The NTUC Income Silver Protect is now obsolete.

The NTUC Income Silver Protect is a cancer insurance plan targeted towards those with pre-existing medical conditions.

It’s hard to imagine facing a dreadful health situation such as early or advanced-stage cancer, accidental fractures, or needing hospice care due to cancer.

Cancer can, unfortunately and unpleasantly, surprise you!

That’s where NTUC Income’s Silver Protect steps in, offering you a safe haven against these health adversities.

Keep reading for our review.

Criteria

- 50 to 74 years old at the time of application and last birthday.

General Features

Premium Payment Terms

- The premium payments remain consistent throughout the entire policy term.

- Flexibility to choose how and when to make monthly, quarterly, semi-annually or annual payments.

- Premium payment options are available up to the age of 84.

Policy Term

The NTUC Income Silver Protect has a 10-year policy term and is renewable every 10 years until you’re 84 years old.

Protection

Death Benefit

The Silver Protect insurance plan has specific provisions for Death Benefits in non-accidental cases:

- If you pass away within a year from the start date of the coverage due to non-accidental causes, the plan will refund 100% of the total premiums paid.

- If you pass away after your first year of the coverage start date due to non-accidental causes, the plan will pay $5,000.

After that, the policy ends, and there are no more benefits.

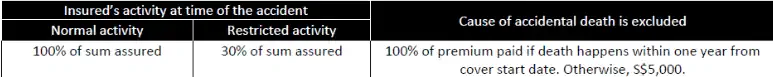

Accidental Death Benefit

If you pass away due to an accident during the policy term, the plan will pay 100% of the sum assured.

The cause of accidental death has some limitations, such as restricted activity and exclusions, which are explained in the product summary.

This will result in a reduced benefit payout.

Here is a table of benefits payable under the different circumstances of accidental death:

The Accidental Death Benefit under the NTUC Income Silver Protect protects the insured due to death from an accident within 365 days of the accident.

The policy will end upon payout; no further benefits or coverage will be provided under this plan.

Early Stage of Major Cancer Benefit

Under the NTUC Income Silver Protect, if you are unfortunately diagnosed with an Early Stage of Major Cancer during the policy term, the plan pays out 25% of the sum assured.

However, once a claim is made for Early Stage of Major Cancer, the benefit is no longer valid or applicable to future claims.

It won’t be paid again, even if the policy is renewed.

However, the policy will continue for the remaining unclaimed benefits.

As an added benefit, the Premium Waiver Benefit will start so the policy can continue without you paying more premiums.

The Early Stage of Major Cancer Benefit has a waiting period of 90 days that applies from the start date of the cover.

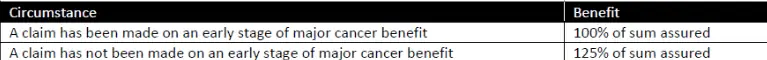

Advanced Stage of Major Cancer Benefit

The NTUC Income Silver Protect covers you for Advanced Stage of Major Cancer if are diagnosed during the policy term.

The benefit amounts payable depend on different circumstances, as shown below:

The Advanced Stage of Major Cancer benefit has a waiting period of 90 days from the start date.

This means that if you are diagnosed within the first 90 days of this plan incepting, the benefit will not be payable.

Similarly, the Premium Waiver Benefit will kick in if there are still unclaimed benefits.

After that, the policy will end should you pass on or at the end of the policy term, whichever is first.

After this termination, the policy will not be renewed.

Key Features

Premium Waiver Benefit

The Premium Waiver Benefit starts when you are diagnosed with Advanced Stage Major Cancer.

You are no longer required to make premium payments for the remaining policy term.

The policy will continue to be in force for unclaimed benefits if the premiums have been paid during this period.

So, the policy remains active, and benefits can be claimed, assuming that premium payments are up to date.

The policy will end upon your or the insured’s death or at the policy term’s conclusion, whichever occurs first.

Cancer Hospice Care Benefit

The Cancer Hospice Care Benefit supports you if you are diagnosed with terminal cancer.

Here’s how it works:

- If, sadly, you are diagnosed with terminal cancer and hospice and palliative care at an inpatient hospice facility is recommended, the policy will pay out 15% of the sum assured.

- If you are referred to a home care or daycare hospice facility instead, the payout is 5% of the sum assured.

However, if you are later admitted to an inpatient hospice facility, a further 10% of the sum assured will be paid, bringing the total benefit to 15% of the sum assured.

