The GREAT Lifetime Payout is now obsolete. Check out our best retirement plan post for similar policies.

The Great Eastern GREAT Lifetime Payout is a participating annuity policy with a 3-year premium term.

In this review, we’ll explore the plan’s features, benefits, comparison with other similar policies, and much more.

Keep reading.

My Review on the Great Eastern GREAT Lifetime Payout

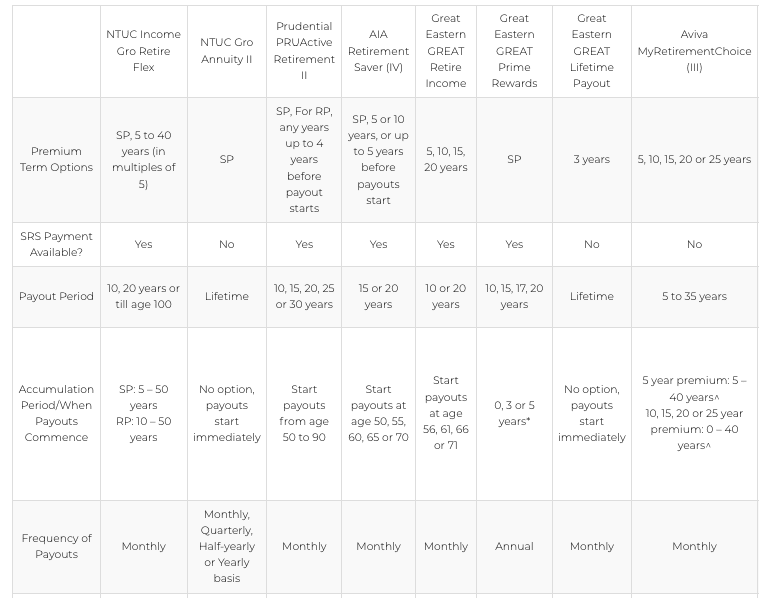

Here, we compare the GREAT Lifetime Payout with other plans.

Subject to;

- Entry Age, premium payment term and accumulation period less than or equal to 80 ANB

- Additional payout plus basic monthly payout

- All policies payable in cash

One drawback of the GREAT Lifetime Payout policy is that it does not allow premium payments from your SRS account.

In addition, there’s no option when to start receiving your payouts after an accumulation period because the payments commence immediately.

Also, the policy does not cover Total Permanent Disability and, therefore, may not cushion you if you lose your sight or limbs.

Overall, I feel that the GREAT Lifetime Payout plan is still a good option because it offers a 3-year premium payment option with the advantage of receiving a lifetime payout.

Therefore, this eliminates the possibility of outlasting your retirement funds.

There is also a 100% capital guarantee on the 6th year, meaning your capital will be assured past the 6th year.

But if you’re looking to purchase this plan, then I’m afraid you’ll have to look elsewhere as it’s no longer available.

If lifetime payouts are what you’re interested in, then consider the Manulife Ready LifeIncome (III) as it’s currently the best in the market, with the best performing participating funds.

Otherwise, we consider the Manulife RetireReady Plus (III) as the best retirement plan in Singapore because it is feature-packed and can be customised to your needs.

If you’re still unsure, getting advice from unbiased financial advisors is always best.

Is this something you might be interested in?

We partner with MAS-licensed financial advisors who can help you compare policies to find the best one for your needs.

Criteria

- For the life assured: From age 1 to 75 years old

- For the policyholder: Age 19 onwards

Premium Payment Options

The plan has a three-year premium term, starting at S$10,000 per year payable in cash.

Payout options

As the name suggests, the plan offers a lifetime monthly payout consisting of guaranteed and non-guaranteed cash bonuses commencing from the policy’s 4th anniversary.

This means that after paying your premiums for 3 years, you can start receiving your monthly payouts from year 4.

Features

Lifetime Monthly Payouts

At the 4th anniversary of the policy, you’ll receive a regular monthly payout, also known as the survival benefit, which is paid until you make a claim or the plan’s termination, whichever comes first.

The monthly payout is made of;

- Guaranteed monthly income

- 1/12 of the annual bonus starting from year 4.

Notably, you may choose to withdraw the payouts or allow the policy to keep them to earn non-guaranteed interest in the future.

Furthermore, the non-guaranteed interest can change anytime without any notice. If you owe the policy, the amount is first deducted before you get paid.

Capital Guarantee

The policy offers a 100% capital guarantee as long as you pay the premiums annually and there are no changes to your policy.

Bonuses

The GREAT Lifetime Payout has both guaranteed and non-guaranteed bonuses or benefits.

The guaranteed bonuses include those already declared and which will be paid regardless of the performance of the participating fund.

On the other hand, non-guaranteed bonuses depend on how the participating fund performs.

