The NTUC Income Lady 360 is a specialised critical illness insurance plan for women which meets the unique protection of women’s needs.

It offers coverage for various aspects of women’s health and well-being.

Lady 360 includes coverage for female health conditions and surgical procedures, offering financial assistance when needed.

The plan provides support after specific diagnoses or surgeries, helping ease the financial burden of medical treatments and recovery.

It also offers the benefit of regular biennial health screenings.

These screenings aid early detection of health issues and promote proactive health management.

In the sad event that you do pass away, this plan financially supports your beneficiaries or estate.

Keep reading for more of our review.

Criteria

- The criteria for entry age depend on selecting a 10-year (renewable) policy term; the entry age is between 15 and 44 as the last birthday age.

- If you choose a policy term that extends up to the policy anniversary immediately after your 64th birthday, the entry age can be between 15 and 59 years as the age of your last birthday.

Policy illustration below:

Women who have turned 15 up to 17 as of their last birthday require parental or legal guardian consent to take on this policy.

Parents can’t buy policies insuring the lives of their children who are 18 years old (last birthday) as above.

General Features

Premium Terms

Premiums are payable throughout the NTUC Income Lady 360 policy term.

Policy Term

The NTUC Income Lady 360 policy term extends to the age of 64, and your policy can be renewed at the end of each 10-year policy term.

If there are no claims during the current policy term, the policy will be renewed automatically.

This means that you can continue your coverage without the need for a new application or underwriting.

Protection

With NTUC Income Lady 360, you can claim multiple insured events, specifically the Female Illnesses Benefit, Female Surgeries Benefit, and Support Benefit.

These claims can add up to the cover limit specified for each benefit.

You can receive benefits for multiple events if the claims are not for the same illness, surgery, or cause (except for cancer).

If you experience different insured events covered by the policy, you can make separate claims for each, subject to the individual benefit limits.

Below are the benefits under Income Lady 360:

Death Benefit

In the unfortunate event of you passing away during the policy term, a death benefit of $10,000 will be paid out.

The policy will end after the death benefit payout.

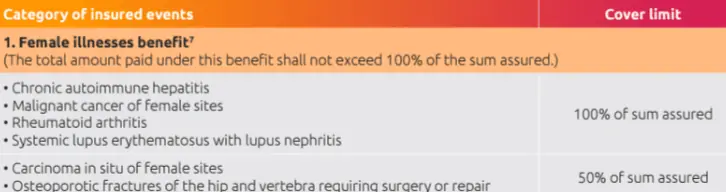

Female Illnesses Benefit

During the term of the plan, if a registered medical practitioner diagnoses you and is eligible for female illnesses that are covered by the plan, you will receive a payout.

Below are the cover limits for each insured event:

The amount paid under this benefit will not exceed 100% of the sum assured.

For conditions other than cancer, once you’ve submitted a claim for a specific illness, you can’t make another claim for the same condition in future.

Suppose multiple conditions are diagnosed in any paired organ on the same date (even if they exist in different stages or forms).

In that case, only the benefit related to the condition for which the highest benefit amount is payable will be paid.

To qualify for the benefit, you must live for at least 7 days after diagnosis of the covered female illness.

Waiver of Premium

The Lady 360 policy includes a Waiver of Premium benefit in case of a successful claim for any of the covered female illnesses during the policy term.

Premium payments will be waived for up to 24 months or until the policy term ends, whichever occurs first.

This benefit will waive the premiums due after the diagnosis date of any of the covered female illnesses, ensuring that you do not have to carry on making premium payments during the specified waiver period.

You can only claim once for this benefit.

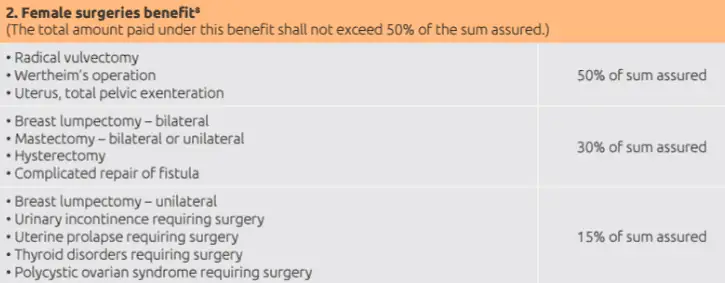

Female Surgeries Benefit

If you undergo a female surgery during the policy term, this benefit will provide a payout.

The payout is determined based on the limits set for the type of surgery, as shown below.

However, the maximum benefit payout is capped at half of the sum assured specified in the policy.

To qualify for this benefit, the surgery must be medically necessary by a registered medical practitioner and performed in a Singapore hospital.

Should you need multiple female surgeries due to the same condition, only the female surgery with the highest benefit limit will be paid, thus ensuring that the benefit is not duplicated for the same condition.

Female surgery can be claimed only once, except for surgeries related to cancer.

If multiple conditions are diagnosed in any of the paired organs on the same date, only the benefit related to the necessity for which the highest benefit amount will be paid.

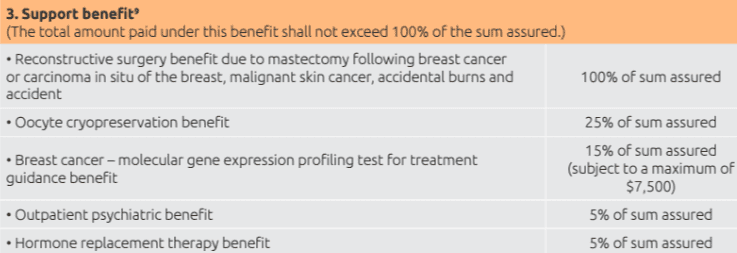

Support Benefit

The NTUC Income Lady 360 allows you to claim for any covered events specified under the Support Benefit during the policy term, and this benefit will provide a payout.