- Once the maximum 15% of the sum assured has been paid under this benefit, it will end, even if the policy is still active.

This cover also has a waiting period of 90 days from the policy’s start date before this benefit can be claimed.

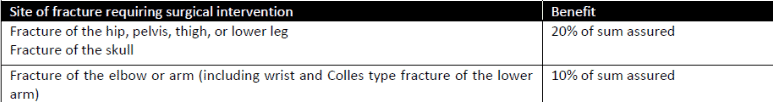

Accidental Fractures Benefit

The Accidental Fractures Benefit under the Silver Protect policy is designed to cover unexpected accidents that cause fractures and need surgical intervention.

A few key points to remember are:

- The fracture must require surgery involving regional or general anaesthesia to be eligible.

- Non-surgical treatments like casts or immobilisation do not qualify for this benefit.

- Hairline fractures are excluded from the coverage.

- The surgical procedure must occur within the first 30 days of the accident.

The benefit amounts will vary depending on the location of the fracture, as shown below:

To further clarify, the Accidental Fractures Benefit under this policy is capped at 20% of the sum assured.

This means that once an eligible fracture occurs and you receive this 20% payout, you won’t be able to claim this benefit again, even if your policy is renewed.

But there’s a silver lining.

If you’ve only claimed part of the 20% – say 10% – and your policy is up for renewal, the renewed policy will still cover the remaining 10% of the sum assured for this benefit.

This ensures you don’t lose out on potential claims due to timing or partial claims in the past.

Renewability

After every 10-year term, your policy gets automatically renewed for another 10 years, given that no claim-triggering event has occurred (with early-stage cancer and accidental fractures being exceptions to this rule).

However, things change a bit once you hit your 65th birthday.

If you renew your policy at or after turning 65, your policy will only be extended until the anniversary following your 84th birthday.

After this point, the policy will no longer be renewed.

The premium you’ll need to pay upon each renewal is not fixed.

It will depend on your age at the time, the sum assured, and the premium rates prevailing when the policy is renewed.

Remember, the decision to renew is ultimately in your hands.

You can opt out of renewing your policy.

Summary Of NTUC Income Silver Protect

| Cash & Cash Withdrawal Benefits | |

| Cash Value | No |

| Cash Withdrawals | No |

| Health & Insurance Coverage | |

| Death | Yes |

| TPD | No |

| Terminal Illness | Yes |

| Critical Illness | Yes, cancer |

| Early Critical Illness | Yes, cancer |

| Health & Insurance Coverage Multiplier | |

| Death | No |

| TPD | No |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |

My Review Of NTUC Income Silver Protect

NTUC Income’s Silver Protect is a comprehensive cancer insurance plan offering coverage for both early and advanced stages of cancer for those aged 50 and above.

The application process is pretty simple and does not require a medical check-up, which means that if you have a pre-existing medical condition, this might be for you.

One of this plan’s highlights is its guaranteed renewal every 10 years, allowing you to renew your coverage until age 84.

Importantly, even if an early-stage cancer claim is made, the sum assured remains the same, ensuring continued protection.

In the event of an advanced-stage cancer diagnosis, NTUC Income Silver Protect pays out 100% of the sum assured.

If no previous early-stage cancer claim has been made, an additional 25% of the sum assured is provided.

Furthermore, if you are diagnosed with advanced-stage cancer, future premiums for the policy are waived, reducing financial stress during a challenging time.

Any unclaimed benefits remain available.

For terminal cancer cases, a medical practitioner’s recommendation for hospice and palliative care can trigger a payout of up to 15% of the sum assured, enhancing your quality of life during this challenging period.

Accidents are also covered under this plan.

In case of a fracture due to an accident, you can receive up to 20% of your sum assured, with the benefit amount depending on the site of the fracture.

NTUC Income Silver Protect provides coverage for both accidental and non-accidental death, paying up to 100% of the sum assured in the case of accidental death.

Despite the many advantages, it’s important to note that the NTUC Income Silver Protect plan does not include a Total Permanent Disability (TPD) benefit or policy riders, which would enhance your coverage.

Though there is much to like about this plan, it might be suited for those with pre-existing conditions better.

Those in better health might find more benefits from a regular term life insurance plan, coupled with a critical illness insurance plan instead.

Consider consulting with a financial advisor to ensure you choose the best policy for your specific needs.

They can provide personalised advice and guidance to help you make the right decision for your requirements.