The NTUC Income Gro Cash Flex Pro is a regular premium endowment plan that lets you get cash payouts as early as your 3rd policy year.

This is one of the most flexible plans out there, allowing you to choose the amount and frequency of your premium payments and the length of your savings term.

But is this for you?

Continue reading our review of the NTUC Income Gro Cash Flex Pro to find out more.

My Review of NTUC Income Gro Cash Flex Pro

What makes the NTUC Income Gro Cash Flex Pro so great as an endowment plan is its wide choice of premium payment terms and policy terms – allowing you to customise the plan according to your financial goals.

But what really sets this plan apart is its flexibility and packed features. You can appoint a secondary life assured and choose from a range of optional riders to make the plan fit your specific needs.

And starting from the second year of the policy, you’ll receive yearly or monthly cash benefits of 3% of your sum assured, plus extra cash bonuses that may vary.

You can even accumulate these benefits and earn interest at a rate of up to 3.00% per year.

And with death and terminal illness coverage, your loved ones will be taken care of financially when they need it most.

Even better, the guaranteed insurable option allows you to add an existing life policy to your plan if certain events occur in your life.

But perhaps the best part is the guaranteed insurable option, which allows you to add an existing life policy to your plan when you hit certain milestones in life.

And when your policy reaches maturity, you’re guaranteed to receive back at least all the premiums you’ve paid – excluding any premiums for optional riders you may have chosen.

Plus, you’ll also receive non-guaranteed bonuses.

Ultimately, this means that you can say goodbye to financial worries and hello to a brighter, more secure future.

However, as always, it’s best that you get a second opinion on whether the NTUC Income Gro Cash Flex Pro is for you because what I think is good, might not be good in your situation.

For example, if you’re looking for a highly flexible policy, then the Manulife ReadyBuilder (II) is the most flexible endowment plan in Singapore.

But if you’re looking for a policy that offers the highest guaranteed returns, then the Singlife Choice Saver is a better bet.

I recommend starting by reading our post on the best endowment plans in Singapore first to understand what your alternatives are.

Then, you should talk to an unbiased financial advisor to help you compare and find the best endowment plan based on your needs.

With a premium payment term of up to 30 years and a policy term up until you’re 120, it’s best that you take some time before committing to a long-term policy.

If you’re interested in getting a second opinion or comparing policies, we partner with unbiased financial advisors who have helped thousands of our readers compare various policies, and I believe they can help you with this, too.

Click here for a free comparison session.

Here’s more about the NTUC Income Gro Cash Flex Pro.

Criteria

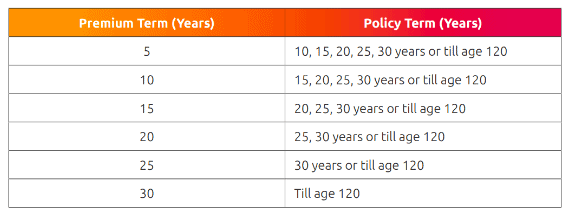

- Premium Payment Term: 5 – 30 years (by multiples of 5)

- Policy Term: 10 – 30 years or till age 120

- Coverage age: Below 70 years old

General Features

Premium Payment

You get to choose how long the policy lasts – 5, 10, 15, 20, 25, 30 years, or until you reach age 120.

The premium terms and coverage are described in the table below:

Kindly note that you can only make yearly premium payments only.

Protection

Death Benefit

If the insured passes away while the policy is still active, NTUC Income will pay out 105% of all the premiums they have paid, minus any deductions.

This payout will also include the terminal bonus but not the premiums paid on riders.

Additionally, any money that has accumulated as cash benefits and bonuses will also be paid out.

If the option to receive cash benefits monthly were chosen, any remaining monthly payments and bonuses for that year would also be given.

After all these payouts, the policy terminates.

Terminal Illness (TI) Benefit

The terminal illness benefit will payout should the policyholder be diagnosed with a terminal illness.

This benefit plays out the same as the Death Benefit.

Cash Benefit

At the end of the 2nd policy year, the insured will start to receive cash payouts consisting of a yearly cash benefit that is 3% of the sum assured.

This is provided premiums for the policy have been paid for at least 2 years.

You also have the choice to receive the cash benefit as a payout or reinvest it to earn more interest.

If the policy is held all the way through the policy term, you will receive a final yearly cash benefit and a cash bonus as a lump sum along with the maturity benefit.

The policy will then end thereafter.

Should the sum assured of the policy be at least $80,000, the yearly cash payouts can be received in monthly payments.

However, you can only make yearly withdrawals if the sum assured is less than $80,000.

