Are you looking to open a Central Depository Account but don’t know where to start?

Don’t worry, you’re not alone.

The process of opening a Central Depository Account can be intimidating, especially for those who are unfamiliar with the financial industry.

But here’s the good news: opening a Central Depository Account is actually easier than you might think.

With the right guidance and a few simple steps, you’ll be on your way to opening your own account in no time.

In this article, I’ll walk you through the process of opening a Central Depository Account, from understanding the basics to completing the necessary paperwork.

By the end, you’ll have all the knowledge you need to confidently open your account and enjoy the benefits of a Central Depository Account.

What is a CDP Account?

I won’t delve into too much of the fine print of what a CDP account is, but it stands for the “Central Depositary”.

Having a CDP account allows you to trade stocks in the Singapore market while having all your shares secured by the Singapore Exchange (SGX).

You can link your CDP account to different brokers approved by the SGX.

We’ll get to this later on in the article.

Essentially, while your brokers (such as POEMS, moomoo, or Tiger) execute your trades for you, your CDP account will hold all your shares in a secure central account.

A step-by-step guide to opening your CDP account (as a Singaporean or foreigner)

Step 1: Prepare your personal documents (locals)

Before we start, it’s important that you have all the necessary documents on hand to make sure that signing up for your CDP account is a smooth process.

You’ll need to prepare 3 things.

Firstly, you’ll need your bank details. Namely, details of your Singapore bank account.

The eligible bank accounts you can use to set up your CDP account are as follows:

- Citibank NA (Citibank)

- DBS Bank Ltd (DBS/POSB)

- Malayan Banking Berhad (Maybank)

- Oversea-Chinese Banking Corporation Limited (OCBC)

- Standard Chartered Bank (SCB)

- The Hongkong and Shanghai Banking Corporation Limited (HSBC)

- United Overseas Bank Limited (UOB)

Secondly, you’re going to have to prepare a photographed or scanned copy of your signature.

There are multiple free applications on the Play Store or App Store, so check them out.

Do make sure that your signature is accurate, as you’ll need to use it when you update your particulars or make a transaction.

Lastly, have your NRIC on hand.

Also, just a note that you’ll need to be at least 18 years old and not an undischarged bankrupt to create your account.

Step 1: Prepare your personal documents (foreigners)

For non-Singaporeans, the set of documents you will have to prepare is slightly different since you will not be signing in via SingPass.

As such, you will have to prepare your Passport, Work Pass, or Malaysian Identification Pass (for Malaysians).

You’ll also need a secondary supporting document.

This can be a bank statement from any Monetary Authority of Singapore (MAS) licensed banks, a statement from the Central Provident Fund (CPF), or a statement from the Inland Revenue Authority of Singapore (IRAS).

Do note that this supporting document should be from the last 3 months and must contain both your name and residential address.

Apart from that, you’ll also need to prepare a scanned copy of your signature and have a Singaporean bank account.

For non-Singaporeans, your TIN should be printed on your Immigration Pass or Work Pass.

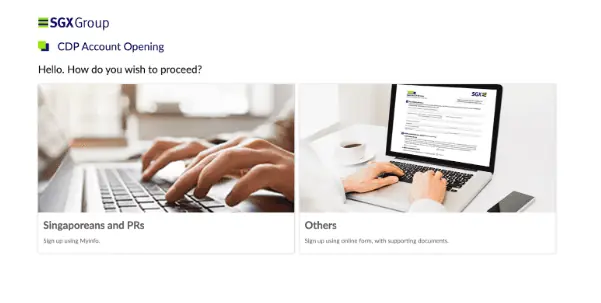

Step 2: Sign up at the SGX Website via MyInfo

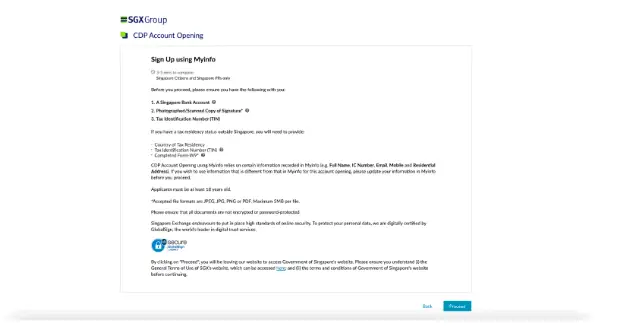

Great! Now that you have all the necessary documents, head to the SGX website to sign up for your CDP account.

For non-Singaporeans, click on “Others” as you would not have a MyInfo account.

You’ll be directed to sign up via MyInfo or the Others page, and the page should have a reminder of the documents you’ll need to have on hand.

MyInfo will retrieve all your personal information via Singpass so you don’t have to manually key in all your details.

Also, it makes your application processing time quicker. Pretty neat.

For foreigners, simply fill up your details and upload the documents required.

Step 3: Wait for SGX notification

Once you’ve completed your application, SGX will take about 5 business days to notify you if your application is successful.

If you manually keyed in your information without MyInfo, your application should take about 10 business days to process.

Connecting your CDP Account to your brokerage

So the CDP account is where SGX holds your stocks, but you’ll need a broker to help you make the transactions in buying and selling shares.

Here’s a list of the most popular brokers in Singapore which you can connect your CDP account to:

- CGS-CIMB Securities (Singapore) Pte. Ltd.

- DBS Vickers Securities (Singapore) Pte Ltd

- iFAST Financial Pte Ltd

- KGI Securities (Singapore)

- Lim & Tan Securities Pte Ltd

- Maybank Securities Pte. Ltd

- Moomoo Financial Singapore Pte. Ltd.

- OCBC Securities Private Limited

- Phillip Securities Pte Ltd

- Tiger Brokers (Singapore) Pte. Ltd.

- UOB Kay Hian Pte Ltd

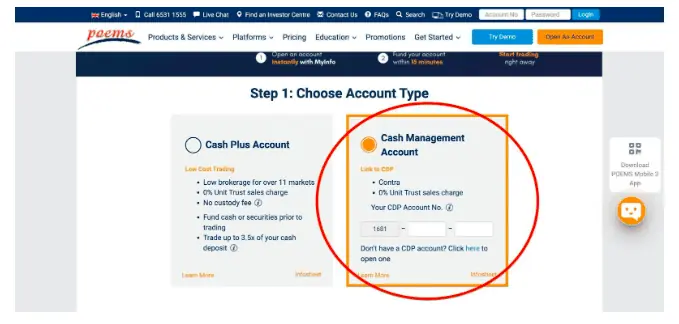

To connect your CDP account to your broker, each brokerage typically has an option to key in your CDP Account number (once you have it) when creating an account.

Here’s one example by Philip Securities:

Final Words

In conclusion, opening a CDP Account can be a game-changer for your financial future.

With the ability to securely store and manage your investments, you’ll have peace of mind knowing that your assets are in capable hands.

So don’t wait any longer, take the necessary steps to open your Central Depositary Account and unlock a world of financial possibilities today!

Remember to choose your broker wisely according to your needs, and if you’re searching for more broker-related advice, check out our other articles!