The AIA Pro Achiever 2.0 is an investment-focused investment-linked insurance policy (ILP) that helps you build your wealth through regular investing.

This is the update of its previous version – AIA Pro Achiever.

Unfortunately, by the time we got this post out, AIA had released a new version – the AIA Pro Achiever 3.0, which we will (hopefully) review before the newer version comes out!

Instead of scraping this off our content calendar, we’ll publish this as we have readers asking us to review this.

So here’s our review of the AIA Pro Achiever 2.0.

Read on.

My review of the AIA Pro Achiever 2.0

Firstly, I’m going to compare this to the previous version, the AIA Pro Achiever 1.0.

In terms of similarities, it has 0% policy fees after the minimum investment period, allowing you to compound your investments indefinitely at 0% fees.

In addition, you get 5% extra units for premiums paid after the minimum investment period.

These are really great features that AIA has kept for the newer version.

They have also made an improvement by reducing the minimum investment period – from 13 years to 10 years.

I brought this up in our previous review and am glad to see that the minimum period has dropped to a level where it’s less scary for consumers like you and me.

However, they’ve raised the Supplementary Charges from 2.5% to 3.9% p.a., something I’m not too sure why.

Compared to its competitors, 3.9% in annual charges for the 10 years is pretty high – perhaps it’s a way to mitigate any losses by reducing the minimum investment period.

The Manulife InvestReady III charges only 1.41% yearly for the first 20 years and 0.71% annually thereafter.

The Singlife Savvy Invest charges 2.5% for the first 10 years and 0.65% thereafter, while the FWD Invest First Plus charges about 3% yearly on just your annualised regular premiums (instead of account value like the rest).

These alternatives, in my opinion, are better options if you’re looking for the best ILPs to invest in.

Ultimately, the best way to determine whether AIA Pro Achiever 2.0 is right for you is to get a second opinion from an unbiased financial advisor.

Choosing the right investment plan is crucial as you’re about to invest minimally $200/month for (at least) the next 10 years.

You need to ensure that the investment plan not only has the lowest fees and highest earning potential but it also needs to fit into your long-term financial plans.

This means looking at the features offered and making sure it’s flexible enough to suit your ever-changing needs.

If you’re looking for a second opinion or want to explore alternatives, we partner with MAS-licensed financial advisors to assist you with this.

Click here for a free second opinion.

Continue reading if you want to find out more about the AIA Pro Achiever 2.0 in detail.

Criteria

- The minimum investment amount is $200/month

- The minimum investment period is 10 years

General Features

Premium Payment Terms

The minimum regular premiums for each premium payment frequency are shown in the following table:

| Premium Payment Frequency | Minimum Premium Amount |

| Yearly | S$2,400 |

| Half-yearly | S$1,200 |

| Quarterly | S$600 |

| Monthly | S$200 |

The minimum amounts at any point in time are subject to change by AIA.

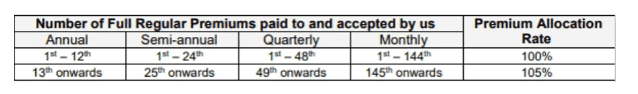

Premium Allocation

As the AIA Pro Achiever 2.0 is an investment-focused investment-linked policy, 100% of your premiums are allocated to investments as seen below:

Protection

Death Benefit

If the insured passes away during the policy term, his or her loved ones (beneficiaries) will receive either the higher of the following death benefits:

- The sum of regular and top-up premiums paid, premium reduction top-ups paid, less total withdrawals made, or

- the policy value, less applicable fees, and charges (if any).

This benefit would not be paid if a secondary insured was designated before the insured’s passing.

Additionally, upon the payment of this benefit, the policy will end automatically.

Accidental Death Benefit

In addition to the death benefit outlined above, this policy pays the beneficiary 100% of the total regular premiums paid.

Only if the insured passes away within 90 days of the accident date and within 2 policy years of the policy’s issuance.