This amount for the monthly cash benefit will be arranged, but you cannot change the payout frequency once the first cash benefit payout has been made.

Note: If there was a loan taken from the policy and any interest accrued on it, that amount would be subtracted before any of the benefits are paid out.

Optional Add-On Riders

Savings Protector Pro

In the unfortunate event whereby the insured becomes totally and permanently disabled before turning 70, further premium payments for the basic policy are waived.

The policy will remain active, and the insured will get a lump sum payment equal to 2 years’ worth of premiums.

Retrenchment Benefit

Under the Savings Protector Pro rider, should you be retrenched and remain unemployed for 3 consecutive months, you won’t have to pay premiums for your basic policy and rider for 6 months.

If you’re still jobless after the 5th month, you can defer payment for the next 6 months.

This gives you peace of mind knowing you’re still provided with the same coverage even if you’re out of work.

Cancer Premium Waiver (GIO)

With this rider, if the insured is diagnosed with major cancer while the rider is active, they won’t have to pay any more premiums in the future.

This is useful in allowing the insured to focus on their health and recovery without worrying about paying for the insurance.

Key Features

Maturity Benefit

You will receive the surrender value if you keep the policy until the end of the policy term.

In addition to the surrender value, any money accumulated as cash benefits and bonuses will also be paid out to you.

Capital Guarantee When Policy Matures

This policy guarantees that your premiums, excluding optional rider premiums, will be returned upon maturity.

You will also receive guaranteed cash benefits, guaranteed maturity benefits, and non-guaranteed bonuses.

Bonuses

The profits from the participating fund are shared in the form of non-guaranteed cash and terminal bonuses.

A cash bonus can be paid to you from the end of the second year of the policy until the policy ends.

The terminal bonus is an extra pay above all other benefits you may receive after making a claim when the policy reaches maturity or if you decide to surrender the policy.

Guaranteed Insurability Option to Purchase An Additional Life Policy

If you go through any of the following life occurrences, you have the option to obtain a new policy solely covering death and total and permanent disability benefits, without requiring medical underwriting:

- Celebrating your 21st birthday

- Getting married

- Going through a divorce

- Embracing parenthood

- Suffering the loss of a spouse

- Purchasing a residential property

The maximum sum assured for the new policy will not exceed 50% of the sum assured for the existing policy, or $100,000, whichever is lower.

To exercise this option, you must satisfy the following conditions:

- Within 3 months of the occurrence of the life event.

- You must not be totally and permanently disabled or diagnosed with an advanced-stage dread disease when choosing this option.

- You should be 50 years old or younger when selecting this option.

- The life event must have occurred no earlier than 12 months after the policy’s start date.

- Upon request from Income, you must provide evidence of the life event.

One notable aspect of this option is that you can use it up to a maximum of 2 times. But, it must be for different or distinct life events.

Appointing Secondary Insured

You may choose to nominate a second person to be the secondary assured person of this policy.

This is provided the following criteria are met:

- The premium of the policy is paid only with cash;

- No nomination of beneficiary has been made for the policy, and;

- There is no change to the policy ownership, including assignment, bankruptcy, and trust.

With a secondary insured appointed, it ensures that the policy will continue even after the main insured person’s death.

The secondary insured person can be yourself (as long as you are under 65 years old), your spouse (also under 65 years old), or your child (under 18 years old) at the time you choose to appoint.

Early Termination

After paying premiums for at least 2 years, this policy has a surrender value.

However, if you decide to terminate the policy early, it can come with high costs.

In some cases, the surrender value you receive may be zero or even less than the total premiums you have paid.

If you choose to surrender the policy before its intended duration, the amount you receive back may be lower than expected.

Check your policy documents or with your financial advisor to determine your current surrender value.

NTUC Income Gro Cash Flex Pro Fund Performance

The participating fund invests its money in different types of investments, such as stocks, bonds, property, and cash.

These investments can have varying performance levels, with some performing better than others.

To ensure that the par funds achieve its objectives and perform well, the fund managers may change their mix of investments.

Here is the investment mix as of 31 December 2021:

| Type of Assets | Allocation Goals (%) | Actual Allocation |

| Fixed Income, Cash & others | 64 | 63 |

| Risky assets (equities and properties) | 36 | 37 |

| Total | 100 | 100 |

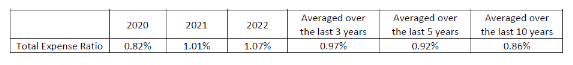

Total Expense Ratio

This is the overall cost of managing and investing the money in the fund, including taxes and other expenses.

