PRUActive Saver III is a participating endowment plan that offers unique flexibility to policy owners.

This endowment plan can cater to individuals with different preferences with various premium payments and policy term options.

These include single or regular premium terms spanning 5 to 30 years and policy terms ranging from 10 to 30 years.

Beyond financial protection in the event of death, you can also benefit from participating in the fund’s performance and receiving bonuses.

Here is a comprehensive review of PRUActive Saver III.

Read on.

My Review of the PRUActive Saver III

If you are looking for an endowment plan that allows you to have control of your premium payment terms, Prudential’s PRUActive Saver III is a great place to start.

With a range of policy term options and flexible payment options, you can customise your plan to fit your needs.

This plan also includes optional riders for added protection and guarantees your capital upon maturity, making it a low-risk option for those seeking peace of mind.

And with strong par fund performance, you can trust that your investment is in good hands.

Unfortunately, Prudential’s PRUActive Saver III falls short in the features department.

If you need withdrawal options or the ability to freeze premiums, add a second life assured, or change the life assured, you won’t find it here.

Plus, there’s no terminal illness or TPD coverage to speak of.

On the bright side, if you’re searching for a more robust and flexible endowment plan, the Manulife ReadyBuilder or the NTUC Income Gro Saver Flex Pro are worth checking out.

Remember, insurance policies are not created equal; therefore, it helps to compare the best savings plans in Singapore across multiple insurers.

This is important as endowment plans are often a long-term commitment, and for the case of the PRUActive Saver III, it’s anywhere between 6 to 30 years.

Start by getting a second opinion if the PRUActive Saver III is good for you from an unbiased financial advisor, followed by exploring if there are better alternatives that might suit you best.

If you need someone to get a second opinion from, we partner with MAS-licensed financial advisors who can help you with this.

Click here for a non-obligatory consultation.

Now let’s explore the Prudential PRUActive Saver III in detail.

Criteria

- Premium Payment Term: 5 to 30 years

- Policy Term: 6-30 Years

General Features

Policy Term

The PRUActive Saver III plan offers a variety of premium payment terms and policy terms that can be customised to match your unique requirements.

You can select a single premium payment or opt for regular premium payments anywhere between 5 to 30 years.

The PRUActive Saver III also lets you customise when your policy matures, as long as it is between 10 to 30 years.

As with most policies, you can decide on your desired premium payment frequency:

- Monthly

- Quarterly

- Half-yearly

- Yearly

Payout Options

With the PRUActive Saver III, you can only receive the payout at the end of your policy term.

Similar to most endowment plans, there is no option for partial withdrawals.

Protection

Death Benefit

If death occurs, your beneficiaries will receive the death benefit as shown in the following table.

| Type of Premium | Death Benefit Payable |

| Regular Premium (Tenure 5-30 Years) | The higher of

Please note that this does not include premiums for supplementary benefits. |

| Single Premium | The higher of;

|

The policy terminates upon payment of the death benefit.

Optional Add-On Riders

Crisis Waiver III

If you get diagnosed with any of the 35 serious illnesses mentioned in the policy, you no longer have to worry about paying premiums.

They’ll be waived so that you can focus on your health and recovery.

Early Stage Crisis Waiver

If you’re diagnosed with any of the covered early critical illness conditions, you won’t have to pay premiums for 5 years.

And if, unfortunately, you’re diagnosed with more serious conditions later on, you won’t have to pay premiums for 10 years.

Payer Security Plus

If something happens to you, like passing away, becoming permanently disabled, or getting seriously ill (touchwood!), this rider will take care of your spouse’s or child’s insurance policy premiums.

It ensures that their coverage continues even if you’re unable to pay. This benefit lasts until the end of the premium term or until you reach 85, whichever comes first.

Key Features

Maturity Benefit

When your policy matures, you will receive the maturity benefit, which includes the sum assured.

This is a guaranteed amount that, as a policyholder, you will receive, as well as any bonuses or profits that may have been accrued over the policy term.

Surrender Benefit

When surrendering your policy, you will be eligible for a surrender benefit composed of guaranteed and non-guaranteed surrender amounts.

If you’re on the single premium policy, you will receive an immediate surrender value.

If you’re on a regular premium policy, your surrender value will only be known after 36 months of paying premiums.

Policy Loan

This is an advance that you can take out against the cash value of your life insurance policy.

