The NTUC Income Gro Cash Sure is a regular premium participating annuity plan that provides you with payouts until you’re 120 years old.

This is also one of the few plans that guarantee your capital, ensuring your retirement funds are kept safe.

In this post, we reviewed NTUC Income’s Gro Cash Sure to help you decide if it’s the best policy to meet your financial goals.

Read on.

My Review of the NTUC Income Gro Cash Sure

NTUC Incomes’ Go Cash Sure is a retirement plan that offers a unique set of benefits. With a capital guarantee upon the end of your premium term, this mid/long-term policy is perfect for those looking for secure investments.

Plus, you can accumulate your cash payouts with interest and receive potential bonus distributions.

One outstanding feature is that you can anticipate receiving cash payouts for up to 120 years, ensuring your present and future security and peace of mind.

With no health condition restrictions and a choice of premium term, the NTUC Income Go Cash Sure ensures you receive cash benefits that perfectly suit your life’s timeline.

It also comes with 2 optional riders, with the Savings Protector Pro being an attractive add-on due to its retrenchment benefits.

The decent performance, together with low expense ratios, is definitely something to be desired from a retirement plan.

Overall, I’d say I like the NTUC Income Gro Cash Sure due to its many great features.

NTUC Income seems to be releasing pretty great annuity plans alongside the NTUC Income Gro Retire Flex and NTUC Income Gro Annuity II.

Their participating funds have also been consistently outperforming most insurers in Singapore, making it a highly attractive option for those looking for endowments or annuities.

However, when selecting a retirement plan, you must compare and contrast all your options.

Not all products may provide the same features, benefits, or payouts, so it’s important to understand what’s available and which is best for you.

This is especially important as you will be paying premiums for the next 5 or 10 years, and your retirement income relies on how well you chose your retirement plan.

You don’t want to be in your retirement years only to realise that the annuity isn’t giving you the payouts that you’re expecting.

That’s why, despite how good the NTUC Income Gro Cash Sure is, we always recommend getting a second opinion from an unbiased financial advisor.

This way, you get to know your alternatives and understand if the NTUC Income Gro Cash Sure is truly the best option for you.

If you need someone to talk to, we partner with MAS-licensed financial advisors to help you with this.

Click here for a free, non-obligatory second opinion.

Continue reading to learn more about the NTUC Income Gro Cash Sure in detail.

Criteria

- Premium payment term: 5 or 10 years.

- Minimum policy term: After the premium payment term.

General Features

Premium Payments

The NTUC Income Gro Cash Sure allows you to select a premium term of either 5 or 10 years.

The policy offers flexible options to manage your premium payments with 4 options available:

- Monthly

- Quarterly

- Biannually

- Annually

Premium Allocation

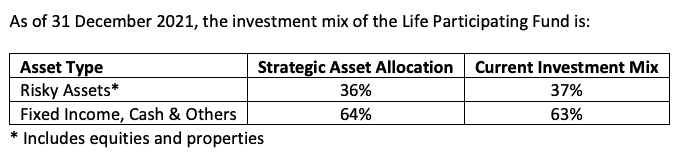

100% of your premiums are used to invest in the participating fund. Here are the asset allocations given by NTUC Income for the Gro Cash Sure:

Payout Options

By opting for the NTUC Income Gro Cash Sure, there are 2 ways to receive your payouts – the Maturity Benefit or the Cash Benefit.

For the Maturity Benefit, you will receive the cash value, benefits, and accumulated bonuses after deducting any policy loans and interest at the end of the policy term.

Alternatively, you may opt for the Cash Benefit, which gives you 2% of your sum assured yearly. We will cover this in more detail later.

Surrender Value

After making at least 2 years’ worth of payments, your policy will acquire a surrender value.

When the premium term ends, and you haven’t cashed in the policy, its guaranteed cash value equals the total premiums paid, not including any riders.

As surrender value varies from policy to policy, it’s best to look at your benefit illustration for details.

