AIA Platinum Wealth Legacy is a universal life insurance designed to provide you with growing wealth and the ability to pass your legacy to future generations.

The policy is a combination of whole-life and investment-linked insurance.

This review explores the AIA Platinum Wealth Legacy to help you decide if it’s the best policy to meet your needs.

Keep reading to find out more.

My Review of the AIA Platinum Wealth Legacy

With the AIA Platinum Wealth Legacy, you have the flexibility to adjust your investments and insurance coverage from just 1 policy.

Moreover, you have the added flexibility to withdraw or top up throughout the policy term.

The AIA Platinum Wealth Legacy covers individuals up to an incredible 122 years. Therefore, you can be sure that you’re covered for the long term.

Additionally, this plan comes with a No Lapse Privilege, which helps ensure you’re always fully protected, even if you cannot make premium payments for some time.

It’s the ideal choice for legacy planning, allowing you to distribute your wealth to your loved ones while making sure your dependents are covered in case of any unfortunate events such as death and terminal illness.

Ultimately, you get to experience the benefits of whole life insurance and an investment-linked policy with this policy.

However, although this plan offers many advantages, it falls short in offering Total Permanent Disability and supplemental add-on riders, which are essential for more comprehensive protection.

Additionally, the 5% charged on the single premium payment is notably steep compared to other plans with much lower fees.

Similarly, the premium charges for regular premiums during the policy’s early years are extremely expensive, up to 36%.

Also, there are only 3 fund choices for you – Conservative, Balanced, or Adventurous. All 3 funds, except for the Adventurous fund, haven’t performed well since inception.

Also, the returns you see above exclude fees and charges. After fees, the Conservative fund performs at -1.46% p.a, Balanced at 0.99% p.a, and Adventurous at 4.7% p.a. since inception.

Also not mentioned in this article, we generated a quotation for a 30-year-old non-smoking male with a sum assured of $500,000.

The single premium for this demographic is $72,805, or $16,790 yearly for the 5-year regular premium term.

With such high premiums and poor fund performance, in my opinion, other options might give you a better bang for your buck.

Perhaps a whole life insurance plan, coupled with a good investment-linked policy, might give you more coverage and better returns on your plan.

A term insurance plan might even reduce your premiums further.

Yes, these options may not offer you coverage up to 122 years old or the No-Lapse Privilege (which we think is really good), but for much lower premiums, you really get much more.

Again, these are not an apples-to-apples comparison, so it might not be fair, but I feel it might be a better alternative, for me at least.

With so many wealth protection and accumulation plan choices, we understand that the decision process can be overwhelming.

To ensure you’re getting exactly what works for your specific situation, take some time to compare other options and talk with a financial advisor who is experienced in helping people like yourself determine which policy best meets your needs.

If you’d like to explore alternatives or get a second opinion, talk to one of our unbiased partners who have helped many individuals in similar situations.

Click here for a free second opinion.

Now’s let’s dive deeper into what the AIA Platinum Wealth Legacy offers:

Criteria

- You must be between 18 and 70 to be issued this plan.

- Minimum sum assured of $500,000.

General Features

Premium Payments

Although this plan has a cash-only option, it provides the flexibility to choose between a single payment or regular payments over 5 years.

You can also choose between currency options of either USD or SGD.

