The NTUC Income Gro Annuity II is now obsolete. Check out other similar policies in our best retirement plans post.

NTUC Income’s Gro Annuity II is a single premium annuity plan that provides you with a lifetime yearly payout in your golden years.

This policy is highly recommended if you would like to receive annual payouts from your policy in the future.

In addition, you can enjoy high payouts in the form of non-guaranteed benefits depending on how the participating fund performs.

Here’s a comprehensive review of NTUC Income’s Gro Annuity III to help you decide if it’s the best policy for you.

Criteria

- Minimum entry age: 40 years

- Maximum entry age: 85 years

Premium Payment Options

NTUC Income’s Gro Annuity II is a single premium payment option; whereby you only have to pay the premiums once.

Take note that this plan accepts cash & SRS payments.

Payout Options

The plan allows you to receive your lifetime annuity payouts on the following basis;

- Monthly

- Quarterly

- Half-yearly

- Yearly

Because it’s an immediate annuity policy, you will receive regular payouts for life when the annuity starts.

Features

Cash Value and Bonuses

The NTUC Income Gro Annuity II policy allows you to cash in for its cash value.

Furthermore, as shown in the table, you’ll receive the cash value as long as the total annuity payouts are less than the single premium.

| Policy start date | Cash value |

| 1 year from the start of the cover | 85% of single premium minus conversion bonus and total annuity payments. |

| 2 years from the start of the cover | 90% of single premium minus conversion bonus and total annuity payments. |

| 3 years from the start of the cover | 93% of single premium minus total annuity payments. |

| 4 years from the start of the cover | 95% of single premium minus total annuity payments. |

| 5 years from the start of the cover | Single premium minus total annuity payments |

Notes:

A conversion bonus is the extra cash value offered by the policy if you opt for an annuity option to purchase the plan. Consequently, the policy ends after you cash in fully.

Non-guaranteed Bonuses

The NTUC Income Gro Annuity II policy is eligible for bonuses declared every year. Upon declaration, the bonuses are included in the annuity payouts.

Worth noting, the bonuses are non-guaranteed as they are based on the performance of the participating fund.

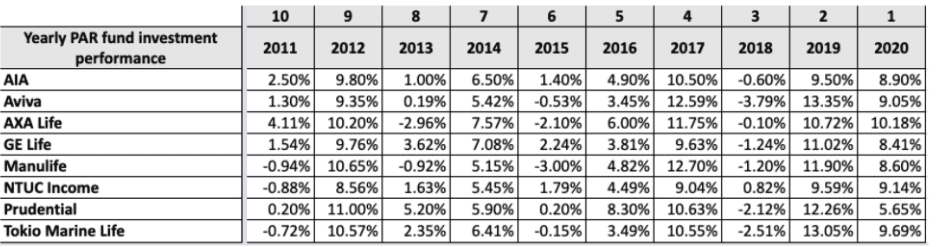

Performance of the Participating Fund

From the table below, NTUC Income has been one of the most decent performing participating funds over the years.

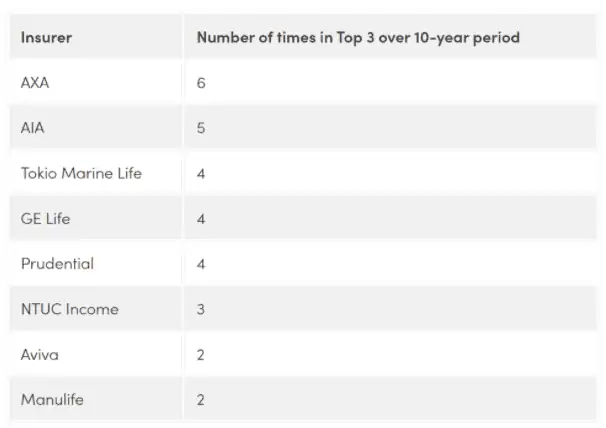

In addition, it has achieved the Top 3 best performing par funds 3 times over the past decade as shown in the table below.

To add on, NTUC Income has one of the lowest expense ratio averages in the past 3 years.

Worth noting, expenses can greatly impact the performance of the fund.

A lower expense ratio is desirable.

Overall, NTUC Income has maintained a steady performance over the years while keeping expenses low.

This is a good positive factor to consider when looking for an insurer with a healthy and stable participating fund.

Protection

Death Benefit

If death occurs, the policy will pay the single premium minus total annuity payments. However, the sum of the annual payments must be lower than the single premium.

Further, debts owed to the policy, such as loans and interest, are also deducted before a claim is settled.

After that, the policy ends, and there will be no future benefits.

Illustration

Here is a simple illustration to understand how the policy works.

Mark is a 55-year-old non-smoking male searching for a policy that will offer him guaranteed income at retirement. He chooses the NTUC Income Gro Annuity II and pays a single premium of S$100,000.

As earlier mentioned, the payouts commence immediately after single premium payment.