Think of it like borrowing from yourself.

Hence, it is secured by your life insurance policy, but you’ll need to repay it with interest (that goes to the insurer, instead of your own policy).

Automatic Premium Loan

If you forget or cannot pay your premium on time, Prudential will automatically lend you the money to cover your premiums.

It ensures that your insurance policy remains active and you don’t lose the coverage.

The loan amount is taken from your policy’s cash value, and you must repay it later.

Another thing to note is that the Automatic Premium Loan is not available to those with a single premium policy.

Surgical & Nursing Loan

This specialised type of loan helps cover the expenses associated with surgical procedures and nursing care offered in partnership with healthcare providers.

It is important to remember that both Policy and Automatic Premium loans come with non-guaranteed loan interest – so make sure to check if getting a loan from your policy gives you the best interest.

Bonuses

Considering the benefits provided by this plan, it is notable that both guaranteed and non-guaranteed benefits are included.

It’s important to note that the guaranteed benefits already allocated to your policy will be paid no matter how well the participating fund is doing.

On the other hand, non-guaranteed benefits comprise Reversionary, Performance, and Maturity Bonuses.

Although subject to variability, these non-guaranteed benefits offer added value and potential for greater returns in accordance with the future experience of the participating fund.

Reversionary Bonus

You are eligible for the reversionary bonus after making 2 years’ worth of premium payments.

It has a projected rate of $8.50 per $1,000 face value and $19 per $1,000 on accumulated reversionary bonuses.

The following table shows the illustrated performance bonus rates for PRUActive Saver III:

| No. of completed years in force | Performance Bonus as a percentage of accumulated reversionary bonus |

| 1 | 0.0% |

| 2 | 0.0% |

| 3 | 5.0% |

| 4 | 5.0% |

| 5 | 10.0% |

| 6 | 15.0% to 20.0% |

| 7 | 20.0% to 40.0% |

| 8 | 25.0% to 60.0% |

| 9 | 30.0% to 80.0% |

| 10 | 30.0% to 100.0% |

| 11 | 35.0% to 99.0% |

| 12 | 40.0% to 98.0% |

| 13 | 45.0% to 97.0% |

| 14 | 50.0% to 96.0% |

| 15 | 53.0% to 95.0% |

| 16 | 53.0% to 94.0% |

| 17 | 54.0% to 93.0% |

| 18 | 54.0% to 92.0% |

| 19 | 55.0% to 91.0% |

| 20 | 55.0% to 90.0% |

| 21 | 56.0% to 89.0% |

| 22 | 56.0% to 88.0% |

| 23 | 57.0% to 87.0% |

| 24 | 57.0% to 86.0% |

| 25 | 58.0% to 85.0% |

| 26 | 58.0% to 84.0% |

| 27 | 59.0% to 83.0% |

| 28 | 60.0% to 82.0% |

| 29 | 60.0% to 81.0% |

| 30 | 61.0% to 80.0% |

Maturity Bonus

The maturity bonus is calculated as a percentage of the accumulated reversionary bonuses. This bonus is paid out once when your policy matures.

The following table shows the illustrated maturity bonus rates for PRUActive Saver III:

| Policy Term | Maturity Bonus as a percentage of Accumulated Reversionary Bonus |

| 10 | 23% to 235% |

| 11 | 23% to 248% |

| 12 | 13% to 243% |

| 13 | 9% to 245% |

| 14 | 23% to 248% |

| 15 | 22% to 247% |

| 16 | 19% to 244% |

| 17 | 27% to 239% |

| 18 | 31% to 238% |

| 19 | 30% to 241% |

| 20 | 36% to 249% |

| 21 | 32% to 249% |

| 22 | 39% to 253% |

| 23 | 44% to 262% |

| 24 | 49% to 278% |

| 25 | 53% to 294% |

| 26 | 57% to 313% |

| 27 | 64% to 327% |

| 28 | 70% to 337% |

| 29 | 73% to 347% |

| 30 | 76% to 348% |

Performance Bonus

The performance bonus is a specific percentage of the total reversionary bonuses earned, which is paid either upon policy surrender or policy maturity.

The actual amount you receive depends on when you terminate your policy.

PRUActive Saver III Fund Performance

Premium Allocation

Because PRUActive Saver III is a participating endowment plan, part of your premiums is used to buy sub-fund units.