It is calculated by comparing the total expenses to the total amount of money in the fund.

A higher expense ratio means that a larger portion of your premiums goes towards covering these costs, which can impact the benefits you ultimately receive from the policy.

Here are the total expense ratios for past years as of 31 December 2022:

When investing in a participating fund, don’t just focus on performance – take a look at costs too.

Here is a table that compares NTUC Income’s expense ratios to other top industry players:

NTUC Income has one of the lowest expense ratios in Singapore, averaging at 0.83% from 2017 to 2019.

This ratio is notably low compared to other insurance providers – which is a good thing.

But it’s not just about the costs – you also need to consider the value you’ll get in return for your investment.

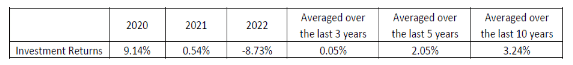

Investment Rate of Return

This is the amount of money the participating fund earns from its investments over a period of time and is affected by various factors in the economy.

Here are the past investment returns (as of 31 December 2022) of the NTUC Income Gro Cash Flex Pro’s par funds:

In the 3 years, the rate of return for this fund has declined from 9.14% to -8.73%.

A negative rate of return can result from various factors, including dwindling income, economic turbulence, and inflation.

But in this case, it can be attributed to the market downturn due to the pandemic.

However, there are still positive 3, 5, and 10-year returns from the participating funds.

Looking at the geometric average net returns, NTUC Income has performed above average amongst other insurers across 3, 5, and 10 years; showing a pretty stable track record.

NTUC Income Gro Cash Flex Pro Illustration

Mr Leon is 55 years old and wants to grow his wealth and plan for retirement.

He decides to get the NTUC Income Gro Cash Flex Pro policy, with a sum assured of $41,667.

To get this policy, he needs to pay $25,000 as a premium every year for 5 years until he reaches the age of 120.

He also includes his son, Pedro, who is 17 years old, as a secondary insured on the policy.

Here are the expected benefits:

After the second year of having the policy, Mr Leon starts receiving a yearly cash payout.

He chooses to accumulate this money with the insurance company.

When Pedro is 32 years old and wants to buy a new house, Mr Leon decides to withdraw $59,802 from the accumulated cash payout of the policy.

He uses this money to support his son’s home renovation expenses.

At the age of 71, Mr Leon decides to start receiving a yearly cash payout from the policy of $3,500 each year to support his retirement years.

Unfortunately, when Mr Leon reaches 80 years old, he passes away.

Fortunately, the NTUC Income Gro Cash Flex Pro policy continues for Pedro as he becomes the new insured person of the policy.

When Pedro turns 82, the policy reaches its maturity date, paying him a total of $274,167.

From this policy illustration, the total amount paid out over the years is $508,969.

Summary of Benefits:

| Policy Year | Events | Amount |

| After 2nd | Mr Leon Reinvests annual Cash Benefit | 3% of $41,667 |

| 15th | Partial Cash Benefit Withdrawal | $59,802 |

| 16th | Mr Leon Opts for Yearly Cash Payout | $3,500 |

| 25th | Mr Leon passes on aged 80.

Pedro continues with the policy as a secondary insured |

– |

| 65th | Policy maturity date | $274,167 |

| – | Total Benefits | $508,969 |

Based on a 4.25% p.a. returns illustration.

NTUC Income Gro Cash Flex Pro Fees and Charges

The NTUC Income Gro Cash Flex Pro fees and charges vary year to year depending on how much it costs to manage the participating fund.

This is seen in the expense ratio and will not be an additional expense on top of your premiums.

These costs include things like commissions, overhead expenses, and policy claims.

Certain expenses are directly related to the participating fund itself.

For example, if there are commissions paid to agents or administrative costs associated with managing the fund, those costs will be taken care of by allocating a portion of the fund’s assets.

Some expenses are not specific to the fund alone but are spread across multiple funds.

For instance, general administrative expenses might apply to all the funds the insurance company manages.

These shared expenses are distributed among the different funds based on certain allocation principles.

Summary of NTUC Income Gro Cash Flex Pro

| Cash and Cash Withdrawal Benefits | |

| Cash Value | Yes |

| Cash Withdrawal Benefits | Yes |

| Health and Insurance Coverage | |

| Death | Yes |

| Total Permanent Disability | No |

| Terminal Illness | Yes |

| Critical Illness | No |

| Early Critical Illness | No |

| Health and Insurance Coverage Multiplier | |

| Death | No |

| Total Permanent Disability | No |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |

| Optional Add-on Riders

Savings Protector Pro Cancer Premium Waiver |

Yes |