From 56 years old, Mark will start receiving a guaranteed monthly annuity payout of S$70.70 for life. In addition, from 65 years, he will start receiving a non-guaranteed monthly annuity payout of S$51.15.

In total, he will be receiving a total illustrated monthly annuity payout of S$121.85 (51.15+70.70)

At 95 years, here is how his total payout will look like.

| Non-guaranteed monthly annuity payout at age | S$554.00 |

| Total illustrated monthly annuity payout | S$624.70 |

Notes;

- The amounts are based on the prevailing IIRR.

- Bonus rates are not guaranteed as they depend on the performance of the participating fund, which is assumed to have an illustrated investment rate of return(IIRR) of 4.25%.

- If, for example, the IRRL is 3.00% p.a, the total monthly annuity payout for Mark will be S$427.154 at 95 years and S$110.754 at 65 years. As you can see, with a lower IIRR, the payouts will also be significantly smaller.

NTUC Income Gro Annuity II Summary

NTUC Income’s Gro Annuity II has multiple benefits as highlighted in the table below.

| Cash & Cash Withdrawal Benefits | |

| Cash Value | Available |

| Cash Withdrawal Benefits | Available |

| Health and Insurance Coverage | |

| Death Benefits | Available |

| Total Permanent Disability | Not Available |

| Terminal Illness | Not Available |

| Critical Illness | Not Available |

| Health & Insurance Coverage Multiplier | Not Available |

| Death/Total Permanent Disability/Terminal Illness/Critical Illness/Early Critical Illness | Not Available |

| Optional Riders | Not available |

| Other Benefits | |

| Loans | Available |

| Non-guaranteed bonuses | Available |

Key highlights of the NTUC Income Gro Annuity II

- You get to enjoy lifetime annuity payouts during retirement. Therefore you don’t have to worry that your retirement will outlive the policy.

- You can choose when to receive your annuity payouts: monthly, quarterly, semi-annually, or yearly.

- You can enjoy higher payouts in the form of non-guaranteed payouts.

- There is a death benefit that enhances your protection even as you save.

My Opinion of the NTUC Income Gro Annuity II

Overall the NTUC Income Gro Annuity II is a great retirement plan with guaranteed payouts that will last for a lifetime.

Therefore this ensures you have a comfortable life in your retirement since you can enjoy a stable income stream without worrying about your retirement funds.

Subject to;

- Entry Age, premium payment term and accumulation period less than or equal to 80 ANB

- Additional payout plus basic monthly payout

- All policies payable in cash

Most policies start their payouts a few years after the accumulation period. Fortunately, one positive aspect of this plan is that payouts commence immediately after you make your premium payment.

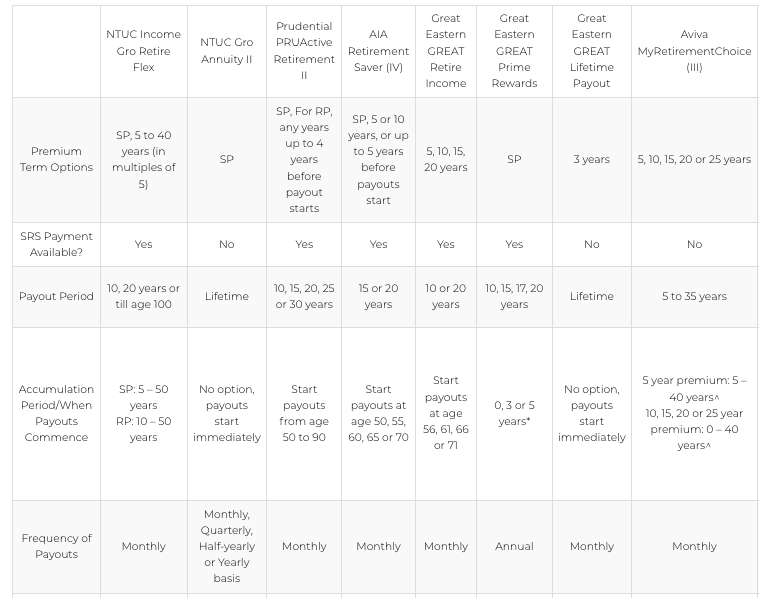

NTUC Income’s Gro Annuity II is a lifetime annuity payout plan similar to the Great Eastern GREAT Lifetime Payout.

However, its major drawback is that it only allows a single premium option.

Therefore, you must make a single payment when signing up for the policy.

On the other hand, the GREAT Lifetime Payout is more flexible because it has a three-year premium payment option.

However, a single premium payment may be a good thing as you don’t have to worry about not being able to meet premium payments or you have a large sum available.

As this is a single premium policy, there are not many features that can be offered.

Read our best retirement annuity plans in Singapore guide to check for the best plans based on different needs.

However, if you’re unsure, it’s always best to talk to an unbiased financial advisor.

They will help you pick the best choice among many options on the market, thereby saving you the hassle and worries you may face.