The accidental death benefit will not be paid if a secondary insured was chosen before the insured passes away.

Maturity Benefit

On the maturity date, your policy will automatically cease.

When your policy matures, you will receive the policy value less any applicable fees and penalties (if any).

Key Features

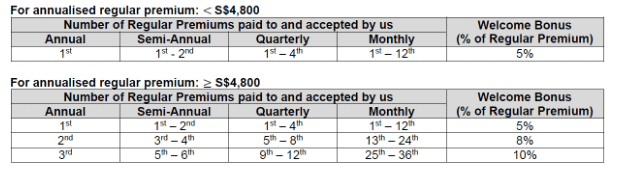

Welcome Bonus

You will receive a Welcome Bonus in the first to third policy year based on your annualised regular premium.

Here are the Welcome Bonus rates:

$4,800 yearly is $400/month of regular investments.

Thus, if you’re making an investment of $400 and above per month, your Welcome Bonus starts at 5% and gradually increases to 10% in your third year.

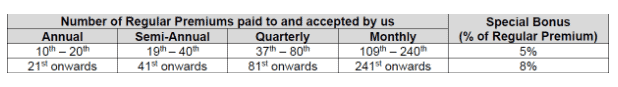

Special Bonus

You will be paid a Special Bonus when you continue to invest past the minimum investment period of 10 years.

For every regular investment you make, you will receive the following Special Bonus:

Secondary Insured Option

During the policy’s term, a Secondary Insured can be chosen to ensure the policy’s continuation in the event of the Insured’s death.

The original policyholder can only appoint a secondary insured during the policy term or at the policy application time.

The modification of the Secondary Insured will nullify any appointment previously submitted.

The Secondary Insured can be the original policyholder, his/her spouse, or a child (who is below age 16).

The Secondary Insured cannot be older than 70 at the time of the appointment, and should there be a trust created under this policy, a secondary insured cannot be appointed.

Reduce Regular Premiums

You can request a reduction of your regular basic premium payment amount after the 4th annual/ 8th semi-annual/ 16th quarterly/ 48th monthly regular premium has been paid.

A reduction request in the regular premium amount before the 11th annual/ 121st monthly Regular Premium is paid will attract a Premium Reduction Charge – which I will cover later in this post.

The minimum regular premium amount is currently $2,400 Annually or $200 Monthly.

AIA does not allow you to increase your regular investments, which is odd – why wouldn’t they want to take my money and invest it?

Top-up Premium

If all regular premiums are paid when they are due, you can make ad-hoc premium top-ups.

The minimum top-up premium amount is $1,000 and is subject to change anytime.

100% of your top-ups will be invested according to your fund allocation after it incurs the premium charge of 5%.

Ah, now I know why I can’t increase my regular investments – I have to make premium top-ups instead.

Partial Withdrawals

After paying the

- 3rd annual,

- 6th semi-annual,

- 12th quarterly, or

- 36th monthly regular premium,

you may seek a partial withdrawal from your account value, subject to a partial withdrawal charge.

The minimum withdrawal amount is $1,000 (may vary from time to time), and the policy value must be at least $10,000 after withdrawal.

Premium Holiday

You can take up a premium holiday with no charge under AIA Pro Achiever after paying your regular premium consistently for 10 policy years.

However, should you miss a premium payment before then, your policy will be considered to be on a premium holiday, and charges will be inflicted on your ILP. (Check out the Fees Section for more)

Fund Switching

A minimum switch amount of S$50 is required to transfer any or all units in one ILP sub-fund to another ILP sub-fund.

Only the AIA Money Market Fund units are exempt from this minimum switch amount restriction as long as it’s fully switched out.

Automatic Fund Rebalancing

You can automatically rebalance your holdings across several ILP-sub funds regularly to meet your predetermined fund allocations.

However, swaps will not be executed if they are less than S$50 or 1% of the policy amount (whichever is lower).