Protection

Death Benefit

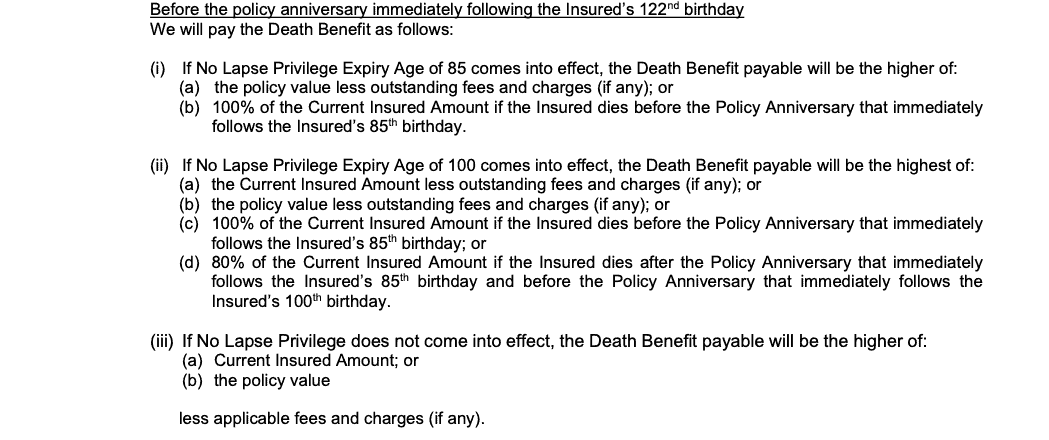

Typically, the death benefit will be paid to your beneficiaries upon the insured’s demise.

In addition, on the anniversary of your policy, immediately after turning 122, you will receive either the current insured amount or the calculated policy value minus any applicable fees and charges.

The death benefit will depend on your No Lapse Privilege option. Here’s how much you can expect to receive in death benefits:

Terminal Illness Benefit

Upon diagnosis with a Terminal Illness, the insured will receive up to U$2,000,000 in death benefits.

The terminal illness must be expected to result in the life assured’s death within 12 months from the diagnosis.

No Lapse Privilege (NLP)

When it comes to the policy value of a life insurance policy, performance and adjustments like varying insured amounts or premiums can influence its worth significantly.

However, with the No Lapse Privilege in effect until a designated expiration age, you’ll have that extra layer of financial protection as your policy’s value won’t drop to zero when faced with challenging times.

Please note that with this plan, you have the option to prioritise your protection by selecting a No Lapse Privilege Expiry Age of either 85 or 100.

Key Features

Varying Your Policy

With this policy, you can tailor the amount of coverage to suit your needs by increasing or decreasing the insured amount.

Increasing The Insured Amount

After one year from its issue date, you can adjust by increasing the insured amount by a minimum of $10,000 in your policy currency.

Every time you increase your insured amount, a new layer is created, which is subject to its own set of charges, including; administration, premium, surrender or partial withdrawal charges.

Decreasing The Insured Amount

You can reduce the insured amount if you have a minimum of $500,000. Similarly, the minimum reduction is $10,000 in your policy currency.

In addition, you must meet the following conditions;

- Your policy must be at least 25 years from the sign-up date, or

- On or after your policy anniversary after your 65th birthday; In both cases, whichever is later.

Exercising the option mentioned above will cause the automatic termination of the “No Lapse Privilege”.

Partial Withdrawal

The AIA Platinum Wealth Legacy lets you make a minimum withdrawal of $1,000, provided that there is a remaining balance of at least $10,000.

However, the charges can be quite hefty and will depend on the policy year and whether you selected a single or regular premium payment term.

I’ll share more about these charges later in the fees and charges section.

Premium Top-Ups

You are able to make a minimum of $1,000 of ad-hoc or regular premium top-ups to your policy.

For those who opted for the regular premium payment term, you must make all the basic premium payments first before you can choose to make any top-ups.

Premium top-ups are subject to the prevailing premium charges, which we’ll cover later.

Full Surrender

You are able to surrender your policy in full for its cash value. However, surrender charges will apply.

Fund Switching

The AIA Platinum Wealth Legacy does not offer fund switching.

AIA Altitude Membership

As an AIA Platinum Wealth Legacy policyholder, you have access to an exclusive membership program – AIA Altitude. This package boasts perks such as:

- Year-round deals

- Exclusive event invitations

- Exclusive access to select restaurants and wellness services

- Priority customer service at any AIA customer service centre

- Complimentary use of the AIA Altitude Lounge.

However, do keep in mind that this membership is by invitation only.

