PRULifetime Income Plus is a participating annuity plan that provides lifetime payouts and financial protection for you and your loved ones.

This plan provides a guaranteed monthly cash benefit from the 49th month onwards and can potentially increase over time.

Here is our review of the PRULifetime Income Plus.

Keep reading.

My Review of the Prudential PRULifetime Income Plus

The PRULifetime Income Plus guarantees that you will receive regular monthly cash benefits for the rest of your life, which can help you cover your expenses and maintain your lifestyle.

You can use this money to enjoy retirement, travel, or pursue other goals.

In addition to the lifetime cash benefits, PRULifetime Income Plus offers you the option to accumulate your monthly income by reinvesting in the plan, allowing you to grow your wealth.

By taking advantage of this feature, you can earn more than if you were keeping your money in a savings account or other low-risk investment.

This plan also allows you to change the life assured to a loved one.

Hence, you can transfer the policy ownership to someone else while retaining control over the policy benefits.

This can be useful for legacy planning, allowing you to provide financial security for your family.

PRULifetime Income Plus provides coverage against life’s uncertainties.

If the assured passes on, their beneficiaries will receive a lump-sum payout that can help them cover any expenses or responsibilities.

Additionally, if you are diagnosed with a total and permanent disability during the premium payment term, all future premiums will be waived.

Finally, in the event of retrenchment, you will receive a one-time lump sum payout during the premium payment term, which can help you cover expenses while you look for a new job.

PRULifetime Income Plus is a comprehensive insurance plan that can help you maintain your lifestyle, grow wealth, and plan for the future.

Especially on the lifetime cash benefits and coverage against life’s uncertainties.

Comparing it against other policies that give you a lifetime payout, PRULifetime Income Plus still holds its ground with the array of features it provides.

However, other policies may pay you higher guaranteed and non-guaranteed cash benefits, such as the Singlife Flexi Income.

The Singlife Flexi Income comes with more premium payment terms – between 1 to 25 years – which gives you more customisation based on your needs and a capital guarantee.

And if you’re looking for the absolute best annuity plan for lifetime payouts, then the Manulife Ready LifeIncome (III) is the best, in our opinion.

Not only do they provide lifetime income, but it’s one of the most flexible annuities in the market, with retrenchment benefits and premium freezes offered.

Manulife’s participating fund also is the best performing amongst all insurers when compared on a 15-year annualised basis – which is an important factor given that your funds need to continuously perform well for you to get the highest possible payouts for a lifetime.

But as with all policies, it’s always best to compare your choices, as what’s the best for me might not be the best for you.

This is especially important since everyone has different goals, time horizons, budgets, and many other factors to consider when deciding which retirement plan is for you.

And with a policy that determines how comfortable you’re going to retire for the rest of your life, it’s wise to take some extra effort to research your available options.

Click here to read our comparison of the best retirement plans in Singapore – of which we included annuities with lifetime payouts as a category.

You should even consider getting a second opinion from an unbiased financial advisor to understand if Prudential’s PRULifetime Income Plus is for you.

If this interests you, we partner with MAS-licensed financial advisors to help you with this.

Click here for a free non-obligatory chat.

Now let’s explore what the PRULifetime Income Plus has to offer:

Criteria

- Premium Payment Term: 4 or 10 years

- Policy Term: Up to 110 years old

General Features

Policy Terms

- You will pay regular premiums based on the premium payment term – 4 or 10 years.

- Premiums are payable monthly, quarterly, semi-yearly, or yearly, depending on what works best for you.

- This policy will last all the way until you turn 110 years old.

Protection

Death Benefit

In the event of death, PRULifetime Income Plus shall pay the higher of:

- 101% of the total basic policy premiums paid at the time of death or

- 101% of the assured surrender value at the time of demise.

Any cash benefits left with Prudential, less outstanding debts, will also be added to your death benefit.

It is important to note that any cash benefits overpaid due to late notification of death will be deducted from the payout.

However, if the person covered by the policy dies within 12 months after the policy inception date or the reinstatement date due to a pre-existing condition or suicide, Prudential may choose not to pay the death benefit.

Cash Benefit

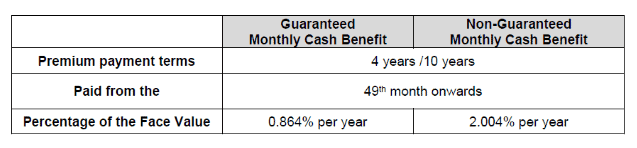

The monthly cash benefit you will receive consists of guaranteed and non-guaranteed benefits.

The non-guaranteed portion of the monthly cash benefit will be paid out from the 49th month of the policy onward and will depend on the performance of the participating fund in the future.

This benefit is a percentage of the face value of your policy and is based on the premium payment term you have chosen:

You also have the option to reinvest the cash benefits and earn non-guaranteed interest.

Accidental Death Benefit

Suppose the person covered by the PRULifetime Income Plus dies due to an accident, the Accidental Death Benefit payout will the higher of:

- 105% of the total basic policy premiums paid at the time of death, or

- 101% of the policy surrender value at the time of demise,

Plus any cash benefit left with the insurance company, less any outstanding debts.