There are 2 types of non-guaranteed bonuses, cash and terminal bonuses.

Cash bonuses are announced annually from the policy’s 4th anniversary.

After a declaration, the amount will be guaranteed and accordingly paid.

Every amount declared is split into 12 instalments, and each is paid every month alongside the survival benefit.

The terminal bonus is a one-time amount paid in the following circumstances;

After submitting a claim where it leads to termination

- When there is a surrender of the policy, whichever comes first.

- The terminal bonus is reviewed yearly.

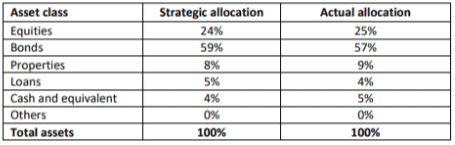

The Participating Fund

Typically, all your premiums from all participating policies are combined into a single asset and subsequently invested to earn income.

The following table is just an example of the investment mix by the company by 31st December 2020.

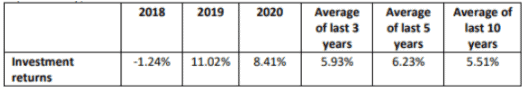

Here is the previous investment rate of returns minus expenses from the participating fund in previous years.

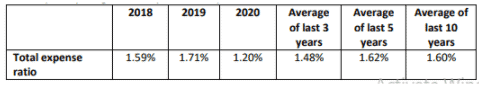

Over the years, the fund has managed to keep the expense ratio below 2%, as shown below.

It should be noted that the fund performance is likely to be affected by investment returns, expenses incurred, previous claims, and the number of surrenders.

Surrendering Your Policy

You can get the surrender value of your policy after paying your premium throughout the 3 years the policy is running.

Contact your financial advisor for the surrender value of your policy.

Protection

Death Benefit

The policy will pay 105% of the standard annual premium and bonuses minus debts owed if death occurs.

The standard annual premium is the basic premium paid yearly while considering any adjustments made on the sum assured.

It also excludes any discounts or extra loadings.

Terminal Illness Benefit

If a diagnosis of a terminal illness is made, you will receive the death benefit paid as a single amount.

However, the claim is only honoured if death is expected within 12 months after the terminal illness diagnosis.

In addition, this diagnosis must be from registered medical personnel and confirmed by a doctor appointed by the policy.

Summary Of Features And Benefits

The table below summarises the benefits and different features of this policy.

| Cash and Cash Withdrawal Benefits | |

| Cash value | Available |

| Cash withdrawal benefits | Available |

| Health and Insurance Coverage | |

| Death Coverage | Available |

| Total Permanent Disability | Not Available |

| Terminal Illness | Available |

| Critical Illness | Not available |

| Early Critical Illness | Not available |

| Health and Insurance Coverage Multiplier | |

| Death | Not available |

| Total Permanent Disability | Not available |

| Terminal Illness | Not available |

| Critical Illness | Not available |

| Early Critical Illness | Not available |

| Optional Add-on Riders | Not available |

| Other Benefits | |

| Lump-Sum Maturity Benefit | Available |

| Survival Benefit | Available |

| Guaranteed and Non-guaranteed Benefits | Available |

Illustration

To understand how the plan works, here is an illustration.

Jackson is a 50-year-old non-smoking male who plans 2 retirement options. In 5 years, he intends to semi-retire and finally retire when he finally reaches 70 years.

After evaluating several options, he settles for the GREAT Lifetime Payout with a yearly premium of $30,000.

On the 4th anniversary of the policy, Jackson will start receiving a monthly payout of S$225 comprising;

- S$75 Guaranteed Income

- S$150 Non-guaranteed Income

Scenario 1

At age 60, Jackson will have received a total monthly payout of S$16,200 (S$225 x 12 months x 6 years).

In the same year, he may decide to surrender the policy to fund his retirement.

In this case, the guaranteed + non-guaranteed amount received will be S$92,401.

In total, payouts received by Jackson will be 1.2 times the premium paid.

Scenario 2

In the second scenario, Jackson retires at 70 years as earlier planned. He continues to receive monthly payouts.

Tragically, Jackson dies at 85 years of age. By this time, he’ll have received S$83,700 ($225 x 12 months x 31years) total monthly payouts.

Subsequently, his family receives a Death Benefit of S$102,368.

By the time of the Death Benefit, the total guaranteed and non-guaranteed benefits received by Jackson is 2.06 times the annual premiums paid.

Notes;

- All the calculations are based on a 4.25% IIRR of the participating fund.

- From age 54, the monthly payouts are based on an IRR of 3.00% per year.

- During the surrender, the total amount includes guaranteed and non-guaranteed surrender value alongside declared and unpaid cash bonuses. It also includes non-guaranteed interest, which is earned on the unearned monthly cash bonus. This is also based on an IRR of 3.00% per year.