AIA Platinum Wealth Legacy Funds

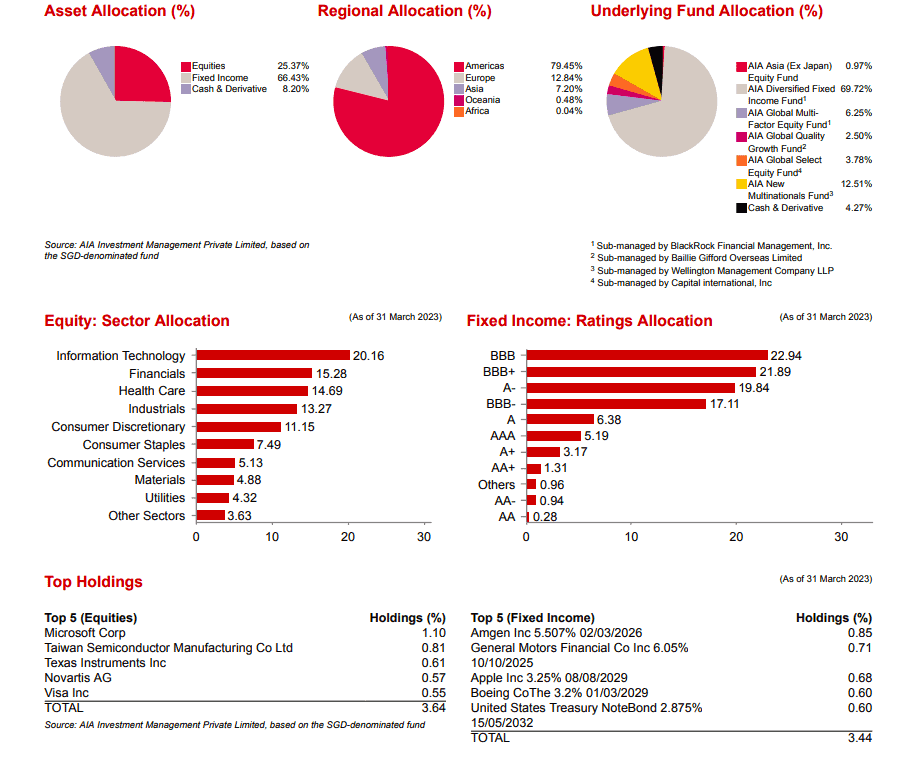

With the AIA Platinum Wealth Legacy, you have 3 different funds: AIA Elite Adventurous Fund, AIA Elite Balanced Fund, and AIA Elite Conservative Fund.

These funds are unit trusts and are insurer sub-funds, which means you might incur an additional layer of fees.

Also, each of these funds has both USD and SGD versions, so make sure to look at the correct fund factsheet.

In this post, we will only be looking at the SGD versions.

