Fund tools

AIA Pro Achiever 3.0 Fees and Charges

Premium Charge

A premium charge of 5% will be deducted for any top-up premiums you make in the AIA Pro Achiever 3.0.

Supplementary Charge

The Supplementary Charge is deducted monthly and is calculated as (3.90% / 12) of your policy value.

This charge will not be imposed during the Premium Holiday period or if the Premium Holiday Charge is payable.

In addition, it will continue to be deducted until the payment of the following premiums;

- 11th annual premium

- The 21st semi-annual premium

- The 41st quarterly premium, or

- The 121st monthly regular premium, depending on the premium payment frequency chosen.

This means the Supplementary Charge may extend beyond the 10-year mark if you miss premium payments.

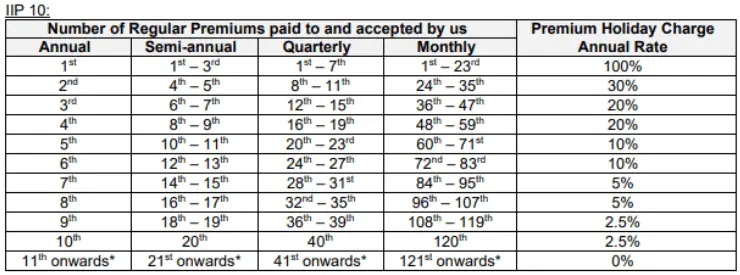

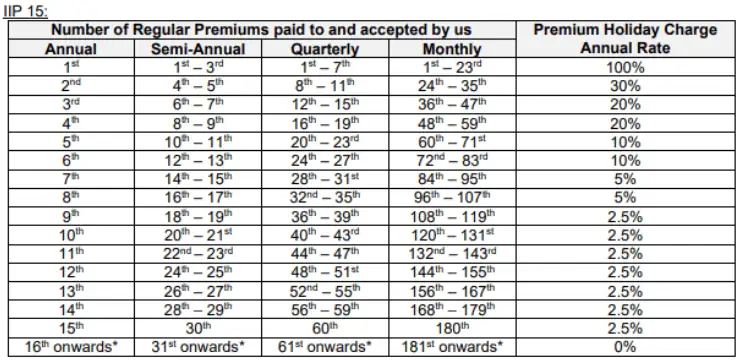

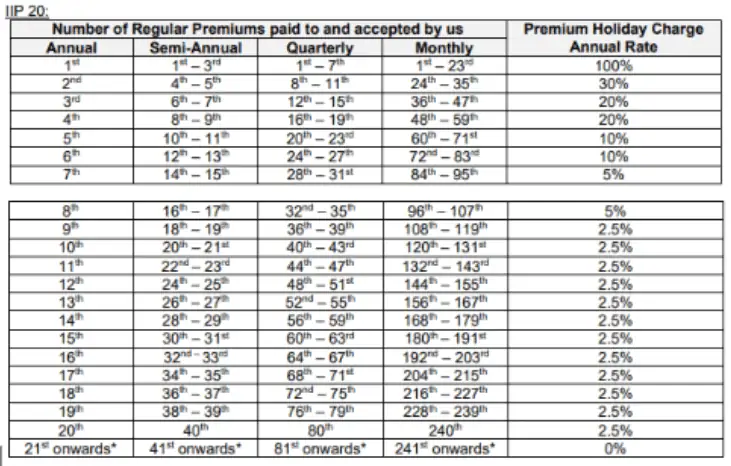

Premium Holiday Charge

This charge is applied monthly if you miss paying your premium when it is due.

This charge will continue until you resume making premium payments.

Therefore, the charge will be imposed beyond 10, 15, and 20 policy years if you miss regular premium payments during your chosen IIP.

Please note that this charge does not apply during the Premium Pass Period.

The formula to calculate the Premium Holiday Charge is shown below:

![]()

The following tables show the Premium Holiday Charge Yearly Rate based on the chosen IIP:

IIP 10

IIP 15

IIP 20

During a premium holiday period, the supplementary charge will not be imposed.

If you choose to take a premium holiday during your Initial Investment Period (IIP), it’s important to note that premium holiday charges may apply.

Premium Reduction Charge

If you choose to reduce your premiums during the IIP, you will incur a Premium Reduction Charge.

