The Manulife Ready LifeIncome (III) is a participating retirement plan that is designed to give you a steady income stream until you turn 120 years old.

It is a regular premium policy, and you can choose either a 5- or 10-year premium payment term.

You can also decide if you want to receive the policy payouts at the end of the 5th or 10th year.

Here’s our review of the Manulife Ready LifeIncome (III) to help you decide if it’s the best policy for you.

Spoiler Alert: We like it. A lot.

My Review of Manulife Ready LifeIncome (III)

The Manulife Ready LifeIncome (III) is an excellent annuity plan for those looking to get retirement income up till they’re 120 years old.

It also provides you with coverage against 2 critical situations – death and terminal illness – until you reach the age of 120.

This means that should such unfortunate events occur, your loved ones will receive the financial support they need.

Flexibility is a key aspect of this plan.

You can choose when you want to start receiving the yearly income payout – either at the end of the 5th year or the end of the 10th year (for policies with a 10-year premium payment term).

You are also given the choice to commit to a premium payment term of 5 or 10 years.

Starting from the year you chose to receive your income payout, you’ll continue to get a guaranteed income every year until just before the policy ends at age 120.

On top of that, there may be extra yearly payouts, and even a guaranteed bonus payout when you celebrate your 120th birthday!

With the Secondary Life Insured Option, you can extend the coverage of the policy to your loved ones by adding them as secondary life insured – potentially helping you with legacy planning too.

The Premium Freeze option is like a safety net. If you ever face financial difficulties or need a break from paying premiums, this option allows you to stop paying premiums for a year while keeping the policy in force.

After the freeze period, you can continue with the coverage as usual.

In addition, during total and permanent disability, you won’t have to worry about paying any future premiums.

The policy will waive those premiums, but the coverage will still continue, providing financial security during challenging times.

In case you find this policy to match your needs, the application is straightforward, and there’s no need for a health check-up.

You are guaranteed acceptance with no health questions asked, making the application process hassle-free.

With so many things to like about the Manulife Ready LifeIncome (III), it’s no wonder that we’ve considered it as one of the best endowment plans in Singapore.

Nonetheless, whether you should purchase Manulife Ready LifeIncome (III) depends on your own financial goals, risk tolerance, and budget.

With something that you’re investing for up to 10 years and that you’ll rely on for your retirement income, it’s best to get a second opinion as to whether the Manulife Ready LifeIncome (III) is truly good for you.

If you’re looking for someone reliable to get a second opinion from, we partner with MAS-licensed financial advisors who have helped hundreds of our readers in similar situations.

They’ll be happy to assist you with a second opinion or even explore any alternatives with you, too!

If you’re interested in this, click here for a free non-obligatory consultation!

Criteria

- Premium payment term: 5 or 10 years

General Features

Premium Payment

You have the choice of either 5 years or 10 years as your premium payment option.

You can make these investments monthly, quarterly, bi-annually, or yearly.

Policy Term

The Manulife Ready LifeIncome (III) has a policy term of up until you turn 120 years old.

Payout Options

Yearly Income

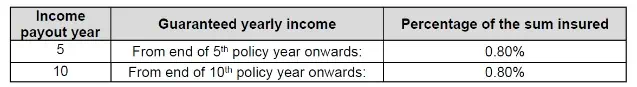

The Yearly Income is a regular payment that you will receive each year consisting of guaranteed and non-guaranteed components.

You’ll start receiving this yearly income from the end of the income payout year (5 or 10 years) until the year just before the policy reaches maturity.

The amount of yearly income is calculated as a percentage of the amount the policy covers you.

You have options to either receive the yearly income directly as a payout or accumulate it with an added non-guaranteed interest rate of 3.00% per year.

If you choose to accumulate the yearly income, you can still withdraw from the accumulated amount whenever you need it.

The minimum amount you can withdraw each time is $500.