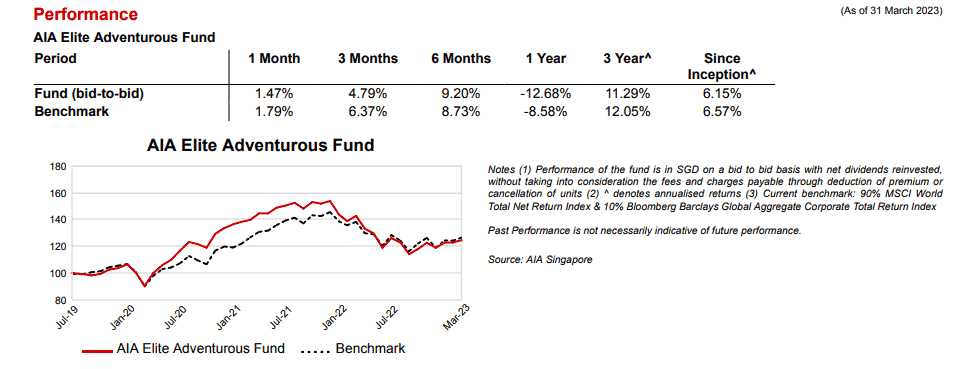

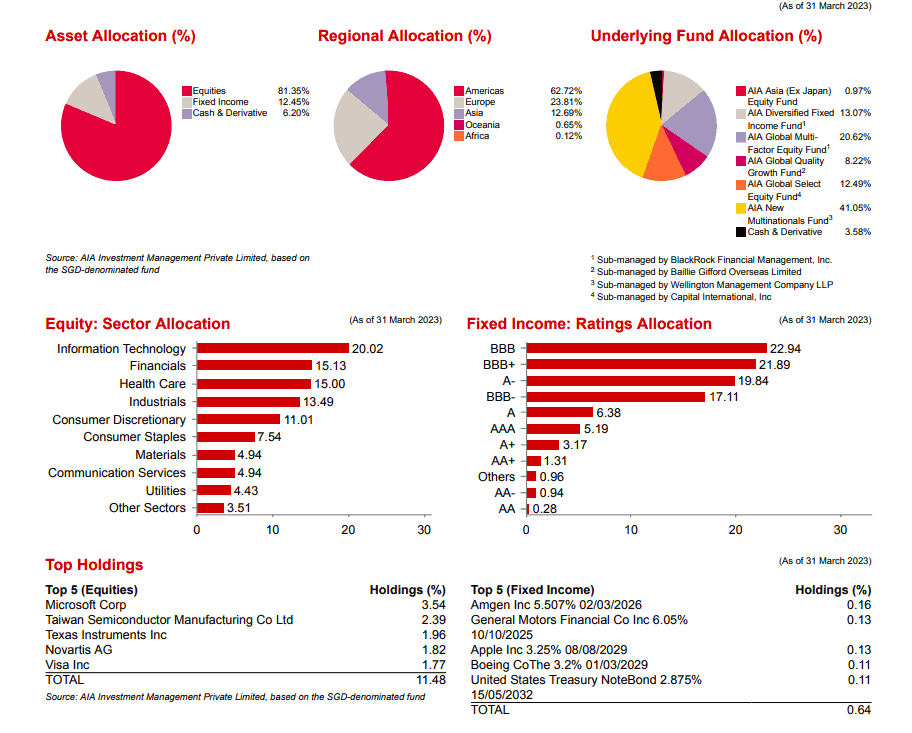

AIA Elite Adventurous Fund

This is the most aggressive fund available.

Here are the returns from the fund as compared to its benchmark. Since inception, the annualised returns are 6.15% p.a, before fees.

Here are what it allocates your investments into:

As you can see, about 80% is allocated to equities, and the remaining 20% is to fixed income, cash, and cash derivatives.

It also invests in its own AIA sub-funds, which then invests directly in the assets.

The fees are at 1.45% p.a of the overall asset value. Since returns are before fees and charges, this fund’s annualised returns since inception are about 4.7% p.a.

Information is accurate as of 31 March 2023.

