The Singlife Comprehensive Critical Illness (previously Aviva My Early Critical Illness Plan II) is an early critical illness insurance policy that provides basic protection against multi-stage critical illnesses and other specified medical conditions.

It has also been considered one of the best CI plans in Singapore – continue reading our review to know why.

General Features

Policy Terms

The Singlife Comprehensive Critical Illness provides insurance coverage for you for a minimum of 10 years, up until you are 99 years old.

Premium Payment Terms

Premiums are payable as long as the policy is active.

As with all CI premiums, premiums are not guaranteed and may be adjusted.

Your final premium amount is determined by factors such as age, gender, smoker status, sum assured, policy type, and length of premium period.

Protection

Critical Illness Benefit (CI)

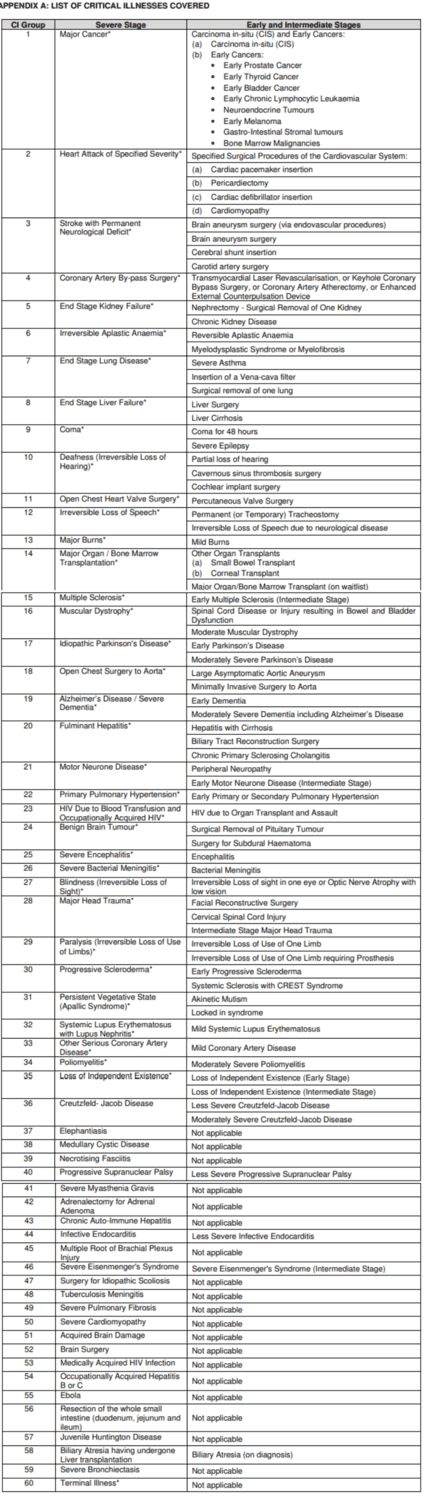

The Singlife Comprehensive Critical Illness plan provides up to 100% coverage of the sum assured against 132 early, intermediate, and severe stage CIs.

Here are the critical illnesses covered by the Aviva My Early Critical Illness Plan II:

Waiting Period

If any of the following is encountered, it will result in ineligibility of benefit claim:

Upon diagnosis of any of the following early, intermediate or severe stage critical illness under the critical illness benefit:

- the date of diagnosis of Heart Attack of specified severity, Major cancer, or other serious coronary artery disease; or

- the date of diagnosis of coronary artery disease leading to performance of coronary artery by-pass surgery.

Within 90 days from:

- the Policy Issue Date;

- the Benefit Commencement Date of this Policy; or

- the reinstatement date of this Policy.

Survival Period

To be eligible for the Critical Illness Benefit, the insured needs to survive at least 7 days after the date of diagnosis or the date of surgical procedure performed for a critical illness covered under the critical illness benefit.

