PRUActive Protect is a multipay critical illness plan covering you for up to 36 conditions.

This plan also lets you choose extra protection for serious health problems that can make life harder.

It also has some extra benefits like kids’ protection and waiver of premiums if something happens to you.

Let’s find out why the Prudential PRUActive Protect is one of the most popular CI plans in the market.

Keep reading our review.

My Review of Prudential’s PRUActive Protect

The PRUActive Protect is a flexible critical illness insurance plan that can cover you for up to 36 critical illnesses.

You can choose how long you want this protection for, from as short as 10 years to as long as 99 years.

Most importantly, it doesn’t just protect you once but multiple times for both ECI and CI.

PRUActive Protect also looks out for your children.

They get complimentary coverage against serious illnesses and conditions – without additional premiums and not reducing your sum assured.

Sometimes, a severe illness or accident can lead to intensive medical care in the ICU.

This policy ensures you receive a payout to help with the financial impact of such situations.

In addition, during this tough time and your spouse has a policy, this benefit can help by waiving the premiums for a year, reducing your financial burden.

More importantly, even if you claim a critical illness, your coverage doesn’t disappear. It comes back to 100% after each claim.

You can make multiple claims, adding up to 500% of the initial coverage amount.

However, many of its features are only available as add-ons (apart from the base 36 CI conditions, child cover, and additional benefits).

If you want protection for early critical illness and get multiclaim for ECI and CI, you will need multiple riders for this.

It also only covers 36 CI conditions and slightly over 100 ECI conditions.

This is much less than other multiclaim plans – of which some can offer up to 189 conditions; the AIA Absolute Critical Cover!

On the other hand, the Manulife CI FlexiCare (Deluxe) has a great balance between price, coverage, and features, making it the best multi-pay critical illness plan for us.

As an ECI/CI policy is one of the most important insurance plans you should have, it’s essential that you compare it with other critical illness plans in Singapore.

You should also take time to get second opinions from unbiased financial advisors.

This is important as a critical illness insurance plan is something you’ll be paying for until you’re 65 or 75, which to most, is 20 to 40 years of premium payments.

With so much money being invested in a ECI/CI plan, it’s essential that it’s the best possible coverage your budget can buy.

If you want to explore your options or get a second opinion from a financial advisor, we partner with MAS-licensed financial advisors to help you with this.

Click here if you’d like a free second opinion.

Let’s now explore the PRUActive Protect in detail.

Criteria

- Policy Term: 10 to 99 years

- Coverage from 10 years to 99 years

Product Features

Policy Terms

You may have a policy term from 10 years up to 99 years

Premiums Payment Terms

The premium payment term for Prudential’s PRUActive Protect will last as long as the policy is in-force.

You may make payments monthly, quarterly, bi-annually, and annually.

Like all critical illness plans, the premiums are not guaranteed.

Protection

Death Benefit

If the insured passes away while the policy is in force, Prudential will provide a payout equal to 20% of the sum assured after subtracting any outstanding amounts owed to them.

Any other claims made under the PRUActive Protect and its associated riders won’t reduce the Death Benefit.

However, if you decide to reduce the sum assured on your PRUActive Protect policy at any point, the Death Benefit will be adjusted accordingly.

In this case, it will be set at 20% of the newly reduced sum assured.

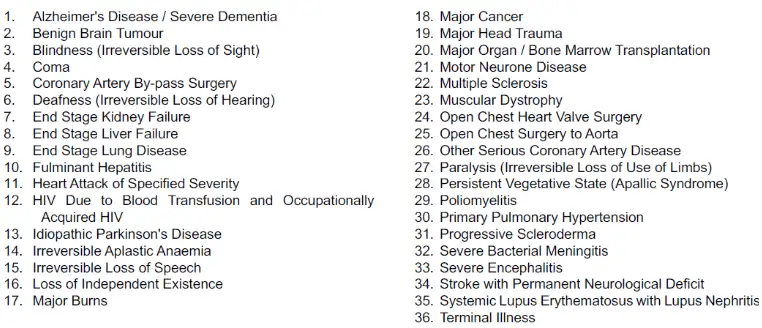

Critical Illness Benefit

Under this benefit, the PRUActive Protect Coverage will cover you if you’re diagnosed with 1 of 36 critical illnesses listed in the policy.