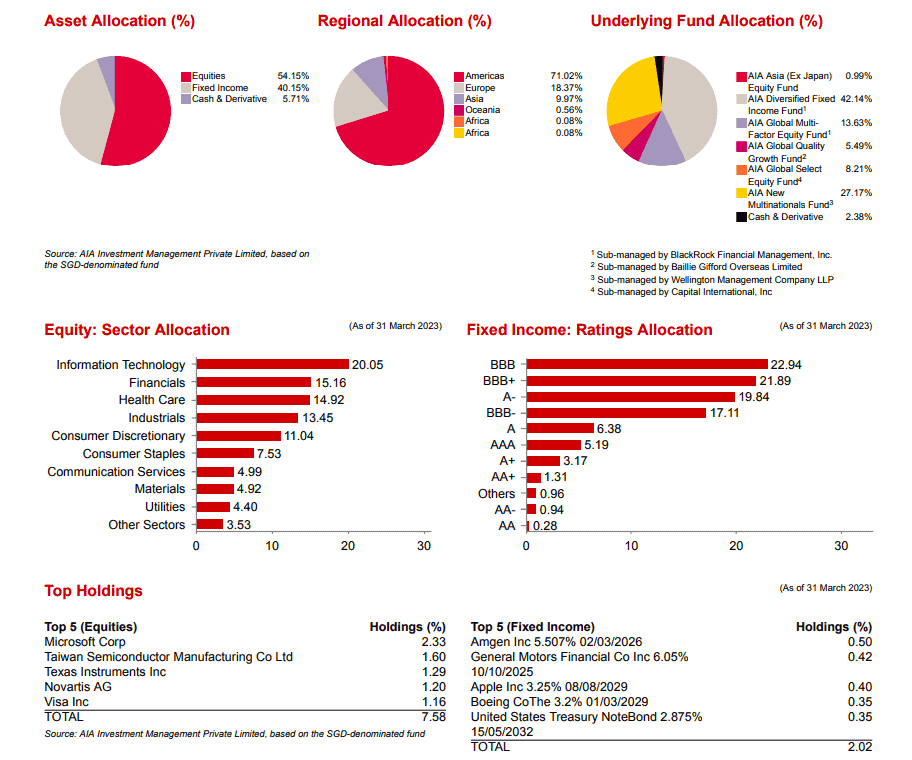

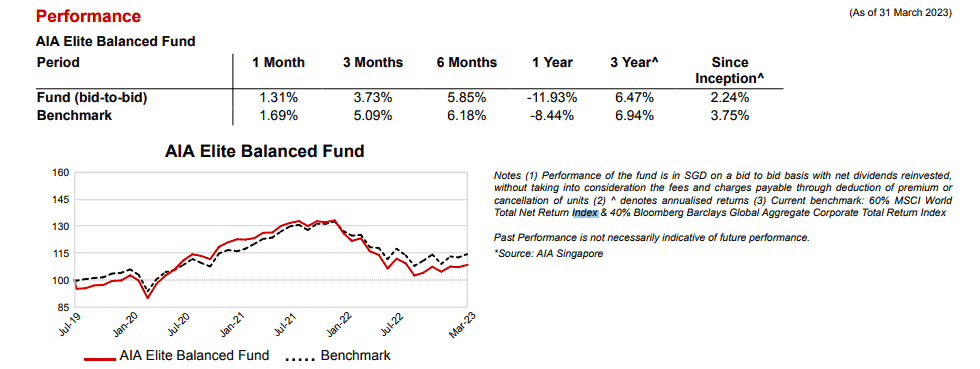

AIA Elite Balanced Fund

This balanced fund invests about 50% in equities and 50% in fixed income, cash, and cash derivatives.

Similarly, it invests in its own AIA sub-funds.

Here are the returns from the fund as compared to its benchmark. Since inception, the annualised returns are at 2.24% p.a, before fees.

The fees are at 1.25% p.a of the overall asset value. Since returns are before fees and charges, this fund’s annualised returns since inception are about 0.99% p.a.

Information is accurate as of 31 March 2023.

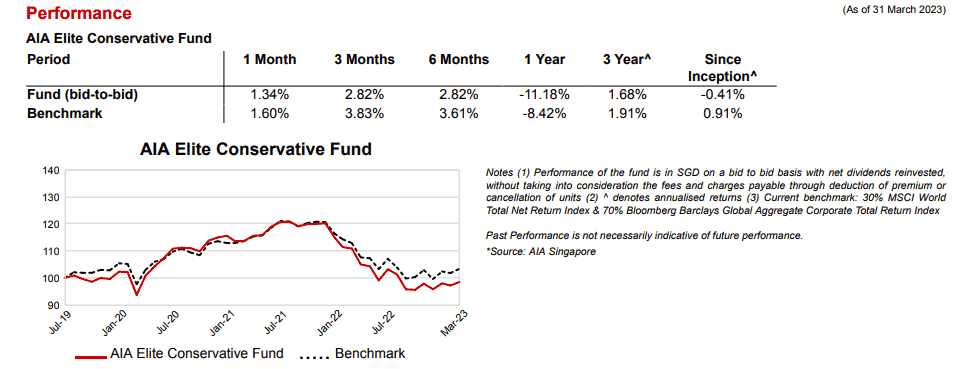

AIA Elite Conservative Fund

This is the most conservative fund available.

Here are the returns from the fund as compared to its benchmark. Since inception, the annualised returns are at -0.41% p.a, before fees.

The fees are at 1.05% p.a of the overall asset value. Since returns are before fees and charges, this fund’s annualised returns since inception are about -1.46% p.a.