When investing in an endowment or annuity plan, do not overlook the significance of the par fund’s performance.

As of 31st December 2022, your premiums are allocated as shown in the table below.

| Type of Asset | Allocation Goals

(%) |

Asset Allocation

(%) |

| Bonds | 47.5 | 58.4 |

| Equities | 29.5 | 25.8 |

| Property | 10 | 8.9 |

| Other Assets, such as policy loans and cash | 13.0 | 6.9% |

| Total | 100% | 100% |

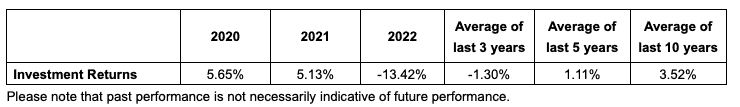

Past Fund Performance

The following table shows the net past return rate of the participating fund, whereby the expenses have already been subtracted.

Looking at the geometric 3, 5, and 10-year net investment returns for par funds, you will find that PRUActive Saver III is definitely a standout choice, consistently making the highest returns amongst all insurers.

However, note that the data is dated (2010 to 2019) and does not reflect future performance.

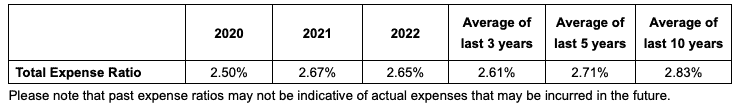

Total Expense Ratio

This ratio is a way to measure how much money a fund spends on various costs compared to the total amount of money it manages.

When you have a policy with a participating fund, these expenses are already included in the premiums you pay. Hence, you don’t have to pay extra for them.

However, if the actual expenses end up being much higher or lower than what was expected, it can affect the benefits you receive from the fund that is not guaranteed.

To give you an idea of how this fund has been managing its expenses in the past, you can take a look at the table below, which shows the Total Expense Ratios for previous periods:

The previous 3-year average is much lower than the 5 and 10-year averages.

In the recent past, the fund was performing better in cost management than over 5 years ago.

In addition to the above data, here’s the table you can use to compare the expense ratios with those of other insurers:

On average, Prudential wasn’t the best performing during the years surveyed, performing slightly above the industry average. But from the most current data above, there is a great improvement of 2.99% in 2017 to 2.65% in 2022.

Please note that the data is dated (2017 to 2019) and does not reflect future performance.

Fees and Charges

All the fees and charges have already been factored into your premiums for the PRUActive Saver III.

This means there will be no surprise charges or extra expenses to catch you off-guard.

An Illustration of How PRUActive Saver III Works

Meet Peter, a 35-year-old father with big dreams for his 3-year-old daughter. Intending to send her abroad for university, Sam invests $1,000 per month for 9 years through the PRUActive Saver III plan.

He plans to stop payments when his daughter enters secondary school to keep things manageable.

When his daughter turns 19, Sam could potentially receive a payout of $153,857 following a fully customised 16-year plan designed to meet his unique needs.

Of course, investment rates are not guaranteed, but even at a conservative rate of return of 3.00%, Peter could still expect to receive a payout of $134,655.

With PRUActive Saver III, Sam can rest easy knowing he’s taking concrete steps towards building a brighter future for his daughter.

Let’s simplify things with this table to make it clear.

| Year | Event |

| At the start of the policy year,

Peter-35 years old Child 3 years old |

Set aside $1,000 per month for 9 years. |

| At Policy Year 9, Peter is 44 and Child is 12.

Peter stopped paying premiums |

Total Premiums Paid is 1,000*12*9

$108,000 |

| Policy Year 16, Peter is now 51 and child is 19. | Receives $153,857 for child’s university education |

Based on an illustration of 4.25% returns.

Summary of the PRUActive Saver III

| Cash & Cash Withdrawal Benefits | |

| Cash Value | Available |

| Cash Withdrawals | NA |

| Health & Insurance Coverage | |

| Death | Available |

| TPD | N/A |

| Terminal Illness | N/A |

| Critical Illness | N/A |

| Early Critical Illness | N/A |

| Health & Insurance Coverage Multiplier | |

| Death | N/A |

| TPD | N/A |

| Terminal Illness | N/A |

| Critical Illness | N/A |

| Early Critical Illness | N/A |

| Additional Benefits | |

| Optional Add-on Riders | Available |