Optional Rider Add-ons

This ILP offers 5 riders, the Critical Protector Waiver of Premium, Early Critical Protector Waiver of Premium, Early Critical Protector Payor Benefit, Payor Benefit, or Payor Benefit Comprehensive Special.

Note that opting for either of these riders will incur additional charges.

The Critical Protector Waiver of Premium protects you in the event of a critical illness, while the Early Critical Protector Waiver of Premium will waive your premiums due to early critical illness.

The Payor Benefit riders, on the other hand, provide peace of mind for your loved ones.

If you pass away, fall seriously ill, or become disabled, AIA will take care of all future premium payments, ensuring that your children do not have to bear these costs.

I believe the Payor Benefit riders are applicable if there’s a second life insured.

AIA Pro Achiever 2.0 Top 10 Performing Funds

The AIA Pro Achiever 2.0 invests in unit trusts via its own ILP sub-funds.

| Name of Fund | 5-Year Annualised Returns |

| AIA Global Technology Fund | 9.54 |

| AIA International Health Care Fund | 9.52 |

| AIA US Equity Fund | 7.2 |

| AIA Global Equity Fund | 6.29 |

| AIA Portfolio 100 | 4.59 |

| AIA Portfolio 70 | 3.79 |

| AIA India Equity Fund | 3.35 |

| AIA Portfolio 50 | 2.77 |

| AIA Global Property Returns Fund | 2.11 |

| AIA Portfolio 30 | 2.06 |

Accurate as of March 2023.

From: AIA ILP Fund tools

AIA Pro Achiever 2.0 Fees & Charges

Supplementary Charge

Every month, a supplementary charge equivalent to (3.90%/12) of the Regular Premium Policy Value will be deducted from your policy.

The Supplementary Charge will not be imposed if the Premium Holiday Charge is payable.

This Supplementary Charge will stop after the minimum investment period of 10 years.

Benefit Charge

The Benefit Charge will be taken out of your account monthly to cover insurance costs.

If the Sum-at-Risk is 0 or less in a particular month, you will not have to pay a Benefit Charge for that month.

The calculation of the Benefit Charge is done by dividing the Annual Benefit Charge Rate by 12 and multiplying the result by the Sum-at-Risk.

Premium Top-up Charge

You will be charged a Premium Charge of 5% for any premium top-ups you make.

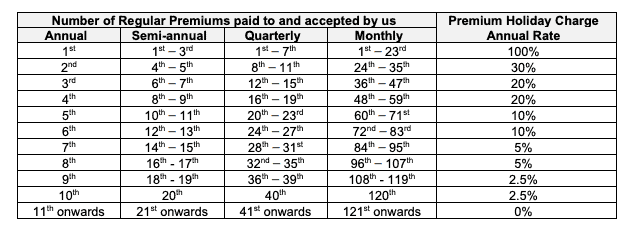

Premium Holiday Charge

With AIA Pro Achiever 2.0, you can enjoy a premium holiday without incurring any costs after consistently paying your regular premium for 10 policy years.

However, if you miss a premium payment before that, your policy will be considered to be on a premium holiday, and you will be subject to the Premium Holiday Charge.

Premium Holiday Charge = Premium Holiday Charge Annual Rate/12 x Annualised Regular Premium

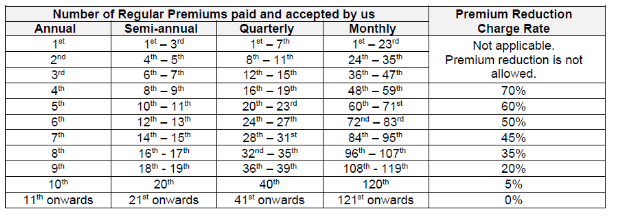

Premium Reduction Charge

If you reduce your premium before paying the 11th annual or 121st monthly regular premium, a Premium Reduction Charge will be applied.

This charge will be deducted from your Premium Reduction Policy Value and will continue past the 10th policy year until the full regular premium amount is met.