Guaranteed yearly income computation:

Non-guaranteed yearly income computation:

Maturity Benefit

Let’s say that you’re blessed to celebrate your 120th birthday, Manulife will pay you the maturity benefit.

The benefit is paid in one lump sum after subtracting any outstanding amounts owed. It includes the following:

i) The higher amount between:

- 101% of the total premiums you have paid so far for the basic policy (minus any advance premiums), or

- The guaranteed surrender value you would get if you decide to terminate the policy early.

ii) The non-guaranteed maturity bonus that may be added to the Maturity Benefit based on the performance of the participating fund.

iii) Any income payments you were entitled to receive but had not yet received by the time of reaching 120 years of age.

Once the Maturity Benefit is paid out, the policy will end, and there will be no further benefits or payouts from the policy.

Protection

Death Benefit

In the unfortunate event of the insured’s passing during the policy term, Manulife will pay the Death Benefit in one lump sum after subtracting any outstanding amounts owed.

The Death Benefit consists of:

i) The higher of:

- 101% of the total premiums you have paid so far for the basic insurance (minus any advance premiums), or

- The guaranteed surrender value if you were to terminate the policy.

ii) The non-guaranteed claim bonus that may be added based on the performance of the participating fund.

iii) The accumulated yearly income that has built up with interest, if any but had not yet been received by the time of the death.

Once the Death Benefit is paid out, the policy will come to an end, and there will be no further benefits or payouts from the policy.

Terminal Illness (TI) Benefit

Should the insured be diagnosed with a serious illness, and doctors expect that the person may not live for more than a year, the policy will pay the Death Benefit in advance to help with medical expenses, financial support, or any other needs during that difficult time.

This way, the money can be used when it is most needed, providing some relief during a challenging period.

After the TI Benefit is paid out, the insurance policy will end, and there will be no further benefits from the policy.

However, the total amount payable for the TI and any critical illness (CI) benefits across all policies covering the same life insured is $2,000,000. Within this limit, the TI benefit specifically cannot exceed $1,000,000.

Key Features

Bonuses

Surrender Bonus

Manulife may declare a non-guaranteed surrender bonus if you decide to surrender or terminate the policy after it has been active for minimally 3 years.

This bonus will be added to the policy’s surrender value, providing you with an extra amount when you surrender the policy.

Claim Bonus

When you make a claim, Manulife may declare a non-guaranteed claim bonus.

This bonus will be added to the claim amount, giving you an additional payment when you make a valid claim.

Maturity Bonus

When your policy matures, Manulife may declare a non-guaranteed maturity bonus.

This bonus will be paid in addition to the guaranteed benefits of the policy when the policy reaches its maturity date.

Waiver of Premium on Total and Permanent Disability

If the life insured faces total and permanent disability, the premiums on the basic insurance plan will be waived.

To be eligible for this waiver, the unfortunate event must have occurred before the policy anniversary immediately following their 70th birthday, or before the end of the premium payment term.

Even though the premiums are waived, the insurance coverage will continue without any additional cost, providing financial security during a difficult time.

For the Waiver of Premium benefit to be approved, the disability must last for a minimum period of 6 consecutive months before a claim can be admitted.

Premium Freeze Option

The Premium Freeze Option allows you to stop paying premiums for a year while keeping your insurance policy active.

The conditions for the Premium Freeze Option are:

- Your policy must have been in force for at least 2 policy years, and

- You have already paid 2 annual premium payments in full.

The number of times you can use this premium freeze option depends on the premium payment term you initially selected.

You can use this option once if your premium payment term is 5 years. This option can be used twice for a premium payment term of 10 years.

Using this option can provide some flexibility when you may be facing financial constraints but still want to keep your insurance coverage in place.

However, please note that the period you need to pay premiums and the policy’s maturity date will be extended by 1 year for each freeze.