However, you must survive for at least 7 days after a registered medical practitioner’s official critical illness diagnosis.

It’s important to note that the benefit can only be claimed once, even if you are diagnosed with multiple critical illnesses.

Hence, once Prudential pays out the benefit for a critical illness, the Critical Illness Benefit coverage ends.

If you previously received a payout from your insurance for a severe medical condition but not among the 36 critical illnesses, that payout will be deducted from the benefit amount.

In all cases, the diagnosis of the critical illness must be made by a qualified and registered medical practitioner.

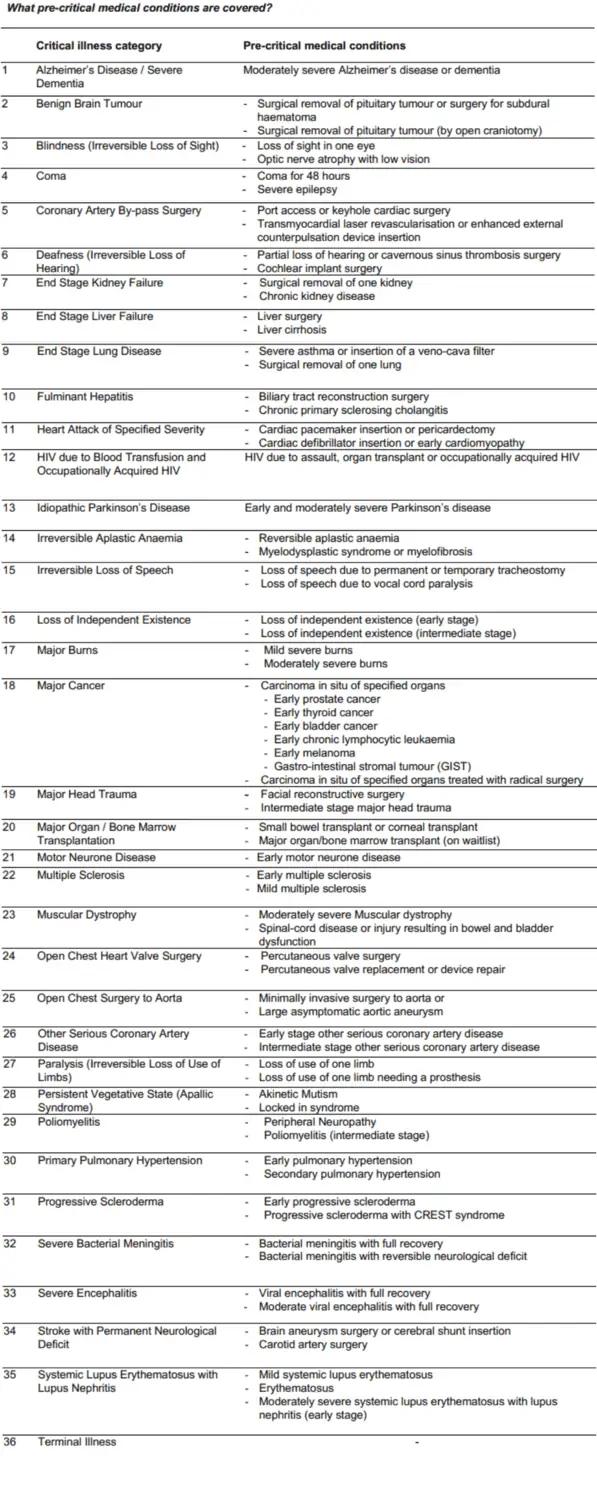

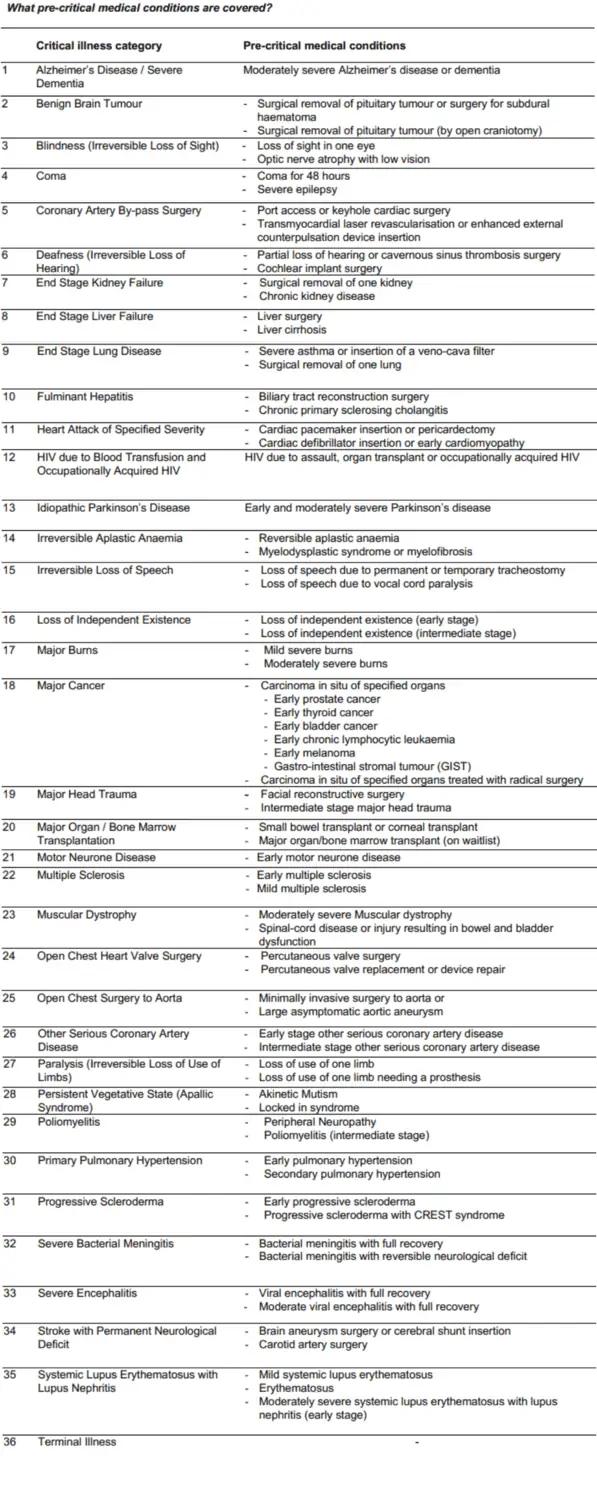

Below is a list of the critical illnesses covered:

Crisis Care Accelerator Benefit

This benefit applies if the insured person undergoes surgery on 1 of the vital organs (like the heart, lung, brain, kidney, or liver) due to an illness or an accident and is admitted to the Intensive Care Unit (ICU).

However, the admission has to be for at least 3 consecutive days following the surgery, and Prudential will pay you 50% of the sum assured.

A certified specialist must also confirm the surgery and ICU stay as medically necessary.

Furthermore, any health condition for which you’re claiming this benefit must first be considered or claimed under the 36 critical illnesses listed above.

Additional Benefit

The Additional Benefit is applicable if the life assured is diagnosed with a medical condition that requires Angioplasty and Other Invasive Treatment for Coronary Artery.

The PRUActive Protect will provide 10% of the sum assured as a payout, up to a maximum of $25,000.

A registered medical practitioner must officially diagnose the medical condition and persist for at least a week after diagnosis for the benefit to be payable.

