Cancer is a rising cause for concern, with statistics showing that 1 in 4 Singaporeans are diagnosed with cancer at least once.

Further aggravating the issue, an average of 15 deaths daily are cancer-related.

If you have ever worried about contracting cancer, the NTUC Income Cancer Protect might be right for you.

The NTUC Income Cancer Protect plan is a standalone cancer insurance policy that offers protection if the insured contracts cancer or, unfortunately, passes away.

This helps to protect you and your loved ones against the high costs you could incur if you are diagnosed with cancer, allowing them to dedicate their time to caring for you.

However, by the time we published this review, NTUC Income has discontinued the Cancer Protect and released the Complete Cancer Care.

We’ll do our best to get the review of the NTUC Income Complete Cancer Care up, but in the meantime, here is our complete review of the NTUC Income Cancer Protect – for those who already bought the policy.

My Review of the NTUC Income Cancer Protect

From my perspective, the NTUC Income Cancer Protect is a good policy that acts as a safety net to protect you against both early and advanced stages of major cancers.

Apart from waiving the need to undergo medical checkups, NTUC Income allows you to be covered even if you have preexisting medical conditions such as diabetes or hypertension.

Its low premium rates, starting from only $14.40 per month, also ensure that this policy remains pocket-friendly and accessible for most people to get the basic protection they need against major cancers and death.

However, you should also be mindful that the NTUC Income Cancer Protect is not a comprehensive package and should not be a standalone plan.

While it covers you against major cancers and death, it does not cover you against other forms of critical illnesses, terminal illnesses (TIs), and total permanent disabilities (TPDs).

In addition, most of its coverage (for non-accidental death and accidental death above the age of 70) only serves to refund you the total amount of premiums you have paid up to date and does not value-add to the premiums you have paid up so far.

As such, those thinking of taking up this policy should also consider signing up for other policies that can cover up the gaps in this policy, allowing you to have a comprehensive protection plan.

However, analysing the NTUC Income Cancer Protect itself as a standalone cancer insurance plan – it’s pretty basic and is good to have as a basis coverage.

And if we compare it against other cancer insurance plans in Singapore, there are better options out there.

For instance, you can get FWD’s Cancer Insurance plan at a cheaper price than NTUC Income’s Cancer Protect.

Or if you want more comprehensive coverage, consider a multipay ECI/CI plan instead, which will cover you for more critical illnesses besides cancer.

Nonetheless, it is important that you carefully weigh all your options and speak to a financial advisor to guide you in choosing the right plan that you are most comfortable with.

With 25% of Singaporeans contracting cancer yearly, it’s critical that you take additional time to explore your options.

If you need a second opinion on whether the NTUC Income Cancer Protect is for you, we partner with unbiased financial advisors who can help you with this.

Click here for a second opinion.

Now here’s more on what the NTUC Income Cancer Protect covers:

Criteria

- Entry Age of Insured: 30 – 64 Years Old

- Fixed Policy Term of 10 Years

- Renewable Without Underwriting Required for Subsequent 10 Years

General Features

Policy Terms

The NTUC Income Cancer Protect has a fixed policy term of 10 years.

After the 10-year policy term is up, the policy will be automatically renewed without requiring further underwriting for another 10 years.

However, to be eligible for the policy renewal, there must not be any claims on the policy during its term, with the exception of the Early Stage of Major Cancer Benefit.

Premium Payment Terms

The NTUC Income Cancer Protect policy allows you to stay protected from cancer with affordable regular premiums of as low as $14.40 per month throughout the entire 10-year period.

You can choose to make your regular premium payments every 1, 3, 6, or 12 months.

However, premium payment rates are subject to changes, and you will be notified of any changes to the premium payment rates 6 months before the revision occurs.

In addition, you have 3 different levels of plans to choose from, each with a different amount of coverage.

| Plan Type | Sum Assured |

| Plan 1 | $100,000 |

| Plan 2 | $80,000 |

| Plan 3 | $50,000 |

Protection

Early Stage of Major Cancer Benefit

Under the NTUC Income Cancer Protect policy, you will receive 25% of the sum assured in a lump sum if you are diagnosed with an early stage of major cancer.

For example, if your sum assured is $100,000, you will be eligible to obtain $100,000 x 25% = $25,000 under this benefit.

For your diagnosis to be classified as an early stage of major cancer, it would have to fall under the list defined by NTUC Income:

- Carcinoma-in-situ (Supported by a Histopathological Report)

- Early Prostate Cancer

- Early Thyroid Cancer

- Early Bladder Cancer

- Early Chronic Lymphocytic Leukaemia

You should also note that there is a waiting period of 90 days from the start of the coverage before you can make a claim.

As this is a one-time benefit, the Early Stage of Major Cancer Benefit will terminate, and you cannot make another claim under this benefit.