Specific Reconstructive Surgery

Under this benefit, the payout amount is determined based on the limit set for the specific insured event, as tabulated below:

You can claim multiple insured events covered under the Support Benefit if each claim is valid and distinct.

The total amount paid under the Support Benefit will be at most 100% of the sum assured.

After reaching the insured limit, the benefit will end.

Oocyte Cryopreservation Benefit

If an insured individual, aged between 15 and 40 years, undergoes oocyte cryopreservation treatment before chemotherapy or radiotherapy (excluding target therapy) for cancer treatment, the policy pays 25% of the sum assured.

The cancer treatment via chemotherapy or radiotherapy must be endorsed by a licensed medical professional. Please note this benefit will only be paid out once.

Breast Cancer Benefit

The Breast Cancer Benefit in the Lady 360 policy offers specific coverage related to breast cancer diagnosis and treatment.

Should you undergo a molecular gene expression profiling test during the policy term, this benefit provides coverage.

The payout under the Breast Cancer Benefit equals 15% of the sum assured, subject to a maximum limit of S$7,500.

To qualify for this benefit, you must have undergone surgical excision of an early-stage malignant breast tumour.

The benefit starts if you undergo a molecular gene expression profiling test, a specialised diagnostic test used in the assessment and treatment of breast cancer.

Outpatient Psychiatric Benefit

This comes in handy and is activated when you are diagnosed with either major depressive disorder (MDD) or anxiety disorder due to traumatic life events.

Upon your diagnosis of MDD or anxiety disorder, this benefit pays out 5% of the sum assured as specified in the policy.

You need to be diagnosed with the specified mental health condition by a registered psychiatrist in Singapore who has practised Psychiatry for at least 6 continuous months.

Hormone Replacement Therapy Benefit

The Hormone Replacement Therapy Benefit in this policy covers you if you undergo specific medical procedures that require hormone replacement therapy.

Eligibility Criteria:

- You must be under the age of 50.

- You must have undergone a bilateral oophorectomy, hysterectomy, or both.

- Hormone replacement therapy is considered medically necessary.

- Medical Certification by a registered medical practitioner.

Hormone replacement therapy should be prescribed for a minimum of 1 year after the oophorectomy or hysterectomy, or both.

If you meet the criteria, the policy will pay out 5% of the sum specified.

Care Benefit: Health Screening

With the NTUC Income Lady 360 plan, the Health Screening Benefit under the policy promotes preventive healthcare by offering biennial health check-ups to you.

This benefit helps you monitor your health and identify potential issues early.

The benefit kicks in after receiving a letter of notification.

The screening must be completed within 180 days at a designated panel clinic.

Summary of NTUC Income Lady 360

| Cash & Cash Withdrawal Benefits | |

| Cash Value | No |

| Cash Withdrawals | No |

| Health & Insurance Coverage | |

| Death Benefit | Yes |

| Female Illness Benefit | Yes |

| Waiver of Premium Benefit | Yes |

| Female Surgeries Benefit | Yes |

| Support Benefit | Yes |

| Breast Cancer Benefit | Yes |

| Outpatient Psychiatric Benefit | Yes |

| Hormone Replacement Therapy Benefit | Yes |

| Care Benefit: Health Screening | Yes |

| Health & Insurance Coverage Multiplier | |

| Death | No |

| TPD | No |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |

My Review of the NTUC Income Lady 360

The NTUC Income Lady 360 is a specialised critical illness insurance policy that accommodates unique health and financial needs for women.

It offers extensive coverage for specific female illnesses, offering a lump sum payout of up to 100% of the sum assured upon diagnosis.

This ensures that you have the financial means to access necessary medical treatments and cover related expenses.

In the event of female surgeries related to these illnesses, the policy offers payouts of up to 50% of the sum assured.

This helps cover the costs of surgical procedures and post-operative care.

NTUC Income Lady 360 prioritises your well-being by waiving policy premiums for the next 24 months upon diagnosis of a covered female illness.

This financial relief allows you to focus on your recovery and health without the burden of premium payments.

The policy offers competitive and affordable premium rates, starting at $1.40 per day, meaning you can access this comprehensive coverage without going bankrupt.

You will receive regular health screenings every 2 years to help you stay proactive about your health and detect potential issues early.

This promotes preventive care and ensures you’re in good health.

While the primary focus is on health-related benefits, the policy also provides a $10,000 death benefit, offering financial support to your beneficiaries in the event of your passing.

Importantly, your coverage remains in place even after claiming covered illnesses or surgeries.

You’re not penalised for utilising the policy to address your health needs.

Further, the policy goes beyond traditional critical illness coverage by offering additional support benefits, such as:

- Fertility preservation.

- Psychiatric treatment coverage due to traumatic life events.

- Molecular gene expression profiling for breast cancer treatment.

The policy recognises the financial challenges that can accompany a female illness.

It waives premiums when a female illness is diagnosed, ensuring you have the necessary funds to cover medical expenses.

In summary, the NTUC Income Lady 360 is a policy tailored to women’s health and financial well-being, offering comprehensive coverage, premium flexibility, and valuable support benefits.

However, since every person is different, this policy might not be the best for you.

We suggest taking some time to explore alternatives first, especially for critical illness insurance, before deciding on a specialised plan like this.

It’s also wise to get a second opinion from an unbiased financial advisor, especially since this is a long-term commitment that you’re making.

Click here to get a free, non-obligatory session.