Here are the fund allocations of the AIA Elite Conservative Fund:

Information is accurate as of 31 March 2023.

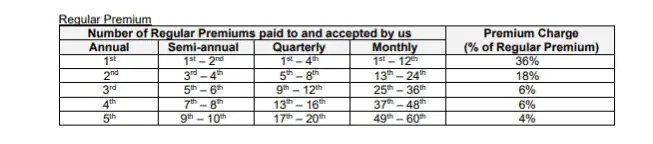

AIA Platinum Wealth Legacy Fees and Charges

Premium Charge

For any premium payments received on this policy, a surcharge will be added before being used to purchase units in the ILP sub-fund at the bid price.

Investing in a single premium comes with a 5% charge.

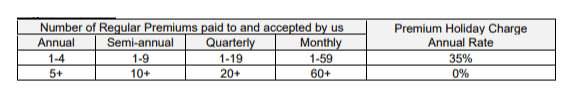

However, should you invest via regular premiums, the following table shows the respective premium charges you’ll incur:

If you want to make premium top-ups, the premium charge is 3%.

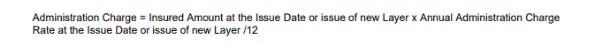

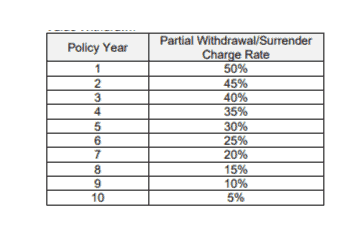

Administration Charge

Each month for the initial 10 policy years, an administration charge will be imposed even during the Premium Holiday.

Please note that these rates are not guaranteed and are subject to fluctuation.

Here is the formula to calculate the administration charge:

Here is the annual administration charge as of 15 May 2023:

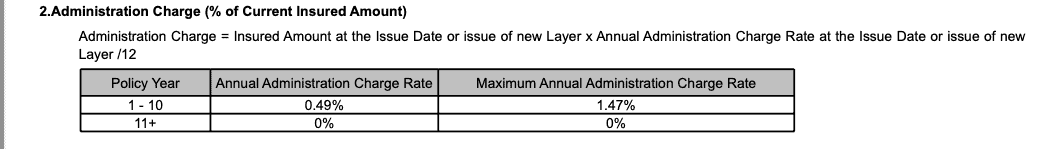

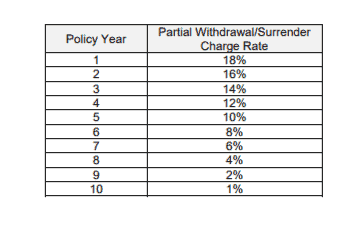

Partial Withdrawal and Surrender Charge

If you choose to cancel your policy, a surrender charge will be deducted from the value of that policy. Any remaining funds after this deduction will then be paid out.

In addition, for partial withdrawals, there may also be charges for units being cancelled.

For single premium and regular premium units, your Partial Withdrawal or Surrender Charge is determined by multiplying the Policy Value you have withdrawn by a specific factor.

The rates are shown below.

Rates for Partial Withdrawal or Surrender Charge on Single Premium Units

Rates for Partial Withdrawal or Surrender Charge on Regular Premium Units

Notably, top-up units are not subjected to partial withdrawal or surrender charges.

Premium Holiday Charge

If you miss any due premiums within your first 5 policy years, your policy will be put on a Premium Holiday, and a Premium Holiday Charge will be imposed.

This charge will continue until the full outstanding premiums have been paid.

The Premium Holiday Charge rates are highlighted in the following table:

This charge does not apply to single and top-up premiums.

Insurance Risk Charge (IRC)

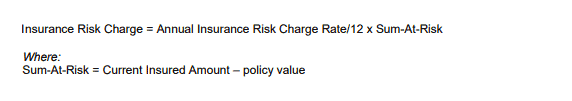

An insurance risk charge will be imposed if your policy value exceeds your current sum insured.

The difference between your current insured and policy value is known as sum-at-risk, and the insurance risk charge will kick in if the sum-at-risk hits zero or becomes negative.