Any overpaid cash benefit due to late notification of the accidental death will be deducted from the payout.

Retrenchment Benefit

You will receive a one-time lump sum if you get retrenched during the premium payment term and remain unemployed for at least 30 consecutive days.

This lump sum amount as of the date of retrenchment depends on the chosen premium payment term of your policy as follows:

- For a premium payment term of 4 years, you will receive 50% of the annualised premium

- For a premium payment term of 10 years, you will receive 100% of the annualised premium.

Key Features

Disability Waiver Benefit

Suppose the life insured becomes totally and permanently disabled before the age of 70 or before the end of the premium payment term, he/she will not have to pay future policy premiums.

This benefit only applies to regular premium policies and can be claimed once per PRULifetime Income Plus policy.

The nature and level of acceptable disability vary with the assured’s age.

The premium waiver ends when the life assured stops being totally and permanently disabled before the end of the premium payment term.

Partial Cash Benefit Withdrawal

If you have accumulated a certain amount of cash benefits in your policy, you can request to withdraw at least $1,000 at any time.

This amount may come in handy when you need to pay huge expenses like university fees.

However, you must withdraw the entire amount if you have less than $1,000.

Change of Life Assured

If you want to change the life assured to another, you can do so only after the premium payment term has ended.

Once the change is made, the original person covered by the policy will no longer be covered, and the new person’s coverage will start on a new date.

Based on the original life assured’s age, the policy will now have a cover end date set at 110 years old.

All the benefits available for the original person will continue to be available for the new person, except for any supplementary benefits (if any).

Early Surrender

If you surrender your policy after the following;

- 12 months of paying premiums for a 4-year premium payment term or

- 36 months of paying premiums for a 10-year premium payment term,

you will receive a guaranteed surrender value plus a non-guaranteed surrender value.

Note that early termination may come with high charges. Hence, the surrender value receivable may be less than the total basic policy premiums you have paid.

Refer to your policy documents or ask your financial advisor how much you’ll receive upon surrendering.

Loans

You can take out a policy, surgical and nursing, or automatic premium loan against your policy.

However, note that taking out these loans will decrease the overall cash value of your policy in the long term.

Except for the policy loan, an annual interest will be charged at a variable rate, but a minimum of 3 months’ written notice will be given.

PRULifetime Income Plus Fund Performance

Considering the insurance company’s investment strategy and track record is important before investing in a participating policy.

The specific mix of assets will vary depending on the investment strategy of the insurance company, as well as the risk profile of the policyholders.

Here is PRULifetime Income Plus’ investment strategy and allocation record as of December 2022:

| Type of Assets | Allocation Goals (%) | Actual Allocation |

| Bonds | 47.5 | 58.4 |

| Equities | 29.5 | 25.8 |

| Properties | 10 | 8.9 |

| Other Assets | 13 | 6.9 |

| Total | 100 | 100 |

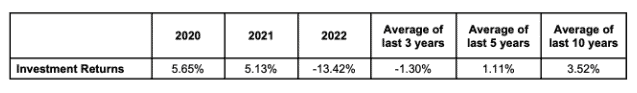

Investment Rate of Return

It’s also important to note that the returns earned from a participating endowment plan are not guaranteed and can vary based on the performance of the underlying investments.

Here is the past performance record of the participating fund to help you decide on investing in this endowment plan:

Due to the pandemic, it is understandable that funds have a negative return in 2022.

However, it’s best to view the geometric average returns of participating funds of life insurers to get a better understanding of how their overall funds perform,

Based on a 3, 5, and 10-year geometric average return, Prudential’s par funds are performing well, consistently ranking in the top 3 amongst other insurers.

Note that past performance does not dictate future performance.

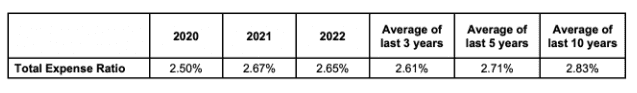

Total Expense Ratio

Examining the total expense ratio of various participating funds is crucial when considering investment options.

This is because the expenses related to overseeing these investments can directly impact your potential profits.

A certain amount of your premium payment is set aside to cover the fund management expenses of the participating fund.

However, if the actual expenses differ from what was expected, it may affect the non-guaranteed benefit.

Hence, it’s important to keep this in mind when considering the potential returns of your policy.

Here is a table below that displays the past expense ratios of the participating fund:

Similar to fund performance, you should compare expense ratios to the industry as well:

On average, Prudential wasn’t the best performing during the years surveyed, performing slightly above the industry average (lower is better). But from the most current data, there is a great improvement of 2.50% in 2020 to 2.65% in 2022.

Note that the data is dated and does not reflect future performance.