During the freeze period:

- Your policy’s anniversary date remains the same

- All basic and supplementary benefits remain applicable

- No reversionary bonus will be declared

- The accumulated reversionary bonus will follow a yearly compounding rate declared by Manulife

- The guaranteed surrender value and non-guaranteed surrender bonus rate remain unchanged at the value before the activation of the option

- The benefit end date for death and Terminal Illness (TI) benefit will be extended by 1 year for every time the option is exercised, up to the expiry date of the Accidental Death Benefit (ADB), whichever comes first

- The benefit end date for the waiver of premium on Total Permanent Disability (TPD) benefit will be extended by 1 year for every time the option is exercised, up to the expiry date of the TPD, whichever comes first

- Reduced paid-up insurance will not be applicable

Retrenchment Benefit

This benefit is another feature of the Manulife Ready LifeIncome (III) – offering financial support if you lose your job and remain unemployed for at least 30 consecutive days.

To qualify, the retrenchment must occur before the policy anniversary immediately after your 65th birthday.

The lump sum payment is as follows:

- If your premium payment term is 5 years, you will receive 50% of the annual mode premium.

- If your premium payment term is 10 years, you will receive 100% of the annual mode premium.

If the coverage period for this benefit is shorter than your overall policy premium term, the premiums you need to pay after this benefit ends will be reduced accordingly.

Change Of Life Insured Option

It is possible to request a change in the person covered by the policy, provided the following conditions are met:

- The policy has been active for at least 2 years from the issue date.

- You must have an insurable interest in the new person being covered.

The request for a change of life insured is restricted to one time only if an individual or an organisation owns the policy.

But for corporations, there is no limit to the number of times you may do so.

Remember that changing the life insured could affect the coverage and terms of the policy, so it’s essential to consider this option carefully and understand the implications before making a request.

Manulife Ready LifeIncome (III) Fund Performance

Investment Mix

Manulife Ready LifeIncome (III) focuses on investing assets to grow your funds over a long period.

The table below shows the strategic allocation of assets against actuals for the participating fund that this policy invested as of 31st December 2022:

| Type of Asset | Allocation Goals

(%) |

Actual Allocation

(%) |

| Fixed-Income | 70 | 73 |

| Equities | 27.5 | 26.5 |

| Property | 2.5 | 0.5 |

| Total | 100% | 100% |

The fund’s foundation comprises fixed-income assets, including government and corporate bonds. These are meant to cover most of the guaranteed financial commitments of the policy.

Equities (stocks) and real estate investments are included to generate higher returns, providing potential bonuses or benefits that are not guaranteed.

The fixed-income portfolio also includes cash and money-market instruments, ensuring liquidity and safety.

These short-term investments can be easily converted to cash.

Overall, the investment mix shows a balanced approach, prioritising stability while using growth opportunities to get potential gains for the non-guaranteed payouts of this policy.

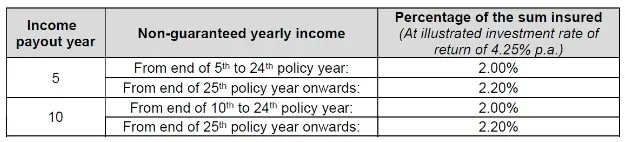

Investment Rate of Return (IRR)

Regarding the investment rate of return (IRR), data before 2022 is not available since the Participating Sub-Fund was established in April 2021.

The year 2022 was a year full of ups and downs and a lot of unpredictability in the financial world.

As the year progressed, the impact of the COVID-19 pandemic became less severe, and economies started to recover, indicating positive expectations come 2023.

The markets constantly shifted between 2 main ideas: one focused on economic growth, and the other worried about inflation. Central banks took strong actions to control inflation, including increasing interest rates very often.

This move caused bond yields (returns on certain investments) to go up as well, making it harder for individuals and businesses to get loans or credit, affecting the overall availability of money in the economy.

Hence, when making investment decisions, it’s crucial to consider the investment strategy, market conditions, and other relevant factors.

Industry Returns Comparison

Below is a 3, 5, and 10-year geometric average net investment return on all par funds of major life insurers, including Manulife:

From the above data, Manulife’s overall performance on all par funds has been positive across the 3, 5, and 10 years net averages posting a 7.68% average return in 2017 to 2019.