Benign and Borderline Malignant Tumour

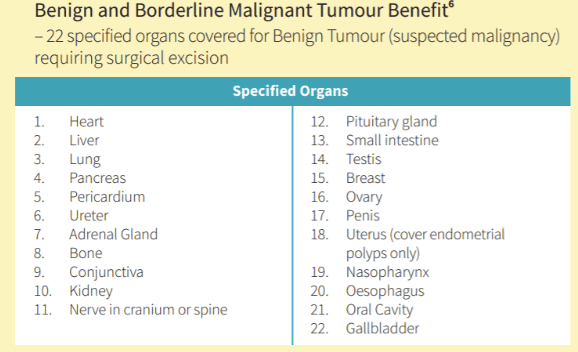

Upon diagnosis of a Borderline Malignant Tumour or completion of a surgical excision of a Benign Tumour of suspected malignancy, you will receive a payout of an additional 20% of the sum assured, up to S$25,000 (or equivalent currency) per life.

There is only one claim per policy under this benefit.

Here are the 22 Specified Organs covered under the Benign and Borderline Malignant Tumour Benefit:

Waiting Period

If any of the following is encountered, it will result in ineligibility of benefit claim:

- The date of diagnosis of the Borderline Malignant Tumour or the date of diagnosis of any conditions leading to the requirement of surgical excision of the suspected malignancy Benign Tumour of suspected.

occurs within 90 days from:

- the Policy Issue Date;

- the Benefit Commencement Date of this Policy; or

- the reinstatement date of this Policy.

Survival Period

To be eligible for the Benign and Borderline malignant Benefit, you need to survive at least 7 days after the date of diagnosis of a benign and borderline malignant condition or the date of surgical procedure performed for a benign and borderline malignant covered under this benefit.

Intensive Care Benefit

If you are required to be admitted into an intensive care unit (ICU) for 4 or more days within one hospital stay, you are entitled to an additional 20% of the sum assured up to S$25,000 (or equivalent currency) per life.

Waiting Period

If any of the following is encountered, it will result in ineligibility of benefit claim:

- The first day of ICU stay for admissible claim under the Intensive Care Benefit.

occurs within 90 days from:

- the Policy Issue Date;

- the Benefit Commencement Date of this Policy; or

- the reinstatement date of this Policy.

Special Benefit

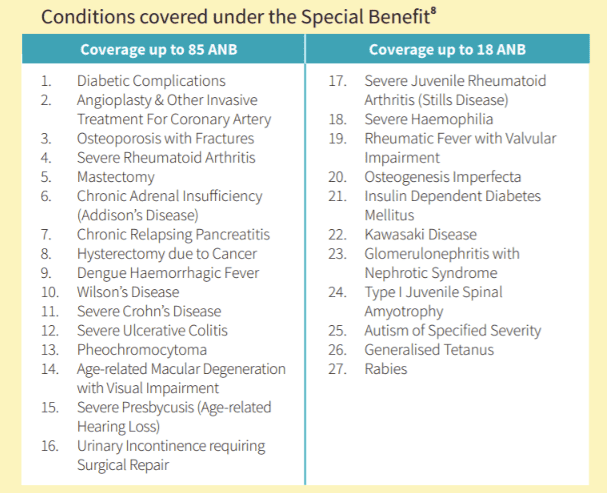

Upon diagnosis of any of the 27 medical conditions as stated below, the insured is entitled to an additional 20% of the sum assured up to S$25,000 (or equivalent currency) per life per condition.

The Special Benefit provides coverage for you until age 85 for conditions (1) to (16).

The Special Benefit provides coverage for you till the age of 18 for conditions (17) to (27).

The Special Benefit only allows one claim per condition and a maximum of 6 claims under the Special Benefit.

The Special Benefit does not reduce the basic sum assured or the death benefit.

Waiting Period

If any of the following is encountered, it will result in ineligibility of benefit claim:

- the date of diagnosis of:

- Age-related Macular Degeneration with Visual Impairment; or

- Severe Presbycusis (Age-related Hearing Loss); or

- the date of diagnosis of the condition resulting in the below surgeries:

- Hysterectomy due to Cancer,

- Mastectomy,

- Urinary Incontinence requiring Surgical Repair, or

- Angioplasty & Other Invasive Treatment For Coronary Artery;

occurs within 90 days from:

- the Policy Issue Date;

- the Benefit Commencement Date of this Policy; or

- the reinstatement date of this Policy.