Protection

Death and Terminal Illness (TI) Benefit

With the NTUC Income Gro Cash Sure, you can rest assured that in the unfortunate event of death or terminal illness during the policy term, you or your beneficiaries will receive a benefit payment of:

- The higher of:

- The guaranteed cash value, or

- 105% of the net premium paid; and

- A terminal bonus

Moreover, NTUC Income will adjust this payment to account for any cash benefits and bonuses, including earned interest, past payouts, and any amount owed.

However, it’s important to note that the net premium amount excludes any premiums paid on riders.

If death occurs and a secondary insured has been appointed, they will become the new policyholder, and this benefit will not be paid out and will continue under the new insured.

Optional Add-On Riders

Savings Protector Pro

If you face an unfortunate total and permanent disability before you turn 70, your future premiums on your policy will be waived.

And that’s not all!

Your policy will continue, plus you will receive a single-payment benefit equivalent to 2 years’ yearly premiums of your basic policy and the Savings Protector Pro rider.

Retrenchment Benefit

Not only will you waive your premiums, but you’ll also have peace of mind in case of unexpected job loss.

If you get retrenched and can’t find work for 3 consecutive months, don’t worry about paying your premiums; they will be waived for up to 6 months thanks to the Retrenchment Benefit with this rider.

During this time, you’ll still have the same coverage while searching for your next job.

Also, you can postpone policy payments for the following 6 months if you’re still unemployed at the end of the 6th month.

This helps keep your worries at bay with an added layer of protection.

Cancer Premium Waiver-GIO

The Cancer Premium Waiver is an add-on to your existing policy that ensures that you won’t pay premiums if you have a doctor’s report confirming a major cancer diagnosis.

Key Features

Cash Benefit

If you have been paying your premiums regularly, you may opt to receive a yearly cash benefit of 2% of your sum assured for as long as your policy is active.

If your policy has a sum assured of at least $80,000, you can choose to receive this cash benefit monthly.

Should you still have any balance and your policy reaches the end of its term, NTUC Income will pay you the remaining amount as the maturity benefit.

You can cash out the benefit or accumulate it with the policy at a non-guaranteed interest rate of 3.00% p.a.

This balance can be withdrawn anytime.

Cash Bonus

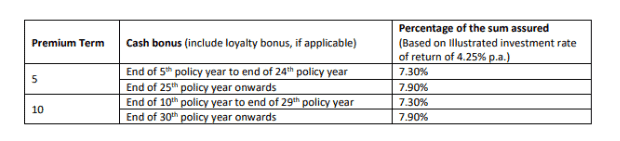

Like other annuity plans, you may receive a cash bonus as part of the non-guaranteed portion of your returns.

This bonus rate is declared annually and includes any loyalty bonuses that may be payable at the end of the 20th policy year following the end of the premium term.

The bonus rate is variable and changes yearly depending on how well the participating fund performs.

The following table shows the cash bonus percentage depending on the premium term:

Like the cash bonus, you may reinvest it with NTUC Income to gain higher returns from the participating funds.

As usual, these rates are non-guaranteed.

Terminal Bonus

A terminal bonus is paid when you make a claim, reach maturity, or surrender your policy. NTUC Income will decide the bonus amount to be given out when the time comes

Secondary Life Assured

You may choose to appoint or remove a secondary insured up to 3 times before the insured passes.

At the time of exercising this option, the secondary insured must be yourself (before the age of 65), your spouse (before the age of 65), or your child or ward (before the age of 18).

Purchasing An Additional Life Policy

Big life changes like getting married, ending a marriage, becoming a parent, turning 21 years old, buying a new house, or tragically losing a spouse could mean new benefits for you.

For instance, without medical underwriting, you can become eligible to purchase an additional life policy providing you with coverage for death and TPD.

However, you must meet the following conditions;

- You must exercise this option within 3 months of a life event.

- This option is available if you are under 50 years of age

- The new policy’s sum assured is up to a maximum cap of S$100,000 or 50% of the original policy, whichever is lower.