The Premium Reduction Charge will be incurred by cancelling units from your Premium Reduction Policy Value at the Bid Price.

Premium Reduction Charge = Premium Reduction Charge Rate x Premium Reduction Policy Value

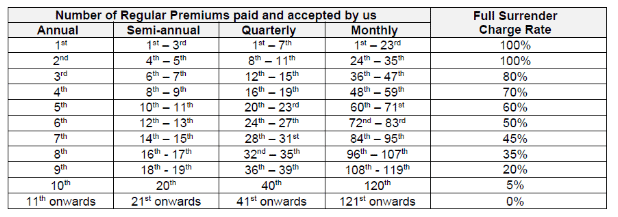

Full Surrender Charge

If you choose to surrender your policy, the full surrender charge will be taken from your policy’s value, and the remaining amount will be paid.

However, this charge will only stop applying after you have made your 11th annual premium or 121st monthly payment.

Full Surrender Charge = Full Surrender Charge Rate x Regular Premium Policy Value

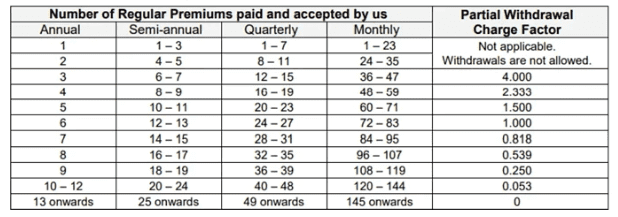

Partial Withdrawal Charge

If you request a partial withdrawal, a partial withdrawal fee will be charged based on the amount of the regular premium value.

The fee will only stop being applied once you have made the 11th annual regular premium payment.

If you miss any premium payments during the 10-year period, the fee will continue to be in effect until you’ve made the 11 years’ worth of premiums.

The partial withdrawal charge factor is shown in the table below:

The formula is as follows:

Partial Withdrawal Charge = Partial Withdrawal Charge Factor x Regular Premium Policy Value Withdrawn

Fund-Related Charges

There are 2 fund-related charges that you will incur when investing via the AIA Pro Achiever 2.0.

Sales Charge

Firstly, every time you make an investment, your premiums will incur a sales charge charged by the sub-fund.

This goes up to 5% and is pretty standard across unit trusts by most fund management companies.

Fund Management Fees

The fund management fees will differ depending on the fund you choose to invest in.

From a glance at the top 10 funds mentioned above, this ranges between 1.5% to 1.75%, which is excluded from the returns calculations.

Compulsory Fees

As with all ILPs, you will not incur all the fees mentioned above. So, what are the fees that will be compulsory for you to pay?

- Supplementary Charge – 3.9% p.a.

- Fund Management Fees – 1.75% p.a.

How much will I receive upon maturity of the AIA Pro Achiever 2.0?

Assuming that you invest $200 monthly for 20 years and let it compound until the 30th policy year, the funds perform at 10% per annum, you made no withdrawals nor top-ups, and you did not take up any premium holidays; you can expect the below:

| First 10 Years | |

| Monthly premium: | $200 |

| Premium Payment Term: | 10 years (120 months) |

| Annual Fund Performance: | 10% |

| Fees in the first 10 years: | 3.9% + 1.75% |

| Net Fund Performance for the first 10 years: | 4.35% |

| Investment value: | $29,592.86 |

| Next 10 Years | |

| Monthly Premium: | $200 |

| Premium Payment Term: | 10 years (120 months) |

| Fees in the next 10 years: | 1.75% |

| Net Fund Performance in the next 10 years: | 8.25% |

| Investment value: | $100,566.41 |

| Next 10 Years | |

| Fees in the next 10 years: | 1.75% |

| Net Fund Performance in the next 10 years: | 8.25% |

| Investment value: | $222,193.83 |

Total Invested: $48,000

Total Interest Received: $174,193.83

ROI: 362.90%