Here are the formulas used to calculate the sum-at-risk and insurance risk charge:

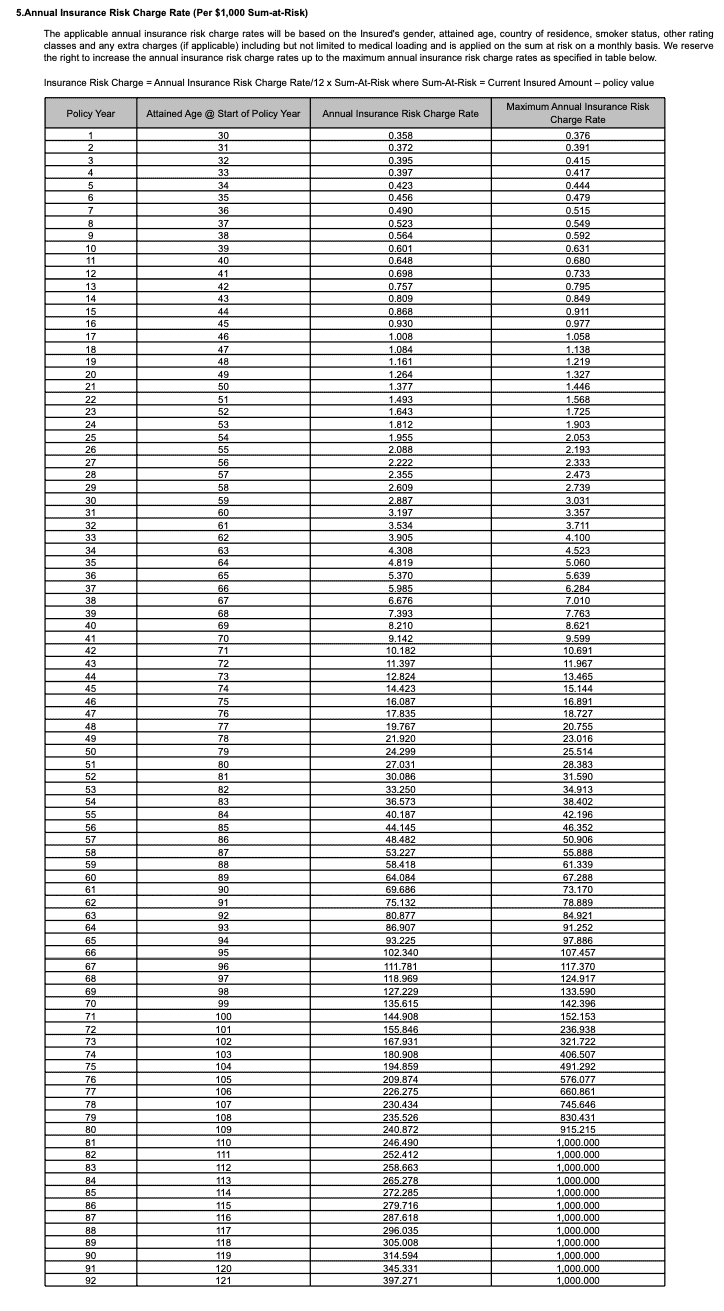

The Annual Insurance Risk Charge Rate differs from person to person, so you must check your policy illustration to find applicable rates.

Here are the charge rates for a 30-year-old non-smoking male:

Fund Management Charge

As an investor of the ILP Sub-Fund, the annual Fund Management Fee is dedicated directly to the fund’s asset value. The returns you see on your fund performance do not include fund management charges.

Please refer to the above section on the available funds for the fund management charges of each fund available to you.

Summary of the AIA Platinum Wealth Legacy

| Cash and Cash Withdrawal Benefits | |

| Cash Value | Yes |

| Cash Withdrawals | Yes |

| Health and Insurance Coverage | |

| Death | Yes |

| Total Permanent Disability | No |

| Terminal Illness | Yes |

| Critical Illness | No |

| Early Critical Illness | No |

| Health and Insurance Coverage Multiplier | |

| Death | No |

| Total Permanent Disability | No |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |

| Optional Add-on Coverage | No |