This option can be exercised twice, each being a different life stage. Make sure to have proper documentation on hand upon request.

Remember, any special terms that apply to your current policy will also be carried over to your new policy, including exclusions and premiums.

How does the NTUC Income Gro Cash Sure work?

Meet June, a 35-year-old who pays a yearly premium of $6,000 for 10 years, getting a sum assured of $24,200.

| Age | Event and Amount |

| 35 years | Takes out Gro Cash Sure with a sum assured of S$24,2000 and annual premiums of S$6,000. |

| 45 years old-

(10th year) |

Has the option to receive $2,251 in yearly guaranteed and non-guaranteed cash payouts.

She decides to accumulate the payouts for future use.

At this point, her capital, $60,000, is guaranteed upon maturity. |

| 50 years old

(15th year) |

June purchases and renovates an apartment by withdrawing an accumulated payout of S$14,560. |

| 51 years old | She decides to start receiving the annual payout of S$2,251 for a vacation. |

| 65 years old

(30th year) |

June receives the loyalty bonus on top of her cash bonus. This amounts to $2,396, and she uses the money during her retirement years. |

| 100 years old | June passes on, and her family gets the death benefit of S$68,494. The policy subsequently ends. |

The above figures are provided by NTUC Income and are based on an IIRR of 4.25% p.a. Take note that the actual returns you will receive are based on how the participating funds perform.

NTUC Income Gro Cash Sure Fees and Charges

The NTUC Income Gro Cash Sure’s fees and charges are already included in your premiums. Thus, you won’t have to worry about any unexpected charges.

However, that doesn’t mean you should ignore the fees you’ll be paying.

When it comes to participating plans, the biggest source of fees you’ll be paying are the expense ratios.

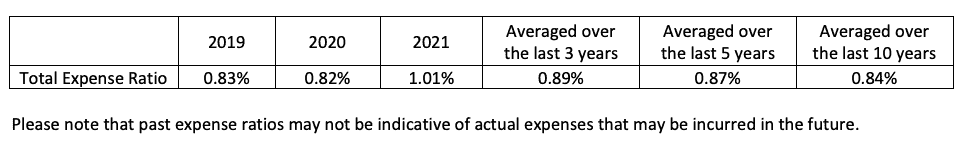

Expense Ratio

As of 31 December 2021, here are the expense ratios for the NTUC Income Gro Cash Sure:

This doesn’t mean much if you don’t benchmark it against the industry, so here are the average expense ratios across all insurers between 2017 to 2019:

As you can see, NTUC Income has the lowest expense ratios across all 8 major life insurers in Singapore. They have also maintained these low ratios even up to 2021.

But let’s see how the participating fund actually performs

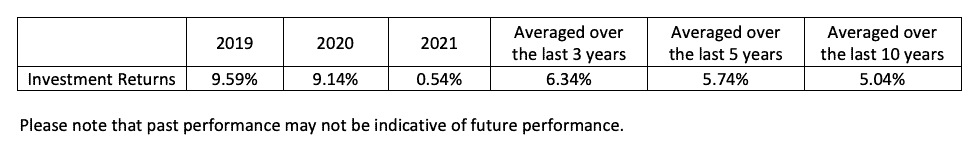

From 2019 to 2020, their par funds perform pretty well at above 9% in returns. However, it dropped significantly in 2021 to 0.54% due to the pandemic.

Looking at the average performance, the annualised 10-year returns are at 5.04%, which is pretty good, especially when your investments will be with them for at least this long.

Summary of NTUC Income’s Gro Cash Sure

| Cash and Cash Withdrawal Benefits | |

| Cash Value | Yes |

| Cash Value Benefits | Yes |

| Health and Insurance Coverage | |

| Death | Yes |

| Total Permanent Disability | No |

| Terminal Illness | Yes |

| Critical Illness | No |

| Early Critical Illness | No |

| Health and Insurance Coverage Multiplier | |

| Death | No |

| Total Permanent Disability | No |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |

| Optional Add-on Riders | Yes |