However, the other benefits under the NTUC Income Cancer Protect will still remain in effect.

Advanced Stage of Major Cancer Benefit

This policy also ensures that you stay protected if you are diagnosed with an advanced stage of major cancer.

However, the payout will depend on the status of the Early Stage of Major Cancer Benefit.

| Status of Early Stage of Major Cancer Benefit | Benefit |

| Claimed Before | 100% of Sum Assured |

| Not Claimed Before | 125% of Sum Assured |

For example, if your sum assured is $100,000 and you have previously claimed the Early Stage of Major Cancer Benefit, you are eligible to receive $100,000 x 100% = $100,000.

If you have not previously claimed the Early Stage of Major Cancer Benefit, you are eligible to receive $100,000 x 125% = $125,000.

For your claim to be successful, do ensure that your condition is included in the list of advanced-stage major cancers defined by NTUC Income:

- Advanced-stage Leukaemia

- Advanced-stage Lymphoma

- Advanced-stage Sarcoma

- Any Other Forms of Advanced-Stage Major Cancer (Positive Diagnosis of Malignant Tumour with Histological Confirmation)

However, do be wary that if tumour cells are present without further definitive and clinically verifiable evidence, your condition will not meet NTUC Income’s definition of an advanced-stage major cancer.

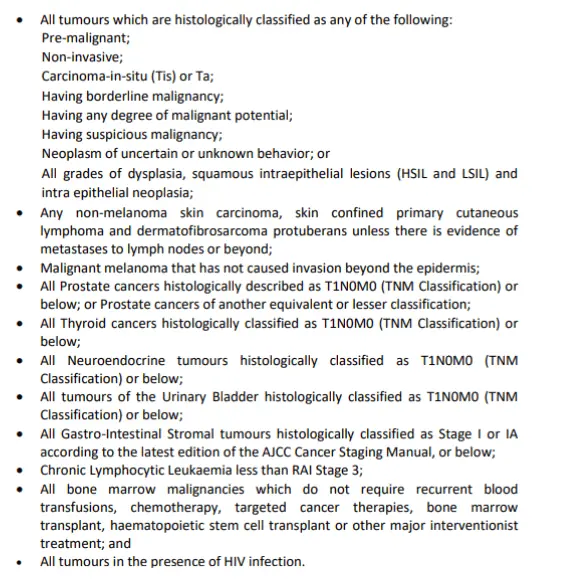

In addition, you would not be able to make a successful claim if your condition falls under any of the following:

Likewise, there is a waiting period of 90 days from the policy start date before you can claim the advanced-stage benefit.

The policy will be deemed terminated upon making a successful claim under the Advanced Stage of Major Cancer Benefit.

Non-Accidental Death Benefit

In the event that the insured passes away due to non-accidental reasons during the policy term, your beneficiaries are also able to claim this benefit.

However, the payout depends on the date the event resulting in the insured’s passing occurs.

| Date of Event Resulting in the Insured’s Passing | Benefit |

| Within 1 Year From the Cover Start Date | 100% of Total Premiums Paid |

| After 1 Year From the Cover Start Date | $5,000 |

Since this is also a one-time benefit, the policy will be deemed terminated after the benefit is paid out.

Accidental Death Benefit

On the other hand, if the insured’s passing occurs due to an accident or unexpected incident, NTUC Income will also payout the benefit depending on the insured’s age and the nature of the activity resulting in the passing.

| Age at Accidental Death | Insured’s Activity at Time of Accident | Cause of Accidental Death is Excluded | |

| Normal Activity | Restricted Activity | ||

| 69 or Under | 100% of Sum Assured | 30% of Sum Assured | Within 1 Year From Cover Start Date:

100% of Total Premiums Paid After 1 Year From Cover Start Date: $5,000 |

| 70 or Above | Within 1 Year From Cover Start Date:

100% of Total Premiums Paid After 1 Year From Cover Start Date: $5,000 |

||

Policyholders should also keep in mind that this benefit is only payable if the insured’s passing occurs within 365 days of the accident.

Once the Accidental Death Benefit is claimed, this policy will be deemed terminated.

Summary of NTUC Income Cancer Protect

| Cash and Cash Withdrawal Benefits | |

| Cash Value | N/A |

| Cash Withdrawal | N/A |

| Health and Insurance Coverage | |

| Death (Accidental & Non-accidental) | Available |

| Total Permanent Disability | N/A |

| Terminal Illness | N/A |

| Critical Illness | Available |

| Early Critical Illness | Available |

| Health and Insurance Coverage Multiplier | |

| Death | N/A |

| Total Permanent Disability | N/A |

| Terminal Illness | N/A |

| Critical Illness | N/A |

| Early Critical Illness | N/A |