This charge will be deducted from your Premium Reduction Policy Value at the prevailing bid price.

This charge will stop once you have completed your regular premiums.

However, it will be imposed beyond the 10th, 15th, and 20th policy years if you fail to pay your premiums during the IIP.

In other words, the Premium Reduction Charge will be imposed if you miss paying your premiums during the IIP, and it extends beyond the standard 10, 15, or 20-year policy terms.

The formula to calculate the Premium Reduction Charge is shown below:

![]()

The following tables show the Premium Reduction Charge Yearly Rate based on the chosen IIP:

IIP 10

IIP 15

IIP 20

Do keep in mind that the following charges shall not apply to the Premium Reduction Top-Up units:

- Premium Charge

- Supplementary Charge

- Partial Withdrawal Charge

- Full Surrender Charge

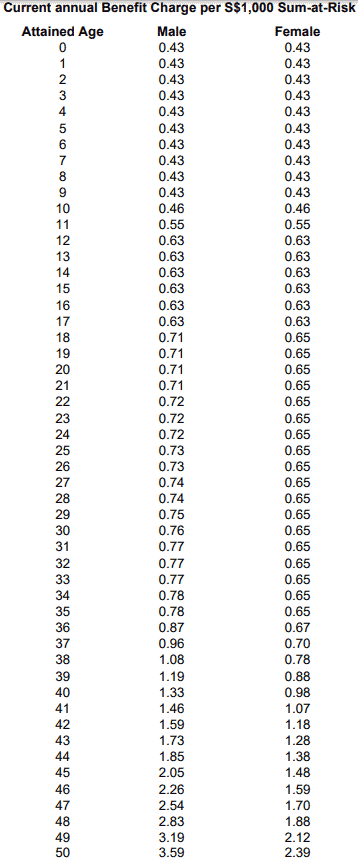

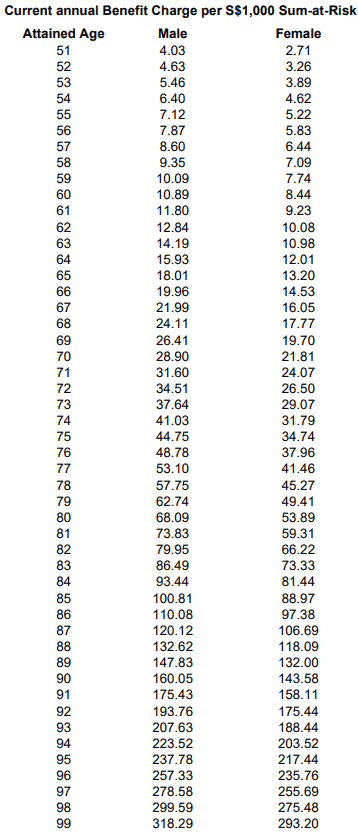

Benefit Charge

The Benefit Charge is deducted monthly to cover insurance costs.

If the Sum-at-Risk for a particular month is zero or negative, no Benefit Charge is payable for that month.

The formula for calculating the Benefit Charge is as follows:

Benefit Charge = (Annual Benefit Charge Rate divided by 12) x (Sum-at-Risk)

The Sum-at-Risk is determined by adding the total regular premiums paid and total top-ups, and subtracting the total withdrawals and policy value.

The following table shows the current Benefit Charge rates (yearly basis) that are applied according to the insured’s gender:

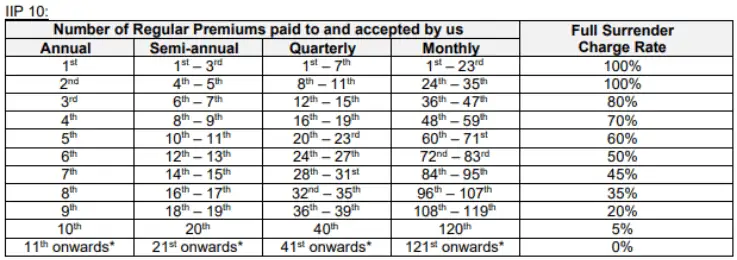

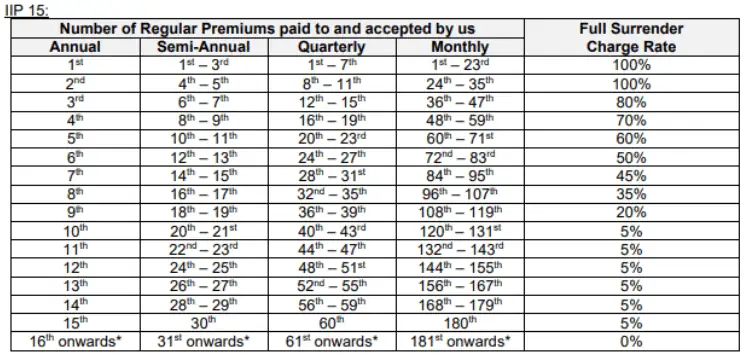

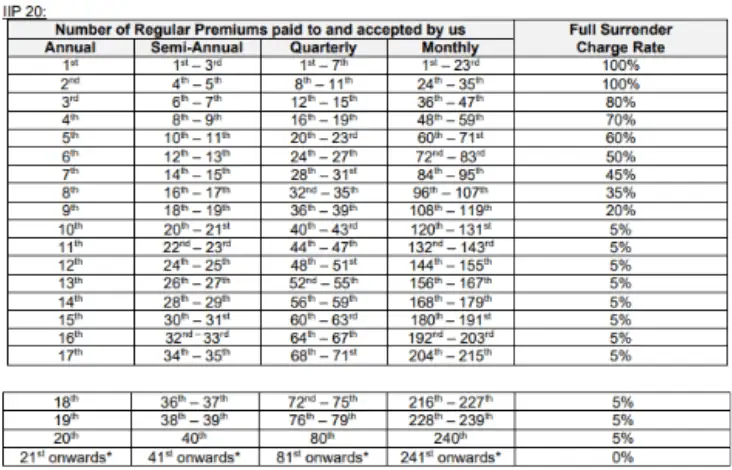

Full Surrender Charge

The Full Surrender Charge is a charge that is applied when you request to surrender your policy.

If you decide to surrender your policy during the IIP, a full surrender charge will be deducted from your policy value, and any remaining policy value will be paid out to you.

This charge ceases to apply once you have completed your regular premiums.

However, it will be imposed beyond the 10th, 15th, and 20th policy years if you fail to pay your premiums during the IIP.

The formula to calculate the Full Surrender Charge is shown below:

![]()

The following tables show the Full Surrender Charge Yearly Rate based on the chosen IIP:

IIP 10

IIP 15

IIP 20

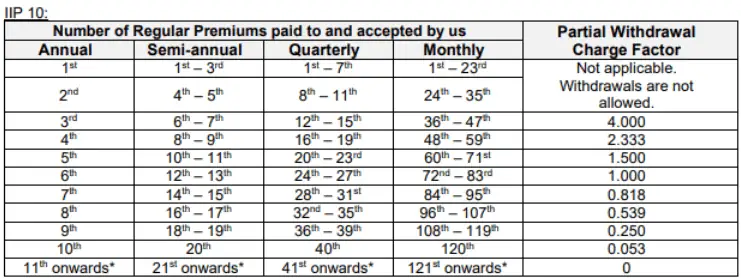

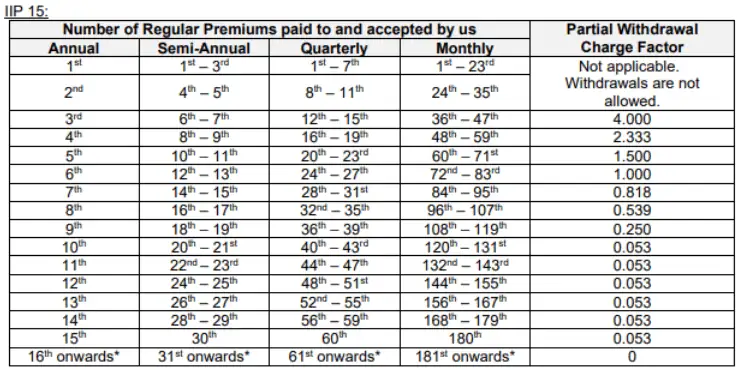

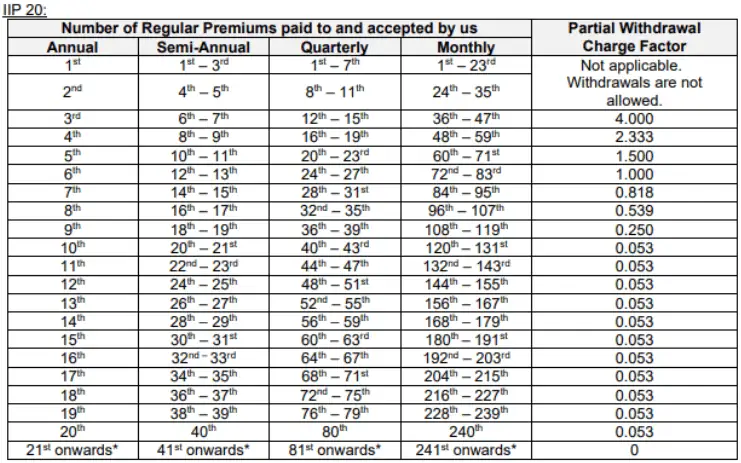

Partial Withdrawal Charge

The Partial Withdrawal Charge is a charge that is applied when you make a partial withdrawal from your policy.

The formula to calculate the Partial Withdrawal Charge is shown below:

![]()

The following tables show the Full Surrender Charge Yearly Rate based on the chosen IIP:

IIP 10

IIP 15

IIP 20

This charge ceases to apply once you have completed your regular premiums.

However, it will be imposed beyond the 10th, 15th, and 20th policy years if you fail to pay your premiums during the IIP.

Fund-Related Charges

There are 2 fund-related charges that you will incur when investing via the AIA Pro Achiever 3.0.

Sales Charge

Firstly, every time you invest, your premiums will incur a sales charge charged by the sub-fund.

This goes up to 5% and is standard across unit trusts by most fund management companies.

Fund Management Fees

The fund management fees will differ depending on the fund you choose to invest in.

From a glance at the top 10 funds mentioned above, this ranges between 1.5% to 1.75%, which is excluded from the returns calculations.

Compulsory Fees

As with all ILPs, you will not incur all the abovementioned fees.

So, what fees will be compulsory for you to pay?

- Supplementary Charge – 3.9% p.a. for 10 years

- Fund Management Fees – 1.75% p.a. for as long as your policy is active

This effectively makes your total fees 5.65% yearly for the first 10 years, and 1.75% thereafter.

How much will I receive upon maturity of the AIA Pro Achiever 3.0?

Assuming that you invest $200 monthly for 20 years and let it compound until the 30th policy year, the funds perform at 10% per annum, you made no withdrawals nor top-ups, and you did not take up any premium holidays; you can expect the below:

| First 10 Years | |

| Monthly premium: | $200 |

| Premium Payment Term: | 10 years (120 months) |

| Annual Fund Performance: | 10% |

| Fees in the first 10 years: | 3.9% + 1.75% |

| Net Fund Performance for the first 10 years: | 4.35% |

| Investment value: | $29,592.86 |

| Next 10 Years | |

| Monthly Premium: | $200 |

| Premium Payment Term: | 10 years (120 months) |

| Fees in the next 10 years: | 1.75% |

| Net Fund Performance in the next 10 years: | 8.25% |

| Investment value: | $100,566.41 |

| Next 10 Years | |

| Fees in the next 10 years: | 1.75% |

| Net Fund Performance in the next 10 years: | 8.25% |

| Investment value: | $222,193.83 |

Total Invested: $48,000

Total Interest Received: $174,193.83

ROI: 362.90%

Summary of the AIA Pro Achiever 3.0

| Cash & Cash Withdrawal Benefits | |

| Cash Value | Yes |

| Cash Withdrawals | Yes |

| Health & Insurance Coverage | |

| Death | Yes (Including Accidental Death Benefit) |

| TPD | N/A |

| Terminal Illness | N/A |

| Critical Illness | N/A |

| Early Critical Illness | N/A |

| Health & Insurance Coverage Multiplier | |

| Death | N/A |

| TPD | N/A |

| Terminal Illness | N/A |

| Critical Illness | N/A |

| Early Critical Illness | N/A |

Optional Riders:

|

|