Any claim made under this Additional Benefit will not affect the overall sum assured of your policy.

However, this benefit is paid out only once and won’t be again for the same condition.

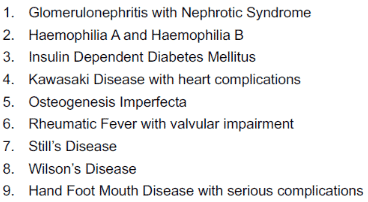

Child Cover Benefit

If you and your spouse purchase a PRUActive Protect policy, your children aged 17 years or younger will receive Child Cover Benefit for free.

It offers financial support if your child is diagnosed with any of the 36 critical illness conditions and Juvenile Medical Conditions.

The payout is either 25% of the higher sum assured from 1 of the parents’ policies or up to $25,000, paid once for each child.

Payouts will not reduce your sum assured.

However, this benefit only becomes active after the second anniversary of the parent’s policy.

If the diagnosis occurs after the first but before the second anniversary of the parent’s policy, the insurance company will pay 50% of the benefit.

Your child must survive for at least 14 days from the date of diagnosis to benefit.

The following Juvenile Medical Conditions are covered:

Spouse Waiver Benefit

Suppose the person whose life is insured has a spouse who is diagnosed with one of the 36 critical illnesses covered by the policy.

In that case, the insurance company will temporarily waive the premiums for the PRUActive Protect policy for 12 months from the next premium due date.

To make a claim, the life assured (the policyholder) must provide their marriage certificate as proof of their relationship with their spouse. You can only claim the Spouse Waiver Benefit once during the policy’s life.

It’s important to note that this benefit does not waive the premiums for any supplementary benefits attached to your PRUActive Protect policy. It only applies to the base policy and its associated premiums.

If you’ve already included the Payer Security Plus benefit in your plan, the Spouse Waiver Benefit won’t be applicable as the two benefits cannot be used together.

Finally, this benefit ends automatically if the Critical Illness Benefit has been fully claimed or the policy is terminated.

Optional Add-On Riders

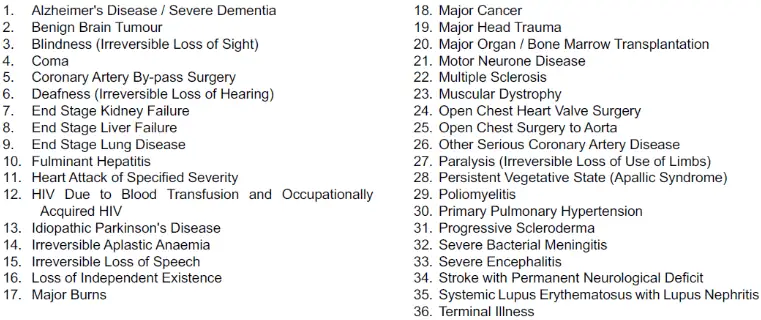

Protect Plus

Protect Plus is a multiclaim late-stage CI benefit you can attach to your PRUActive Protect policy.

Basically, the Prudential PRUActive Protect starts off as a single-claim late-stage CI plan.

Adding this rider makes it into a multiclaim policy as it restores your insurance coverage to its full amount after you claim against the Critical Illness Benefit.

You can claim up to a maximum of 500% of the PRUActive Protect sum assured, which includes any claims made for early critical illness (ECI) conditions under the Early Protect benefit (if you have this benefit).

However, the Critical Illness Benefit will pay out 100% of the sum assured minus the amount paid under the Early Protect benefit claim.

And, if you’ve claimed under the Crisis Care Accelerator benefit, the Critical Illness benefit will be restored to 100% after 12 months.

It’s important to take note that if the next critical illness is not the same as the previous one, there must be a waiting period of 12 months between the dates of diagnosis and 24 months If it’s the same as before.

But, if an ECI claim has been made under Early Protect progresses to a critical illness stage, no waiting period is necessary between claims.