In addition, the high ratio of non-guaranteed benefits reserve to total assets of a par fund indicates the extent to which Manulife participating funds are committed to fulfilling non-guaranteed benefits to policyholders.

This is a positive sign for policyholders, as it indicates the insurance company’s willingness and ability to share profits with them.

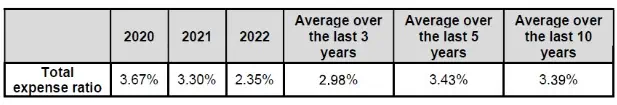

Total Expense Ratio (TER)

The total expense ratio (TER) represents the percentage of expenses incurred by the participating fund compared to its assets.

These expenses include investment fees, management fees, distribution fees, taxes, and related costs.

The expected expenses are already factored into the premiums, so they are not additional costs for you.

However, if the actual expenses differ significantly from the expected level, it can impact the non-guaranteed benefits received.

For this participating fund, the past years’ TERs are shown below:

Past TERs should not be solely relied upon as predictors of future ratios.

Various factors in a particular financial situation, including changes in fund management, investment strategies, regulatory requirements, market conditions, and other variables, can influence expense ratios.

Industry TER Comparison

The report below shows how insurance companies performed in expense management between 2017 and 2019:

Manulife had a higher expense ratio than the industry average between 2017 and 2019.

However, historical data should not be considered a definitive indicator of future ratios.

It’s important to consider the most recent information and the company’s current financial and operational situation to make informed decisions.

Manulife Ready LifeIncome (III) Fees and Charges

The plan has taken into account all the expenses from the participating fund when calculating the premiums for your policy.

This means that you won’t be charged any additional fees for these expenses.

Illustration of How Manulife Ready LifeIncome (III) Works

The below illustration assumes a 4.75% rate of return.

Dorothy, a mother, purchases the Manulife Ready LifeIncome (III) as a gift for her son, Julian. She pays an annual premium of S$10,000 for a total of 10 years.

Starting from the 10th policy year, Dorothy starts receiving $3,000 per year as income.

This income consists of a Guaranteed Yearly Income of $950, the fixed amount that Dorothy will receive every year, and a Non-Guaranteed Yearly Income of $2,050, which may vary depending on how well the participating fund performs.

In the 18th policy year, Dorothy decides to transfer ownership of the plan to her son, Julian. He becomes the new beneficiary and starts receiving the $3,000 Yearly Income.

When Julian reaches the 40th policy year, he names his newborn daughter, Macey, as the secondary life insured. This means that Macey is also covered under the same policy.

In the 60th policy year, Julia transferred the policy ownership to his daughter, Macey. Now, Machas becomes the new policy owner and will receive the benefits going forward.

At the end of the policy term, which is 120 years, Macey receives the Maturity Benefit. This amount is a substantial sum of $2,214,938.

In the table below, we can see the benefits received over the years:

| Policy Year | Policy Owner | Yearly Income | Total Yearly Income | Maturity Benefit |

| 10-17th | Dorothy | $3,000 | $24,000 | – |

| 18-59th | Julian | $3,000 | $126,000 | – |

| 60-119th | Macey | $3,000 | $180,000 | – |

| 120th | Macey | – | – | $2,214,938 |

Summary of Manulife Ready LifeIncome (III)

| Cash and Cash Withdrawal Benefits | |

| Cash Value | Available |

| Cash Withdrawal | Available |

| Health and Insurance Coverage | |

| Death | Available |

| Total Permanent Disability | Available |

| Terminal Illness | Available |

| Critical Illness | N/A |

| Early Critical Illness | N/A |

| Health and Insurance Coverage Multiplier | |

| Death | N/A |

| Total Permanent Disability | N/A |

| Terminal Illness | N/A |

| Critical Illness | N/A |

| Early Critical Illness | N/A |