Survival Period

To be eligible for the Special Benefit, you need to survive at least 7 days after date of diagnosis or the date of surgical procedure performed for a condition covered under this benefit.

Death Benefit

Upon death of the insured, their beneficiaries will receive a payout of $5,000.

My Review of the Singlife Comprehensive Critical Illness Plan

| Tokio Marine Early Cover | Singlife Comprehensive Critical Illness Plan | Singlife Multipay Critical Illness Plan | AIA Beyond Critical Care w/ Early Critical Cover Extra Rider | Tokio Marine MultiCare | Manulife Ready Complete Care | HSBC Life Super CritiCare | FWD Recover First | |

| Policy Term | Up to age 70,75 or 85 years old | From 10 years, or to 99 years old | From 10 years, or to 99 years old | Up to age 85 or 30 years | Up to age 70,75 or 85 | Up to age 75 or 99 | Up to age 50,55,60,

65, 70 or 75

Or

Renewable term of 5,10,25,20,25, or 30 years |

From 5 years to age 85. |

| Annual Premiums | $912 | $920 | $1,465 | $3,104.80 | $1,165 | $1,475 | $1,165 | $1,124 |

| Max Sum Assured | $100K | $100K | $250K | $3 Million | $350K | $500K | $1 Million | $350K |

Premiums are based on a 30-year-old male, non-smoker with a sum assured of $100,000, with policy term up to age 75 – with the exception of the AIA Beyond Critical Care. Premiums are paid annually.

The Singlife Comprehensive Critical Illness Plan has several advantages and disadvantages when compared to other plans available in Singapore.

Starting with the advantages, it provides coverage from the age of 10 to 99 years old, ensuring a long-term safety net for the policyholder.

This duration is longer compared to several other plans in the list, such as Tokio Marine Early Cover and Tokio Marine MultiCare, which offer coverage up to age 85.

This plan, along with the Singlife Multipay Critical Illness Plan, offers the longest policy term, providing security and peace of mind for the insured well into old age.

Not forgetting that the Singlife Comprehensive Critical Illness covers 132 ECI & CI conditions.

Add the Benign and Borderline Malignant and the Special Benefit conditions, this goes up to 181 conditions!

Additionally, with an annual premium of $920, the Singlife Comprehensive Critical Illness Plan is competitively priced, being one of the more affordable options among the listed plans.

This is marginally more expensive than the Tokio Marine Early Cover, which has an annual premium of $912, but is substantially more affordable than the AIA Beyond Critical Care, which comes in at $3,104.80 per annum.

However, the plan also has its disadvantages.

The maximum sum assured is $100,000, which, although standard for the premium range, is comparatively lower than several other options like the AIA Beyond Critical Care with $3 Million, the Manulife Ready Complete Care with $500,000, and the AXA Super CritiCare with $1 Million.

Therefore, for individuals looking for a higher sum assured to cover all potential costs associated with critical illnesses, this plan might not be sufficient.

For the specific case described, where the sum assured is $100,000, the lower maximum sum assured might not be a major concern unless the individual decides to increase the sum assured in the future.

Also, it’s worth noting that this is a single-claim plan, so you can only make a claim once.

Top up another $200 to $300 per year and you can get a multi-claim plan from Manulife CI FlexiCare or the HSBC Life SuperCritiCare.

Thus, if your needs, risk preferences, and financial capacity align with a higher sum assured, then exploring other options would be beneficial.

Otherwise, the Singlife Comprehensive Critical Illness Plan is still a good policy – named one of the best critical illness insurance plans in Singapore.

For critical illness policies, it is recommended to consider the coverage, instead of just the policy premiums.

This is especially true when you’re purchasing for ECI/CI.

Check the definitions and whether what’s covered aligns with your medical history and your family’s.

Need a second opinion as to whether the Singlife Comprehensive Critical Illness is for you?

Or are there better alternatives?

We recommend taking some time to speak with an unbiased financial advisor so that you don’t make the wrong decisions.