Similarly, you must survive for at least 7 days from the date of diagnosis of the critical illness before this benefit pays out.

Otherwise, only the Death Benefit will be paid.

Finally, if the life assured is diagnosed with multiple critical illnesses simultaneously, the policy will pay for the one with the highest severity level.

These are the CI conditions covered:

Early Protect

This benefit pays out for one ECI condition, up to 100% of the Early Protect sum assured.

The benefit amount is reduced by any claims made under the 36 critical illnesses covered by the PRUActive Protect base policy.

The life assured must survive for at least 7 days from the date of diagnosis for this benefit to be payable.

The Early Protect benefit ends once Prudential has paid out 100% of the Early Protect sum assured.

These are the ECI conditions covered by the PRUActive Protect:

Special Benefit

If you are diagnosed with any of the 12 special medical conditions, PRUActive Protect will pay an amount equal to 20% of the Early Protect benefit sum assured.

This benefit can be as high as $25,000 for each medical condition, but the maximum total payout for one person will not exceed $200,000.

Claiming this benefit won’t reduce your overall sum assured.

To be eligible for this benefit, you must survive at least 7 days from the date of diagnosis, and the medical conditions must be confirmed by a licensed medical professional.

Prudential will make this benefit payment once for up to 10 listed special benefit medical conditions.

This benefit covers the following medical conditions until you are age 84 years only:

- Diabetic complications

- Osteoporosis with fractures

- Severe rheumatoid arthritis

As for juveniles, the following medical conditions are covered until the insured person reaches 17 years of age.:

- Glomerulonephritis with Nephrotic Syndrome

- Haemophilia A and Haemophilia B

- Insulin Dependent Diabetes Mellitus

- Kawasaki Disease with heart complications

- Osteogenesis Imperfecta

- Rheumatic Fever with valvular impairment

- Still’s Disease

- Wilson’s Disease

- Hand Foot Mouth Disease with serious complications

Early Protect Plus

The Early Protect Plus is a multiclaim ECI rider attached to your base policy.

You can claim up to a maximum of 500% of the Early Protect sum assured for any of the ECI covered.

However, this 500% includes any claims made for critical illnesses under the PRUActive Protect base policy.

You must survive for at least 7 days from the date of diagnosis of the ECI condition before this benefit pays out.

Otherwise, only the Death Benefit will be paid.

If an ECI condition previously claimed under Early Protect progresses to a critical illness stage, no waiting period is required between claims.

However, the policy will pay 100% of the critical illness sum assured minus the amount paid out under the Early Protect benefit claim.

If you are diagnosed with multiple ECIs or CIs simultaneously, the policy will only pay for the condition with the highest severity level.

These are the ECI conditions covered:

Other Features

Option to Convert Policy

If you purchased your PRUActive Protect under Prudential’s standard terms, you can choose to convert your policy into whole life or an endowment plan.

You can exercise this option if you are under 65 years old and have paid all the premiums due.

Additionally, no claims should have been made under your PRUActive Protect plan or your riders.

The sum assured for the new policy should be the same as or less than your PRUActive Protect policy but not exceed $500,000.

The premium for the new policy will be determined based on the life expectancy at the time of conversion.

If any benefits in your PRUActive Protect policy come with non-medical-related special terms and conditions, these same terms and conditions will continue to apply to the new policy.

Summary of PRUActive Protect

| Cash and Cash Withdrawal Benefits | |

| Cash Value | N/A |

| Cash Withdrawal Benefits | N/A |

| Health and Insurance Coverage | |

| Death | Available |

| Total Permanent Disability | N/A |

| Terminal Illness | N/a |

| Critical Illness | Available |

| Early Critical Illness | Available |

| Health and Insurance Coverage Multiplier | |

| Death | N/A |

| Total Permanent Disability | N/A |

| Terminal Illness | N/A |

| Critical Illness | N/A |

| Early Critical Illness | N/A |

Optional Riders

|

Available |