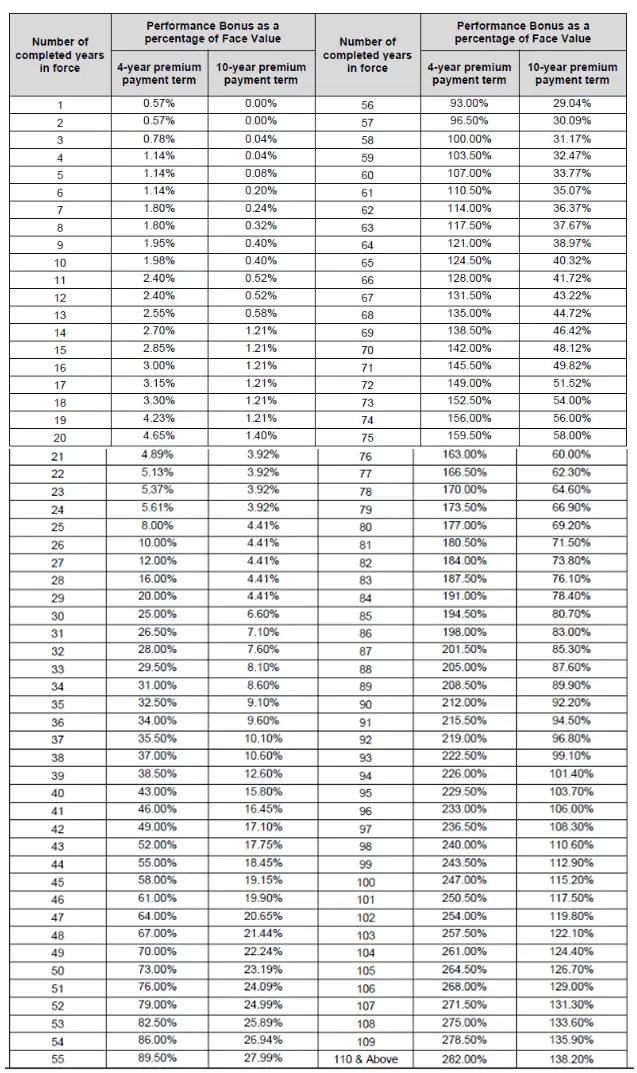

Performance Bonus

The performance bonus you may receive is not guaranteed, it will depend on the performance of the participating fund and how long your policy has been active.

This bonus is a one-time payment you may receive when you surrender your policy.

The bonus rates shown below are a percentage of the Face Value in the policy based on the assumption of an Investment Rate of Return of 4.25% per year:

It’s important to remember that these rates are only estimates, and the actual bonus you may receive could differ.

PRULifetime Income Plus Fees and Charges

With this plan, your policy will be affected by the overall performance of the fund it’s invested in.

This means that if the fund incurs any expenses, those expenses can be charged to your policy based on the risk-sharing rules.

The expenses that could be charged to your policy include fees paid to the fund managers for managing the investments and costs related to death, disability, policy lapses, or surrender claims.

Other expenses that could be charged to your policy include costs related to marketing and distribution, underwriting new policies, and general management and administrative expenses.

In addition, commission paid to Prudential Financial Consultants or other intermediaries could also be charged to your policy.

Fortunately for you, there won’t be any additional premiums as it is already factored into your premiums. However, it’s important to keep these potential expenses in mind when evaluating the potential returns of your policy.

Illustration of How PRUlifetime Income Plus Works

James, a finance manager aged 35, wants to semi-retire in a few years while caring for his family. He has a wife, Rose, aged 35, and a son.

He buys a policy called PRULifetime Income Plus and is covered by the policy. He pays a premium of $50,000 every year for 10 years ($500,000 in premiums in total).

James chooses to reinvest his monthly cash benefit at the start of the 5th policy year (49th policy month).

Unfortunately, at age 43, he loses his job and gets a one-off benefit of $50,000.

James semi-retires when the policy reaches its 10th anniversary and starts getting a monthly cash benefit of $1,195.

At age 50 (15th year of the policy), he withdraws $50,000 from his accumulated cash benefit to pay for his son’s college education.

When James turns 75 (in the 40th year of the policy), he transfers the policy to his wife, Rose, who starts getting the monthly cash benefit of $1,195.

Rose passed away peacefully at 96, and her family received a death benefit payout of $777,182.

Summary of Total Benefits Earned:

| Benefit | Amount |

| Total Monthly Cash Benefit (624 months) | $745,680 |

| Retrenchment Benefit and Withdrawals | $100,000 |

| Death Benefit | $777,182 |

| Total Benefits James and his family receive | $1.6 million (3.3x of the total premium, $500,000) |

The above figures are illustrated based on an investment rate of return of 4.25% p.a. and an interest rate of 2.5% p.a for cash benefit accumulation.

Summary of the PRULifetime Income Plus

| Cash & Cash Withdrawal Benefits | |

| Cash Value | Available |

| Cash Withdrawal | Available |

| Health & Insurance Coverage | |

| Death | Available |

| Accidental Death | Available |

| TPD | N/A |

| Terminal Illness | N/A |

| Critical Illness | N/A |

| Early Critical Illness | N/A |

| Health & Insurance Coverage Multiplier | |

| Death | N/A |

| TPD | N/A |

| Terminal Illness | N/A |

| Critical Illness | N/A |

| Early Critical Illness | N/A |

| Other Benefits | |

| Retrenchment Benefit | Available |

| Disability Waiver Benefit | Available |